There is a debate surrounding the trading community on which type of analysis is best. Is it fundamental or technical analysis?

The proponents of both wings have their arguments. One suggests that you only need fundamentals to trade the markets. Others speak in favor of technical analysis.

So, which one is better? This guide will explain what fundamental analyses are, and should you be only using them for trading?

The basics of fundamental analysis

If you have ever taken an economy class, your teacher probably has told you how the economy makes the world move. Well, he wasn’t wrong.

When we talk about fundamental analysis, it suggests the micro and macro-economic factors or political and social factors affecting markets. For example, a particular tweet from the president can make the USD rise or dip. But that’s just one piece of the puzzle. In reality, fundamental analysis is much more than that.

If you want to become a fundamental analyst, you can’t rely on one specific source. Instead, you need to combine all the sources and put them on your charts.

You see, every bit of info is essential when conducting fundamental analysis. Macro-economic indicators like nonfarm payroll (NFP) report, unemployment rate, trade balance, GDP all matter. And the list doesn’t end there.

One of the striking things about this type of analysis is that you have to keep up with political factors. For instance, if the country’s economy is booming, it will have a stronger currency. Upcoming elections, change in governments, key speeches can all make a significant impression on the market.

Just look at the GBP/USD after the NFP release.

As you can see, just after the NFP, we had a significant bullish GBP/USD candle.

So, how can I apply fundamental analysis?

You can apply fundamental analysis by keeping up with economic, political news that can impact markets.

But you would be thinking, “How the hell would I keep up with the news?” There are tons and tons of sources out there. Just pay attention to the news, and voila! Now that you know what fundamental analysis is, let’s see some of the best forex strategies you can apply based on fundamental analysis.

News strategy

As we mentioned earlier in our example of the NFP release, news can significantly impact the FX market. Sometimes, the market goes wild after the important news.

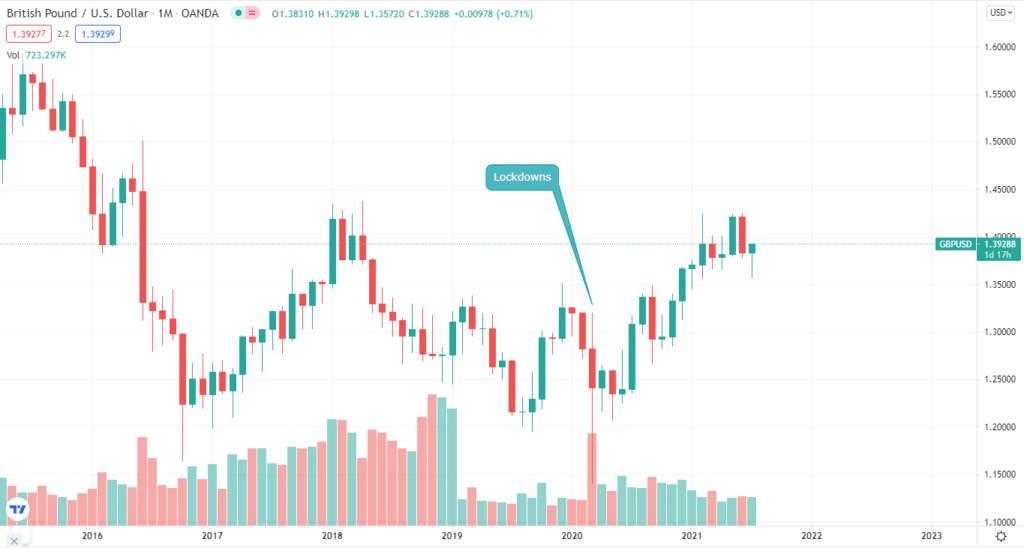

For instance, when the pandemic started and the UK and US imposed lockdowns, the price of GBP/USD took a considerable dip. As you can see on the chart, there is a significant bearish candle for March 2020.

Carry trading strategy

Carry trading is a concept where you follow the interest rates of the two countries. For instance, if your chosen currency pair is EUR/USD, you need to look for the interest rates of the United States and Europe.

What differentiate carry trading from other strategies is that you only need to follow the interest rates of the selected pair.

Sentiment trading

You probably get the idea where this is going. Sentiment trading defines the overall market sentiment.

If the bulls are winning the battle, the market sentiment is positive. On the other hand, if the bears are taking the lead, the overall sentiment is negative.

Sentiment traders benefit when there is a significant new event like elections. This is because these happenings raise volatility, and the price can make substantial moves.

Arbitrage strategy

This strategy signifies profiting from the price differences. Thus, the price you see for the currency pair on your trading platform differs on various institutions.

For example, the Bank of London can quote GBP/USD at 1.4050, while the US Federal Reserve Bank has a rate of 1.4055.

If you apply an arbitrage strategy, you would but at less price, in this case, Bank of London’s price, and sell at Federal Reserve Bank price.

Can you only rely on fundamental analysis?

Before answering this question, let’s give you a glimpse of the fundamental analysis opponent; technical analysis. It is all about price action. Technical traders use different methods to determine the course of price.

They look for candlestick patterns like Doji or chart patterns like head and shoulders to determine where the price is heading next. Traders also utilize technical indicators like the RSI, moving averages, and others for the price action.

Now you know what technical analysis is all about. Technical traders believe that the price repeats its patterns, so they also use past price movements to anticipate. But is it possible to rely on any one of these analyses?

Nope!

You can’t say with confidence one type of analysis is better than the other. This is because the market depends on many factors. They don’t especially relate to fundamentals like economic and political factors or price action patterns.

Even though you do your error-free technical analysis, fundamental factors kick in, and the price starts moving in the opposite direction. What makes a perfect product is a combination of both analyses. And yes, you can combine them both.

Many people argue that when we combine fundamental and technical analysis, it creates all sorts of confusion. But trading requires knowledge and instincts, and you will not get them with one form of analysis.

Pros of fundamental analysis

- It is perfect for swing or position trading. In other words, it is best for long-term trading. When analyzing currency pairs based on economic factors, you can get the exact entry and exit points.

- This analysis is also helpful in determining to undervalue or overvalue FX pairs.

Cons of fundamental analysis

- It can ‘eat up’ much of your time.

- Keeping up with all the fundamental factors can be difficult.

Final thoughts

When trading, you don’t have to pigeonhole yourself into one form; you must join both analyses. You may find your go-to strategy. You never know.