Warren Buffett, at six years old, saw that he could profit from arbitrage. He would purchase a 6-pack of Coca-Cola for 25¢ and sell each bottle for 5¢ in his neighborhood, benefiting 5¢ per pack.

Young Warren Buffett saw that he could profit from the difference in the price of a six-pack versus what people were willing to pay for a single bottle.

This strategy that Warren Buffet was using is known as arbitrage investing. It is an investment strategy that made him very wealthy, even to this day.

Do you want to know what arbitrage investment is? Let us see what arbitrage investing is and how it can benefit your portfolio.

What is arbitrage?

An investment strategy that allows you to buy and sell the same asset in different markets simultaneously is arbitrage. The goal of utilizing arbitrage is to benefit from the difference in price and make a profit this way.

The price differences are usually minor and short-term; however, you can generate significant returns by investing a large amount of capital.

Arbitrage has three types, and these are pure, merger, and convertible arbitrage.

What are the types of arbitrage?

Pure arbitrage

It refers to the purchasing and selling of an asset simultaneously but in different markets.

An example of how pure arbitrage works in the stock market. A company can list two different stock exchanges, like the Tokyo Stock Exchange and the New York Stock Exchange. As an investor, you can trade the same stock through both stock exchanges and benefit from the price discrepancies.

However, price discrepancies are not that common nowadays since technological advances allow the exchanges to sync well with the market. Most hedge funds with sophisticated software to detect price differences can execute trades at fast speeds, and they benefit from pure arbitrage.

Merger arbitrage

It refers to making profits during a merger of two companies. A merger occurs when company A acquires company B at an agreed price.

During an acquisition, the target company’s stocks will be at a lower rate. Investors profit from mergers by purchasing the target company’s stocks since the price is lower than the acquisition value.

Once the deal is through, the price would increase, and if you sell the stocks at a slightly higher price, you profit in this manner.

The risk of this type of arbitrage strategy is if the deal fails to go through, the investors stand to make a loss. The investor or hedge fund should decide early on in the merger to buy the stocks and have high confidence that the deal will be successful.

Convertible arbitrage

It relates to convertible bonds. Bonds are corporate debt that pays returns on the interest to the bond purchaser. A convertible bond enables the bondholder to convert it to stocks of the underlying company.

The strategy is to make a profit off the difference between the conversion price of the bond and the company’s stock price.

Companies issue convertible bonds so that they can offer a lower interest rate. The interest is lower because the investor can profit more by converting the bond, unlike traditional bonds that provide a competitive interest payment to lure investors.

By converting bonds, investors will buy and sell bonds and the underlying company’s stocks simultaneously.

An example of using arbitrage in the stock market

Merger arbitrage is more common than pure or convertible arbitrage. Investors often use this strategy when two companies merge or one acquires another.

As we explained earlier, you can benefit from the stock price difference, especially if there is the certainty that the acquisition will occur successfully.

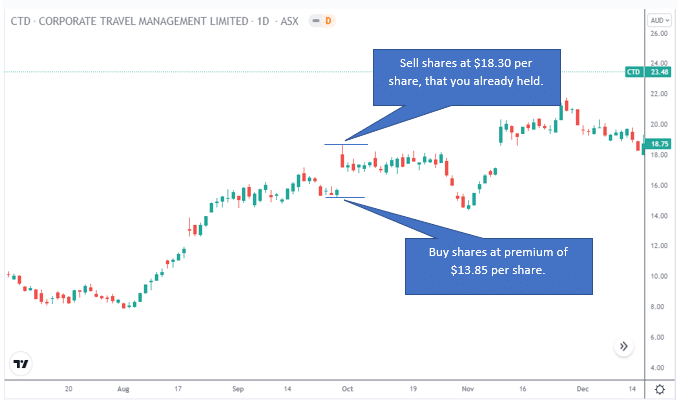

In this example, we look at two companies: Corporate Travel Management and Travel & Transport.

Corporate Travel Management acquired Travel & Transport for around $275 million in October 2020. During this merger, investors were able to buy and sell the same stock but at different prices.

On October 1, 2020, Corporate Travel Management issued shares to investors at $13.85 per share, and existing shareholders could purchase one share for every 4.03 that they were holding. The shares were trading at $17.30 at the same time.

If you were holding shares on this day, you could sell your shares at the market price of $17.30. At the same time, you could buy shares at the lower price of $13.85, hold them longer and sell them later after the acquisition at a higher price.

Let’s assume that you sold 500 shares that you were holding at $17.30 per share.

Sold: 500 shares x $17.30 = $8650

We assume that you pay $50 in broker fees, and we ignore taxes for now. However, it would help if you remembered that capital gain taxes would remain payable on the sale of the shares.

Net profit therefore is: $8650 – $50 = $8600

After the sale, you now purchase 500 shares at the premium rate of $13.85, which the company offered you.

Shares bought: 500 x $13.85 = $6925

Therefore, your overall profit: $8600 – $6925 = $1675

You can hold these shares since the stock’s price increased in value after the merger and sell it when you prefer, at a higher price. This is how you can profit by selling your shares at a higher price and then repurchasing it at the lower price that the company offers.

Pros & cons

Let’s look at the pros and cons of arbitrage investing.

| Pros | Cons |

| • Benefit from the price difference As an arbitrage investor, you can profit quickly from the price discrepancies across different markets. • Low risk There are low to zero risks when using arbitrage investing since the price discrepancy, pushing the stock price up. Firms even use sophisticated software to detect price discrepancies of assets between stock exchanges. • Contributes to efficient pricing The arbitrageurs spot the price differences, and this way, stock markets can detect issues with pricing and ensure the data is more accurate. | • High transaction fees Investors often ignore the fees and taxes associated with short-term buying and selling and only focus on the price difference. The costs can add up, leaving you with less profit than you anticipated. • Few opportunities Arbitrage opportunities are pretty rare in reality. Firms usually would use advanced technology to detect any price differences and to execute trades at high speed. Not everyone has access to this type of technology. • Large capital When you do find an opportunity, you require a large amount of capital. The price difference is usually minimal; therefore, to take advantage of it, you need to trade large volumes, which require a good amount of capital. |

Final thoughts

As you can see, that arbitrage investment strategy can be beneficial to traders and investors. Since you will benefit from price discrepancies, the window of opportunity is small; you will have to stay on top of the markets.

Furthermore, arbitrage opportunities are rare, and a significant amount of capital can help you maximize profits. The risk factor is also reasonably low, but you should note that not all acquisitions are guaranteed when applying merger arbitrage, and there is a risk of deals failing.