One of the most challenging things in crypto trading is setting a proper take-profit level. Many strategies use different parameters, but no one is sure if that take-profit level is too far away or if it is too short so that you will be missing part of the gain.

The Catch the Wave strategy tries to solve this issue and gives us a take-profit level where it’s hard to go short, so at least the strategy addresses part of the risk. The winning probabilities of the trade also increase since we bet that the price repeats a pattern that it just made a few candles ago. Stay glued to your screen throughout this article to learn what this exciting strategy is about.

What is the Catch the Wave crypto strategy?

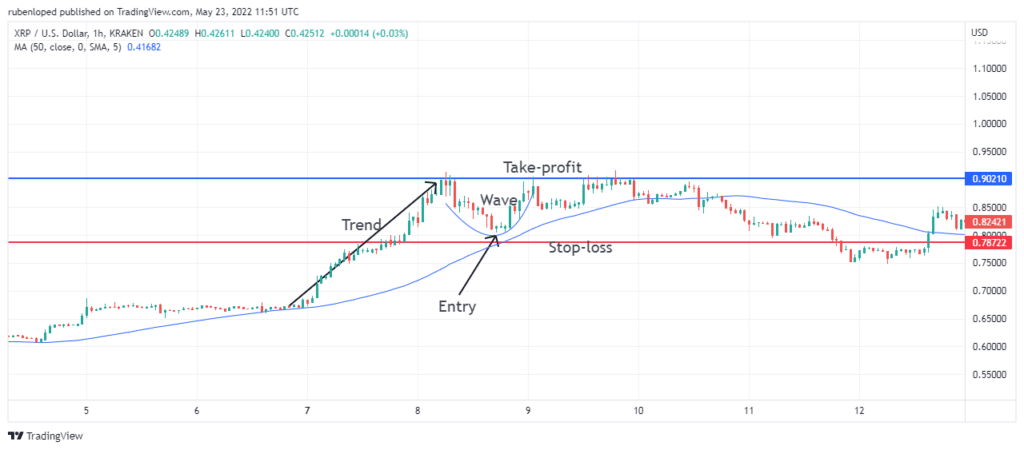

This strategy refers to the form you see in the chart when you apply it. The upside or downside trend looks like a wave, and you are supposed to surf it. The wave occurs after a trend reaches either a support or a resistance level and then pulls back a little.

That’s when the wave begins. After the pullback, the trend will continue, and that’s what we want when we surf it. So we enter at the bottom of the pullback, to the resistance or support level rejected the first time.

How to trade using the strategy?

It has to be used with uptrends and downtrends. The difference with traditional strategies for trends is that we are not trying to catch the whole trend since this brings a considerable amount of risk. Instead, we try to play it safe by waiting for a typical pattern that you can see in most trends. So, while it is true that the profit is much less than the one we get when trading the entire trend, the risk is also less, which in the long run will give us a better winning ratio and, that way, increase our earnings.

Some traders like to combine trend trading with the Catch the Wave strategy. They trade the trend with a conservative approach and then exit the trader until they see the pullback they wait for to surf the trend. However, trends don’t occur every day, so you have to consider if you are willing to let a trend pass and only wait for the wave to get into the trend.

Bullish trade setup

The bullish trade setup is the one in which the trend goes up, and the trader wants the price to retrace a little as a rejection of an upper limit, that is, when the price finds a new resistance level. Once this happens, the most common thing is that the price will either pull back to break the resistance in that same trade or constantly move up and down and form a consolidation channel.

Where to enter?

You enter the trade once the correction or bullish price rejection is over and the trend is likely to continue. Of course, it’s hard to know how deep the rejection will be, so it’s hard to be sure what the right level is to enter.

You want to enter at the bottom to make as many profits as possible. That’s why, like with all strategies, you need to use another indicator. A popular one is the 50-period MA. During the pullback, the 50-period MA will help you identify the support level of the pullback so that you can enter the trade at the lowest price level.

Where to set the stop-loss?

To set the stop-loss, there are various options. A popular one is to set your stop-loss at the same level as the previous candle’s low. Also, you can use the 50-period MA as a stop-loss level.

Where to set the take-profit?

The take-profit setting is the most straightforward instruction of the strategy. The take-profit level is what this strategy is all about. The take-profit level has to be set at the price rejection level that started the whole wave.

Bearish trade setup

Of course, the bearish setup is very similar, but It’s the same as the bullish setup but in the opposite direction. In this case, we’ll see a downtrend that will reject the bearish price and pull back. The pullback will allow us to enter the trade and then exit at the level of the first rejection.

Where to enter?

We enter the short position at the highest point of the pullback. Again, this will need the help of indicators such as the 50-period MA. The great thing about the 50-MA is that since most trades using this strategy combine the catch the wave with the 50-period MA, it’s a self-fulfilling prophecy.

Where to put your stop-loss?

The stop-loss goes a little above the MA since this will work as a resistance level during the wave.

Where to set the take-profit?

Finally, the take profit level will be the same as the bearish rejection started.

How to manage risk?

No strategy is 100% accurate. You want to make sure that you take appropriate measures to secure your money. The stop-loss is always necessary and risks a proper amount of money on each trade. It’s recommended to put just around 2-3% of your principal on each trade.

Also, remember that no single trade will change your life. Trading is a long-term game where the profit should be greater than the losses on average.

How to make $500 per day with this strategy?

The amount of money you’ll make per trade will depend on how deep the wave goes before it goes up again. However, using a conservative take-profit level with a 5% profit target, your principal should be around $10.000.

Final thoughts

This strategy is a safe playing technique. No one knows how far a trend can go, and catching the wave strategy doesn’t tell you either. The advantage is that with this strategy, at least you have a reference point where the probabilities for the price to go there again are very high.