We all want to get just one indicator capable of predicting precisely the next market movement. One indicator helps us predict whether the price will go up or down with just one signal.

Even if you are a newbie, you already should know that such a thing doesn’t exist. However, it is true that some indicators are better than others, or at least more popular. Choosing the right indicators can differentiate between being profitable or just another failed trader. For this reason, you must include the golden cross in your trading set. Read on to learn how to use this signal so popular among all markets.

What is the golden cross crypto strategy?

The golden cross is one of the most powerful signals a chart can give to the trader of all markets, especially cryptos. The golden cross is the interaction between two moving averages of different periods. One of the moving average periods should be significantly higher than the other.

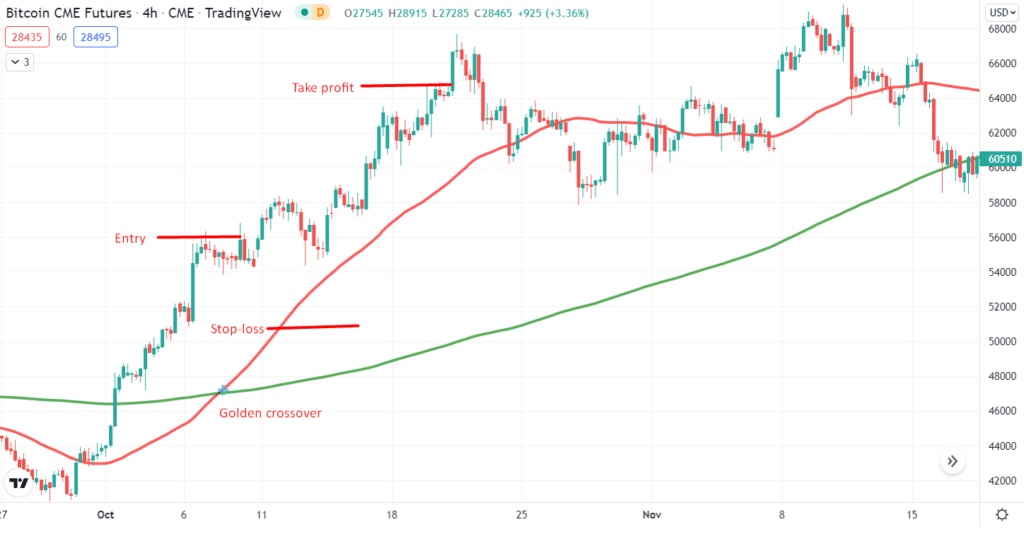

The golden cross crypto strategy purchases the assets once the golden cross occurs. In other words, once the lower period MA crosses above the longer period moving average. Combinations such as 200-periods MA and 50-periods MA or 15-periods MA and 50-periods MA are the most common.

How to trade using the golden cross crypto?

The golden cross strategy is very popular in the crypto market, but it has been around for decades in the stock market and the forex market. It is one of the most popular indicators among technical traders, and it has a counterpart called the death cross.

Crypto traders have adopted this signal and use it to reference their trades. The right way of using this signal is to wait for the shorter period moving average to cross above the longer period moving average to trade. However, as we mentioned, there are no perfect indicators, so you should always look for confirmation in other places. Also, consider the strength of the signal your golden cross gives, especially the time frame studied.

A golden cross on a daily chart is much stronger than a golden cross on a 15 minutes chart.

Bullish trade setup

The golden cross is a bullish signal. Once the golden cross is on your chart, you should be ready to make a bullish bet.

Where to enter?

The right time to enter the trade is when your shorter period MA crosses above your longer period moving average. You can use different confirmation methods and indicators, such as letting the price rise a little before entering a position or looking at other indicators.

Where to set the stop-loss?

With a golden cross, the longer period MA serves as a support level during an uptrend, so using it as a reference to set the stop-loss is a good idea.

Where to set the take-profit?

The reasonable place to set your take-profit level is the nearest resistance level. However, the death cross usually indicates the end of the uptrend, so keeping an eye on that event is also a good idea to exit the trade.

Bearish trade setup

Next, we have to talk about the Death cross for the bearish trade setup. The Death cross is when the shorter-period MA crosses below the longer-period MA. The golden cross is a bullish signal, so it only makes sense to use it as a bullish trade setup.

Where to enter?

Once the death cross happens, the trader has to enter a short position on the crypto.

Where to put your stop-loss?

Now, the longer-period MA acts as a resistance level, so it’s good to take it as a reference for your stop-loss.

Where to set the take-profit?

The take-profit level is at the nearest horizontal support level.

How to manage risk?

We all know that no signal or indicator is enough to make sure where the price of an asset is heading. This is even more true with cryptos. If traditional markets are hard to read, cryptos are even harder. Due to its instabilities and volatility, it is harder to read a behaviour that does not always follow market logic.

One of the best examples of that is Bitcoin. Unfortunately, the most valuable crypto often disappointed investors, expecting an uptrend after a golden cross.

The best way to manage risk with this kind of deal is to set a reasonable stop-loss level, investing only 1 to 3% of your capital on each trade and confirming the golden cross signal with other indicators.

How to make $500 per day with this strategy?

We all know that no signal or indicator is enough to make sure where the price of an asset is heading. This is even more true with cryptos. If traditional markets are hard to read, cryptos are even more challenging. Due to its instabilities and volatility, it is harder to read a behavior that does not always follow market logic.

One of the best examples of that is Bitcoin. Unfortunately, the most valuable crypto often disappointed investors, expecting an uptrend after a golden cross.

The best way to manage risk with this kind of deal is to set a reasonable stop-loss level, investing only 1 to 3% of your capital on each trade and confirming the golden cross signal with other indicators.

Final thoughts

Some may say that the golden cross it’s just one among many indicators. The truth is that while it is true that there are many indicators, the golden cross has been around for many decades across many markets proving to be reliable, mainly when used with the 50-period MA.

The golden cross is not a signal for an uptrend but a signal for a long uptrend, so paying attention to this signal can signify great earnings for the traders. However, the risk is always getting too greedy and not exiting at the right time.

Therefore, sticking to the basic tools of every trader, such as confirming with other signals and setting clear entry and exit levels, are keys to being profitable and taking advantage of the golden cross signal.