Do you ever wonder how some people get huge profits by selling a commodity in a trade market as they bought it from the other market? The differences in the commodity’s price in different markets allow the traders to gain profits. That’s how arbitrage works.

You can make $200 with online arbitrage daily with ease. For example, avocado is available for $2 in one market, while you can sell it for $3 in another shop. So, by buying avocados at a cheap rate and selling them to an expensive market, you will gain about $1. Selling 200 avocados to a trader is an easy task along with no high-risk factor.

The traders dealing with arbitrage continue the sale and purchase of sale commodities repeatedly while making more profits. However, since the talk about arbitrage is little, some of you might not know about its availability in the FX market.

Let’s discuss how you can make money at FX while implementing arbitrage.

What is arbitrage trading?

In the forex trading platform, arbitrage means buying assets from one market and instantly selling them to another by seeking profit in price difference. Since no platform is efficient and there is always a price difference in every asset. The main goal of an arbitrage trader is to find out the variation of a certain asset at different markets to earn profits.

Hence, all this setup of trade is low risk. You can better understand the concepts with a practical example of the FX market.

Types of FX arbitrage trading

Arbitrage is known in two types, i.e., pure and risky.

- The first one is risk-free hedging.

- The second comes up with speculation.

As the latter is based on future predictions that have chances to occur, they might have the possibility of going in the wrong direction. Hence, the arbitrage goes well in the forex, which is called FX arbitration.

Arbitrage trading in retail FX

Hence, arbitration is counted as a risk-free trading strategy. It allows the majority of retail traders to maximize their profits while having no open currency exposure. Whenever you see pricing inefficiencies in markets, this strategy will help you take advantage of these opportunities.

So the retail traders buy/sell several pairs to determine the efficiency in asset pricing. Let’s look at an example of how retail trades avail this opportunity of market inefficiencies with arbitrage.

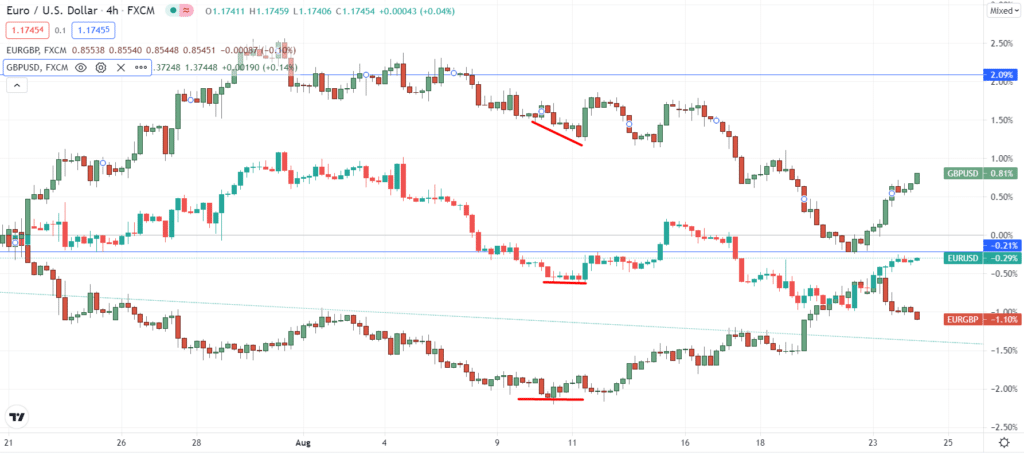

For the currency pairs such as EUR/USD, EUR/GBP, and GBP/USD, the exchange rates are supposedly 1.1837, 0.7231, and 1.5221, respectively. Therefore, investors have the opportunity to purchase a mini lot of EUR for $11.837.

Then, after selling those 10.000 for 7231 GBP, the arbitrage trader sells it to them, which would make these 7231 British pounds worth $11.850. That is how an investor can earn $13 without having an open position in currencies. In the same way, trading 100.000 lots can result in traders making $130 instantly.

The seizing of chances to do arbitration is the main task in trading. So the arbitrage trade requires the availability of real-time values of currencies along with skills to respond quickly to different opportunities. Retail traders can utilize the arbitrage calculator as assistance to find opportunities in a limited period.

Is arbitrage legal in FX?

You may not have listened much to arbitrage trading in FX markets. But yes, trading in the way of arbitration or hedging is legal in the FX market. Also, it is highly profitable for the retail traders in the market as it is a risk-free strategy if done correctly. Let’s have an example from the inter-market.

An XYZ bank is trading for CAD at 74.50 on the Italian stock exchange. Similar stock is available at Jordan Stock exchange for 5.60. Meanwhile, the exchange rate for CAD/USD is around 0.77.

Hence, you can buy XYZ’s share from the Italian stock exchange at CAD 74.50 and sell it on the Jordan stock exchange at 56.50. That’s how you can make a profit of 0.8 Canadian dollars at every trade.

So, now you completely understand how you can achieve profit by arbitration at the FX market legally. However, it would help if you also kept an eye on the negative side of a topic. So here are some risks and issues in arbitration.

Risks and problems associated with arbitrage trading

As you know that arbitration is only possible if a commodity or asset price is fluctuating. So sometimes, due to laws of supply and demand, the price differences of assets shrink. So the arbitrage remains no longer profitable. It all depends on your execution speed and how much profit you can make at a greater speed before shrinking the price.

Negative spread occurrence can also lead to no profit. For example, what happens when the ask price of one buyer is lower than the bid price of another buyer.

So, the FX is highly unpredictable, even for arbitrage traders. So, the arbitration of assets and commodities will only be profitable if the trader plays wisely.

Pros and cons of arbitration

| Pros | Cons |

| • This strategy practically eliminates the risk of a wrong prediction because you know in advance the course’s direction in the next few seconds. | • Not all brokers allow you to work according to this strategy and stop traders’ attempts to make money on the difference in quotes from different exchanges. Such trading tactics are considered unfair since they are based on insider information, not analysis and forecast. |

| • No need to use fundamental and technical analysis tools. The primary tool for your earnings is the simultaneous tracking of quotes from two sources, which requires attention, but not specific knowledge. | • Short-term trading is always psychologically much more complex than medium or long. It requires the utmost concentration of attention and composure, so we do not recommend trading using this strategy for a long time. |

| • It allows you to make money in the shortest possible time because transactions last 1-2 seconds. Based on this, this type of trading can be considered scalping. | • Earnings on arbitrage, although fast, are tiny since the difference in quotes from brokers or exchanges is several points. To make a good profit, you need to make many trades, which is time-consuming. |

Final thoughts

It is a less common trading strategy having vast benefits. A trader needs to exploit market inefficiencies to buy an asset at a minimum price while selling it for a significant profit. Dozens of arbitration in a single day can lead to earning a considerable amount of profit. So, the FX market is one of the best markets that legally allows arbitration.