One of the key factors that determine investors’ success in choosing worthy stocks is their skill to understand the dynamics of market forces, supply and demand ranges, and the existing competitive pressure.

According to the Forbes list (2021) of the companies that remarkably survived the pandemic turmoil, ICBC, JPMorgan Chase, and Berkshire Hathaway were the highest placed organizations. These companies grabbed the top spot due to their effective management, timely policies, and stable framework.

So as an investor, are you interested in learning about the analysis method that can unfold the potential of relevant companies? Company analysis, an element of fundamental analysis, is the ideal tool that can interpret companies’ aptitude by considering a wide range of factors.

Read this article to learn about company analysis, its working technique, benefits, and limitations.

How does the company analysis work?

Company analysis is an assessment method regarding a company’s structure, management, and financial standing. It is a comprehensive research procedure that allows investors to estimate a company’s actual value, future goals, growth potential, and associated risks.

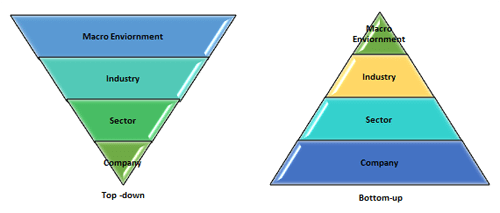

Analysts conduct the company analysis by one of the two practices:

- A top-down approach

- Bottom-up approach

If utilizing the top-down approach, the investors initiate their analysis by examining the overall economy and macro-economic factors. Afterward, they look for well-performing sectors and industries and narrow their search to the most suitable businesses or companies.

The inverse happens in the bottom-up approach, where analysts first investigate the companies or individual stocks. They give less weightage to the larger-scale economic factors believing that the bottom units or companies can surpass the overall economy’s performance.

Moreover, the company analysis involves both qualitative and quantitative research that complement each other. The qualitative factors like a company’s leadership, competitive advantage, and governance system can indicate its stability and consistency. At the same time, quantitative elements like a company’s financial data and balance sheets reinforce the qualitative findings.

Reasons to use for investors

Company analysis is a major component of the fundamental analysis umbrella that deciphers a stock’s original value and indicates its potential under or overvaluation. It is a steady approach that predicts a company’s long-term trajectory, hence suitable for long-term investors.

Moreover, an investment based on a solid analysis like company analysis prevents the investors from acting according to unnecessary fears and greed. The temporary market fluctuations and sentiments are irrelevant for fundamental analysts as they favor long-term profitability.

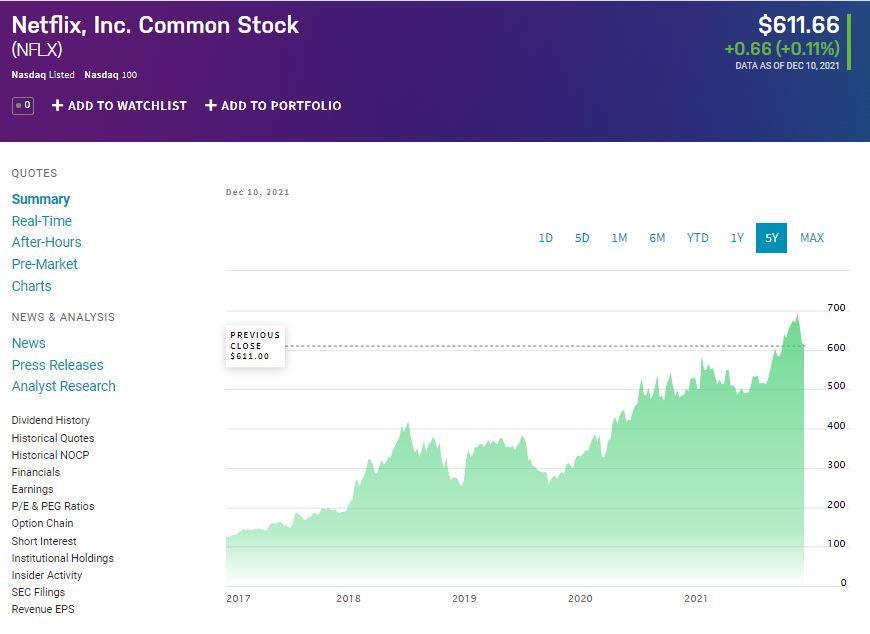

For example, in the entertainment and technology industry, Netflix Inc. is a top-performing California-based company. This production company provides streaming services to more than 190 countries and has a solid user base.

The company’s revenue, historical record, profit margin, gross profit, and revenue growth point to its remarkable position in the technology sector.

How to use the company analysis?

To perform a detailed company analysis, you need to follow a disciplined approach and carry the process step by step.

- Determine the company’s sector and its competitors

As a first step, you need to specify the industry of the relevant company and estimate the internal dynamics. Moreover, determine the competition level and standing of the on-focus company within that competitive environment.

- Get a brief overview of the company

Get a brief idea about a company’s profile, its operational base & branches, number of employees and their income data, legal structure, and future roadmaps or projects.

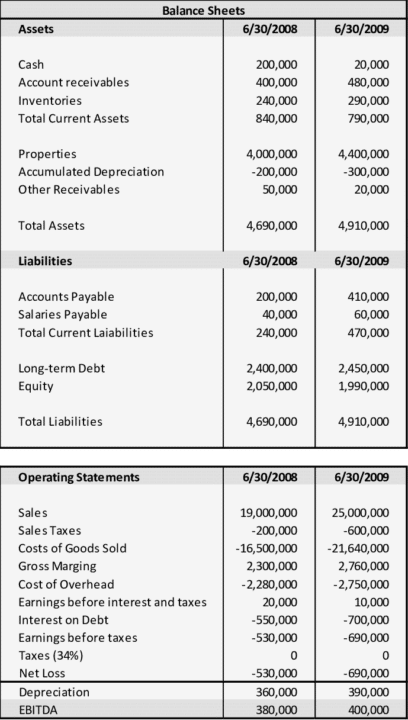

- Study the SEC filings and company tearsheets (Financial data)

Analysis of financial statements like SEC filing reports, value lines, S&P NetAdvantage, free cash flows, and revenue reports can demonstrate the company’s financial framework.

- Analyze the company’s services or products

Moreover, determine the category and nature of a company’s products or services. The market supply and demand proportions, demographic interest, marketing strategy, and particularity of the services can indicate the footing of a company.

- Specify the qualitative factors

Aside from the quantitative factors, qualitative data like a company’s management system, policy-making proficiency, and the handling of problems is also central in identifying the top-performing companies.

- Identify the potential threats and risks

It is prudent to study a company’s risk reports to understand the extent of relevant threats. Avoid companies with a huge debt ratio and unstable management.

Choosing a stock by company analysis

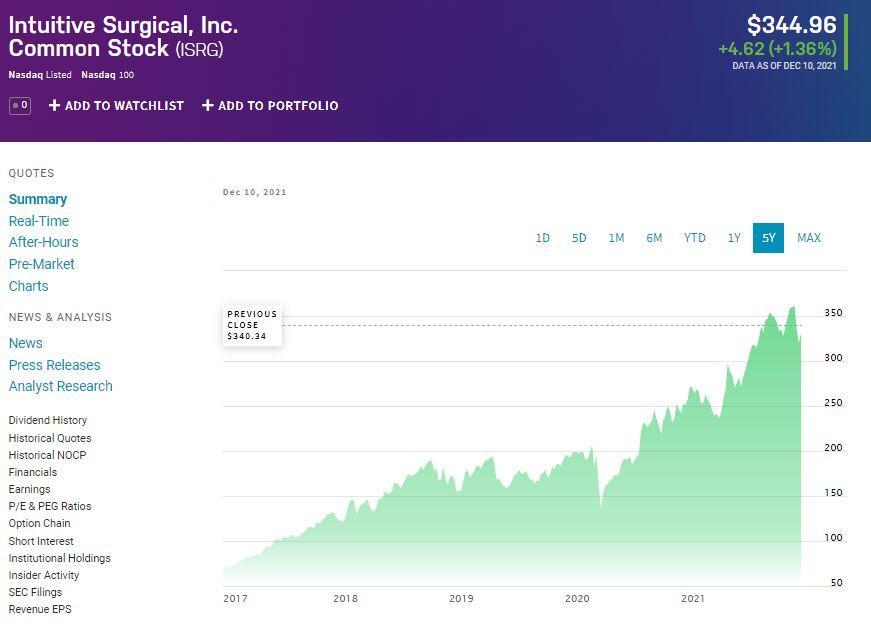

Here, we have discussed an example of a healthcare industry stock chosen by a thorough company analysis.

Intuitive Surgical Inc. is a California-based manufacturer and developer of robotic surgical systems that are helpful during minimally invasive surgeries. The company enjoys a long-term growth potential due to the ever-increasing demand for surgical procedures. Moreover, the company stands out from its competitors due to its remarkable income statements and management effectiveness.

The company has a market capitalization of 123.2 billion and 357 million shares outstanding. The P/E ratio stands at 74.34, with a profit margin of 30.78%. In addition, Intuitive Inc. showed a quarterly revenue growth (YOY) of 30.20% and a gross profit (ttm) of 2.86 billion.

The company faced a downturn during the Covid-19 pandemic; however, its inherent capability quickly pushed it back to the upward momentum.

Pros & cons

Let us look at the advantages and challenges of company analysis in fundamentals.

| Pros | Cons |

| Long-term profitability Company analysis allows the investors to retain investment positions over an extended period and acquire higher gains. | Need extensive research Company analysis needs substantial expertise and comprehensive research that everyone cannot do |

| Free of momentary market disturbances Investors who select stocks by this analysis technique do not waver with market disturbances or bad news and events. | Risk of value alteration Any sudden negative change in a company’s functionality can alter its stocks’ valuation. |

| Strong investment base Company analysis is an intelligent method that provides stable and strong investment options. | Risk of wrong analysis Company analysis is a subjective method and can generate incorrect interpretations in some cases. |

Final thoughts

Company analysis is an excellently targeted approach to pick out companies with robust infrastructure, productive activities, and growth prospects. Similarly, a detailed company analysis can also indicate a company’s associated political, local, and legal risks.

Moreover, investors can utilize comparison tools to get a clearer picture of a company’s standing than the other players. This solid analysis method can help select stocks with high yields; however, it is essential to exercise caution and follow risk management to prevent significant losses.