Cryptocurrency is rapidly gaining the interest of investors due to its decentralized blockchain technology and execution of smart contracts.

With more than 8,000 digital coins in circulation, it has become essential to identify the valued ones among them.

Are you wondering how to detect worthy tokens from this large pool of cryptocurrencies? Technical and fundamental analysis techniques provide traders and investors with an insight to evaluate the future outlooks of different coins.

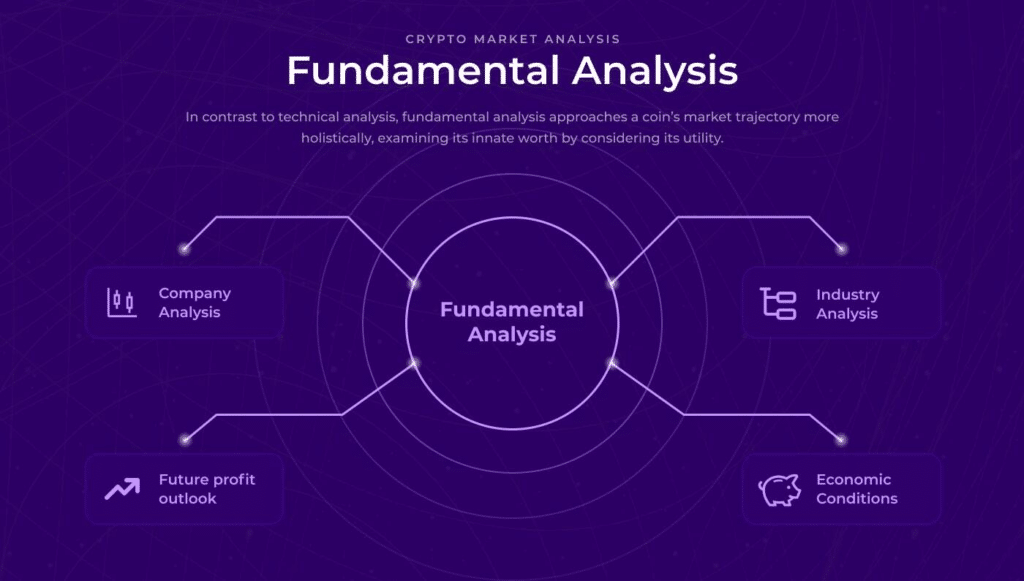

Let’s review various fundamental analysis techniques for assessing crypto blockchains.

Basics of fundamental analysis

Fundamental analysis helps in determining the objective value of an entity. This approach takes a broader outlook when gauging an asset. For example, a fundamental analyst considers macroeconomic and financial factors, relevant company’s performance and revenue, cash flows, profit margin, growth, policies, and future agreements.

This technique exhibits the currency’s current value and assists the investors in their long-term investing decisions. An educated approach towards financial markets reduces the risk of losses and maximizes gains.

How to do fundamental analysis in crypto?

Step 1. Target market

Digital coins appeal to different target markets. The ratio of penetration of these digital tokens on various platforms defines the corresponding value of cryptocurrencies.

For example, some larger target markets include offshore accounts and remittance transactions, whereas smaller markets include micropayments and crypto trading.

Assessing the extent of a particular coin’s circulation in these markets gives investors an idea about the prospects of that cryptocurrency. Furthermore, traders or investors can analyze coin prices by carefully evaluating market sizes and the currency exchange ratio.

Step 2. Roadmap

Most crypto blockchains have developed roadmaps for their future plans and projects. Roadmaps lay out clear objectives and targets of a project during an estimated time frame. This framework serves as a driving force for development and management teams to achieve fixed landmarks.

By gauging the roadmap of a crypto project, investors can evaluate the project’s standard and future success chances. In addition, a detailed roadmap indicates the project owners’ commitment to advance in this competitive sphere strategically.

Step 3. Competitor comparison

Competition is a matter of fact for any progressive market. But it is essential to evaluate a blockchain’s competitors to assess whether any other platform has already adopted this technology. Or is any other team moving forward with this type of project at a faster pace?

Careful perception is required to estimate the success potential of different companies. Unfortunately, there is no 100% confirmation formula to evaluate any project’s future path. But a shrewd judgment can give you a better direction for your investment plans.

Step 4. Releases/development

The crypto arena is continuously progressing with numerous developments and releases by blockchain platforms. Significant past developments indicate the promising future of the relevant cryptos. It also signifies the confidence of different industries and companies in using that cryptocurrency.

These developments may include accepting them as a mode of payments on significant platforms and incorporating them into real currency’s digital wallets. Therefore, past quality releases by crypto networks are a green signal for investors to consider that coin for their investments.

Step 5. Demand & utility

As cryptocurrencies are virtual assets, their functionality depends solely on supply and demand. As a result, they have their worth as long as people utilize them. Unfortunately, many digital coins have “died” due to the loss of their demand.

Networks that have roadmaps for tackling problems associated with blockchain technology have a high probability of creating their demand. Investors need to take into account the utility and demands of different coins for gauging their future value.

Step 6. Tokenomics

In simple words, tokenomics refer to all the characteristics, including a crypto token’s supply/demand and economics. Whitepaper of a crypto project usually sheds light on its working, total coin supply, and future projects.

Before investing in a crypto asset, you can look at its tokenomics to estimate its worth in the future. Knowledge of some points like burned or unusable coins, the maximum supply of tokens, and the potential for the future generation of coins can be vital for your investment decisions.

Step 7. Liquidity & volume

Liquidity and volume are interlinked concepts but have significant differences. For example, trading volume indicates an asset’s total quantity present in the market at a particular time. On the other hand, liquidity points to the ability of an asset to be sold or bought with swiftness.

As we can see, some digital assets like Bitcoin and Ethereum show tremendous liquidity resulting from high trade volumes and market interest. A greater volume forecasts the interest of investors in that market which inevitably leads to enhanced liquidity. On the other hand, investors avoid illiquid coins due to slippages and slow target achievement.

Step 8. Market cap

The cryptocurrency market cap continuously fluctuates as it depends on the total coins in circulation and the current price of that token at a particular time.

Consideration of the market cap is vital in your analysis because it indicates the coin’s horizon, supply, and potential among traders and investors. In recent days, the Bitcoin market cap has reached up to $2 trillion.

However, the market cap is prone to wild swings; therefore, investment only based on market capitalization carries enormous risks.

Step 9. Partnerships

Partnerships are an excellent way for any business or company to flourish. The same rule applies to cryptocurrency blockchain networks and platforms.

Strategic partnerships diversify the market reach and expand the customer base of every partner. In addition, parties can benefit from the professional knowledge and resources of each other. The success of a crypto platform depends on its services quality and extensive adoption by users around the globe. Healthy collaboration between blockchain platforms stipulates a promising future outlook for relevant digital tokens.

Step 10. Regulations

With the widespread use of cryptocurrencies in worldwide transactions, governments and authorities have set regulations to prevent illegal activities and tax evasion practices.

Cryptocurrency regulation has become an important emerging issue for higher authorities. As a result, most countries have developed registration and tax documentation processes for crypto assets.

Investors should try to avoid investing in unregistered or banned crypto networks as it can lead to accounts closure or seizure of assets.

Pros & cons

| Pros | Cons |

| Comprehensive future outlook Fundamental analysis involves in-depth and wide outlook studying of the blockchain networks that provide valuable information. | Difficulty in data acquirement Data of some projects are not easily accessible. In addition, it requires a considerable amount of time to study all facts and prospects. |

| Suitable for long-run investments This analysis takes various economic and performance factors into account, making it appropriate for long-term investments. | No consideration of short term swings Fundamental analysis does not account for rapid market swings due to changing public sentiments. |

| Less stressful It does not require continuous monitoring of charts and markets, therefore, causes less stress. | Not necessarily symbolize price gains Even if a company’s intrinsic value is good and promising, it can encounter falling prices and a loss in value. |

Final thoughts

Cryptocurrency has permeated this digital era and has grabbed the interests of investors and the tech-savvy generation.

The DeFi applications and decentralized features of crypto blockchains appear appealing to companies and people around the globe. As a result, experts have devised many techniques and analysis methods to make your investment decisions easier. If you are a long-term investor, implementing fundamental analysis steps before investing in digital assets can prove highly beneficial to you.