Delta and Gamma (D&G) are important option that defines the sensitivity of an options trading instrument. Investors can quickly determine the value of an options trading instrument using the Black and Scholes formula, but understanding the volatility is essential.

D&G is a process to determine how much an options trading instrument is vulnerable to changing other market variables like market price, interest rate, expiry time, etc. The following section will uncover everything a trader should know about the Greeks to make their trading fruitful.

How do the Delta and Gamma hedging option strategies work?

Options Delta calculates the sensitivity of the price of a crypto option instrument with the change in other variables. For example, if we look for a call option on Bitcoin expiring on 31 December 2022, the Delta will measure how much the instrument’s price might move with the change in the spot price.

The option Delta of a call option varies from 0 to +1. On the other hand, for a put option, this metric varies from 0 to -1. It indicates the instrument’s sensitivity to the change in any variable, while Gamma identifies how much the Delta changes. Overall, Gamma measures the momentum while Delta determines the rate of change. The combination of these two metrics helps traders to make reliable trading decisions.

Reason to use Delta and Gamma hedging option strategy for traders

In options trading, many factors affect the price movement, making trading difficult even for an experienced trader. Sometimes, traders have to make a quicker decision based on the market condition and uncertainty.

We can’t define the impact of changing a variable for the option value in options trading. However, we can measure the influence of purchasing a call option instead of purchasing the entire contract. Gamma shows how the risk of the particular investment is heading. Using this, you can find the exposure rate, whether in a positive or negative direction. Moreover, Gamma works well on market strategies where different strike prices are present. This strategy changes the Gamma value with the change in volatility and asymmetry.

How to use the Delta and Gamma hedging options strategy?

Let’s see how D&G hedging works in the step-by-step approach.

Step 1. Identify the geek

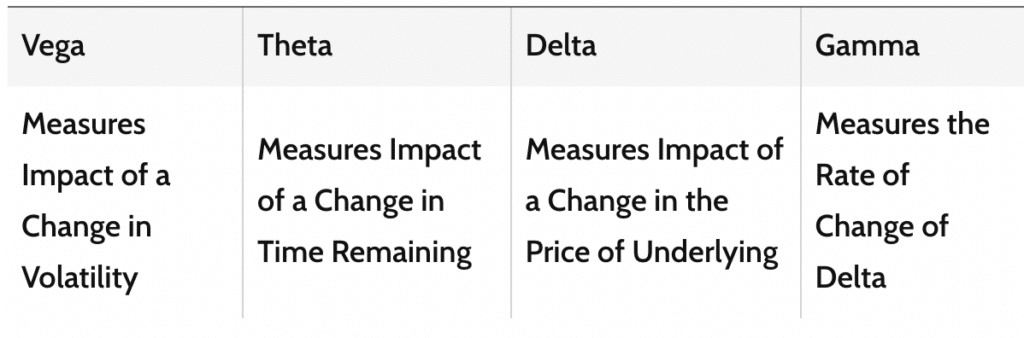

Delta, Gamma, Vega, and Theta are common geeks that every options trader should know:

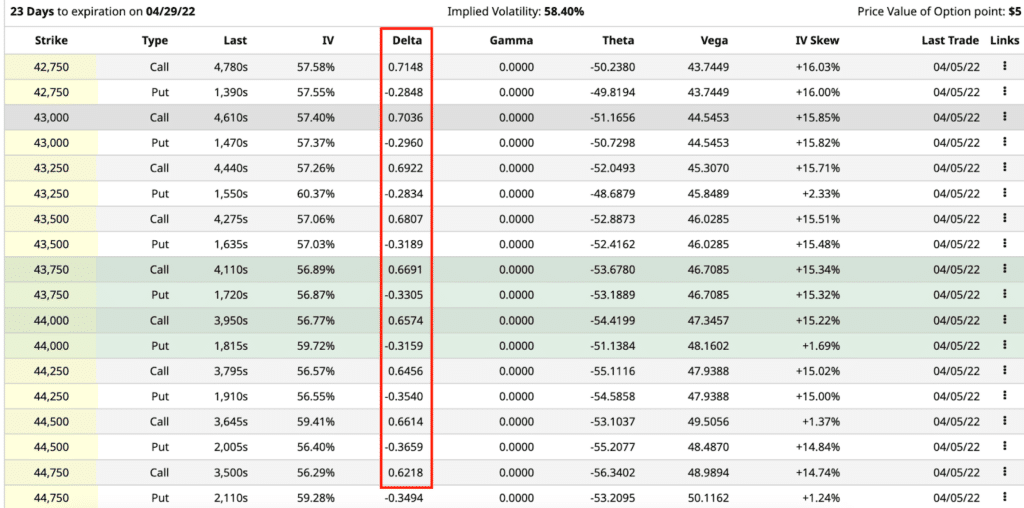

Step 2. Delta

Delta defines the change of the trading instrument from the change of a variable. Its direction changes from -100 to 0 for the put option and 0 to +100 for the call option. The negative Delta in put option holds an inverse relationship with the price of the trading instrument.

On the other hand, the call option has a positive correlation with the instrument. If the price of an underlying asset rises, there will be no change in variables like the implied volatility or the expiry time. However, if the price falls, the call premium will be declined by keeping other things constant.

Let’s see an example. Imagine a race track where the tire is Delta and gas paddle is the underlying price. Therefore, the low Delta means an economy tire where the contraction between the vehicle and road will be low. Conversely, the high Delta is a drag race where the acceleration increases with an increased speed.

Step 3. Gamma

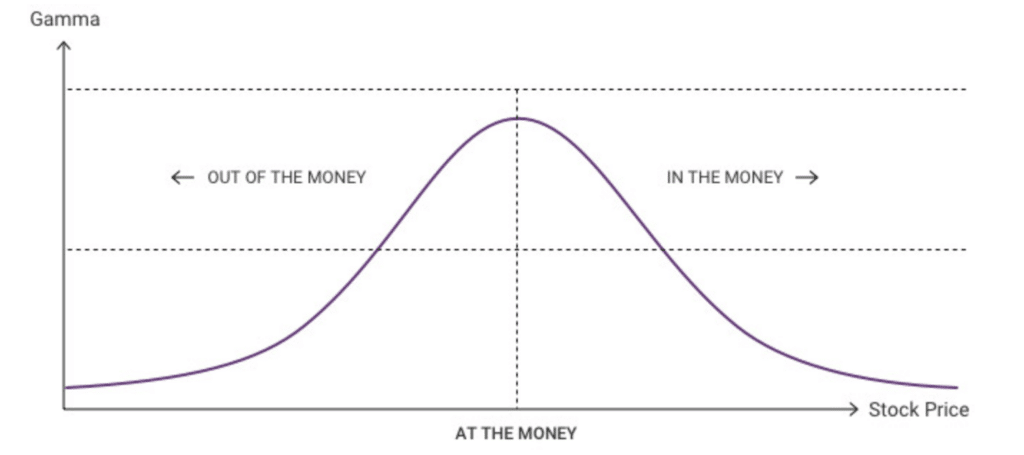

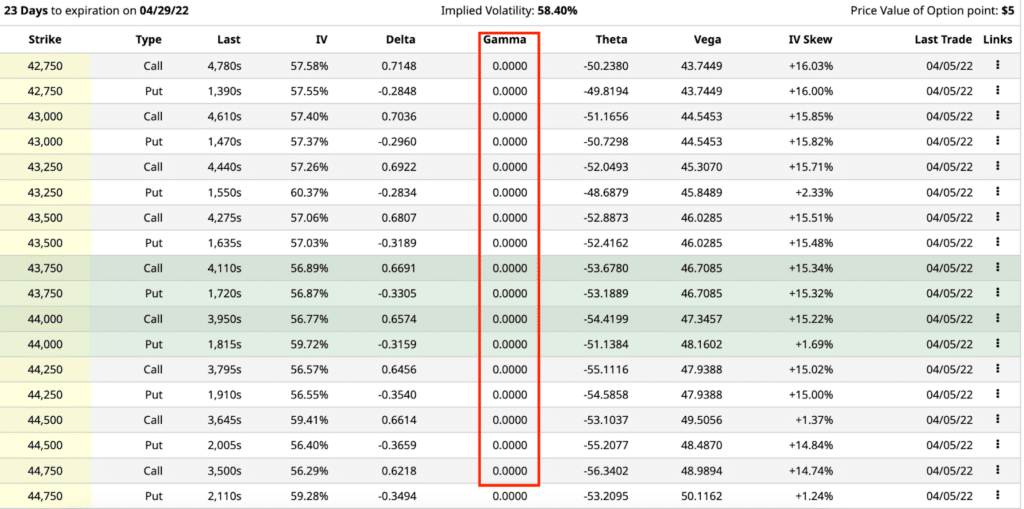

Gamma defines how much Delta changes with the price movement. Gamma changes its value with the price over time, but there is no way to track how much it is changing. Gamma covers the gap by calculating the change.

Suppose that two options have the same Delta value but one with a lower Gamma and another with higher Gamma. The higher Gamma value will represent a higher risk even if the Delta is the same. Therefore, the instrument is highly volatile if the Gamma value is high, whereas predicting the future price is difficult.

Bullish trends

This section will see how to use D&G hedging in a buy trade.

Where to enter?

Suppose that the in-the-money option has a Delta of 0.80 while another out-of-the-money option has a Delta of 0.25. A $1 price change will prove a $0.25 increase in the second asset and a $0.80 increase in the first asset. Therefore, traders should find the asset offering a higher Delta while making the buying decision.

Where to put the stop-loss?

In a call option, traders want a positive Delta with the underlying price. Therefore, make sure these conditions determine the risk:

- Delta increases the expiration price near or exact at-the-money option.

- Gamma influences the Delta by showing the rate of change.

- Delta has a connection with price volatility. The increase in volatility is a sign of an increased Delta.

Where to take profit?

Delta hedging is a process to determine the likelihood of a trading asset during the expiration. From the above example, we can say that the 0.20 out-of-the-money Delta indicates a 20% chance that the money will be at the expiration date.

Bearish trends

In the put option, traders expect the price to come down where the Delta measures the probability of winning the trade.

Where to enter?

Like the bullish trade, trades should list the associated trading setups with the Delta and find which put option is providing a higher Delta. In that case, any bearish pressure on the higher Delta would make more selling momentum than the lower Delta.

Where to put the stop-loss?

Delta measures the risk associated with the trading instrument. Therefore, investors should keep these risk factors in their mind:

- Delta increases the expiration price near or exact at-the-money option.

- Gamma influences the Delta by showing the rate of change.

- Delta has a connection with price volatility. The increase in volatility is a sign of an increased Delta.

Where to take profit?

If the Delta of a put option is 30%, it indicates that there is a 30% chance that the price will be during the expiration.

Pros & cons

| Pros | Cons |

| These tools define how the asset price changes its value compared to other variables, which is an essential metric for analysis. | These tools are not complete tradings methods as it only defines the volatility rate. |

| They work together where the Delta shows the volatility, and Gamma shows the volatility rate. | Besides using them, investors should have a profitable trading method. |

| They provide a better price outlook than Vega and Theta. | In a volatile market like Bitcoin, it is hard to find a reliable D&G to make proper trading decisions in a volatile market like Bitcoin. |

Final thoughts

In the above section, we have seen a detailed use of D&G in crypto options trading. Using these tools would make the trading decision effective by reducing the risk of losing money. However, investors should use other metrics and trading methods to benefit from options trading.