Identifying the best and worthy stocks for your investments requires substantial research and dedication. Technical and fundamental analysis are the two most common methods that help investors estimate the current value of financial securities and predict their future course.

Fundamental analysis is the golden stone for long-term investors due to their preference to determine the inherent value of investment products, irrespective of the short-term price swings. Though many consider the process complex, there are many simplified methods to gauge the fundamentals of the relevant company and country.

This article will explain the component of economic analysis in fundamentals, how it works, and its limitations.

How does economic analysis work?

Economic analysis in fundamentals refers to evaluating the original value of stocks or other financial products by considering the relevant economic and financial information. Investors utilize this analysis method and macroeconomic indicators to determine the condition of a country’s or business’ financial state.

Economic analysis maintains a considerable significance among investors as it can indicate the future direction of an economy and assist them in formulating solid investment strategies. Weekly or monthly data releases like unemployment reports, business surveys, construction reports, durable goods reports, etc., carry helpful information for economic analysts.

It is important to note that the notion of economic analysis is markedly different from technical assessment methods that rely on price action. Economic analysis deciphers the intrinsic value of stocks or funds in relation to macroeconomic or external factors.

Reasons to use for investors

The economic analysis aids the investors in recognizing worthy stocks with good growth potential. Moreover, this analysis technique allows investors to buy stocks at a discounted value if the economic data shows promising aspects.

For example, a stock price may plunge to a lower value due to temporary disturbances. An economic analyst can identify this fall’s true nature and purchase the security if it displays a positive financial record with a good intrinsic valuation.

Moreover, leading and lagging economic indicators assist the investors to grab the trading or investing opportunities timely without false signals. In addition, this analysis method is suitable for long-term investors as it can specify the long-run outlook of stocks.

How to use economic analysis to pick the best stocks?

Various economic indicators assist in identifying the best stocks with productive potential. Here we have discussed some of the most common indicators involved in economic analysis:

Gross Domestic Product

GDP is the most critical and primary indicator that estimates a country’s economy’s overall size and health. It reflects all the economic activity and exchange of goods and services in the public and private sectors.

The GDP rate is compared with the previous ones to assess the economy’s percentage of growth or contraction. This indicator helps sort out stocks by presenting a comprehensive picture of the economy.

Market indexes

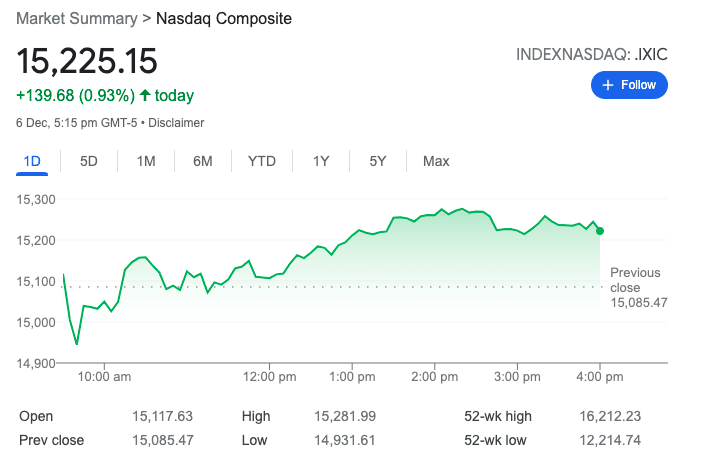

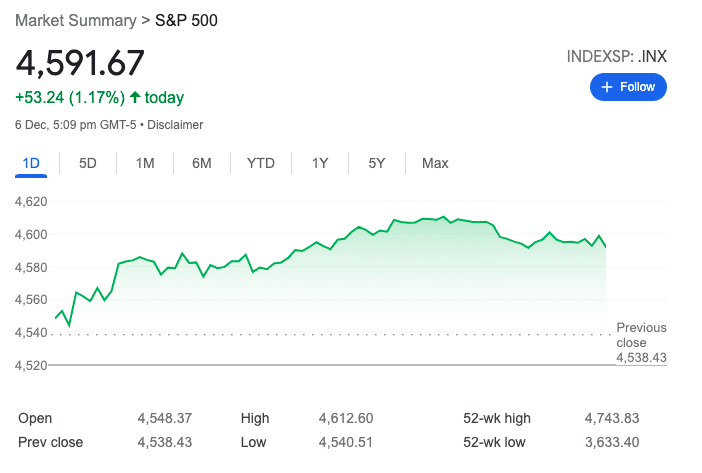

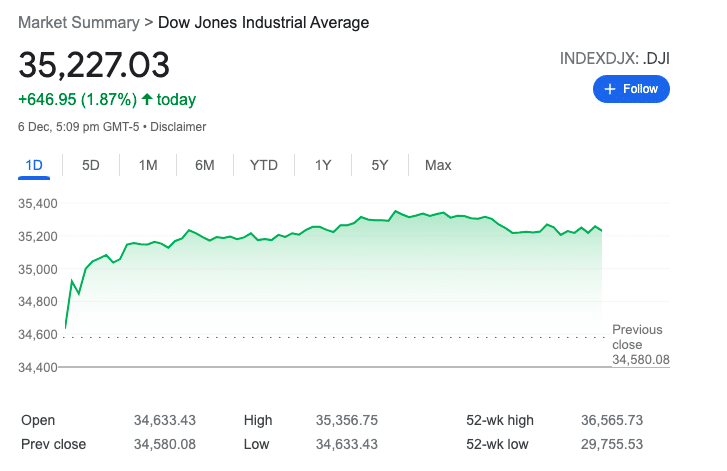

The three most popular market indexes, i.e., Dow Jones, Nasdaq, and S&P 500, indicate the overall market health by showing the performance of US leading companies.

| Nasdaq | S&P 500 | Dow Jones |

|

|

|

Investors utilize them according to their specific requirements as each index consists of diverse market or value-weighted, established, or young companies.

Inflation indicators

Indicators like Producer Price Index (PPI) and Consumer Price Index (CPI) help estimate inflation level and corresponding interest rates. These indicators measure the price variations of raw or final goods and the costs of products/services paid by consumers.

Currency value

Currency strength is an essential gauging factor of a country’s economy and affects investment levels. A strong currency boosts the economy and indicates the stability of investment products.

Unemployment data

Unemployment reports like US’ non-farm payrolls’ specify the number of available jobs, range of workforce, and the number of unemployed individuals during a particular period.

Investors look at these reports to make their investment decisions as a low unemployment rate indicates rising stock prices and vice versa.

Best stocks using economical analysis

Here we have discussed an example of stock worth investing in according to the economic analysis.

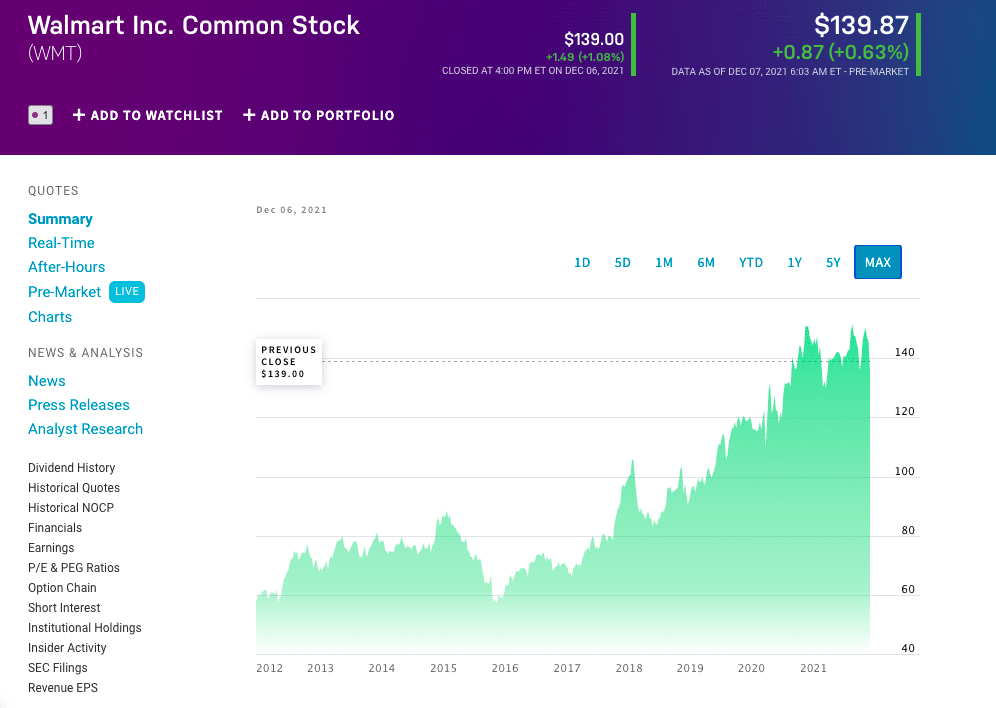

Walmart Inc. is a consumer retail and wholesale chain that operates more than 11,000 stores worldwide. It offers e-commerce services, grocery products, health & fitness products, and manages supermarkets.

WMT has exhibited a consistent bullish performance in the past five years, representing its financial health. The company has a revenue generation (ttm) of 571.9 billion with a gross profit of (ttm) of 138.8 billion. Moreover, it has a current trailing P/E of 48.08 and shows a 7.45% return on assets.

These figures, alongside other factors, point to the long-term potential of this stock.

Investors can buy the stock after careful consideration of all factors. An ideal entry point is when the price pulls back from the high price zone, providing a cost-effective entry for purchasing the stock.

Economic analysts hold their investments for the long-term; however, it is prudent to look for warning signals such as deteriorating financial data to quit an investment.

As economic evaluation stipulates a stock’s actual value, investors could hold their investments till the predicted target gets achieved.

Pros & cons

Let us have a look at the advantages and limitations of economic analysis.

| Pros | Cons |

| High success probability The economic analysis looks into the state of business instead of temporary price movements. Hence, it has higher chances of succeeding in the long term. | Time-consuming research This analysis method necessitates extensive and careful research to make sense of the economic data. |

| Independent of market sentiments Investors who purchase stocks through a careful fundamental analysis do not engage in panic buying and selling. | Long waiting time This technique does not generate immediate profits and requires a longer duration to manifest results. |

| Reliant on solid underlying factors Economic analysts select stocks by studying the solid underlying factors of security that drive their growth. | Complex data Economic analysis is not suitable for investors who cannot handle complicated financial data and reports. |

Final thoughts

There is a wide range of economic analysis techniques that have varied usefulness according to the suitability of each investor. Nonetheless, a comprehensive understanding or knowledge of the economic sphere is necessary to achieve long-term investment success.

Moreover, you can combine and compare numerous financial reports and economic indicators to gain a clearer picture of the economy. However, every investment involves speculation and requires proper risk management to prevent enormous losses.