Over the years, the stock market has massively expanded, displaying massive public interest in the investment realm. According to some estimates, the total worldwide stock market capitalization crossed the $90 trillion market in 2020, exhibiting the economic importance of stock markets.

Moreover, investors are constantly looking for financial securities with the maximum probability of profits. Investment may appear simple and easy to earn passive money without much effort; however, success only follows investors who acquire pertinent knowledge, explore financial data, and utilize various tools to pick out worthy stocks.

Stock float is one of such essential tools that describes a lot about the working methodology of stocks.

Read this article to get a detailed understanding of how stock float works and what its specifications are.

What is float in stocks?

Stock float refers to the number of publicly available stock shares that trade on the stock exchanges. Floating stock represents the number of shares left after excluding the restricted and closely-held shares from outstanding shares. For further clarification, the stock float is a portion or subset of total outstanding shares.

The stock float figure carries great importance for investors, indicating the number of available stocks for trading. You can calculate the float by subtracting the total number of outstanding shares from restricted stocks and stocks held by company insiders and institutional investors.

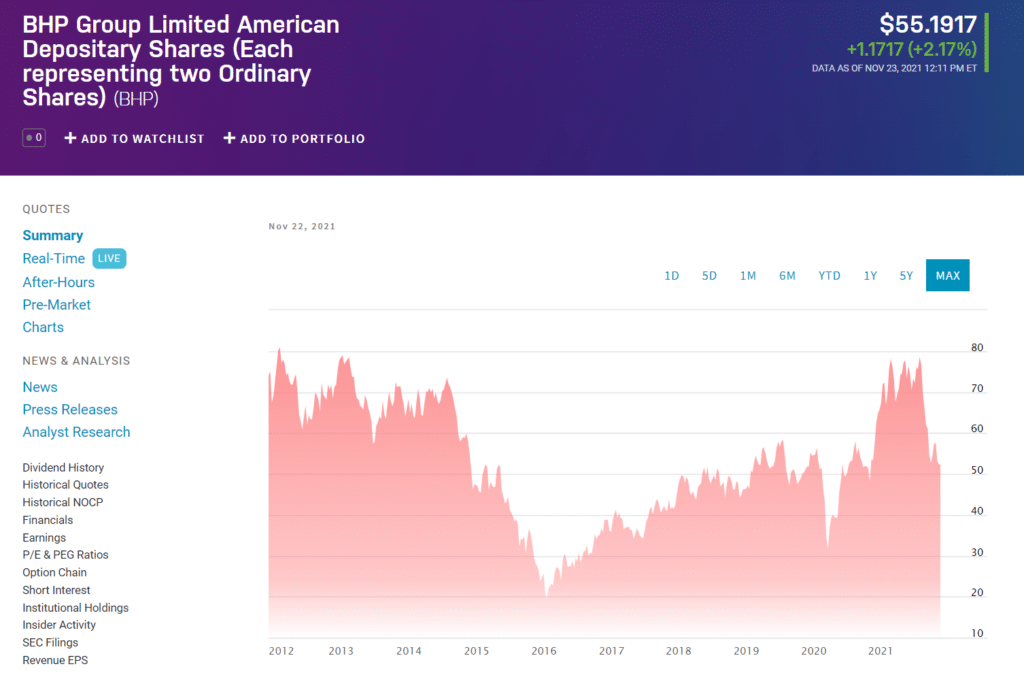

For example, as of November 2021, BHP Group (metals mining company) has 2.53 billion outstanding shares. Insiders hold 0%, and institutions hold 7.05% of the total outstanding shares. That would mean that this is a high-float stock with around 93% publicly available shares.

How does float works?

Investors usually classify stock float into two categories, namely high-float and low-float. High float indicates a larger number of publicly available shares with high trading volumes and enhanced liquidity. AAPL is one of the high-float stocks with less than 1% insider-held shares.

On the other hand, low float points to a limited number of publicly available shares, generally below ten million. The low number of traded stocks results in higher volatility as traders exercise more control over the price movement.

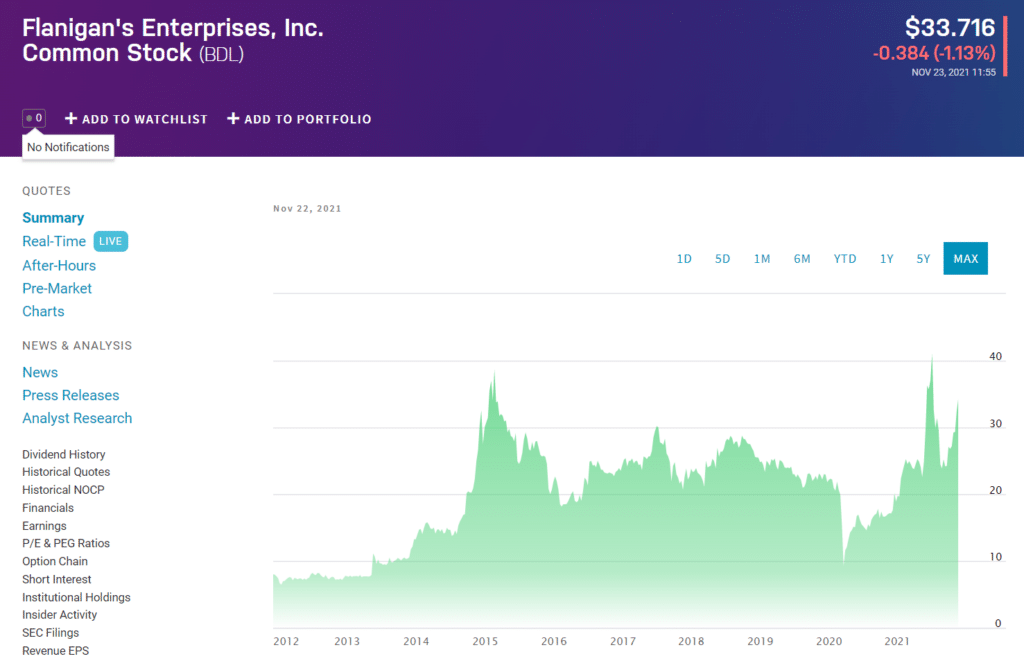

The wild price swings make low float stocks a risky investment but correspondingly enhance the chance to gain rewards. Flanigan’s Enterprise (BDL), a Floridian food chain, falls into the category of low float as insiders hold almost 70% of the total outstanding shares.

Moreover, a stock float can change whenever the company issues new shares or the buying/selling percentage of insider and institutional holding fluctuates.

What to consider when buying floating stocks?

The decision to invest in low-float or high-float stocks vary with personal preferences and goals. What is your risk tolerance? And do you want to invest in volatile or stable stocks? The answers to these questions can indicate your investment alignment.

Low float stocks appear as a lucrative investment option for day traders and short-term investors. Due to the limited amount of available shares, any notable event can significantly move the stock prices. However, investors need to consider several factors before selecting a well-performing low float stock.

Investors should look at the relative trading volume of low float stocks to determine their liquidity range. Low liquidity can cause investors to get stuck in trades without buying or selling the securities. Moreover, evaluate the impact of new events on such stocks and the stock split or reverse split.

Here, we have compiled a list of some low float stocks considering their historical performances and ratings.

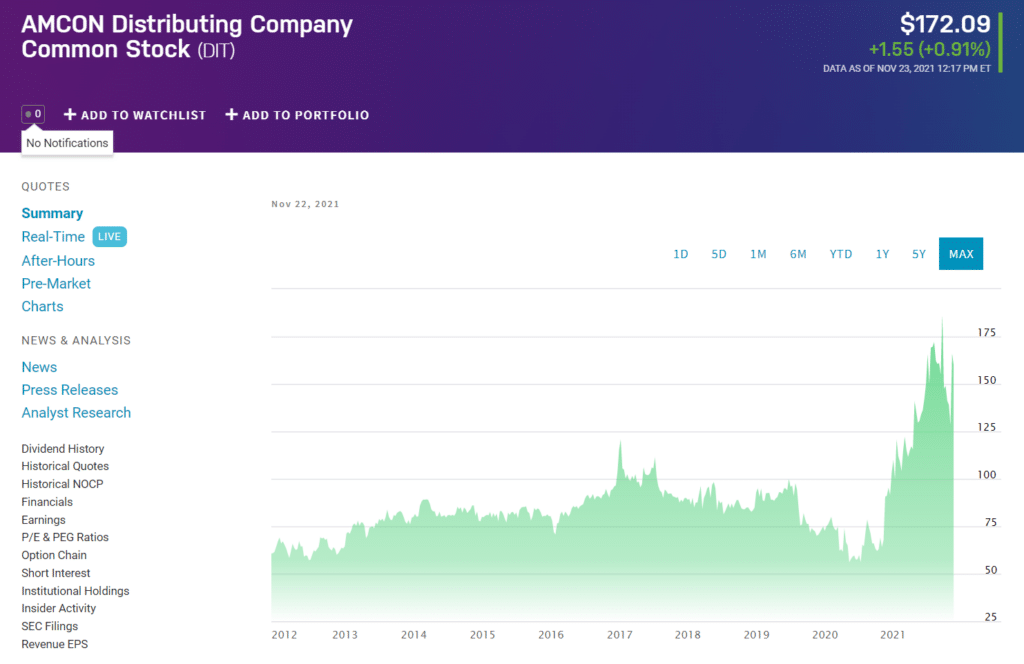

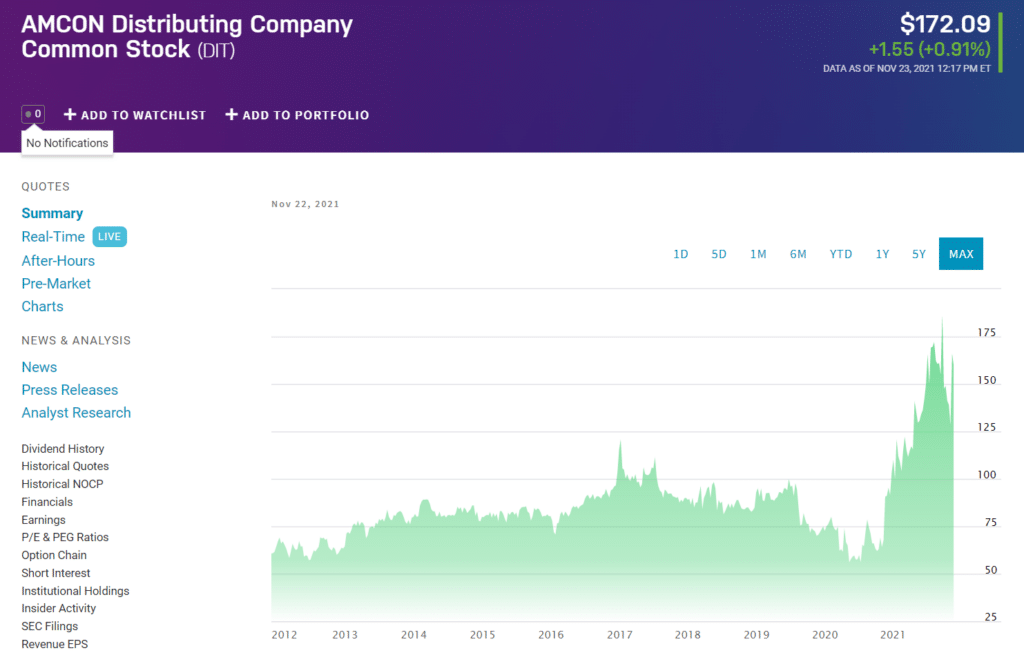

1. AMCON Distributing Company (DIT)

Price: $172.09

EPS: 27.38

Market capitalization: 98.2 million

Dividend yield: 0.72

AMCON Distributing Company is a food distribution company dealing with wholesale consumer products such as groceries, beverages, frozen and refrigerated products, confectionery items, and paper products.

This Nebraska-based company also operates through a retail health food segment and manages around 20 retail centers around the US. As of November 2021, AMCON Ltd has about 582k outstanding shares and 166k floating shares, indicating a floating percentage of 28.5%.

The company showed 1.27 billion in revenue in the last 12 months with quarterly revenue growth of 8.20%.

DIT stock price forecast 2022

Technical indicators and forecasts indicate the promising prospects of this low float stock. DIT price can reach up to $267 by the end of 2022.

2. HMG/Courtland Properties, Inc. (HMG)

Price: $17.78

EPS: -0.55

Market capitalization: 17.5 million

Dividend yield: 0.50

HMG/Courtland Properties, Inc. is a US-based real estate investment trust company that owns and manages various commercial properties. The company also invests in non-REIT securities, including debt and equity securities of large-cap corporations, government agencies, and private companies.

The company has about 1.02 million outstanding shares, out of which only 41% of shares are available for public trading. The trailing price-to-earnings ratio and a price-to-sales ratio of HMG Inc. stand at 41.81 and 220.3, respectively.

HMG stock price forecast 2022

Analysts report that the price of HMG stock can undergo ups and downs in the upcoming period. However, it can cross the $25 mark by the end of 2022.

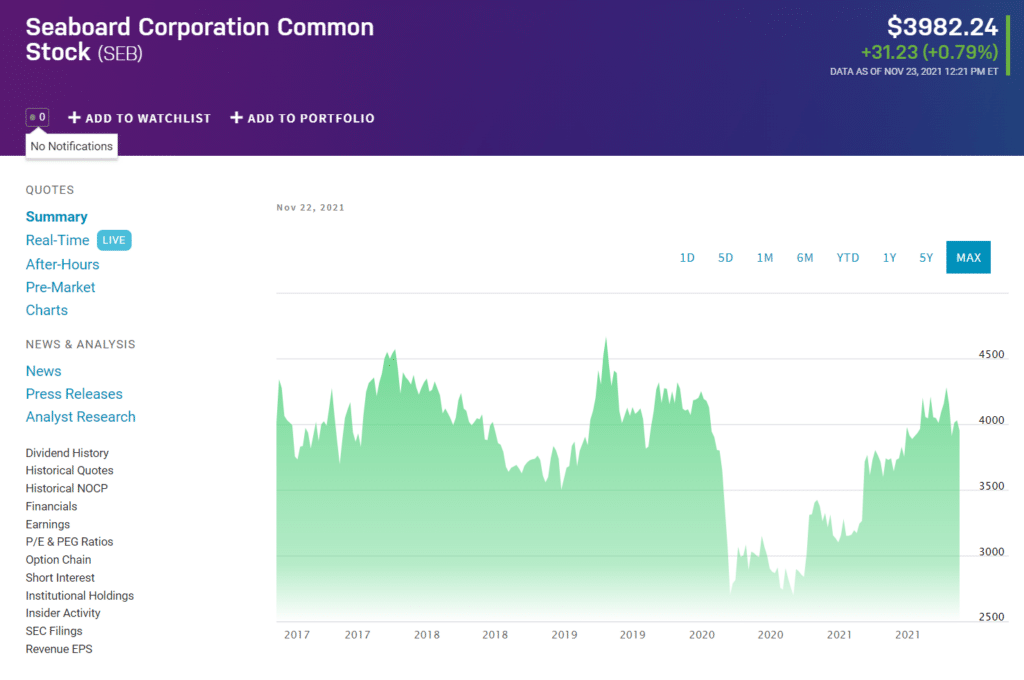

3. Seaboard Corporation (SEB)

Price: $3925.01

EPS: 609.6

Market capitalization: 4.55 billion

Dividend yield: 9.00

Seaboard Corporation is a Kansas-based large agribusiness and transportation company that operates through six major branches. The company provides services related to Commodity Trading and Milling, Marine, and power. In addition, it also produces and distributes products like Sugar, Alcohol, Pork, and Turkey.

The company has approximately 1.16 million outstanding shares and a stock float of 255k. This float indicates that the public can trade only 23% of the total outstanding shares on the stock exchange.

Seaboard corporation generated a revenue of about 8.76 billion in the past year with a quarterly revenue growth rate of 38.4%.

SEB stock price forecast 2022

This low float stock will most likely retain its upward momentum in the upcoming years. According to Wallinvestor, the price can reach up to $5377 by the end of 2022.

Pros & cons of low float stocks

Low float stocks accommodate various advantages and limitations. Let us have a look at the pros and cons of this stock category.

| Pros | Cons |

| Instances of high demand Any news event of catalyst can trigger high demand of low float stocks, sometimes spiking the price to more than 200% in one day. | Unstable growth Low float stocks are not suitable for investors who prefer slow and steady price growth. |

| Strong momentum Low float stocks offer intense price volatility and momentum, suitable for day traders. | Low liquidity A lesser number of publicly available shares results in illiquid markets and high bid-ask spreads. |

| Intrinsic worth Insiders and institutions hold a major portion of stocks, indicating the intrinsic potential of the relevant company. | Unknown companies Most of the low float stock companies are less known with scarce financial data. |

Final thoughts

Stock float is an essential standard to estimate the reward and risk potential, liquidity, and ownership percentage of stocks. Among various investing tools and metrics, investors evaluate the stock float to maximize their profits.

High float stocks involve lower risk and steady momentum, but low float stocks offer higher rewards and quick gains. The decision to invest in either category depends on the investors’ objectives, goals, and investment duration.