There are myriads of opportunities you can take advantage of the currency market. You can find such opportunities by analyzing charts and observing price action. With a trained eye, you might come across price patterns that tend to repeat over and over again. Who knows you can decipher a market anomaly not yet seen by other traders? The currency market indeed provides endless opportunities.

In this article, we will look at a market anomaly caused by the decentralized nature of the forex market. While taking advantage of this opportunity is difficult as it usually requires equipment, research, and programming skills, it is good to know that it exists and is up for grabs for anyone interested. What we are talking about is arbitrage, a common but fleeting occurrence in FX. You will learn more about it as we go along the discussion.

What is forex arbitrage?

FX arbitrage involves exploiting price differences in platforms providing price quotes such as banks and brokerage firms. You can execute arbitrage in various ways, as you will see later. Whatever method you use, your goal is to buy and sell currencies whose prices differ or are divergent at the moment in time between platforms.

You perform these transactions in anticipation of the eventual convergence of price in the platforms involved. In time two prices on those platforms will become the same. When this happens, you can close both trades and make money in the process. Be aware that a successfully implemented arbitrage transaction can take seconds or milliseconds to complete.

How does arbitrage work?

As already mentioned, the FX market is decentralized. As a result, price quotes of the same currency may differ from one liquidity provider to another. This market inefficiency is prevalent despite the era of digital technology and automated trading we are in. If you have spotted such price discrepancy, you should buy whichever price is lower and sell whichever price is higher. From the point of view of traditional buy-and-sell transactions, you stand to make money in doing this. The same applies to trading.

Let us use an example to illustrate the point more clearly. Assuming the exchange rate of EUR/USD in a bank in the US is 1.18500 while a bank in the Philippines provides 1.18550. Here you see a discrepancy of 5 pips in the exchange rate. If you have access to these quotes and can transact from both banks, you can buy the US price and sell the Philippines price.

When the quotes later converge to, say, 1.18560, then you can close the two trades. The Philippines trade would lose one pip, while the US trade would gain six pips so that you would gain five pips in profit without the commission fees.

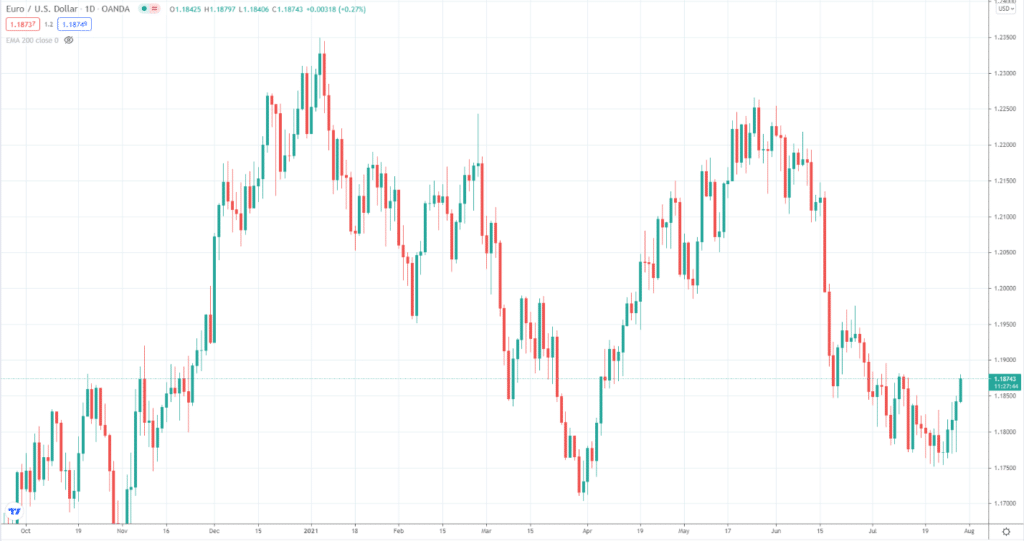

The chart above shows the current price of EUR/USD. The market price is 1.18743. However, this price is from the Oanda broker. If the price for this pair is different from other brokers and the difference is significant, this is an opportunity you can take as an arbitrager.

The role of arbitrage

Compared to discretionary trading, you might say the profit you could gain in terms of pips using arbitrage is not that much. As shown in the above example, the arbitrage trade resulted in a 5-pip profit with fewer commissions. The good thing is that it is possible to find arbitrage opportunities in many instruments simultaneously, and you can find such opportunities several times in a trading day.

Because of this, some companies invest time and money in building systems to exploit and profit from this market anomaly. This is one of the reasons why participants in the currency market today are not only humans and institutions but also computers running automated systems.

With automation, you can enter and close arbitrage trades in a concise period. In the past, divergent price quotes across trading platforms typically lasted a few minutes or seconds. However, today this price-quote divergence could reach equilibrium in a matter of milliseconds. As a result, the forex market has become more efficient than it was before. Still, few other arbitrage opportunities come from time to time. These occur during news events that cause wild price fluctuations or in the wake of erroneous price quotations.

Types of arbitrage

There are other classes of FX arbitrage worth mentioning here. Refer to the list below:

- Basic forex arbitrage

It concerns the process of taking trade transactions to take advantage of variances in price quotes across providers instead of speculating on the change in exchange rates of currency pairs.

- Triangular arbitrage

It refers to the process of exploiting price quotations of currency pairs whose base or quote currency is not the US dollar. The method of implementing the arbitrage transaction is the same as the first variant.

- Covered interest-rate arbitrage

It refers to the process of investing in a currency pair where the interest rate difference between the base and quote currencies favors the investor. Here the investor would put money in the currency with a higher interest rate and then use a currency forward to manage the risk.

- Uncovered interest-rate arbitrage

It refers to exchanging one currency with a lower interest rate with another currency with a higher interest rate. One way to do this is to open a bank account in your country, choose an account type denominated in a foreign currency, and then save money in it.

An example is a Filipino depositor opening a dollar account in a local bank in the Philippines and depositing money in that account. The bank will convert the local currency (peso) to the US dollar-based on the exchange rate at the time of deposit. If the US dollar appreciates against the Philippine peso, the dollar account will stand to make money apart from the interest provided by the bank yearly.

- Spot-future arbitrage

It refers to purchasing a currency from the spot market and selling the same currency in the futures market. You may also sell a currency in the spot market and buy the same currency in the futures market. It all depends on which price divergence is favorable to you.

Forex arbitrage challenges

Although arbitrage provides a unique opportunity that allows you to make money in the currency market without going deep into market analysis, there are challenges that you must overcome or find a workaround.

Below are some of these challenges:

- Arbitrage trades require speedy execution, or you miss the opportunity. From the time you identify a price anomaly, you should execute the transactions quickly. To do this, you will need a high-end computer with a fast internet connection.

- Finding trade opportunities in multiple symbols is difficult, if not impossible, to do manually. Therefore, you will need an expert advisor for this purpose. This type of expert advisor is often not easy to find, and not many developers can create this program.

- Spread is one factor that may adversely affect your arbitrage trading results. Make sure that you open your account with a broker that provides tight spreads. Examples of these brokers include OctaFX and ICMarkets. You might find such brokers, but you might need to open a standard account.

The above chart is a one-minute chart of EUR/AUD. The red line is the ask price, while the blue line is the bid price. The difference between the two is the spread, which is 2.2 pips here. In contrast, the spread of this pair in ICMarkets is only 0.9 pips.

Final thoughts

Arbitrage is another way to participate in the Fx market without doing speculation. If you can find solutions to the problems posed by arbitrage trading, then this path might be suitable for you. However, this route is not an easy one to journey on as well. There are challenges you must face and conquer to get your foot in the door.