You can make money in crypto even without learning trading or investing strategies. Such opportunity exists through arbitrage.

For example, an arbitrageur can hold 1 BTC on Coinbase and $53,000 worth of USDT on Binance. When the price of Bitcoin is $53,000 on Binance and $53,200 on Coinbase, the logical trader could sell their Bitcoin on Coinbase for USDT and buy 1 BTC on Binance with their USDT holdings. This would allow the trader to pocket the $200 difference as a profit.

With crypto arbitrage, you will not worry about price moving against you and holding on to losing positions for a long time. Arbitrage allows you to get in and out of trades quickly without much risk.

Let’s move to arbitrage opportunities and challenges. Once you conquer these, you might succeed in this business.

What is arbitrage?

Traders have been doing arbitrage even before cryptocurrencies came into existence. An arbitrage opportunity presents itself when the price of crypto varies from one platform to another, such as between two exchanges.

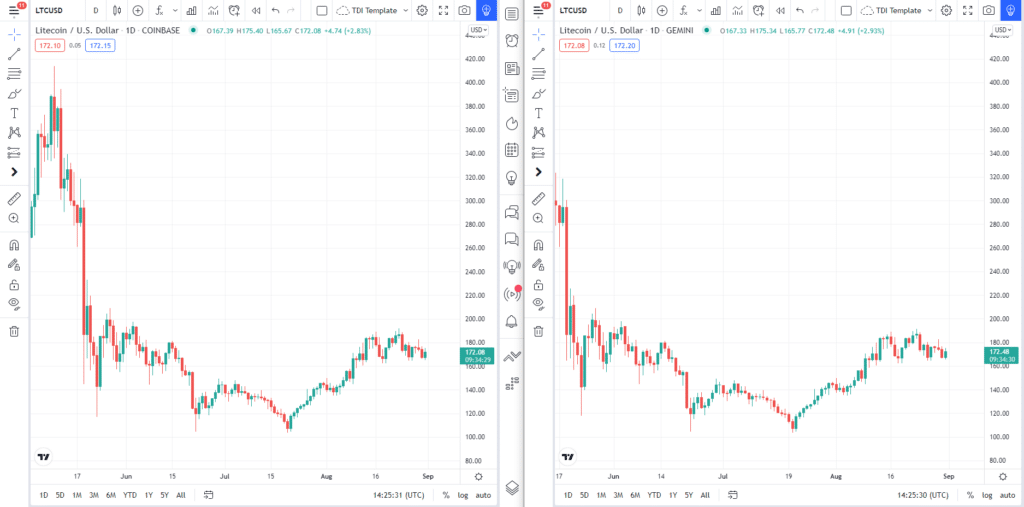

For example, if the price of Litecoin in Coinbase is $172.08 and in Gemini $172.48, you can take advantage of this opportunity by buying Litecoin in Coinbase then selling it in Gemini. You buy crypto from a platform offering a lower price and then sell it to another platform offering a higher price.

That is precisely the situation in the image shown below. There you can see the daily charts of Litecoin in Coinbase and Gemini. The price difference is not much, but you can benefit from it. At other times, the price differences are substantial. On many occasions, the prices are the same or very close to each other.

Price variation in various platforms is due to market inefficiencies, which you can benefit from. This market inefficiency also occurs in fiat currencies, though not as frequent and not as noticeable. In contrast, price variances occur very often and with significant differences in cryptocurrencies. Crypto is run in decentralized networks, apart from being a new market using new technology (i.e., blockchain). Each crypto exchange might price assets differently based on different reasons.

Why do prices vary?

Prices vary due to market inefficiencies arising from decentralized operations. While small exchanges seem to mimic the prices of assets from more prominent crypto platforms, most exchanges have an in-house quoting system.

Crypto platforms update the exchange rates of crypto assets in real-time based on the prevailing prices at which traders buy and sell these assets on the respective platforms. Thus, crypto prices depend on the supply and demand in real-time.

Types of crypto arbitrage

There are various types of crypto arbitrage you can engage in. Here we outline the three most popular types of arbitrage among crypto users.

Deterministic arbitrage

Deterministic arbitrage is the primary form of arbitrage, and it is the type discussed so far. As an arbitrager, you will look for arbitrage opportunities in various exchanges. Once you identify an asset being traded at different prices in two exchanges, you can buy an amount from the one that offers a lower price and then sell the entire asset to the another that holds a higher price.

Triangular arbitrage

By the term itself, triangular arbitrage involves three crypto assets, and you trade these three assets in one crypto exchange. Once you identify a situation where the prices of three crypto assets in an exchange are uncorrelated, especially when one asset is underpriced, you can make money without leaving the exchange.

For instance, you could trade Ethereum with your Bitcoin, trade ripple with your Ethereum, and finally, trade Bitcoin with your Ripple. In summary, you move your funds around using three crypto assets. Your goal is to get more crypto at the end of the three conversions for the asset where the conversion begins and ends, in this case, Bitcoin.

Decentralized arbitrage

Decentralized arbitrage involves performing arbitrage transactions in decentralized exchanges such as Curve, Balance, or Uniswap. As an arbitrager, you can buy or sell combined crypto assets you think are overvalued or undervalued in these different exchanges. This trading activity will ultimately result in price convergence in these exchanges.

Things to consider in crypto arbitrage

While the arbitrage concept is easy enough to assimilate, the actual execution process can be lengthy and complicated, and you might miss the opportunity in the process. There are at least two things you must bear in mind before you jump into this opportunity.

Execution speed

The price can change quickly since volatility characterizes the crypto market, and you might miss the arbitrage opportunity. To make money out of arbitrage trading, you must execute the trades as quickly as possible, that is, as soon as you have spotted an opportunity. Otherwise, you would not make money or, worse, lose money when the price difference shifted not in your favor.

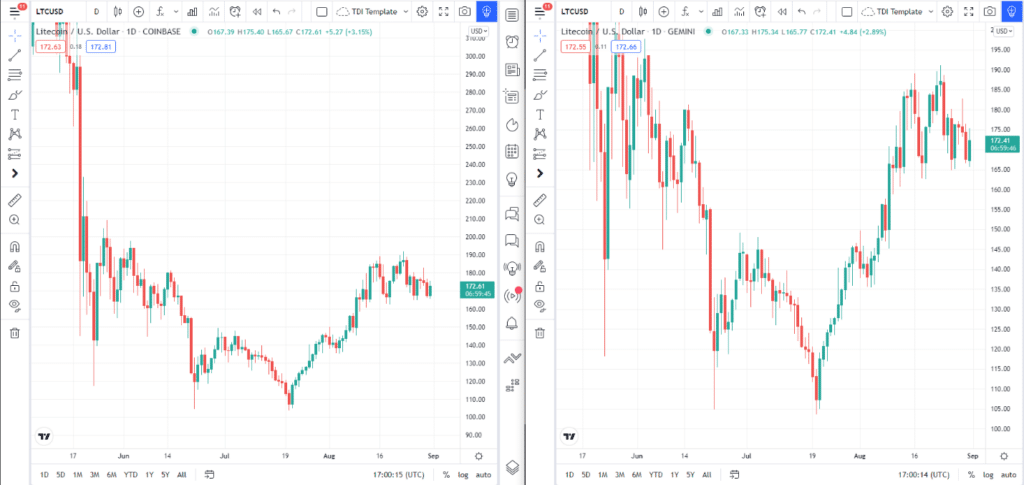

Consider the two sets of images above. They show Litecoin prices on the same two exchanges initially mentioned. As you can see, prices have changed immediately after a short while, particularly on the Gemini exchange.

One way to execute trades fast is by using exchanges with high volume and thus high liquidity. Another great option is to use automated programs or robots that automatically execute arbitrage transactions without your input. The challenge is developing the automated trading program itself, as the coding involved is entirely different from the expert advisors used by traders in the currency market.

If your crypto arbitrage method requires transferring funds from one exchange to another, make sure that your transactions involve crypto assets that you can transfer quickly between exchanges. This means that bitcoin is not a good candidate for such a transaction as you have probably known that bitcoin transfer can take time.

Transaction costs

Another thing to consider when arbitraging is transaction fees. These fees could eat up your profits when you perform transactions such as the following:

- Buying crypto coins using your local currency. You will buy at the ask price.

- When you use PayPal to receive funds and your account is denominated in another currency.

- When you withdraw PayPal funds to your bank account.

To avoid moving funds frequently between platforms, you can deposit large funds in multiple crypto exchanges at one time. When you find arbitrage opportunities, you can adjust your portfolio to capitalize on those opportunities. It is better to transfer large funds occasionally than move small funds when you need to move funds.

Final thoughts

Before you begin your crypto arbitrage journey, carefully consider the two factors (i.e., execution speed and transaction costs) mentioned above. If you can find a way to circumvent or address these two obstacles, you might succeed in crypto arbitrage.

To get the most of every arbitrage opportunity, you must use large funds in every transaction. The price differences of crypto assets can be minor, but you can profit when you trade with large capital.