The married put trading strategy is popular among options traders to build downside protection while investing in any asset. This trading method allows investors to make a profit while the asset price may involve depreciation risk. The method can be an attractive approach for crypto market participants when implementing the setup correctly.

However, it is mandatory to have a specific understanding to implement any strategy successfully in crypto assets. This article will discuss the married put trading strategy and explain the successful implementation of this method in crypto assets.

What is the married put crypto strategy?

You can consider an option as a contract that allows investors to buy/sell shares of any underlying asset that can be a security, stock, or any other trading instrument. This options strategy is a unique method in which an investor holds the underlying asset and puts a contract for that asset.

Investors usually use this method for a bullish hedge; many investors also name this method a protective put. When any market participant follows this method, it enables downside protection of price change of any trading instrument. So it makes sense that the married put method acts as insurance for investors. When you are interested in any trading instrument besides concerning volatility in the short-term, then a put call option alongside holding the asset gives you the advantages.

Sometimes investors refer to this trading method as synthetic long call as this strategy is similar to the long call option method. This method shares similarities with the covered call method as investors hold shares of any asset alongside a call option. When you exercise this concept in crypto trading, you can name it a married put crypto strategy.

Essential components of option trading methods

Call options

They provides purchasing rights to investors at a specific strike price within particular expiry date.

Put options

They enables investors to sell an underlying asset at a specific strike price within a particular period.

For example, you may want to purchase an asset class ABC that is floating near $56 per share, and you want to buy 100 shares with a put option near $51 and a premium of $3. The price might end up near $43 within the expiry date. Your loss will be only $5 with the premium of $3 instead of $13 ($56-$43) per share when you exercise the married put. That is the part of capping potential loss and the most attractive feature of the married put option strategy. Again, suppose the price ends near $86 within the expiry date. You will gain $30, and the loss will be that $3 premium for the put option.

Reason to use the strategy

- It is a simple and easy applying trading method that suits fine on crypto assets.

- The profit target is unlimited in this method, where the loss is limited.

- Maximum loss equals the current price to the put strike price alongside the premium.

How to use the strategy?

When you master the concept of this strategy, it becomes a profitable and straightforward trading approach. It is mandatory to observe several factors when you exercise this method on crypto assets.

Check on conditions, including:

Choosing assets

Choose crypto assets that are potent to grow in the future within the expiry date of your contract.

Delta value

Check delta value is over 0.80% as it declares sufficiently positive.

Put strike price

Never set a put strike value below 20%, as it can cause the maximum loss through this method if the price remains below the strike price at the expiry date.

Strategy explanation

The strategy uses some formulas such as:

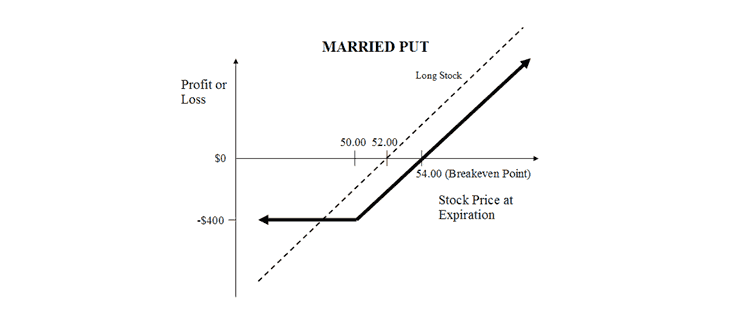

- Max loss = premium paid + commissions paid

- Max loss occurs when price of underlying <= strike price of long put

- Breakeven point = purchase price of underlying + premium paid

Bullish view

This trading method suits assets that investors have a long-term bullish view. The married put option starts giving investors profits when the price reaches the breakeven point. For example, investors pay a $5 premium on an asset price of $55 when exercising the married put options strategy. So the price should reach at least $60 till the contract’s expiry date to cover the loss. Any price above $60 is a profit to the investor.

Where to enter?

Enter or execute positions by checking delta value and volatility. Delta value should be above 0.80%, and may the asset have sufficient potential to grow as it is a bullish method. Investors seek to open long-term trading positions through this method, so you may conduct technical analysis of weekly or monthly charts while making trade decisions.

Stop loss

Place a stop loss below 50% from your entry as this method also includes a put strike price below the current price.

Take profit

There is no limit on the upside for this trading method. We recommend placing the profit target above the 50% gain level, and you can extend your profit target as you are betting on bullish momentum.

Bearish view

The price may enter a bearish momentum in the short term. This strategy is suitable for assets that have the potential to increase in value over a more extended period. This method limits your downside risk by involving a specific put option price with a premium. If the price starts below the put strike price, you only pay the premium and price difference between the entry and put strike price.

Where to enter?

The strategy is suitable for assets that involve long-term potential bullish expectations. You can open sell positions by checking on the volume and delta value of the underlying asset.

Stop loss

The expiration period is essential for any contract. You may allow a 25% depreciation for your order, and the stop loss level can be below 50% from your entry.

Take profit

The take profit level should be above 50% gain from the entry.

Pros and cons

| Pros | Cons |

| High reward The strategy is a profit-making method that allows making unlimited profits. | Knowledge/Skill Any investor who wants to practice this method should be self-reliant and knowledgeable. |

| Limits risk This method provides downside risk protection or allows investors to avoid maximum loss through premium. | Fixed loss The price hits the take profit level, but investors pay the premium, a fixed loss. |

| Low cost This method is comparatively cheaper than other methods and acts as insurance. | Volatility risk Practicing more of this method can affect the price of the underlying asset. |

Final thought

The method is a successful trading approach when applying it to financial assets like stocks, bonds, ETFs, etc. When a crypto investor can implement the concept correctly in crypto charts, it will increase his profitability and limit his loss.