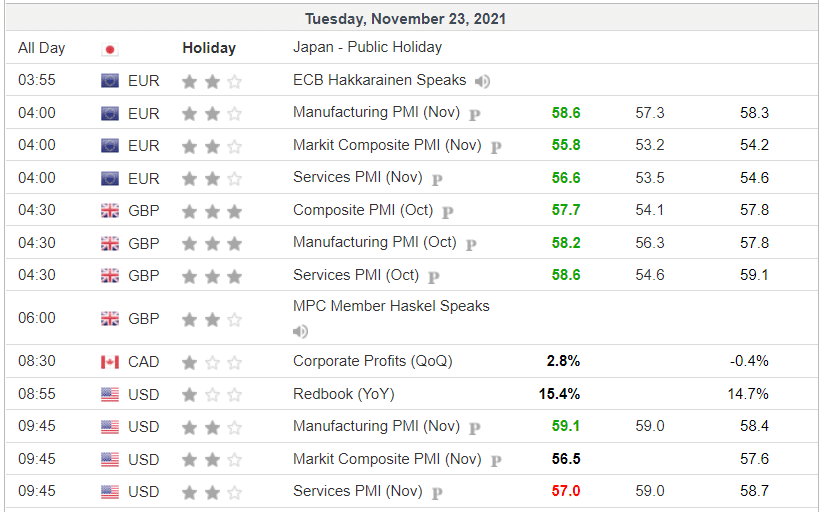

When it comes to stock or forex trading, we all wish that we had a crystal ball to predict the next move in the market. If this were possible, we would all be extremely wealthy. News plays a significant role in the behavior of a financial instrument. It is the driving force behind the value of stocks and currencies.

Every trader or investor needs to follow the news carefully; even if they are not news traders, they need to understand the impact of the news release on the price action. Some new events’ effects move the market by 100-120 pips instantly.

Few traders specialize in only trading news events, and some are very successful. However, it requires skill and knowledge.

To lessen the burden, we have come up with news trading strategies that can benefit you. Therefore, read this article further to understand how to trade the news.

What is a news trading strategy?

As a trader or investor, learning to trade the news is an essential tool to have in your skillset.

Essentially, there are two categories of news:

- Periodic

- Once-off news events

Periodic events reoccur on a daily, weekly, monthly, or quarterly basis. This is news such as the Fed’s interest rates announcements, GDP reports, corporate earnings reports, and unemployment change reports. There are many more of these recurring news events, and it has different impact levels on the market.

The once-off news occurs unexpectedly and usually involves geopolitical or adverse weather conditions. Examples of these are terrorist attacks, earthquakes, and government elections. Furthermore, these types of news are generally harmful rather than good.

The news release can affect a particular asset or an entire industry, depending on the nature of the news.

A news strategy determines when to buy or sell a specific asset based on the news results. Therefore, understanding the consequences of the news release gives investors an idea of how an investment will behave.

Strategies are usually determined for recurring news events since investors already know how the market reacts to specific news events.

But the news release is not a sure signal to buy or sell a security; you need to determine a robust strategy.

How to determine a news trading strategy?

Periodic news events are more predictable than unexpected events. Therefore, developing a strategy around recurring events will give you a higher chance of success than unforeseen events.

To determine a strategy that will give you consistent results, you first need to decide which news events you will focus on. As mentioned, several events occur daily, monthly, and quarterly. It is advisable to focus on a specific news event and become highly knowledgeable of the factors related to the news event.

Furthermore, you will need an advanced knowledge of price action trading since you cannot enter the market based on the outcome of the news alone.

We will use an example of a specific news event to determine a bull and bear strategy.

Bullish trade setup

Earnings reports are news events associated with sock performance and essentially show investors how well a company has performed during the last quarter.

A strong earnings report indicates that a company is doing well, prompting investors to invest more in the stock. Therefore, the price might increase after the release of the earnings report.

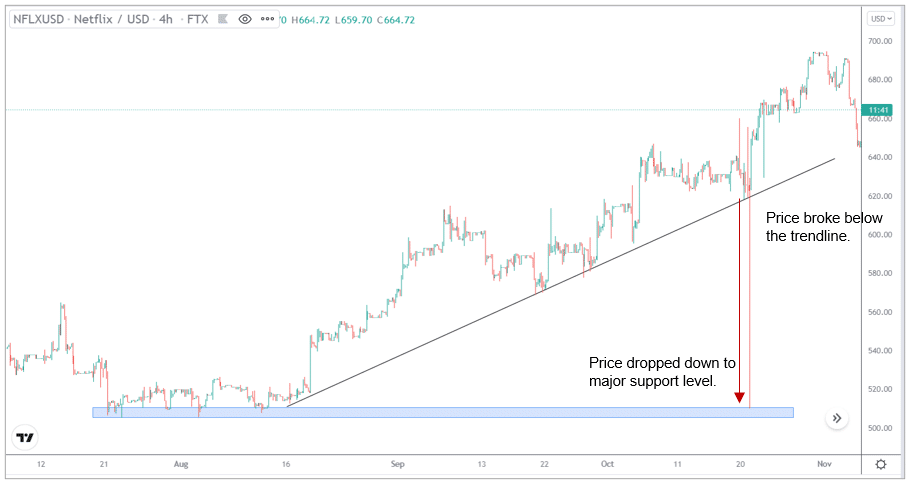

In our example for a bullish strategy, we will use the Netflix stock chart. Netflix reported its third-quarter results in mid-October 2021.

Netflix showed good earnings for quarter three, and earnings per share increased to $3.19 versus the estimate of $2.56. However, the stock price fell after the release of its earnings report.

What we see from the above chart:

- Investors started selling off, and the price dropped

- The price broke below the trendline

- And decreased further to the significant support level

The support is a good buying point to enter the market.

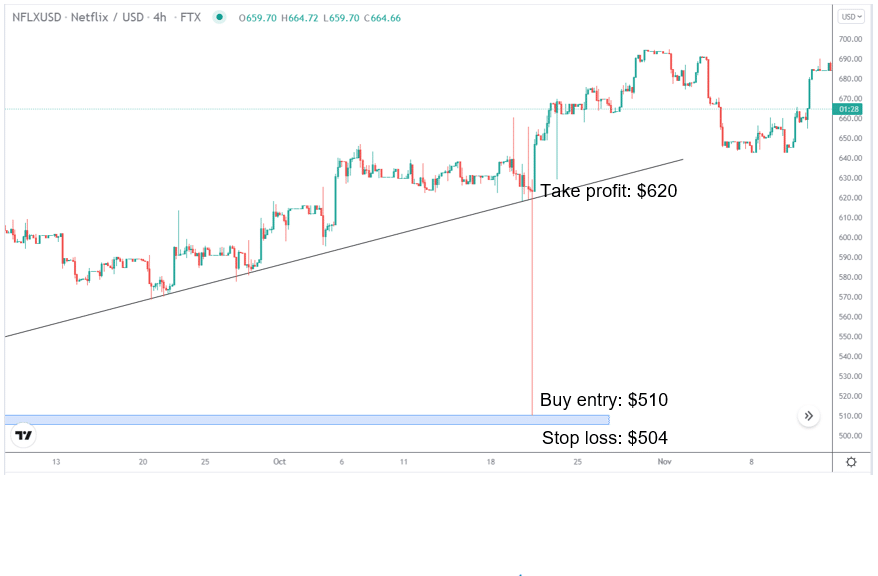

Entry

Open the buying position at $510 levels.

Stop-loss

Put the SL below the support, which is around the $504 level.

Take profit

Take profit at $620.

The earnings report for a stock is a significant news event. Investors react to the information based on predetermined forecasts. As in our example, we could see, although the company reported good earnings, the stock price fell dramatically. However, it increased by the same amount and surpassed its record highs.

Bearish trade setup

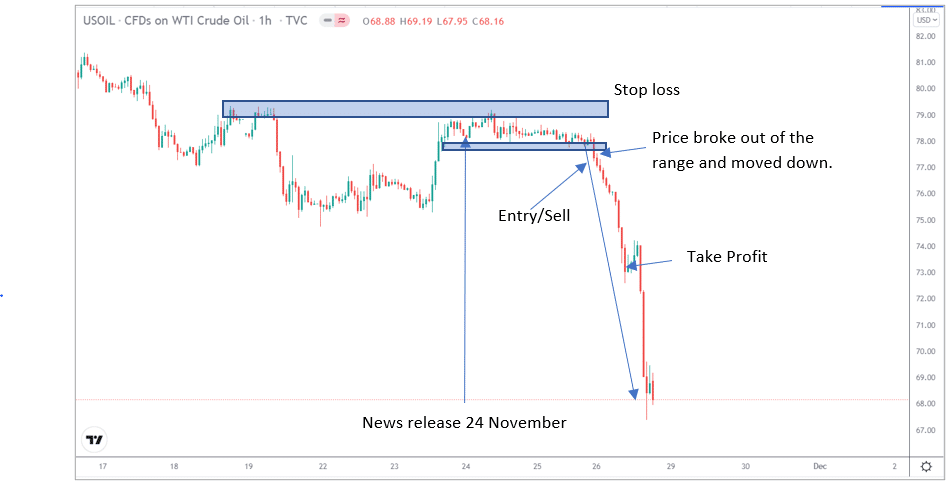

In this strategy, we will focus on a commodity that is affected by periodic news events. We will use the crude oil inventory report; this report is published weekly in the USA. It measures the weekly change in the number of commercial crude oil barrels kept by US firms.

The recent crude oil inventory report was on the 24th of November. The forecast of barrels held was -481,000. However, the actual change in barrels for the week was 1.017 million. Therefore, there was an increase in stock holding of crude oil. This number has a significant impact on the price of oil.

We can see from the chart that the price of crude oil has been in a prolonged downtrend. We will focus on the period of the news release.

In the 1-hour time frame, the price is moving in a range. It failed to break the resistance even after the news release. The increase in barrels means less demand for oil. Therefore, the price of oil will decline.

A sell trade entry is possible as soon as the price breaks out downwards.

Entry

Open the selling position at $77 level.

Stop-loss

Put the SL above the high, which is around the $79.40 level.

Take profit

Take profit at $73.00; this will give an R: R of 1:3.

How to earn fast with a news trading strategy?

The strategies we shared above are less risky and require some patience to wait for the correct entry. However, some methods can give you much faster profits if traded carefully.

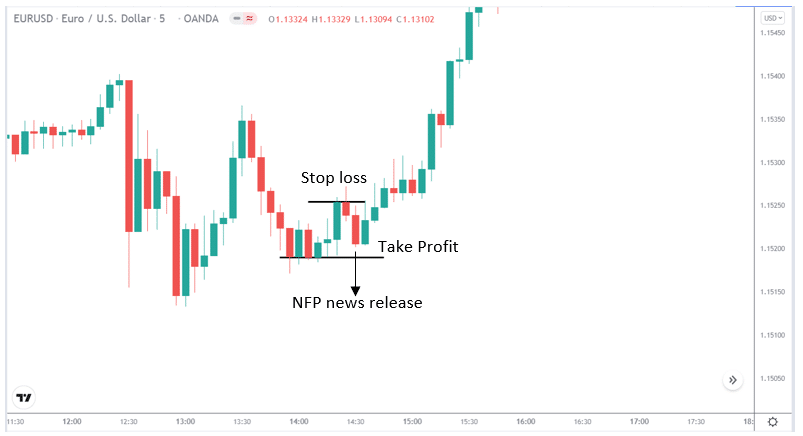

One such strategy is the NFP news release. Many traders use this news release to trade currency pairs. This type of strategy is more suitable for scalpers who trade on five and 15-minute time frames.

We focus on the candlestick before the news release. If the price fails to break the high of the previous candlestick, then we can take a short sell trade. The news was good for the US dollar, which means the dollar gained a bit of strength. Entering the market at the exact time of the news release is also critical.

A safe option would be to place a stop loss above the high of the previous candlestick.

Once you enter the market, you can hold it until the price touches the support level and close the trade within the 5-minute time frame.

This is a quick strategy to trade within the same time frame as the news release. However, it is a high-risk strategy. During NFP, the price moves rapidly, and it can trigger your stop loss. Therefore, sound risk management is essential.

Pros & cons

| Pros | Cons |

| •High-profit Such trading can bring in significant profits since it can fuel the trend up or down in a powerful way. | •Trading news only is not ideal Trading based on the news outcome alone is not adequate. You will require technical analysis and perhaps other technical indicators to confirm your entry. |

| •Quick trades This trading allows you to enter and exit the market quickly. | •High-risk Trading the news comes with a high risk that you would normally not encounter in the market. |

| •Periodic news is predictable In most instances, the news that occurs regularly has high predictability since traders know its impact on a particular asset. | •News does not always guarantee significant market movement Sometimes the market does not react to the report. |

Final thoughts

Trading news, although highly profitable, is also extremely risky. Besides the risk, investors require in-depth knowledge of the markets and associated news events.

A beginner trader should avoid trading news events until they are more confident in their analysis. However, once you have sufficient knowledge and experience, you can become profitable considering proper risk and money management.