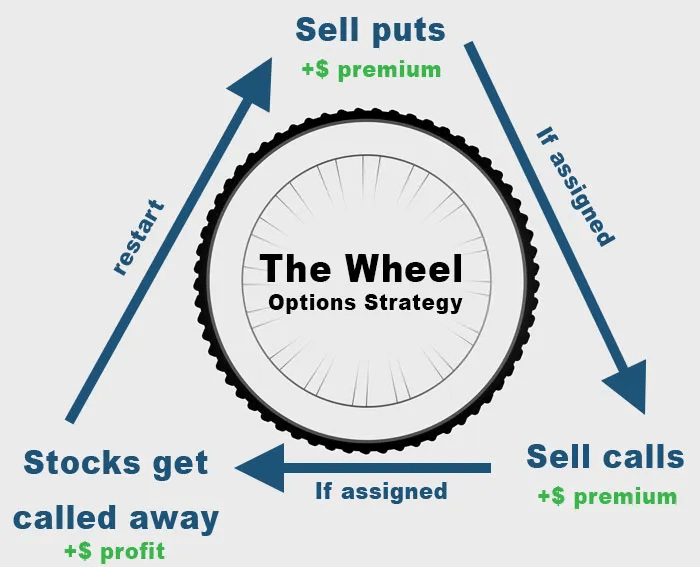

Having a passive income is one of the investors’ preferred strategies to profit. With the options Wheel strategy, you can make money constantly, no matter if the market goes against you. This is a strategy that, when you execute it properly, allows you to generate income by collecting premiums from selling put or call options, whatever the case is.

The annual revenue from the strategy is calculated at 50%, which is a great rate, especially considering the low risk the trader takes.

This strategy is attractive for beginners because of its simplicity. However, even people without much experience with options trading can start to earn money. Here is everything you need to know about this strategy.

How does the options Wheel strategy work?

Traders use this strategy to gain money whether the asset’s price goes up or down. What they do is to sell cash-secured put options repeatedly when they don’t own the asset. They want to do this to collect premiums.

However, eventually the underlying will reach the strike price, and they will be obligated to buy the asset. Once that happens, they repeatedly sell covered call options until the price rises again to the level where it is attractive for them to sell again. Meanwhile, they collect premium after premium generating passive income again.

How to use the strategy?

There are some keys to using this strategy. First, you want to use this technique with an asset you want to own. Second, you will use this strategy only if you think that the underlying will be on a bullish trend in the long run.

In this way, if you are forced to buy it because of the put option you sold, you can be sure that the price will rise again, and sooner or later, you will recover the money invested in the underlying.

So, this setup is like this.

Choose the right asset

The trick is to win no matter the outcome of the option. To achieve this, you want to sell put options on assets with a bullish trend. So ideally, you don’t have to buy them. However, if you are wrong and the price hits the strike price, you want to buy an underlying that you know its price will rise again, so you are comfortable owning it.

Sell puts

Once you choose the asset, you want to sell put options betting that it won’t be enough to hit the strike price even if the trend reverses. This way, the option will expire worthlessly, and you keep the premium and no losses. Repeat this as much as you can.

Sell calls

Eventually, the option will be executed, and you’ll buy the option. Now, you own the asset, and you’ll be selling call options. Every time the option expires worthless, you’ll be keeping the underlying and collecting premiums. The strike price of this call option has to be close, so in case the price hits the strike price quickly, you can recover your losses.

Sell the asset

Finally, your call option will be executed, and after collecting premiums from the call options sold, you’ll finally sell the asset near to the price you bought for.

Besides these four steps, in terms of trend, you can separate the options Wheel into two stages.

Bullish trend

It is when the setup begins. In this stage, the trader chooses an asset, betting that the price of it will rise.

Where to enter?

While the trend remains bullish or neutral, the trader keeps placing options below the current price to collect premiums.

Where to take profit?

The profits are taken at the expiration date when the option expires worthless. However, if you don’t want to risk some of the profit you already made, let’s say, at the half of the period, you could buy back your option and lock your profit before expiration.

Bearish trend

Once the price reverses and enters a bearish trend, it will probably hit the strike price of the put-call, and the trader will now buy the underlying.

Being that the case, the trader must start selling call options while the trend remains neutral to bearish, so he can keep collecting the premiums from the sold calls.

The Wheel starts from scratch again when a bullish trend surpasses the strike price of the last call option. At that point, the trader can make a balance of his winning and losses.

Where to enter?

Right after the put option is executed, the trader, who now owns the assets, must write covered calls to collect premiums or sell the underlying at a good price.

Where to take profit?

If the option expires worthless at every expiration date, the trader keeps the premium and is set to write another call option and keep another premium. However, the other profit point is when the strike price is reached, and the trader finally sells the asset.

Reasons to use the options Wheel strategy for traders

Traders want to use this strategy to generate constant profits at the expiration time. Some of the advantages of this strategy are low risk, passive income, and the comfortability of knowing that even if things go wrong, you’ll own an asset you want to own anyway.

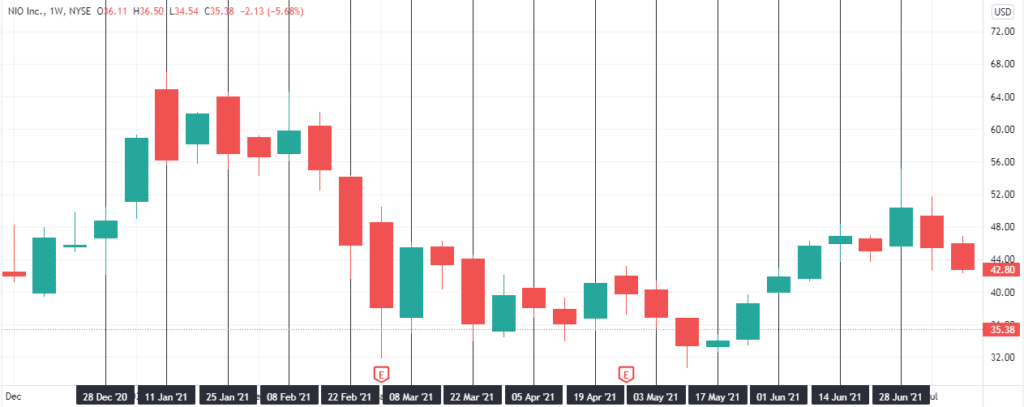

Let’s see how this works with an example. A trader is interested in NIO stocks which by late December is quoting at $48.58. The trader starts this strategy by selling a put option. Let’s see how this strategy is developed throughout six months.

| Trade № | Trade | Premium | Earnings | Result | NIO Price | Stock Balance |

| 1. | Sell 1 Put @ $43.5 Strike | $0.40 | $40 | Expired | $49 | |

| 2. | Sell 1 put @ $48 Strike | $0.46 | $46 | Expired | $56 | |

| 3. | Sell 1 put @ $46 Strike | $0.36 | $36 | Expired | $56 | |

| 4. | Sell 1 put @ $51 Strike | $0.48 | $48 | Expired | $60 | |

| 5. | Sell 1 put @ $46.5 Strike | $0.75 | $75 | Option exercised | $45.73 | -$77 |

| 6. | Sell 1 call @ $47.5 Strike | $0.35 | $35 | Expired | $45 | |

| 7. | Sell 1 call @ $46 Strike | $0.54 | $54 | Expired | $36 | |

| 8. | Sell 1 call @ $45 Strike | $0.46 | $46 | Expired | $38 | |

| 9. | Sell 1 call @ $45 Strike | $0.80 | $80 | Expired | $41 | |

| 10. | Sell 1 call @ $40 Strike | $0.34 | $34 | Expired | $37 | |

| 11. | Sell 1 call @ $40 Strike | $0.37 | $37 | Expired | $34 | |

| 12. | Sell 1 call @ $43 Strike | $0.50 | $50 | Expired | 41.99 | |

| 13. | Sell 1 call @ $46 Strike | $0.55 | $55 | Option exercised | $47 | -100 |

| Premium Collected | $636 | Stock Balance | -177 |

By the end of the cycle, the trader lost $177 but earned $636. Thus, the trader’s net profit was $459.

Pros & cons

| Pros | Cons |

| •Easy to apply The principle is simple, so even beginners can use this strategy. | •High initial investment To apply the strategy, you have to make a cash-secured call, which means you need to buy the asset if the price reaches the strike price. |

| •Low risk By not letting greed take control, traders can get constant income with high winning probabilities. | •Not for every asset A big leap will trigger the option execution without getting all the premiums gains and leaving only the losses from the asset price. |

| •Allows to buy better Suppose you want to own an asset. The price of that asset is rising, and you want to wait until the price retrace to your strike price to buy it. Using this strategy, you can not only do that but also gain money in the process. |

Finals thoughts

It is a simple strategy that minimizes risk and allows traders to get passive incomes. However, there are some downsides to this strategy:

- It requires a considerable initial investment since the trader should write a cash-secured put option.

- The strategy should be used only with stocks carefully selected.

- Many traders debate about how better it would be to buy the assets in the first place and then write covered calls.