A pairs trading strategy is a process to find two securities’ historical correlations. The strategy concept is that two assets that correlate with each other will deviate around an equilibrium. The main profit operator from the pair trading method is available on high positive correlation in securities.

When the asset pair is outside the equilibrium, a position opens and closes if the asset pair reverses to the balance. The vital element of the strategy is that two assets will keep up a particular correlation. In case the assets collapse from the correlation, it associates with the risk of the pair trading method.

However, this method helps market participants take a trade on the opposite of the trading instruments that have negatively correlated. A trader utilizes different tools from fundamental and technical methods wherein the correlation functions as the key price direction in forex trading. Also, financial markets such as stocks, forex, and cryptocurrencies have a potential indication of the market direction. If a trader is well aware of taking trade using the pair trading strategy, then it can be a profitable method.

The following section will see a pairs trading guide that includes exact buying and selling trading methods.

What is a pair trading strategy?

Typically, in yielding some profits, a trader aims to determine a price over the buying level while buying an asset. But it may turn into a loss if the price falls or roams in less than the buying level. No trader will incline to have a loss, but lamentably, there is no such way by which they can disregard the loss.

Yet, there is one way to help traders control their losses, and it is known as ‘Hedging’. A trader can confine the losses via taking trades in distinct currency pairs in the opposite direction.

A pair trading strategy allows the trader to open a buy in one trade and sell in the other one. And this system may end up with winning trades from both sides or may be subject to losses in contrast. The outcome of this method comes from the performance of one pair against the other. The pair trading pay heed to hedging the risk and confining the losses rather than the broader market.

How to use pair trading in a trading strategy?

Investors can execute pairs trading within asset classes and between asset classes which is another strength of this method. And, a trader may take advantage of the changes in correlative values throughout the worldwide markets. Pairs trading in different assets will allow market participants to expand their trading portfolio further. Pair trading is not limited to the FX market only; instead, it accelerates the outcome via comprising stocks, commodities, and indexes.

For instance, there are two stocks, X and Y, with a positive correlation of 0.85. At that moment, a trader takes a dollar matching short position on the better-performing stock Y and a long position on the flopping stock X. Stock X and Y will connect after some time and reverse back to their correlation of 0.85. Then the trader will take profit from the long position and close the short position. Afterward, in the short term, these stocks begin to drift from their historical correlation along with a correlation of 0.25.

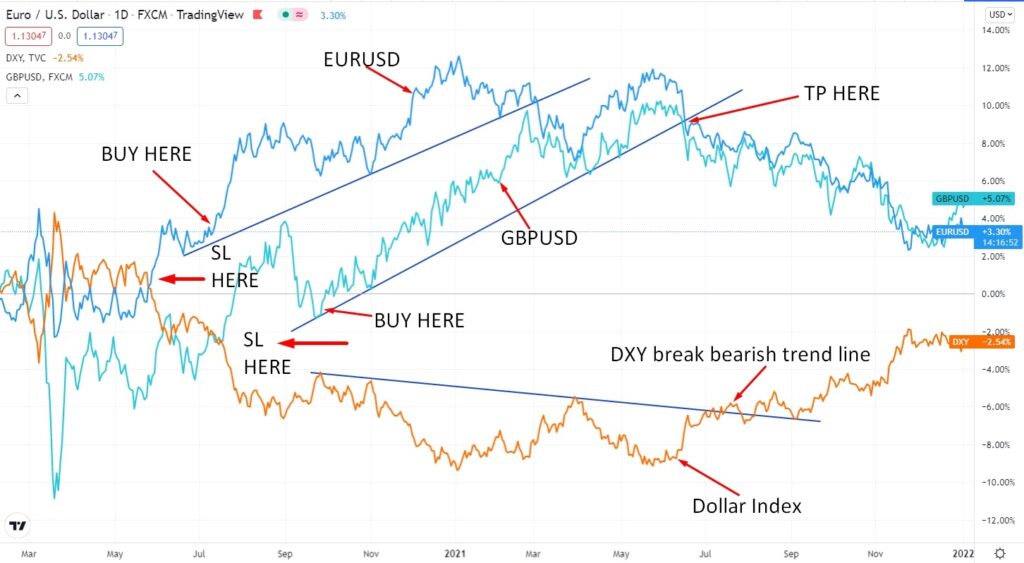

Bullish trade setup

Entry

Look for a buy entry when the dollar index continues downside after dropping below EUR/USD and GBP/USD line chart. Place a buy order on both GBP/USD and EUR/USD simultaneously as the dollar gets weaker on both pairs.

Stop loss

Your stop-loss order should be below the last swing level with at least a 10-15 pips buffer.

Take profit

Take the profit when the dollar index breaks above the bearish trend line. Or else, you can target at least a 1:3 risk/reward ratio.

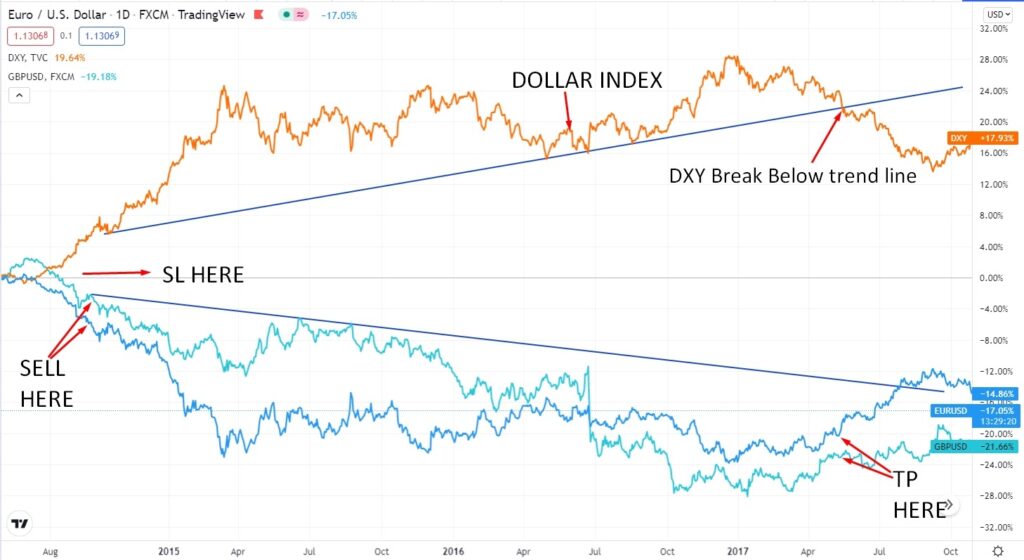

Bearish trade setup

Entry

Look for a sell entry when the dollar index continues upside after climbing over EUR/USD and GBP/USD line chart. Place a sell order on both GBP/USD and EUR/USD simultaneously as the dollar gets stronger on both pairs.

Stop loss

Your stop-loss order should be above the last swing level with at least a 10-15 pips buffer.

Take profit

Take the profit when the dollar index breaks below the bullish trend line. Or else, you can target at least a 1:3 risk/reward ratio.

Is the pairs trade strategy profitable?

Pairs trading is a highly profitable strategy applicable to several financial markets. Since the market changes repeatedly, it may be risky to depend on mean reversion in pair trading. The traders’ anticipation might not always be accurate that the pair trading correlation will return to its original correlation after buying and selling the position.

Hence, a trader must ensure a robust strategy, including risk management, as shown above in this article. If market participants can adequately implement the aforementioned method, they may generate a handsome profit of around 300%.

Pros & cons

| Pros | Cons |

| The method has a high potential in generating profits regardless of the market conditions. | Pairs trading has been dependent on securities with high statistical correlation. |

| It can potentially diminish the risk and losses incurred due to the underperforming assets. | The commission charged for pairs trading is relatively high. |

| A market participant using a pairs trading strategy is fully hedged, which is not found in other types of trading. | Identifying the correlation can be very effortful for the trader to some extent. |

Final thoughts

In a nutshell, pairs trading is an effective strategy based on historical information. It requires expert analysis, both statistical and technical. It suggests accumulating proper knowledge of the market analysis and market research beforehand trading with the pair trading strategy. Moreover, traders must thoroughly evaluate the correlation since any breakdown in the assumption may result in a pair trading method failure.