It is essential that every enterprise tracks metrics like revenue and profit, understands performance, forecasts effectively, and spends wisely — and many other functions rely on these metrics.

Although the two concepts are distinct in their measurement and application, they are often conflated despite their differences. Here, we’ll examine their differences and learn how to distinguish one from the other.

How does it work?

Let’s consider both terms separately.

What is revenue?

The amount of income depends on multiplying the average sales price by the number of units sold. Gross pay is the top-line figure from which net gain is determined by subtracting costs.

What is profit?

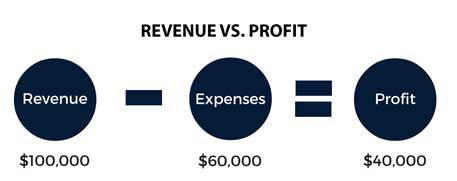

Profits are those earnings generated from enterprise activities more significant than the expenses, prices, and taxes associated with the action — the gains earned by the company flow back to the owners. The owners choose to pocket the cash or reinvest it back. You can calculate this measure by deducting the total payment from the total outlay.

Key differences

If there is no revenue, there can be no profit. Therefore, you cannot determine the income by returns. In other words, payment exists without gain. For example, if a company has more expenses than income, there will be no profit, but pay will exist.

You can evaluate yields by subtracting expenses from gain. As an alternative, we can calculate payment by multiplying the number of items sold with their respective selling prices.

You can divide a firm’s profit and gross yields — close to operating gains, and net yields — income from other sources. An enterprise can earn revenue in two ways:

- Working — made from its operations.

- Non-operating payment — earnings from various sources.

You can find both of them in the statement. Understanding the statement is quite simple if one has a good grasp of the statement.

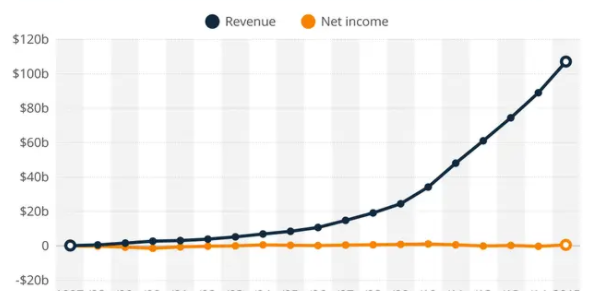

Choosing a stock by company analysis

A company’s top line is earnings, which appears at the top of its income statement. Alternatively, the payoff is known as the bottom line. When you subtract expenses and liabilities from payment, returns are lower. Below is the chart for ten years for Amazon, which shows that profit is always lower than the revenue.

Is revenue the same as sales?

The term “revenue” is often used interchangeably with “sales.” However, in reality, the firm generates any profit before removing expenses. In contrast, these are the payments the firm receives from its customers.

Reasons to use for investors

Despite both being necessary, returns give a more precise picture of a company’s financial health. This is because of a company’s liabilities and other expenditures like payroll when calculating its returns.

How much revenue is profit?

After accounting for costs, debts, additional income, and operating fees, the company’s gain is the actual profit.

Which one is a more significant number?

Both numbers are substantial, but net gain provides the most comprehensive picture of an organization’s financial situation. Likewise, an analysis of recurring costs provides a complete picture of the management of a business.

A company’s gross profit is also an important metric; it speaks volumes about sales and production trends. A company’s top-line growth — gross gain growth — provides essential indications of its strength. However, a company’s gross returns alone do not provide a comprehensive view of its financial health because it excludes all fixed and variable costs unrelated to production and sales. In a company, earnings gross or net income is the best indicator of how well the company is doing.

How to get from revenue to profit?

Gross sales are the most critical metric of a company’s profitability. It’s the product of the quantity of a product or service that a corporation sells and the price at which it sells it. You can calculate total profit without discounting, allowances, and returns.

Some might consider it a form of revenue. But, in actuality, it’s not representative of the income a business brings in, so you cannot find it on the income statement mostly.

Getting from gross to net sales

The net selling is a far more accurate reflection of its total revenue. This is because the analysis includes all the sales a company makes and three factors that determine the price of goods:

- Allowances

Measures a buyer can take to receive a discount after discovering and reporting a product defect.

- Discounts

Reductions in price offered by a seller as an incentive to buyers willing to pay immediately or early.

- Returns

A refund the buyer receives if they return a product.

The company’s actual revenue becomes more apparent once these elements include its financial reporting. Check out the info below if you’d like more gross versus net sales information.

Getting from net sale to gross profit

After determining net receipts, you can compute gross margin by subtracting the cost of goods sold (COGS). Then, deduct the direct payments of producing your product from the net sales figure, including raw materials and labor.

Getting from gross yield to earnings before interest and taxes (EBIT)

When you calculate your gross payback, you subtract your operating costs (also called operating profit) to arrive at earnings before interest and taxes (EBIT). The prices are associated with the resources you use to run your business, such as employee salaries, rent, legal fees, and marketing expenses.

Getting from EBIT to net profit

You can find out the net gain of your business by subtracting the interest and taxes incurred from your earnings before interest and taxes. Then, you can use that final figure to determine your company’s profitability at the end of a particular period.

Pros & cons

| Pros | Cons |

| Revenue’s Financial statement position appears on the trading account while profit’s financial statement appears on the income statement and is presented to the balance sheet. | Revenue is the complete measurement of the company’s profit but misleading mostly. While gross profit doesn’t apply to all companies. |

| High revenue is good for business, but high profit is good for stakeholders. | Increased profit is prone to higher taxes, while higher revenue can attract more investments. |

| Revenue is essential for operating a business, but profit is necessary for the growth and survival of a firm. | Profit doesn’t account for several critical financial aspects, while revenue cannot measure the company’s efficiency. |

Final thoughts

Profit is a component of revenue. A healthy company is profitable. Enterprises start their operations by generating earnings, but they seldom earn since the upfront costs are pretty high. After a few years of operation, organizations often reach a break-even point and then go beyond the break-even point to enjoy a payback. They both indicate what the position of a company is.