The APY (annual percentage yield) is quoted on every savings account at a bank and every investment opportunity. “Annual percentage yield” is the acronym. It depicts how much money you’ll make over the following 12 months, assuming you don’t withdraw or relocate your money sooner.

This data is typically necessary when making financial decisions. For example, if you create a savings account with a bank in certain places, they are obligated by law to disclose it to you.

In traditional finance, the APY is often tiny, averaging one or two percent per year at most. In the case of safer bets, APY is generally more significant in crypto, ranging from 2 to 12 percent. APY may reach 200 percent or even more in the case of very risky DeFi projects solely managed by smart contracts. On the other hand, these more dangerous operations are not indicated for consumers seeking a secure investment with predictable returns.

Now, let us walk you through further APY details in crypto, their working, formula, and everything you must know.

How does APY in crypto work?

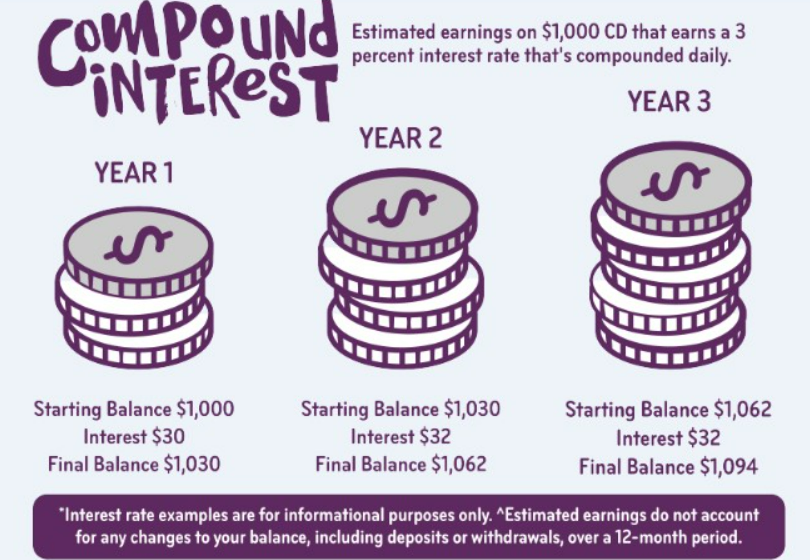

An APY is a return on investment when you factor in compound interest. Compound interest, unlike simple interest, is computed regularly and applied to the account balance regularly. Therefore, the interest is paid when a bank account’s balance rises.

This information may be used to estimate your yearly earnings by looking at the APY. Put another way; this is how interest on a loan is computed over time.

To make money on your Bitcoin investment while keeping it secure, an APY-earning cryptocurrency savings account is one option. There are a lot of Bitcoin yield choices available to you. Do your homework before making a choice. For each cryptocurrency exchange, there are fees, entry constraints, interest-earning systems, and crypto assets exclusive to that exchange alone.

Perform due investigation before investing in any platform or service for yield farming that offers an appealing APR (annual percentage return). The APYs offered by cryptocurrency exchanges are also worth considering before investing. It’s common for these schemes to provide higher APYs initially, only to cut them after they’ve built up a large following.

Reasons and crypto investments involving APY calculation in crypto?

If you’re a HODLer, you don’t have to sit on your crypto and wait for its value to grow. Instead, to expand and double your cryptocurrency holdings, you may use several investment approaches that make use of compound interest or annual percentage yield.

Crypto lending and borrowing

Unlike conventional loans, there is no need for documentation or red tape for crypto finance, which has a lot. And you’re lending Bitcoin instead of fiat currency. In addition, you may earn interest or cryptocurrency dividends in a decentralized network by lending out your crypto. Interest rates might vary from 3% to 17%, depending on the platform. As a result, borrowers profit from the increased liquidity, while investors benefit from a steady income.

Yield farming

It is a term used to describe leasing Bitcoin assets to produce additional cryptocurrency. A yield farmer’s goal is to maximize their return on investment by using this trading approach. The most successful farmers keep a careful eye on the APY, which they regularly track. In many cases, farmers who put their money to work rather than save it in a bank are more likely to reap the benefits.

Staking

A user may earn Bitcoin by staking it on a blockchain network by verifying cryptocurrency transactions. It’s possible to get additional money by participating in proof-of-work (PoW) networks, which aggregate members for verification. At the same time, as you’re keeping the network safe, you’re generating money.

To increase your chances of becoming a validator for new blocks on the blockchain, you need to make more Bitcoin contributions to the network. For prizes, you don’t need any special equipment. When you stake, your currency is removed from circulation for a certain amount of time. As a consequence of the reduction in supply, the coin’s value increases.

How to calculate APY?

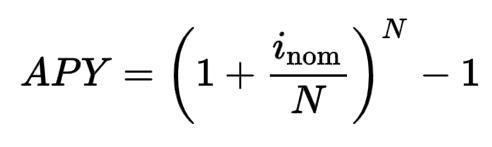

The annual percentage yield (APY) may be determined using a formula. Traditional finance often uses this formula as long as the nominal interest rate stays stable. Interest rates and compounding periods are involved. Both the following definitions are correct:

- The nominal interest rate is the interest rate before inflation is considered.

- The compounding period elapsed between one interest compounding and the next; it means that the interest will be compounded every month, for example. It may be done weekly, daily, annual, or on any other basis.

Example of APY calculation

Below, I’ll go into additional depth about the APY calculation so you can better comprehend it.

Wherein:

- The inom stands for nominal interest rate.

- The letter N is the number of years elapsed since the compounding process.

For example, the following is what I’ll receive if I utilize a 55.44 percent r rate: In other words, the APY is equal to (1+ 55.44 percent/365)365 – 1 = 74.02%.

Pros & cons

Let’s look at some pros and cons of APY in crypto.

| Pros | Cons |

| APY’s interest in cryptocurrency is a source of making passive income. | There is a high risk of depreciation. |

| By constantly tracking APY, you can become the most successful yield farmer. | A few days are needed to transfer money from a checking account to an online savings account. You may be out of luck if you need money straight now. |

| For comparison purposes, APY gives the most accurate estimate of how much your money will earn over a year. | Withdrawing money from an ATM or a physical place is impossible with a cryptocurrency account. |

Final thoughts

The APY calculation is understandably confusing to many yield producers. However, you may better manage your investment if you know this DeFi essential, which significantly bears how much you earn or pay.

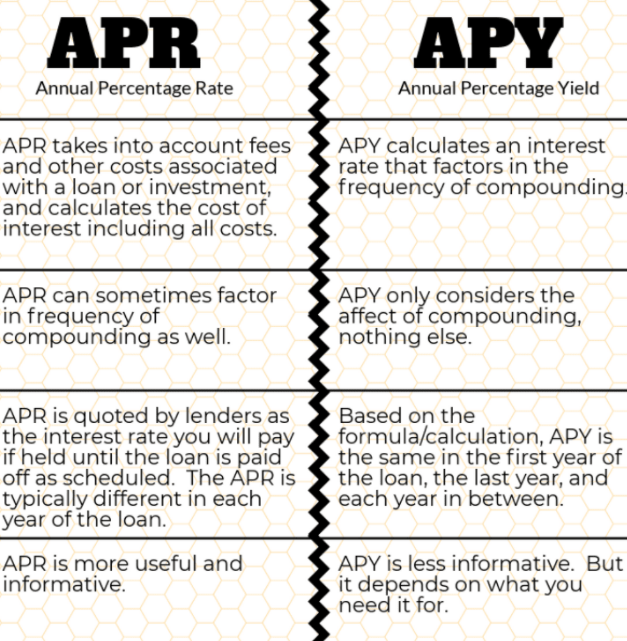

We sincerely wish you would not mistake the APY with the APR due to the similarity of these two terms. But this is not the case. APR and APY are not interchangeable. APY involves compound interest, while APR does not.