Crypto trading is becoming popular among traders because this instrument is somewhat becoming reliable. Due to blockchain, crypto is decentralized, and this makes it protected from government authorities.

Traders like trading crypto because of its high price fluctuations, as it makes it easier for them to take out profit from the market with even slight price movements. Among many other forms like scalping, day trading, swing trading is an exciting and less stressful form of trading. Swing trading allows you to use any strategy, be it multi time frame analysis or indicators.

Do you want to learn precisely how to trade cryptocurrency using the swing trading technique? Let’s get to know a crypto swing strategy even if you are a beginner.

What is swing trading?

Swing trading is a trading technique that enables traders to open a trade position and allow it to run for days or even weeks. In swing, trading traders take out small profits when the market moves in the desired direction.

Swing trading does not need you to sit on the trading system for long; you can take the trade and keep it running after stopping loss and taking a profit.

How does crypto trading work?

Cryptocurrency is decentralized, meaning no single organization or individual has full authority or control over it.

The crypto market, just like others, works on the law of supply and demand. Meaning the prices of particular crypto will go high if the demand is high and low if the demand is low, as the supply of cryptocurrencies is usually fixed.

Trading cryptocurrencies is the action of speculating on the crypto price movements either by CFD trading account or exchanging your fiat money with cryptocurrency on an exchange.

You can think of CFD trading as trading gold, which you can speculate without taking ownership of the asset itself. Just like that, you can buy or sell depending on your analysis. If your analysis suggests that the crypto price might go up, you can take a “buy,” while if you think the price might go down, you can execute a “sell.”

If you wish to use an exchange to trade crypto, you can buy a coin in, say $1 and sell it when the prices are higher, say $2, making a profit of $1.

Swing trading crypto strategy

Crypto trading is not very different from trading other financial assets. The major difference that makes any tradable asset difference is volatility.

Crypto is a very volatile asset, sometimes does not respect the supply-demand or support and resistance zones. As crypto is not very old, traders and investors are still trying to test and bring more strategies and techniques to trade it.

Swing trading will help you stay calm because it uses higher time frames and allows you to keep your trade open for more time than day trading. You will first move to the daily time frame for swing trading to look into the overall market direction:

- Uptrend

- Downtrend

- Sideways

As a beginner, the first thing you must learn and understand is the importance of support and resistance, a zone with a high probability of a price to reverse or break to make a continuous move.

- So, first, you will draw your support and resistance zone on your chart. The chart you will be using is of the 4H time frame. Using a higher time frame gives you better trading opportunities by removing noise and irrelevant information and providing a reasonable price structure.

- Once you have your S&R zones, you can start with your candlestick analysis. Few candles like — Doji, Pin bar, Hammer, Inside bar, etc., show reversal and trend continuation. You will find these crucial candles near your S&R zones.

- You will move to a lower time frame, say 1H, for finalizing your trade setup by seeing the structure — highs and lows break and formation of new highs and lows. Also, you will look into the rejections in the market.

- Once you find a trade setup, use a 30M or 15M time frame to take the trade keeping your risk low and putting your stop loss (SL) and take profit (TP).

We have a bullish and bearish example for you to understand better how you will put all the information together and execute your trade.

Bullish example

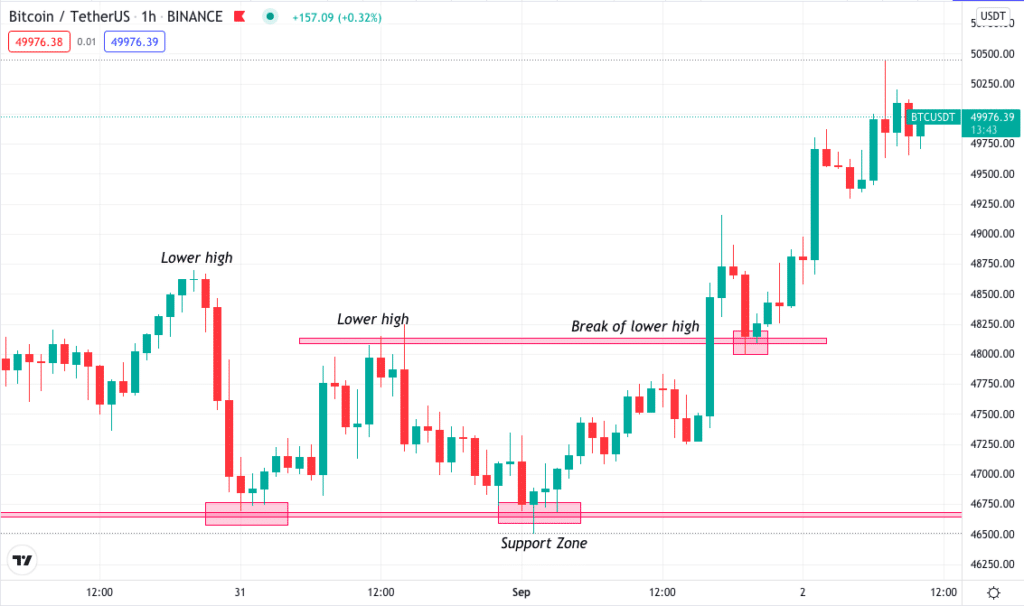

In the BTC/USDT 4H time frame, you can see the price is touching the support zone; here, it is a probability of the price touching the support and moving up.

In the BTC/USDT 1H time frame, the price after touching the support moves up. You can also see a Pin bar and a Doji formation near the support, which shows the buyers entering the market. Moving forward, the price then broke the previous lower high.

You will move to a 15M time frame for trade execution. After the price broke the lower high, it came for the retest, where you have to take the entry.

Entry

You will enter when the price retests the break zone. If the price does not come for a retest, you can wait for the new higher low formation and open the buying position.

Stop loss

You will place your SL 2-3 pips below the break zone.

Take profit

When you are happy with the profit, you will exit the trade, mostly taking 1:2 risk: reward.

Bearish example

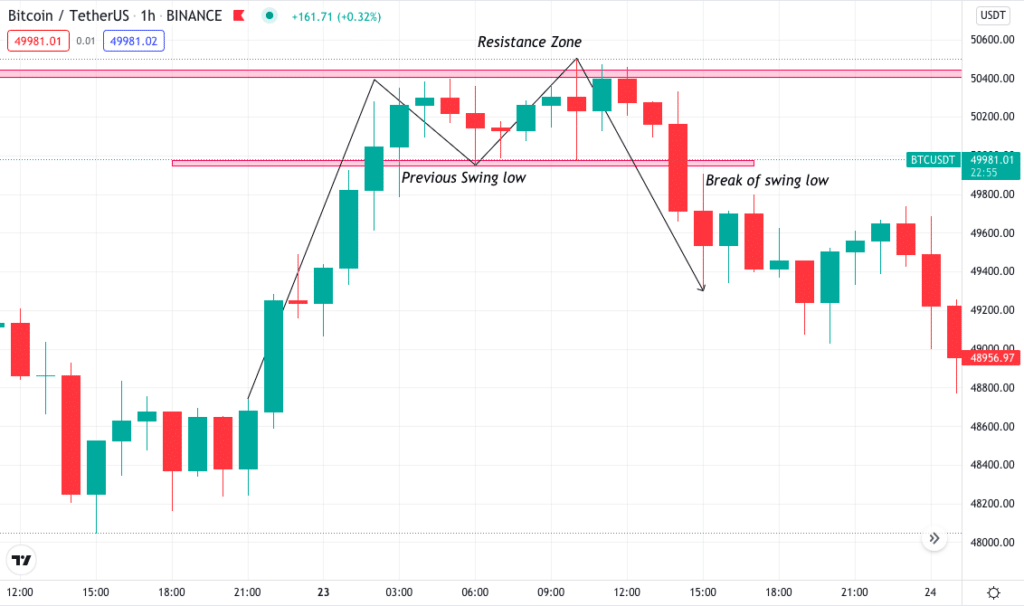

In the BTC/USDT 4H time frame, the price was respecting the resistance zone. Also, the price after the first touch broke the low with big bearish engulfing candles.

After touching the support, the price on the 1H time frame came down and broke the previous swing low.

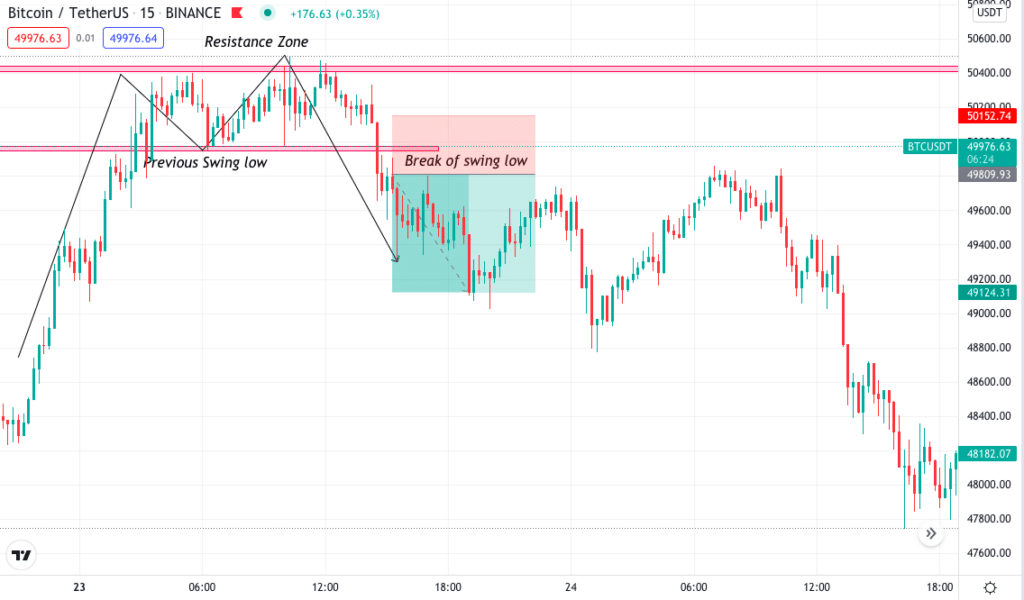

Moving to the 15M time frame, you will take the trade after the price broke the swing low and retest the zone. Remember to have confluence like the price is near the resistance, broke the swing low, and rejected multiple candles.

Entry

You will enter the trade after the price retest the previous swing low break zone.

Stop loss

Stop loss will be 2-3 pips higher than the swing break zone.

Take profit

Place your take profit at 1:2 risk: reward.

Pros & cons

Pros | Cons |

| •Part-time trading It allows you to trade part-time by also maintaining your full-time job. • Less stressful Trades can run for days and even weeks, allowing you not to spend hours in front of the system. • Volatility High volatility in crypto is useful in swing trading, helping in faster price movements. | • Keeping trade overnight There is a risk when it comes to swing trading holding your positions overnight. It increases risk and also gives swap charges. • Price gaps Some traders may encounter price gaps when they hold positions overnight or over the weekend. • Highly influenced by social media Crypto, in particular, is highly influenced by the media. Any influencer’s tweets or news events can bring high volatility and unwanted movements that eventually blow the trading account. |

Final thoughts

This is a complete beginner’s guide to trade the cryptocurrency market. It would be best if you learned about the industry before getting involved in any form of investment.

As a beginner, the most crucial piece of advice would be to learn both fundamentals and technicals. Candlestick can show you what exactly is happening in the market and where the price wants to move.

For any beginner, it can be overwhelming to inherit so much information as the crypto market is overgrowing. Thus it is always better to go slow and learn step by step and not try to find the holy grill that would work all the time because there is nothing like that in trading.