Swing trading is a popular trading style among experienced traders in the crypto space. Swing trading requires less time looking for trades and monitoring them, allowing you to work on other significant concerns.

In swing trading, you will focus on higher time frames such as four-hour and daily charts. Next, you must understand if the market is trending or ranging and then trade accordingly. When you open a trade, you might hold it for one week or more. You trade less, but you can make more return in each trade.

If you are busy due to your day job or business and are a big fan of crypto trading, swing trading might be a good fit. Of course, there are pros and cons associated with this method. You will learn that in this article. First, let us review what swing trading is as it applies to the crypto market.

What is crypto swing trading?

Swing trading is a method of speculating where the crypto market may go in the near term. As a swing trader, you would like to take advantage of the fact that the market tends to fluctuate (i.e., create up and downswings) as it moves in a trend. Your goal is to ride as many up and down swings as possible.

Some of the most volatile crypto assets you can swing trade are Tether, Ethereum, and Bitcoin. These the most prominent market caps coins show significant trends because many traders and investors actively buy and sell them.

Usually, you would use technical analysis to spot swing trades, but adding fundamental analysis into the mix is never a bad idea. Regarding fundamental analysis, you must check news articles about developments happening in the crypto assets of your choice. News events could drive these assets in one direction for a longer duration.

Popular swing trading methods

There are two primary swing trading methods you can apply in crypto trading. You may use one or both of these strategies as you see fit.

Range trade

Although crypto assets trend a lot, there are times when they are caught in a range. When this happens, it often leaves support and resistance zones in the wake of the sideways movement. When you notice this event, focus your attention on occasions when price touches the upper or lower boundary of the range.

Consider price action as it approaches support or resistance. Is it losing momentum? If so, then you might see a bounce when price touches one of the boundaries. Of course, you need confirmation before you take a range trade. The best confirmatory tool is candlestick patterns. The good thing about candlestick patterns is that you can clearly define and limit your risk per trade, and you can go for a reward that is a multiple of your risk.

For example, if the price is approaching support and you see a bullish pin bar, you can take a buy trade and set your stop loss a little below the pin bar’s low. Then you can aim for a target profit that is greater than the trade risk.

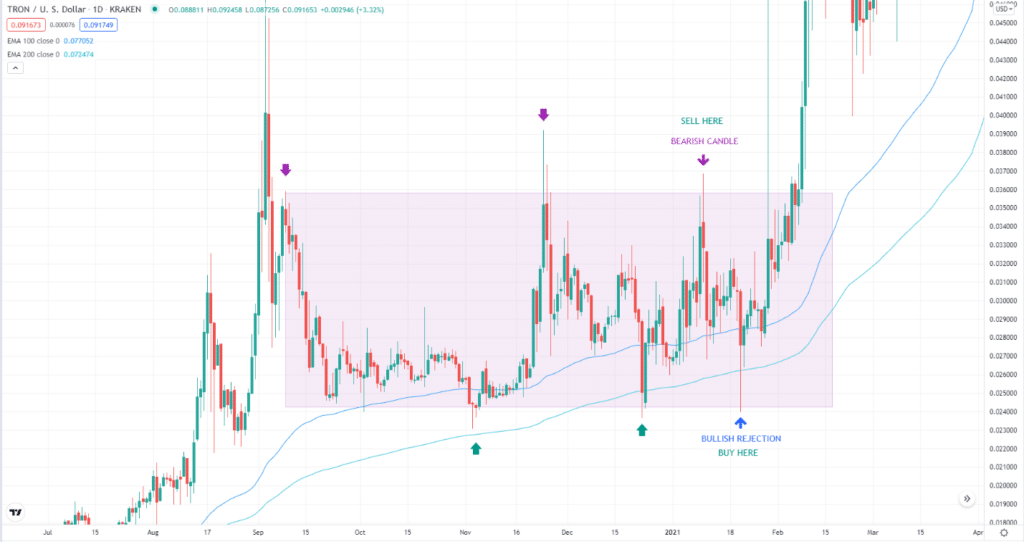

Above is the daily chart of Tron. We have identified the trading range after the two swing highs (marked by purple down arrows), and two swing lows (marked by green up arrows) formed.

Next, you find a bearish rejection candle forming at the top of the range, so you open a short trade. After that, you see a bullish candle rejection at the lower boundary of the range, so you open long trade.

Trend trade

In this strategy, you will take trades in the direction of the movement. Thus, the primary requirement is a trending market. If crypto is not trending, find another asset that does. Further, you would prefer a trending market that is oscillating over one that is moving straight up. Oscillations allow you to time your trades and define the trade risk.

There are tools you can use to define a trend. One such tool is a moving average. Any period higher than 50 is ideal for trend identification. Another tool you can use is a trendline or a channel. Connect two lows or two highs and then extend the trendline or channel to the right to use this tool.

Once you have applied your trend tool on the chart, wait for the price to pull back. If price touches a long-term moving average, for example, and then rejects it with one or more candles, that is an entry trigger. The same is true if you use a trend line or channel. Rejecting the trend line or channel with a candle is an entry trigger.

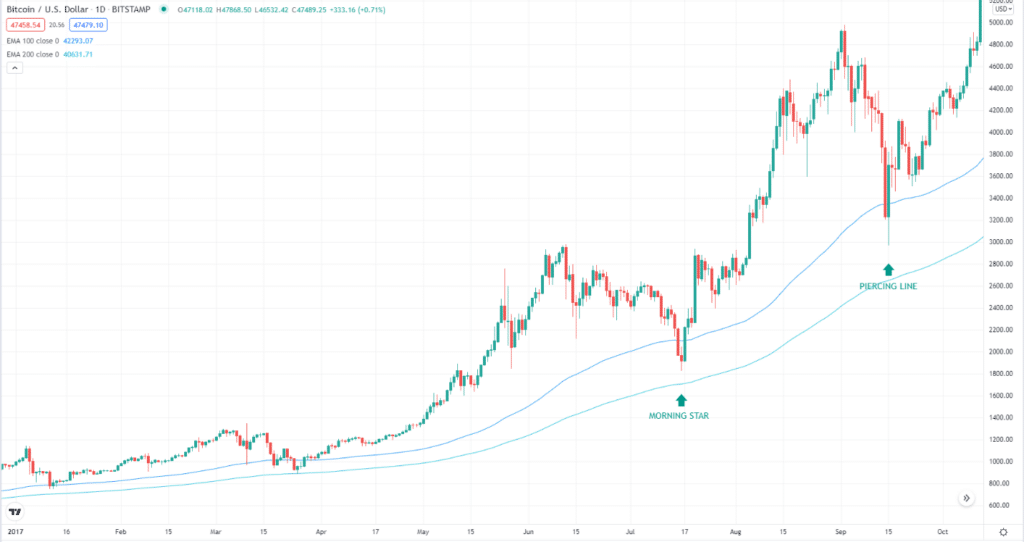

This is the daily chart of Bitcoin. We have plotted the 100 EMA and 200 EMA on this chart. As you can see, there are plenty of trade opportunities you could have taken. The two most apparent setups are marked with green arrows after a pullback to the moving averages followed by rejection candles. A morning star triggers the first trade, and a piercing line triggers the second trade.

When setting your stop loss, you can use the swing low (for a buy trade) or swing high (for a sell trade) as your stop loss point. Since this is a trend trade, you can set high targets for your take profit, such as the previous swing high for a buy trade or a prior swing low for a sell trade.

Pros of crypto swing trading

You might find swing trading an exciting method to learn as it does not demand as much time as other methods like day trading. Here are some benefits of swing trading:

- Less stress. You will find that swing trading is less stressful than scalping or day trading since you are looking at higher time frames. Concomitantly, you will take fewer trades, but it does not mean you will not be profitable.

- Trade on the side. Because it demands less time, swing trading the crypto market allows you to work a day job, manage a business, or maintain your lifestyle.

- Quick trades. Because the crypto market is volatile, you can close trades quicker than when the market is not moving as much.

Cons of crypto swing trading

Although swing trading is generally beneficial for both new and experienced crypto traders, there are some challenges that you must bear, such as the following:

- Negative swap. Since you hold your positions for more than one trading day, your broker will charge carryover fees. On rare occasions, the carryover fee may be positive, but it is primarily negative. Over the long term, these fees might eat your profits. While you can still trade successfully even with a negative swap, be aware of this factor. You may also consider this factor when taking trades, that is, take positions when you can get a positive swap.

- Poor timing. Your trade entries might not be optimal when you trade using higher time frames. In this case, consider going down to a lower time frame when looking for entries while keeping a higher perspective.

Final thoughts

Swing trading enables you to understand the rhythm of the crypto market as you trade. This knowledge is essential as your trading process must align with the market process. There are more upsides than downsides to swing trading. It is up to you to decide if this style is suitable for you at the end of the day. Apply the two strategies above and see if they make sense to you.