Price action trading is quite popular these days. This article will discuss the top five tips to help you become a successful price action trader.

What is price action?

Price action is buying or selling a trading instrument from price movements alone. You observe how price responds to different patterns and key levels of support and resistance.

It’s the price response to something that makes the price action trading strategy so powerful. So let’s dig more into how you can improve your price action trading.

Tip 1. Learn several patterns

To succeed as a price action trader, you need to learn several trading patterns. This will help you implement your strategy more effectively.

As simple as it sounds, most traders do not get it right.

Why does it happen?

Traders usually learn one or two patterns and then stick with them. Unfortunately, this stops them from strategically analyzing the movements because it is possible that one pattern is being followed, whereas many others are yet to be met.

How to avoid the mistake?

Equip yourself with information — master as many patterns as possible to approach the market with a thorough knowledge of the situation.

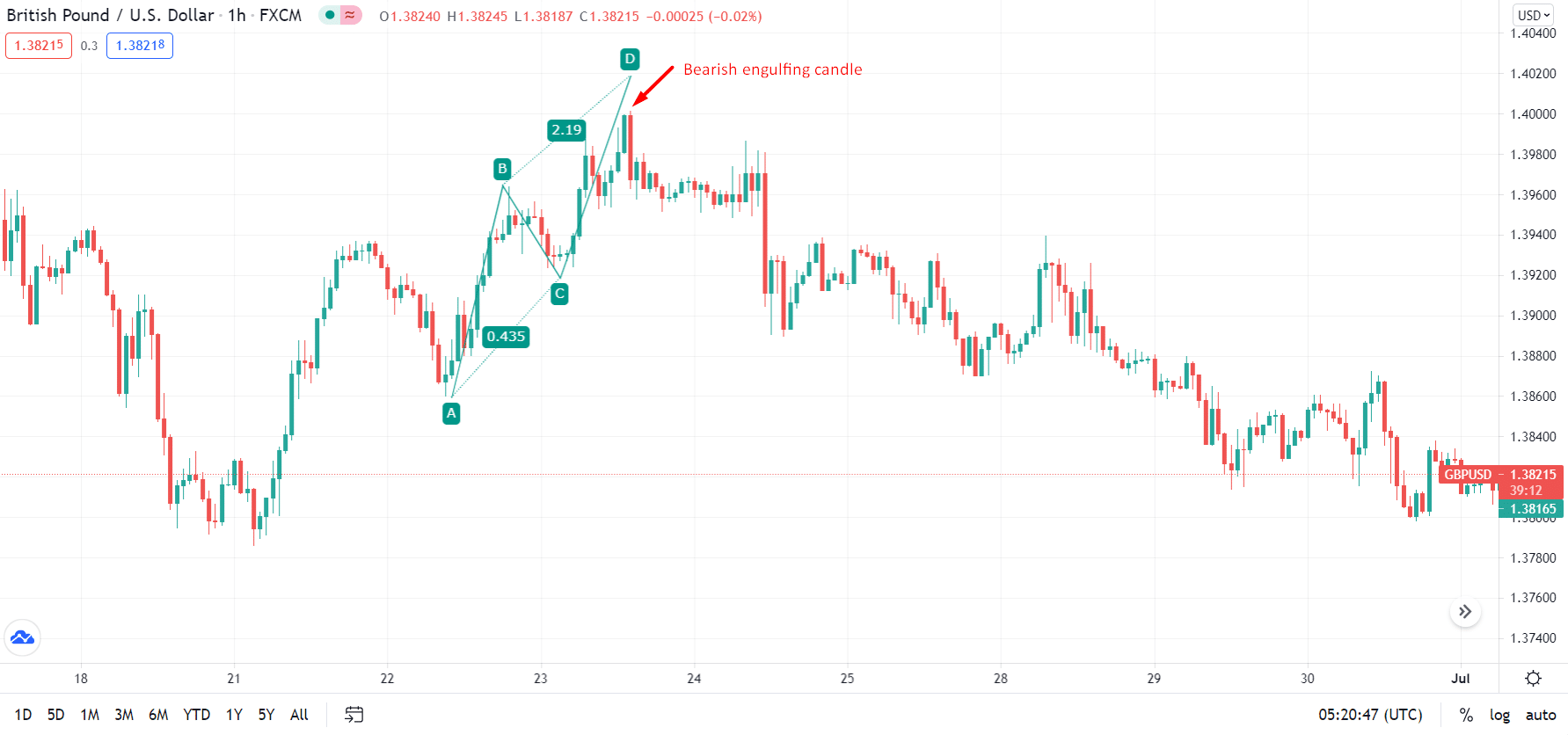

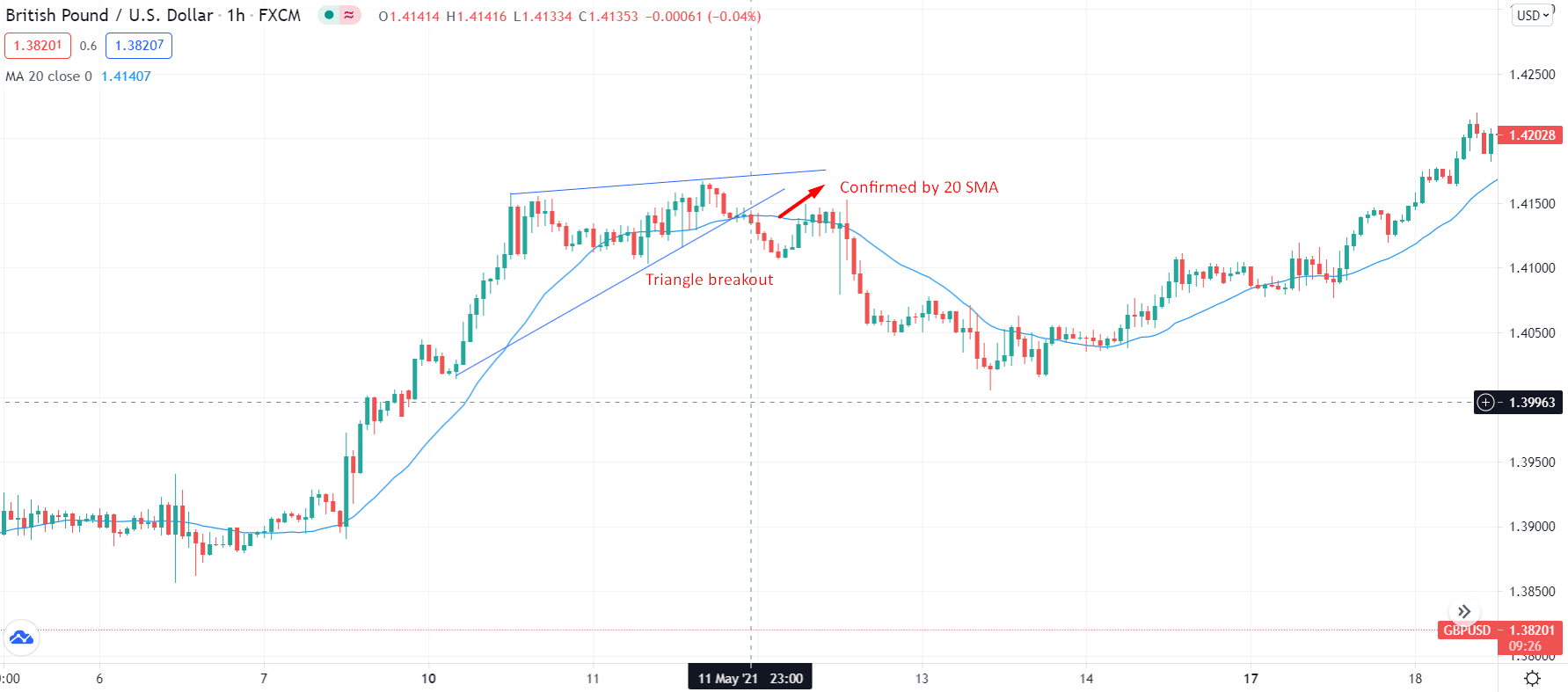

For example, if you opened a trade based on the AB=CD pattern but before the price could reach your profit target (point D), you found a bearish engulfing candle on the way. However, if you already know the bearing engulfing pattern, you can exit your buying position and start seeing the opposite entry. For example, look at the chart below.

There are many patterns such as the bull/bear flag price pattern, ascending/descending triangle price pattern, double top/bottom price pattern, etc.

You can study e-books written by expert traders and consult YouTube for better insight.

Tip 2. Practice identifying patterns

This point relates to the previous one. There are many patterns, most of which are fairly similar to the other. You need to learn the differences and practice identifying them.

Investors fail at recognizing patterns which is why they have to bear losses.

Why does it happen?

As said before, it can be pretty hard to differentiate between patterns. Traders who cannot recognize patterns cannot identify if a pattern is incomplete and lose money.

How to avoid the mistake?

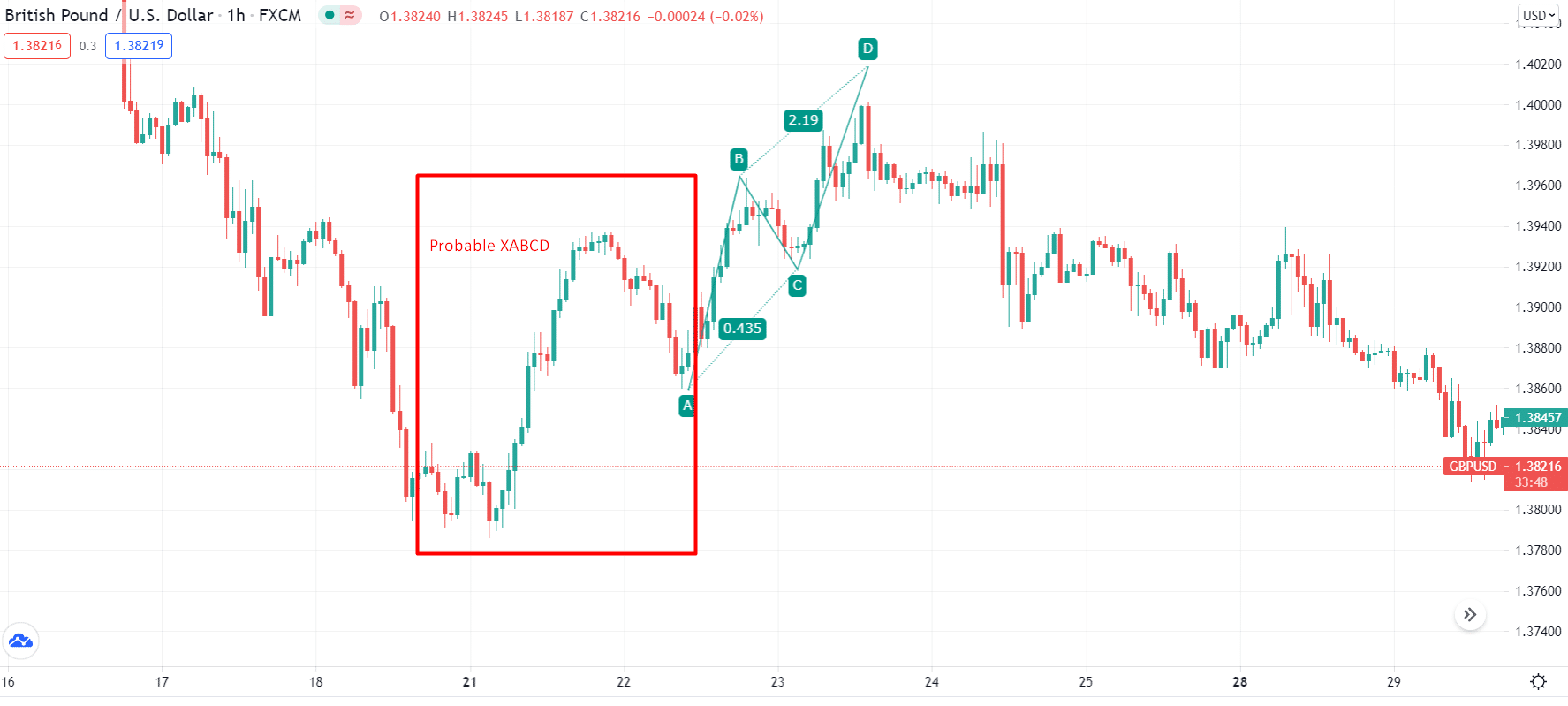

You will have to work on identifying patterns. There are specific rules for pattern recognition that you should practice. For example, consider the bullish AB=CD pattern. You might be looking at AB=CD but ignoring that there could be a XABCD pattern developing in the background.

Only an investor who knows all the rules can take the strategically right decision.

Tip 3. Understand the behavior of a currency pair

Price action trading is a lot more than learning patterns. You have to observe individual currency pairs as well.

Why does it happen?

Each currency pair has a different pattern. Investors who do not learn the behavior of various currency pairs cannot trace the movements efficiently.

How to avoid the mistake?

Track the behaviors of multiple currency pairs. We have major currency pairs that involve some of the world’s largest economies, such as the EUR/USD, USD/JPY, etc. For example, if we discuss the GBP/USD currency pair, it has a greater chance of moving in the London session or during the New York session.

Then we have commodity currencies (Aussie, Loonie, and Kiwi forex pairs) significantly affected by the commodity prices like crude oil, copper, gold, etc.

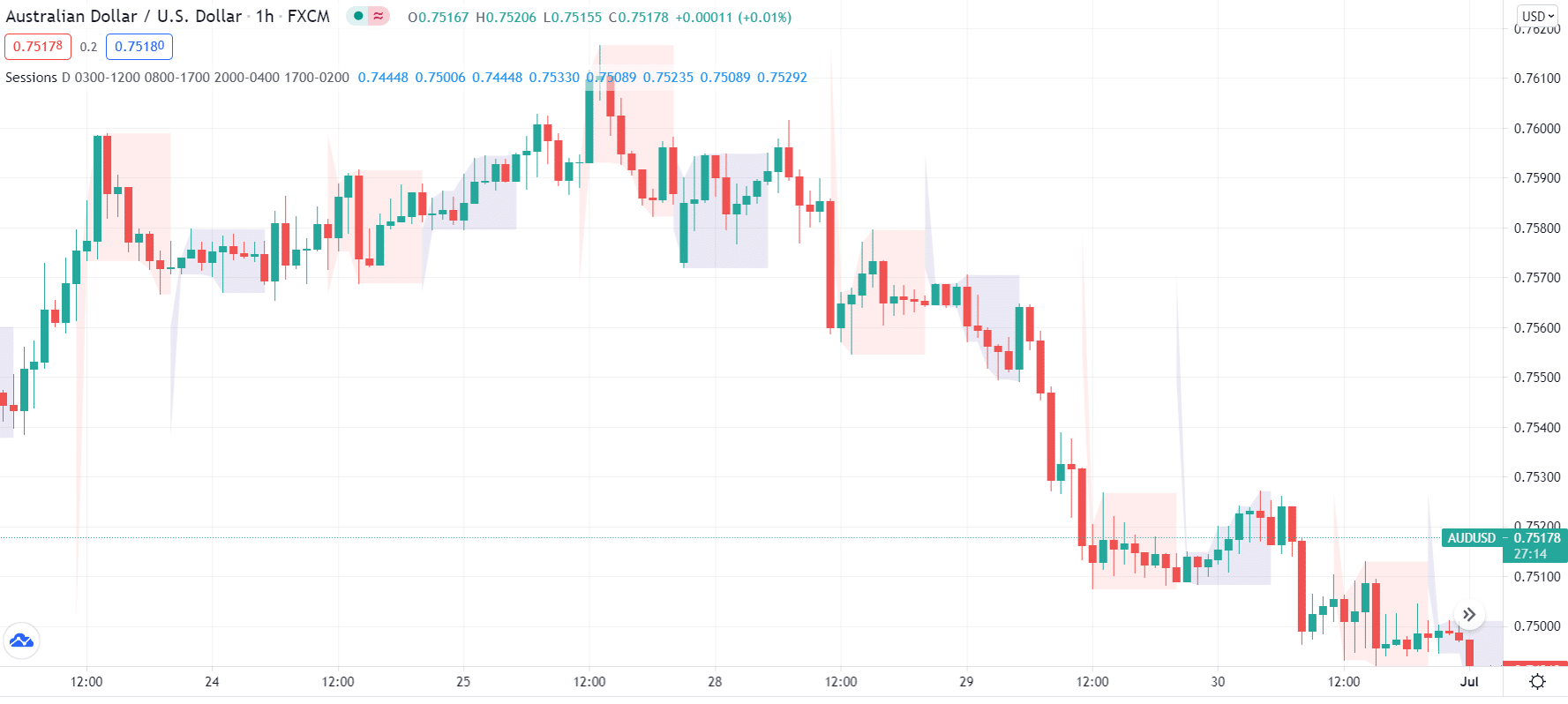

We can consider the AUD/USD pair; the Australian dollar is a major component that is more likely to move in the Australian session. Now, since the other part is the US dollar, it will move better in New York. Hence, look for trading opportunities during the active hours only. You can see the chart below.

To flourish in the business, you have to learn the behavior of as many pairs as possible. Each currency has a separate average daily rate which calls for a difference in their behaviors as well. Similarly, some currencies are range-bound, whereas some are trending. It would help if you kept all these in mind while investing.

Tip 4. Design your strategy

Trading is all about having a strategy. Investing without a technique is like shooting blindly in space. You can never expect some solid outcome out of it.

Having a strategy is not enough; you have to set your own rules based on your experience as a trader. Unfortunately, this is where investors lag.

Why does it happen?

There isn’t a one-strategy-suits-all. If you use a ready-made strategy, the results vary for every individual, so you can never rely on it.

How to avoid the mistake?

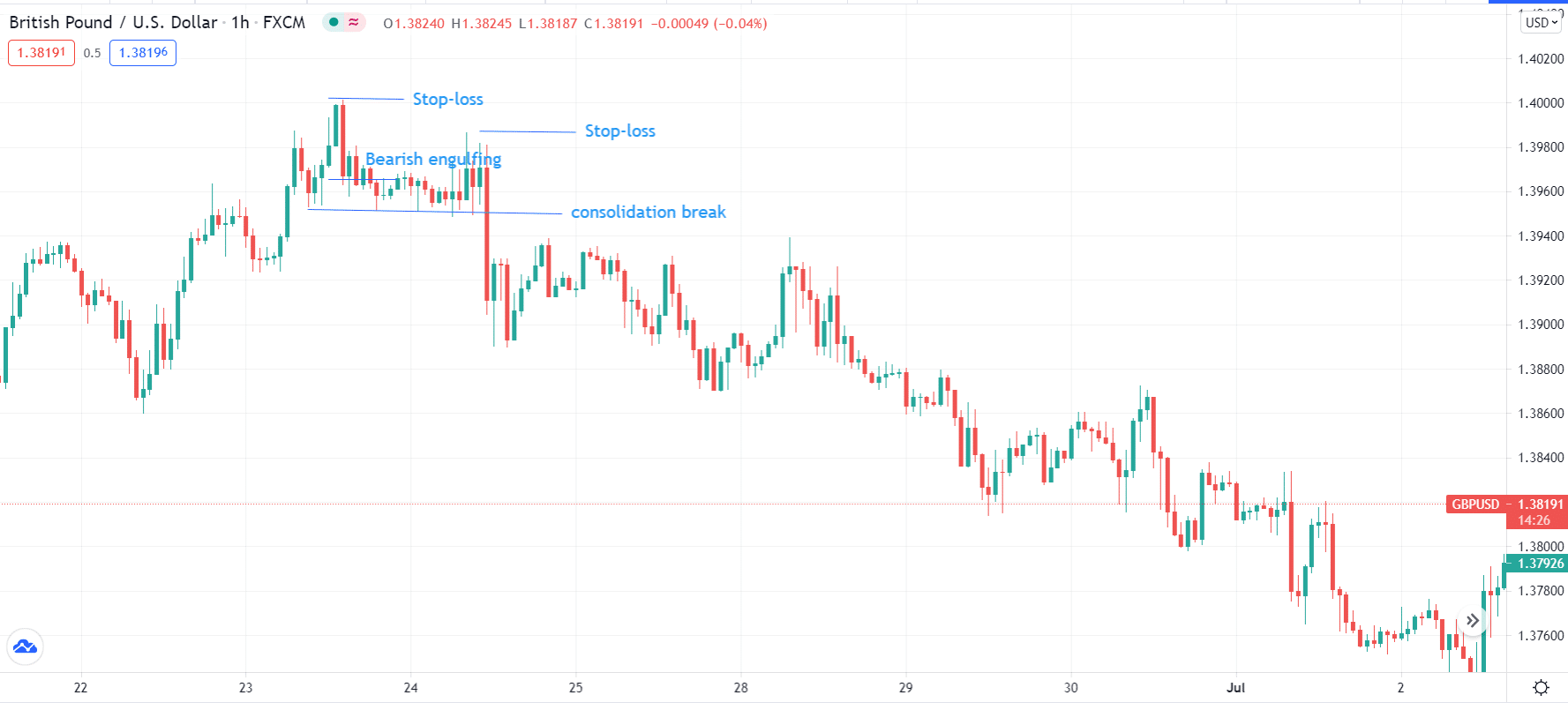

Use all the patterns that you have mastered to design your strategy. First, define your entry-exit rules and risk to reward ratio. After that, run a backtest to figure out your winning probability.

For example, there are many price action patterns, and each pattern may have different rules for entry and exit. However, you can standardize the risk approach and other elements like the confirmatory analysis.

Once you have all the data, finalize an approach that’s custom-made for your trading style. This will help you in predicting results with accuracy.

Tip 5. Confirmatory analysis

A confirmatory analysis is another tried and tested method that will help in this trading technique. You can see a pattern and find out your entry points, but you will need to use confirmatory tools for a higher winning probability.

Why does it happen?

Most traders stay focused on other aspects of trading and undermine confirmatory analysis. Tools for confirmation provide results with better precision.

How to avoid the mistake?

You may use the 20-period moving average as a confirmation tool. Once a price action pattern completes, check out its confirmation. If the tool confirms it, then it is safe to take that trade.

Final thoughts

If approached correctly, a price action strategy can do wonders for you. Follow the steps mentioned above in mind, and you are good to go.