Traders can make money in forex trading from time to time. However, if you want to generate a regular income, you need a strategy that yields consistent results. This is easier said than done, though.

About 33 percent of all traders can make profits over three months, says trader Chris Capre. However, only 7.7 percent among them can make consistent profits year after year. These figures mean that 92 percent of retail traders cannot achieve consistent results.

While the statistics do not look good, there is still a chance to succeed in trading. What you need is a solid trading strategy that you apply consistently. You do not need a complicated trading strategy, to begin with. Even a simple system can work.

In this article, you will learn a straightforward strategy that you can apply right away. You do not need indicators to trade this system. The market experience is not a requirement, too. Just follow the system rules, and you will do fine.

What is 50 pips a day trading strategy?

This strategy aims to make 50 pips of profit each day. Once achieved, you can call it a day and trade again the next day. You will use the following tools to trade this system:

- Candlestick chart

- Hourly chart

- London session indication

The logic behind this method is to capture 50 pips when markets make big moves at the opening of the London session. Your primary focus is the two major pairs GBP/USD and EUR/USD.

Be aware that many traders love to trade the London session. Among these traders are big players who move the markets. When they open positions, volatility floods into the markets. You will need this volatility to catch 50 pips.

How do the 50 pips a day trading strategy work?

This strategy does not use any type of technical indicators and not even price patterns. Here are the key aspects of this trading method:

- Trade major currency pairs with large daily ranges. The larger the range, the better. Take note that the range refers to the distance between the high and low of a daily candle.

- Wait for the market to open in the London session.

The best currency pairs you can trade with this strategy are the following:

- AUD/USD

- USD/JPY

- GBP/JPY

- EUR/JPY

- EUR/GBP

- AUD/JPY

How to trade with the 50 pips a day trading strategy?

You need to take several steps in the correct order to trade this strategy successfully. The steps are outlined below:

- Select any major pair. It is best to trade the major currency pairs with this method, particularly those with average daily ranges of 100 pips or more.

- Set your chart to the hourly time frame. You are going to trade the London session when it opens on the hourly chart. You need to see the first hourly candle that forms and closes after the London session opens. We can call this the trigger candle.

- When the London session opens, wait for the first hourly candle to close.

- Place stop orders. Place a buy stop order two pips above the high of the trigger candle, and a sell stop order two pips below the low of the trigger candle. If the price takes out the high or low of this candle, there is a good chance that it will continue in this direction.

- Set your stop loss. For the buy stop, place the stop loss at least 10 pips below the pending entry price. For the sell stop, place the stop loss at least 10 pips above the pending entry price. You can use higher pips depending on your preferred risk-reward ratio.

- Set your profit. As the name of the strategy implies, you should use a 50-pip to take profit for both pending orders.

- Wait for the price to activate one order. Price can only move up or down. It can hit the buy stop or sell stop order and convert it to a market order.

- Cancel the other pending order not activated.

- Rinse and repeat. Do this process every day to try and generate 50 pips per day.

Bullish trade setup

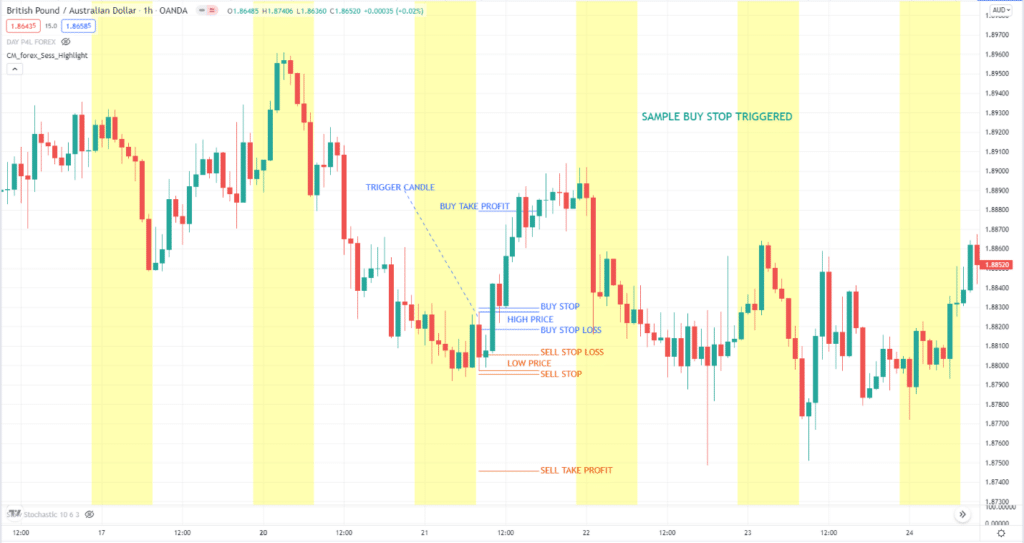

A bullish setup looks like the scenario depicted in the chart below.

Your buy entry is a buy stop order placed two pips above the high of the trigger candle. Its take profit is placed 50 pips above the buy stop entry price. The stop loss is 10 pips below the buy stop entry price.

Bearish trade setup

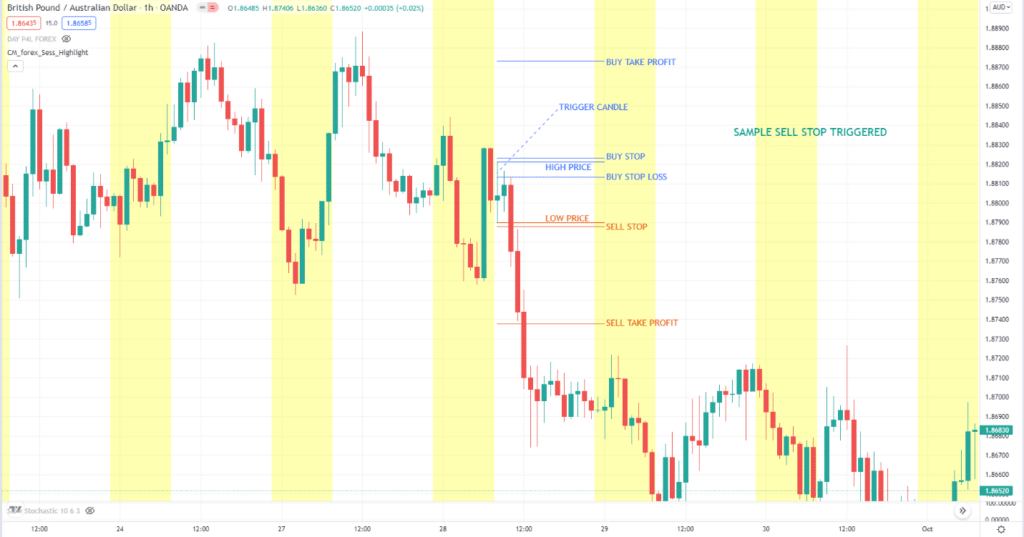

A bearish setup looks like the scenario shown in the image below.

Your sell entry is a sell stop order placed two pips below the low of the trigger candle. Its take profit is set at 50 pips below the pending order entry price. The stop loss is set 10 pips above the sell stop entry price.

How to manage risks?

Through backtesting, you can tell that the win rate of this system is moderate. For scenarios like this, you need a high risk-reward ratio to make money in the long run. As it is laid out above, the ratio is 1:5. You risk ten pips per trade for a potential 50 pips of profit.

To succeed with this system, you should aim to stay long enough for your edge to play out. Therefore, the one-percent rule makes sense for this system. You should risk only one percent of your account per trade. Even if you lose four out of five trades, you can still survive.

Final thoughts

One way to find out if the strategy works is through hand testing. You will need a lot of data to do this, and you will use different pairs. If your initial results look good, that is the time to do demo trading. You might need to adjust as needed and adapt the system to the type of market being traded. Of course, you need to track the win rate to determine what risk-reward ratio is appropriate.

What makes this system unique is the simplicity of its implementation. You do not need market analysis to trade. With this mechanical trading system, you can trade in less time. Plus, you can set and then forget your trades. Who knows, you might find a gem out of this simple system?