Crypto swing traders take speculative actions to participate in the most profitable trades. When seeking to participate in swing trades on crypto-assets, expert investors often rely on technical tools that usually help them find the most potential trading positions. Many crypto swing traders reckon the Bollinger Bands (BB) is preferable.

However, it requires learning the professionals’ way of use alongside having a basic understanding besides clear concepts about any technical indicator or tool when choosing it to execute successful swing trades. This article will briefly discuss the cryptocurrency swing trading strategy using BB.

Bollinger Bands explained

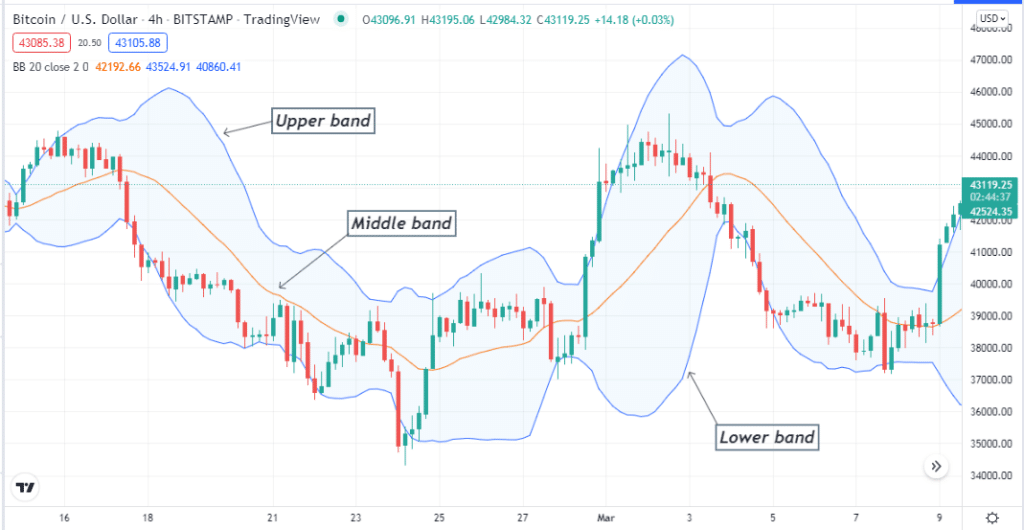

It is a familiar technical indicator to financial traders. John Bollinger is the developer of this indicator and its propounding period is the 1980s. This technical indicator contains three dynamic trendlines and works with two parameters to show the market context: standard deviations and periods.

BB uses a default value of 20 and allows traders to customize the parameter. BB helps spot the highest and lowest points of price movements by dynamic trendlines.

The middle line of the indicator depends on an SMA line, and the other two bands depend on standard deviation and maintain a particular distance from the middle band of the BB indicator. When checking on limitations factors, the BB indicator is more like a reactive technical indicator, not a predictive one. It only shows the existing market condition depending on the historical data.

The indicator first calculates an SMA then calculates the standard deviations. The upper band of BB usually adds the standard deviation value respective to the MA, and the lower band subtracts the standard deviation value from the MA.

Why use Bollinger Bands in crypto swing trading?

It is a unique indicator that suits many trading assets. It has become popular with financial traders, including crypto swing traders, as it involves various positive features and functionalities. You can consider the BB indicator as an easily applicable indicator to any crypto investor.

The tool is available on many trading platforms, and you can use it to identify swing points, overbought/oversold levels, current trends, measure volatilities, etc. However, the BB indicator is a lagging indicator like many other technical indicators, crypto swing traders like this indicator for these various attractive features and functionalities.

How to use Bollinger Bands for crypto swing trading strategy?

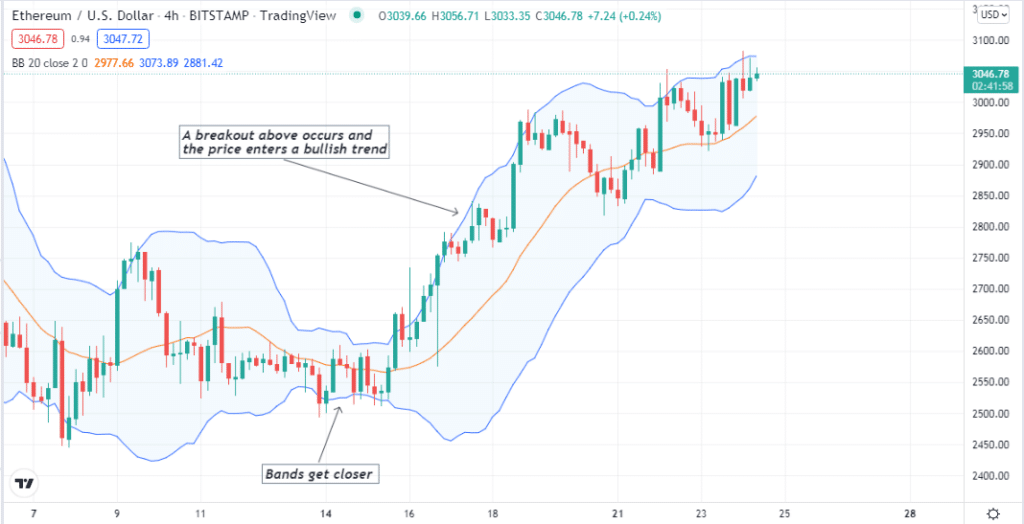

Swing traders prefer the indicator for its unique capability of determining volume and breakouts. The bands of the BB indicator or three dynamic trend lines come together when the volatility decreases on the asset price. As for all financial assets, usually, volatility decreases before a big movement.

For example, when major financial events come upon any fiat currency, such as central banks policies, GDP, interest rate decisions, etc., significant investors usually reduce volumes of their trades or put on the hedge to reduce risk on their capitals. As a result, volatility decreases, and when the event is released, they return to the market with appropriate volume according to their investing strategies.

The same goes for cryptocurrencies; volume drives the price movements. When a breakout occurs, the bands of the BB indicator get wider; the wider bands declare larger breakouts. The price continues to move between the middle and the upper band, indicating the price moving on an uptrend and vice versa when it remains on the down channel. When the price reaches the upper band declaring, it enters on an overbought condition.

Meanwhile, for an oversold condition, the price reaches the lower band. The price can remain in these conditions as long as rapid buying or selling continues. So often, crypto swing traders use other supportive technical indicators or tools to create invincible trading strategies.

Bollinger Bands crypto swing trading strategy

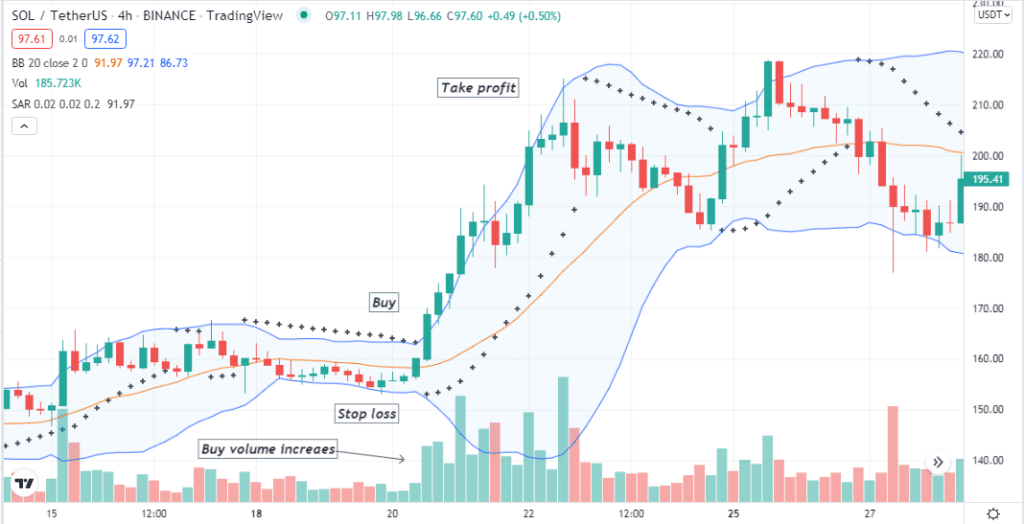

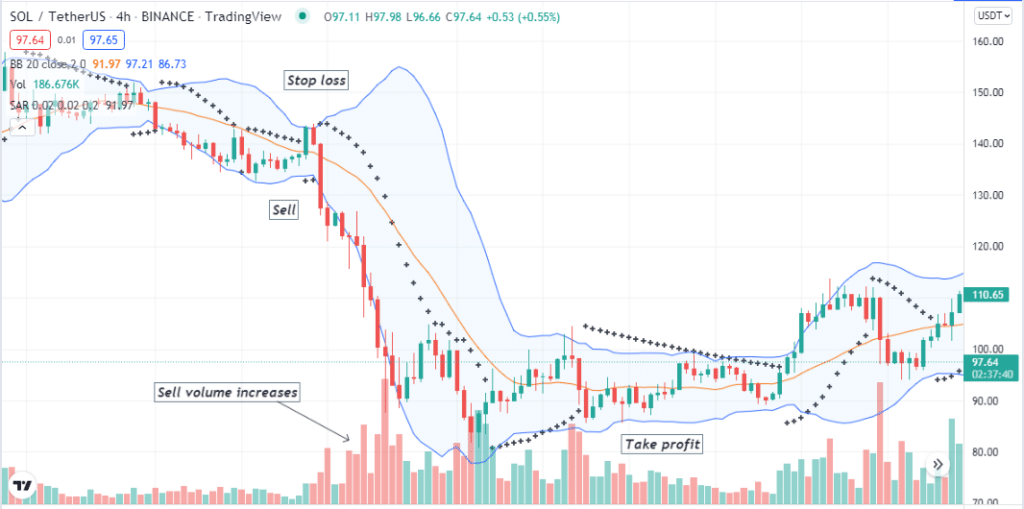

We use the volume and Parabolic SAR indicator in this trading method to determine the breakouts alongside the BB indicator. This method suits many time frame charts; we recommend using 15 min or above time frame charts to get the best results. We get the most potent crypto to swing entry/exit points by combining these three technical indicators.

Crypto swing buy strategy

- Check the price enters a phase of low volatility as the BB indicator bands get closer.

- The price enters on the upper channel of the BB indicator.

- The volume indicator declares an increasing buying pressure on the asset price.

- Parabolic SAR dots take place below price candles.

- The method indicates the initiation of bullish momentum. Open a buy position.

- The initial stop loss will be below the current bullish momentum.

- Continue the buy order till the bullish trend remains intact.

- Close the buy order when the price starts to consolidate or enters a declining phase.

Crypto swing sell strategy

- Check the price enters a phase of low volatility as the BB indicator bands get closer.

- The price enters on the lower channel of the BB indicator.

- The volume indicator declares an increasing sell pressure on the asset price.

- Parabolic SAR dots take place above price candles.

- The method indicates the initiation of bearish momentum. Open a buy position.

- The initial stop loss will be above the current bearish momentum.

- Continue the sell order till the bearish trend remains intact.

- Close the sell order when the price starts to consolidate or surges upside.

Key takeaways

- Don’t put all your eggs in the same basket, so follow investment diversification strategies.

- Never risk more than 2% of your capital in open trades.

- Don’t make any early entries; check all indicators readings carefully before executing any trading action.

- Follow some basic trade management rules while continuing any trade. Shift stop loss positions if needed to reduce losses.

Final thought

Finally, we describe one of the best crypto swing trading strategies using the BB indicator. Smart crypto investors always practice trading strategies before applying live trading to check potentialities and limitations. This trading method enables crypto investors to catch limitless profitable swing trades.