The bull call spread method is one of the simplest options that allow traders to invest in underlying assets with a limited price increase. With this method, options traders make massive profits from the marketplace, maybe 300%, 400%, or even 500% or more of their capital every year. This method you can apply in crypto-assets too, which will reduce your risk to a minimum level.

However, it is mandatory to properly understand before implementing any trading method on live crypto trading. Let’s get to how to implement this technique in trading.

What is the bull call spread crypto strategy?

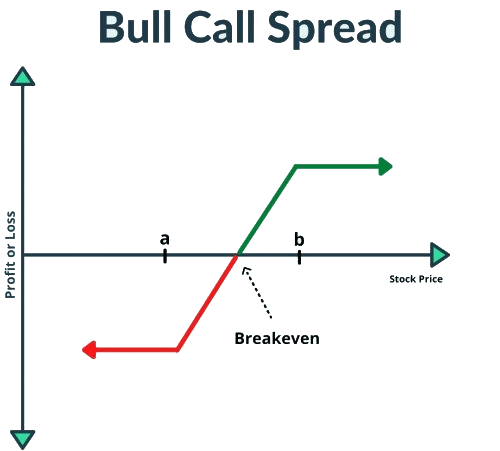

You can consider this method among the most popular spread options strategies. The strategy suits assets with a moderately bullish view, and it contains two strike prices as the range between a lower and an upper strike price through its two call options.

It is usually a two-leg strategy that uses ATM and OTM, although you can use other strikes if you prefer. The net difference between two call options is the cost of the strategy that investors pay.

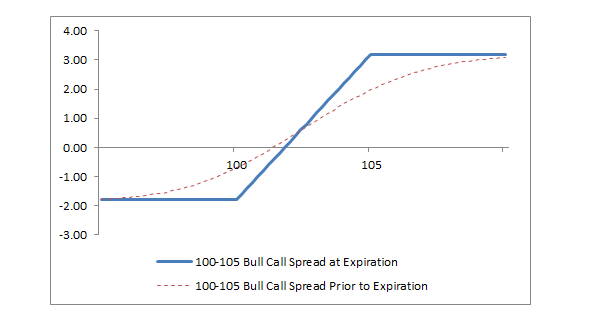

For example, buy 1 XYZ 100 call at $3.40 and sell 1 XYZ 105 call at $1.60, the net cost will be $1.80, and the price difference is $5 (105-100=5).

Basic terms of strategy

Cost

It is the price difference between purchasing and selling any trading asset.

Break-even point

The breakeven price of this spread is to combine the cost of the spread and lower strike price.

Delta

It usually calculates the price change of any underlying asset. The value remains between 0-100 for call options and -100-0 for put options.

Theta

It represents time decay as it is subject to change over time.

Vega

It represents the volatility change risks. Higher volatility indicates that the strike price will meet at some point.

You can consider a bull call crypto trading strategy when this method/concept you apply to a crypto asset.

Reason to use this strategy

The strategy involves using two legs, such as buying 1 ATM call option and selling 1 OTM call option. In the meantime, both options call to contain the same expiry dates and the same number of options. This trading method usually reduces the risk and cost of the call options, but it also comes with the trade-off, so the profit is also caped.

Three primary things of this trading strategy are:

- The breakeven point of this strategy is lower strike + net debit, where there is neither loss nor profit.

- The profit amount is capped in this trading strategy.

- The loss is also limited here.

How to use the strategy?

The strategy is straightforward and profitable when you master the concept. It involves some risk factors and common criteria to check before practicing this method. Some conditions you should match before entering any trade using this method such as:

Choose a good asset

This trading method is for long-term time frames such as daily, weekly, and monthly. So check the long-term trend before entering any trade. The long-term trend should be bullish in this case.

Look for a good delta

Check the delta value of the asset and match it as sufficiently positive. A value above 0.8 is good.

Set strike price at least 20% of the capital

It will give you a good delta and increase the premium amount that investors have to pay.

Strategy explanation

When implementing the strategy:

- Leg 1: buy 1 ATM call option

- Leg 2 : sell 1 OTM call option

When entering trades, confirm that:

- All strikes belong to the same underlining asset.

- The expiry date is the same for both legs.

- Each leg contains the same number of options.

Bullish trend

When the asset remains on the long-term bullish trend, you seek to execute a bull call spread order by measuring a particular range consisting of the lower and a higher strike price. The price reaches those levels within the expiry date; it starts giving you profits.

Where to enter

Enter or execute your position by confirming the asset volatility and delta value. Check that the asset has sufficient volatility and the delta value is above 0.80%. You can ignore the current price movement as you enter for the long term. So it makes sense that you may follow weekly and monthly charts as well.

Stop loss

We suggest that the stop loss level is below 50% of your entry as you are also getting lower strike prices.

Take profit

The preferable take profit level should be above 50% gain, and you can extend the target as you are betting on bullish momentum.

Bearish trend

When the bearish trend for a smaller term may continue for a while, the price may doesn’t reach the higher strike price. If the price expires below the lower strike price, you can also make money through this trading method.

Where to enter?

This trading method is suitable for assets that involve long-term potential bullish expectations. You can enter on bearish momentums by checking volume and delta info.

Stop loss

The time until expiration is an important period. The asset may depreciate 25% as well, so according to the general rule, stop-loss would be below 50%.

Take profit

We suggest place take profit above 50% of the entry price.

Pros & cons

| Pros | Cons |

| High reward The bull call spread is a profit-making strategy. | Limits gain Limits the gain on the upside. |

| Low cost Comparatively cheaper than individual bull call strategy. | Volatility risk This factor can affect the price of the asset. |

| Limits risk This method reduce risk by limiting the maximum loss through its net cost/premium. | Bid/Ask difference The expiration date is far away, so there can be a change in bid/ask prices. Without managing correctly, this can create a loss. |

Final thought

The bull call spread is a potential and successful trading approach for trading assets like stocks, options, ETFs, etc. It helps generate huge profits and limit losses through premiums paid by investors.