Investors need to have multiple strategies to guard against the evolving and unpredictable financial markets. Arbitrage is one of the powerful methods investors use to hedge and diversify their portfolios.

Convertible arbitrage is a highly beneficial tactic and a tool that every investor should have in their kit. It is a common strategy used by hedge funds to ensure clients enjoy maximum benefits from their investments. Many well-known investors have made millions using convertible arbitrage.

As a novice investor, you would surely like to know and understand what convertible arbitrage is and how you can benefit. It sounds like a complex term, but in fact, it is a simple strategy.

We have outlined the concept in this article; please read further if you are interested to learn more about the topic.

What are convertible bonds?

Before we dive into the main topic, let’s understand convertible bonds.

When a business issues bonds to investors, it extends a coupon rate or interest rate yield that the purchaser receives for the investment duration. When you purchase a bond, the issuing entity has to repay your investment after a specified term.

The interest is the investor’s yield, and at the end of the period, the company has to buy back the bond from the investor at its original value. In short, a bond is a type of loan that a business needs to gather funds for projects or assets.

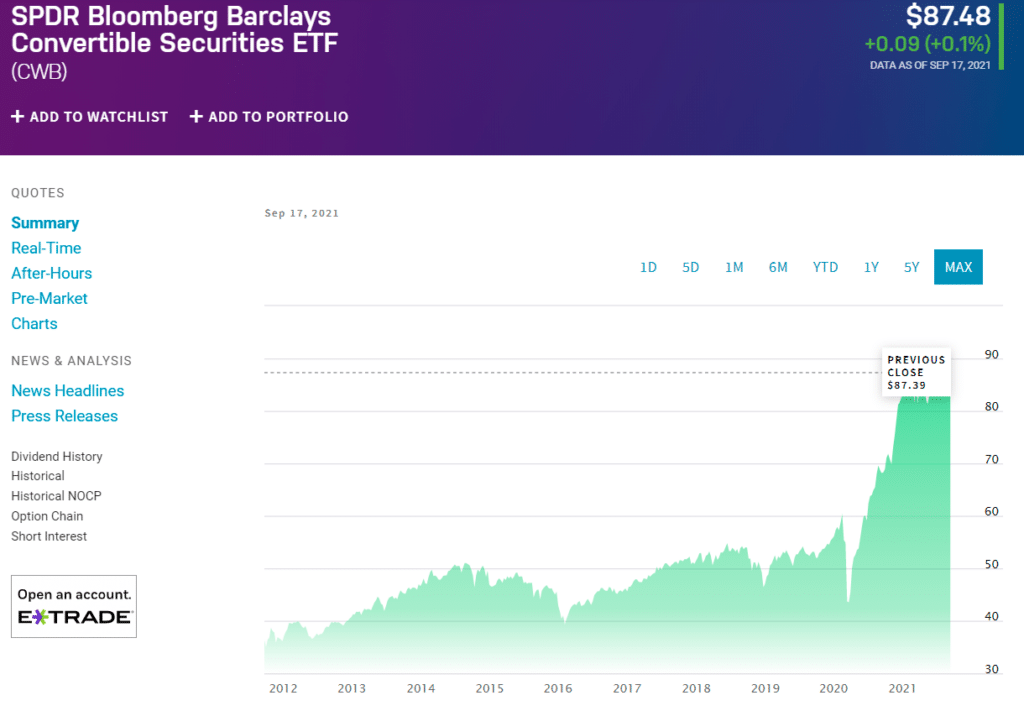

The SPDR Barclays Capital Convertible Bond ETF (CWB) is an example of a convertible bond fund. It is one of the leading funds with an asset holding of over $6 billion in assets.

The bond purchaser makes money off the interest. However, when you purchase convertible bonds, the issuing company will offer low or zero interest. These kinds of bonds are exchangeable for shares.

There are various reasons why enterprises issue convertible bonds to investors. Firstly, they extend low yields on convertible bonds. Secondly, the bond issuer stands to gain a tax advantage depending on their local tax legislation.

On the other hand, the investors receive lower yields, but they can take advantage of exchanging the bonds for shares when their stocks rise in value.

What is convertible arbitrage?

Convertible arbitrage is an approach which investors use during the exchange of bonds to stocks. As we mentioned, you can swap bonds for equity when a favorable condition exists in the market, and they ultimately profit from the price variations between the underlying equity and the bond.

How does convertible arbitrage work?

Convertible arbitrage exists when the bond and the issuing entity’s stock have a price discrepancy. And this is when investors can profit by buying and selling concurrently.

The market volatility influences share prices and creates a delta or a variance in the bond and the underlying stock pricing. The delta measures price sensitivity between the bond’s rate and the issuing company’s stock price.

If the convertible bond and the company’s stock have a significant delta, it presents an opportunity to trade the price difference. You can take a buy and sell position at the same time on both assets.

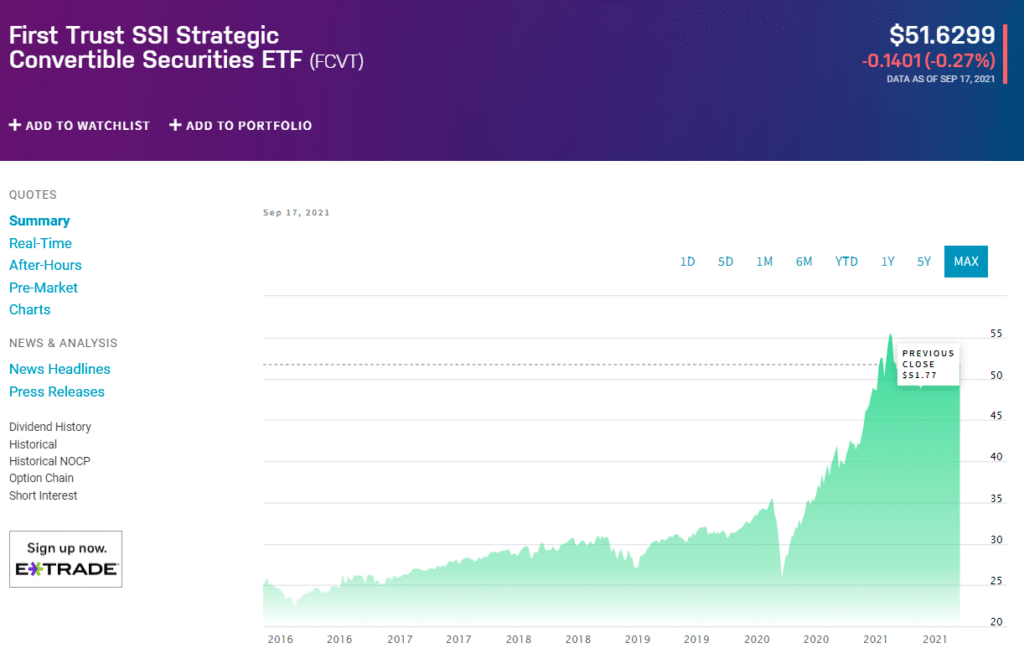

The First Trust SSI Strategic Convertible Securities ETF fund is actively managed and is accessible to investors outside the USA.

Requirements for convertible arbitrage

We will give different scenarios for using arbitrage to exchange bonds into stocks.

The bond price is lower

When the bond’s price is lower than its share price, it is an excellent time to take a buy position on the convertible bond and a sell position on the stock.

When the company’s share value declines, you stand to gain from the selling positions. You will then benefit from the yield from the convertible bond. Simultaneously it will counteract the bond’s long position.

Shares value increases

There can be a scenario where the price of the stocks rises, and the short position you hold will be running at a loss. The good thing is that you can convert the bonds into stock and sell the stocks at fair value. Therefore, you profit from the initial buying position, hedging the loss by converting the bonds.

Bond has a higher price

If the bond has gained value, taking a short position on the bond and buying the stocks is the perfect scenario.

The rising stock prices will offset any losses that you might have from the sell positions and your profit this way. Even if the stocks decrease, any losses you incur from trading the stock should be lower than the rising bond prices. Furthermore, you can take more buy positions on the bonds to neutralize the general losses.

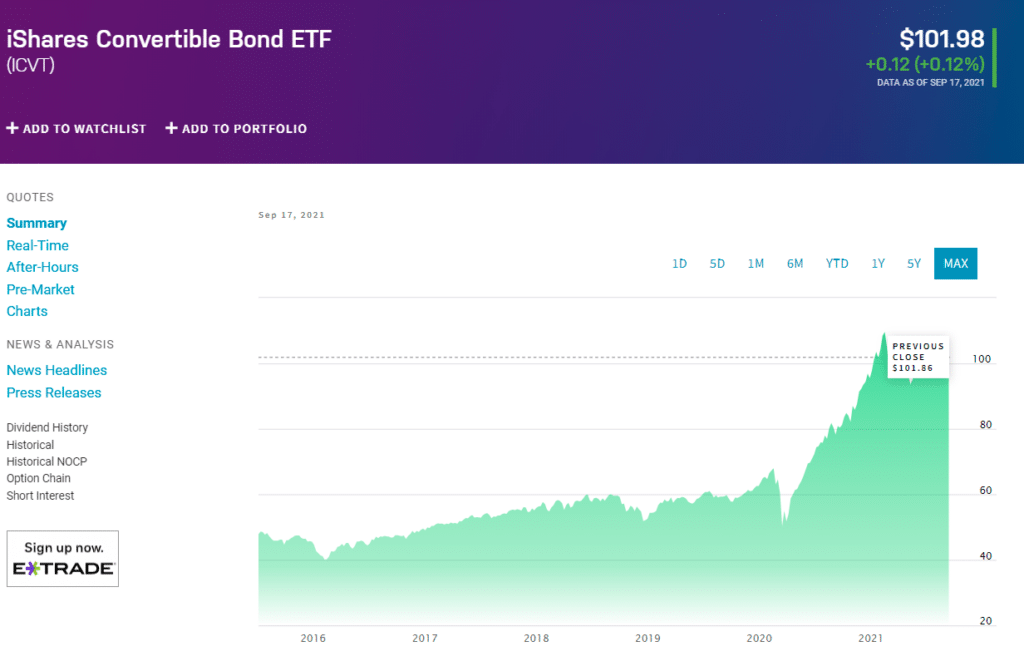

The iShares Convertible Bond ETF (ICVT) has roughly $1.5 billion in assets and tracks the Bloomberg Barclays U.S. Convertible Cash Pay Bond > $250MM Index. The fund is popular among short-term traders due to its higher liquidity.

Pros & cons

Even though convertible arbitrage sounds pretty straightforward, there are still risks involved. Let’s look into the pros and cons of using convertible arbitrage.

Pros | Cons |

| Hedge losses Convertible arbitrage is a good way to offset losses since you can trade the bond if your positions are running at a loss. | Convertible arbitrage is rare Convertible bonds are not as common anymore due to the reduction in leverage offered. |

| Low risk There is some risk involved, but overall, it is a low-risk investment, provided that you do not overleverage. | Continuously adjust positions Due to the price changes, you have to adjust your positions to minimize losses constantly. |

| Consistent performance Convertible bond funds have shown consistent growth, and if you choose the right one, you can take advantage of high liquidity in the short term. | Bond issuer risk If the bond issuer should liquidate, you risk losing your investment; even if you convert to the stock, the stock will decline in value. |

Final thoughts

The critical point to take away from convertible arbitrage is that price discrepancies exist even today. The risk is lower than other asset investments, and you can gain sufficient yields even if the difference is short-term. However, as we pointed out, prices fluctuate constantly. Therefore, you need to adjust your positions accordingly while minimizing risks.

Furthermore, holding convertible bonds in your portfolio is an excellent way to diversify against unforeseen risks in the markets and is a safer bet during seasons of high volatility.

There are excellent funds in the form of ETFs that offer consistent yields. As a novice investor, you will probably not have access to these funds directly. Therefore it is advisable to sign with a reputable hedge fund to advise on the best funds to invest in.