A dividend investing strategy is associated with holding shares from a company that pays a non-stop standard dividend to its shareholders. The shareholders keep the shares as it is until they’re willing to buy more shares.

Furthermore, if a company encounters growth throughout the years by covering its expenses and manages to generate more cash than the previous year, in that case, the company will be the perfect suitor for dividend investing. Typically, that type of company gradually raises this payout rate due to their constant progress.

Though dividends are a part of profits from the company hence, the company is not compelled to pay it. Now coming to the question of what they are? Let’s will uncover everything you should learn about the dividend investment strategy, along with a buying and selling method.

What is the dividend?

The board decides about the reward or dividend they may pay as cash or elseways, such as stocks. The dividend is a portion of a company’s profit attributable to shareholders for investing in the company’s equity. The declaration for these payments is associated with the raised or reduced equivalents of the stock’s price. Nonetheless, after paying lenders, the company uses the rest of the profit as dividends. On the contrary, the company can bypass paying the dividends and, it mostly happens when the company is going in shortage of money for reinvestment.

As mentioned earlier, the dividend is a profit to deserving shareholders and determines eligibility. The company set a date, and the shareholder registered deserves the dividends. Generally, the company sends the cheques via mail to the shareholders within a week.

How do the dividends work?

When the company produces profit and continues to earn, the management team proposes to pay from profits to the company’s shareholders instead of reinvestment. Afterward, if the board of directors passes the proposed plan and declares the dividends based on the price per share.

Also, the dividend is paid evenly to all the shareholders of the same class. The board of members should pay and endorse the dividend payout. After the dividend announcement, the company distributes it on the payable date, typically within a week. However, the company can pay dividend in different types. Cash is the most common type, but some companies offer dividends as a new share or other benefits.

In terms of buying stocks for gaining dividends, you should remain cautious. All companies do not provide them regularly except for dividend aristocrats. Companies that provide dividends regularly for more than 25 years are known as aristocrats. Buying any stocks from dividend aristocrats at an affordable price is the ultimate target of a dividend investor.

Bullish trade setup

Target incredible organizations that increment their dividends at a rate equivalent to or generously in overabundance of inflation every year. Your positions must be held for a more extended period to take benefits of deferred taxes because it will help you to allow further capital to work for you.

It is enhanced across various business areas to ensure that your dividend flow isn’t excessively dependent upon a solitary field of the economy. Also, ensuring the profit development is financed by more elevated levels of truly primary benefit, not the debt.

Furthermore, own stocks from overseas so that you can have dividends in many currencies to lessen dependence upon a solitary government.

Enter

Although you are buying stocks for dividend growth, you cannot open the buy order at a random place. Ensure that the stock price is trading within a bullish trend and that a bullish rejection appears from the support level.

Take profit

Companies provide such payments on a quarterly, half-yearly, or yearly basis. In most cases, you can get profits directly from the company and withdraw the profit at any time.

Dividend selling strategy

Selling dividends depends on your perceptions. Also, it may depend on your trading strategy and targets. However, dividend development investing exploits a constant flow of easy revenue rather than an abrupt expansion in stock value.

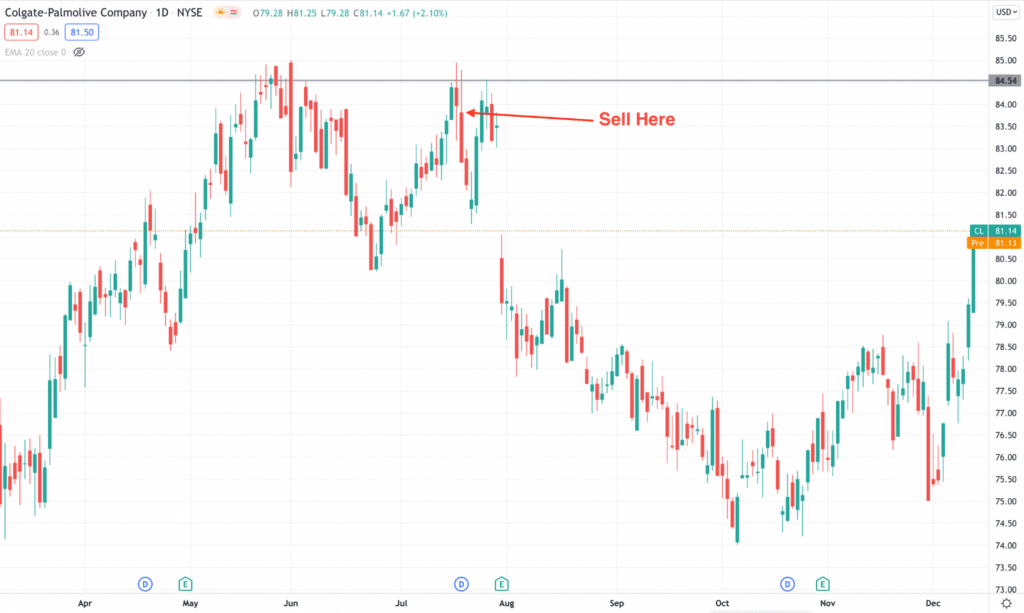

However, there is no reason to sell the dividend, as long as nothing is amiss with the underlying organization and the dividend value grows. You may sell the dividend if significant events are coming up or the price reaches the psychological resistance level.

Enter

If you sell a stock that provides a dividend regularly, you will no longer be able to get dividends. Therefore, before selling a stock make sure that there is a strong background regarding the company’s performance.

Take profit

Once you sell the dividend stock, you will get the profit immediately to your trading account.

Pros & cons

| Pros | Cons |

| Investment tenure These payments can overturn the investment risk by promoting a long-term return. | Distraction Sometimes underperforming companies pay dividends as a distraction for their shareholders. |

| Stability In comparison to the stock, the value of the dividends does not fluctuate that often. | Doubt reduction Companies use these payments as the doubt reduction factor in the volatile market. |

| Profit distribution Dividends are not unpredictable as the stock market. The profit gain on payables date is possible to anticipate in advance. | Taxation They are taxed in double compared to growth stocks besides, companies can cut the dividend anytime they want. |

Final thoughts

In a nutshell, investing in such assets can be beneficial for the shareholders. Besides, it indicates the company’s durability in profit earnings and cash flow and also the ability to provide revenue to the shareholders. Dividend payout is the way to determine the inherent value of a company.