A systematic and disciplined investment approach can reward investors with consistent annual returns. Various investing products such as ETFs, bonds, or stocks offer diverse volatility, growth, and return rates. Therefore, every investor needs to modify their portfolio, keeping their risk appetite and future goals in view.

In addition, numerous methods are prevalent among investors, with the same end goals but different courses of action. Growth investing is one of the most popular techniques utilized by vigorous investors who aim to stay ahead of market performance.

Here, the question arises: what exactly are growth stocks, and how does this investment strategy work?

Read this article to learn about the specifications, factors, and limitations.

How does growth investing work?

Growth investing is the practice of investing in companies with promising potential in the upcoming years. It involves buying shares of the leading companies that consistently outperform their competitors and show optimistic earnings records, indicating the capability of future explosive growth.

Growth investors look for companies and businesses that aspire to expand their operations, revenue, and earnings over a specific period. These aggressive investors strive to procure higher than average returns by investing in emerging and developing sectors.

Most of the growth companies focus on broadening their facilities and services that usually causes a significant rise in the value of their stocks. Moreover, these companies do not distribute dividends as they reinvest their free cash flow.

Reasons to use for investors

Market participants who invest in growth stocks aim to acquire remarkable profits of up to 25-30% of their original investment amount. Growth investing provides an opportunity to achieve market excelling results through capitalizing on strong momentum investment products.

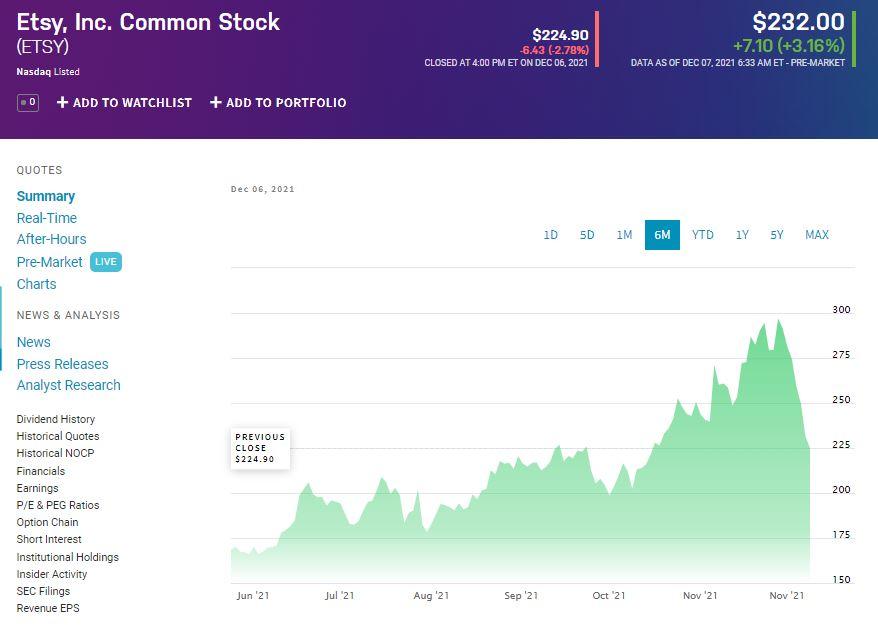

For example, Etsy Inc., an e-commerce company, is an excellent growth stock that has gained more than 40% value since the start of this year.

Moreover, most of these investors put the money in stable and prosperous companies. They consider companies that have shown a remarkable growth record in the recent period and exhibit sufficient stocks liquidity. Resultantly, they can benefit from the bright outlook of these reputable corporations.

In addition, some growth investors also take advantage of the new startups related to ‘hot departments.’ These trendy sectors like “technology” incorporate an immense growth capacity to dispense exponential returns.

How to use growth investing?

Before engaging in growth investing, it is prudent to analyze your financial situation first. It would be best to allocate only that much investment capital to growth investing that you can commit to bound long-term, as this investing strategy requires significant time to be profitable.

Afterward, you need to interpret the relevant company’s capacity and aptitude for achieving significant growth. Earnings estimates reports can point to a company’s plans and earnings trajectory.

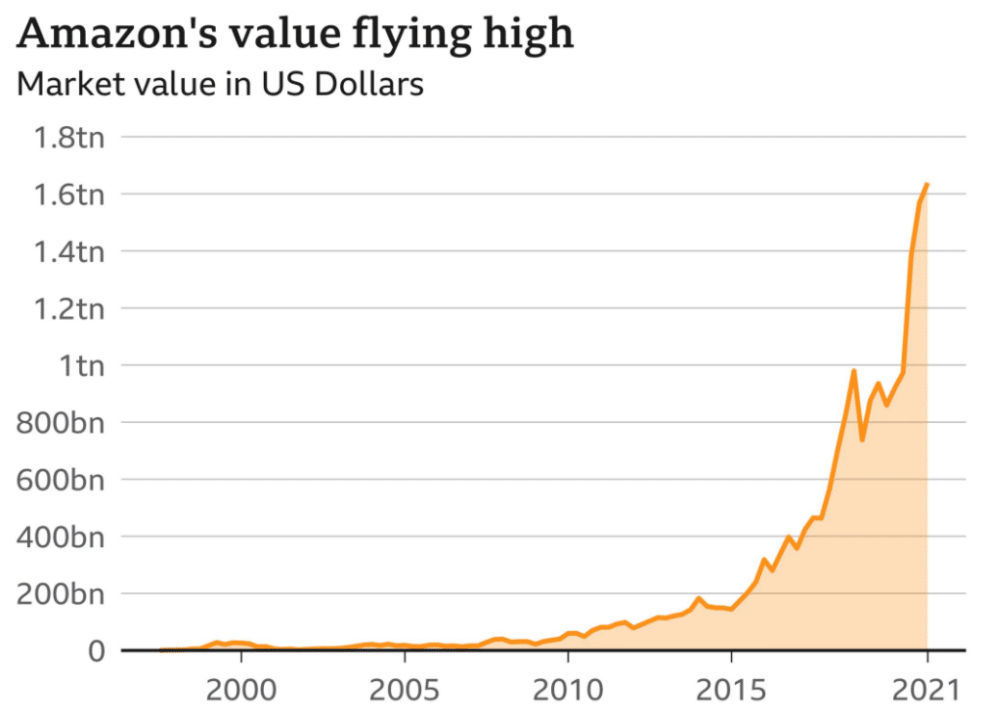

In addition, examine the company’s historical earnings record of at least five years. New and small-cap companies are prone to volatility and can display higher earnings growth; however, established corporations display lower but stable growth. Amazon Inc. is one of the best multinational e-commerce companies showing remarkable historical records.

Moreover, growth investors search for businesses that excel in their industry and demonstrate a competitive advantage over their rivals. Solid profit margin and strong return on equity also indicate good growth stocks.

Professionals recommend diversifying your growth investments by investing in different sectors’ growth ETFs, funds, and stocks. Diversification can ensure less risk exposure and guard against market volatility.

Investors also utilize some of the traditional metrics for picking worthy growth stocks. A high price-to-earnings and price-to-book ratio manifest the investors’ interest in that company with optimistic expectations.

Example of growth investing

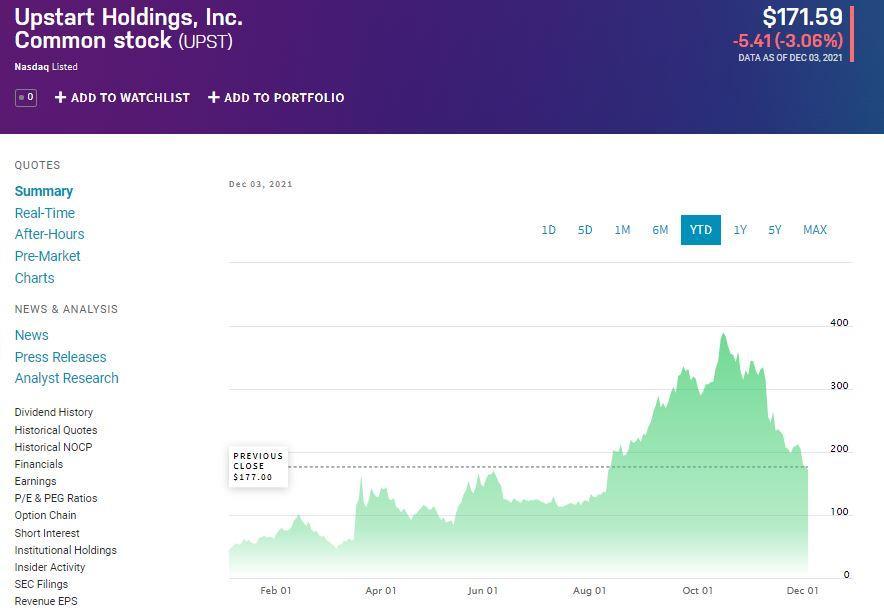

The above chart shows the price fluctuations of the Upstart Holdings growth stock. Upstart Holdings Inc. is a mid-cap, AI-based lending company in the financial sector. The company’s artificial intelligence platform facilitates the connection of banks, institutional investors, and consumers.

The company has reported a return on equity (ttm) of 18.58%, with the current trailing P/E ratio of around 191.49. Moreover, Upstart Holdings has shown a revenue generation of 634 million and an explosive quarterly revenue growth (YOY) of 242%.

The high EPS (200%) and revenue growth of this stock are positive indicators for growth investors. Investors can expect this stock to maintain its bullish momentum in the upcoming years.

In contrast to value investing, growth investing does not rely on the price pullback and stock’s undervaluation to purchase stocks/funds. Investors can buy the stock at its premium price with expectations of enormous growth over the coming period.

It is crucial to secure your investment capital if the stock does not perform as predicted. Look out for red flags such as leadership or management changes, consistent lowering of sales and revenue, and piling debts or losses to exit your investment.

Growth investing is a long-term approach; hence it can take 5-10 years to reach the profit targets. Moreover, growth stocks are volatile so, it is not wise to panic about every market crash. Frequent shifting of investment strategies always results in more considerable losses.

Pros & cons

Growth stocks are investments of choice for gaining higher returns; however, investors can face certain challenges by investing in them.

| Pros | Cons |

| Outperforms the market Growth companies actively strive to increase their sales and revenue exponentially and usually transcends the average market returns. | High volatility The most significant risk of these stocks is their high volatility, resulting in enormous losses. |

| Consumer interest Companies with high growth records remain the investors’ center of interest in even adverse or flat market conditions. | Confusion amid falling prices If the growth investors hold their positions amidst falling stock prices, that can turn against them if the company never recovers. |

| Swift growth Such stocks have the potential to rapidly and vastly increase their valuation, even up to 70% in one year. | Long time commitment Growth investing requires a longer duration for gaining expected returns. It may not be suitable for short-term investors with low tolerance. |

Final thoughts

Investors utilize varied approaches and tools to select growth stocks, as there are no defined criteria for picking out the best ones. Every investor prefers different sectors or industries and diverse methods to choose investment products that best suit their future goals.

Therefore, substantial expertise and research are necessary to profit from growth investing and not take losses after years of waiting. Always keep in mind the golden rules of investment such as diversification, in-depth analysis, and patience before diving into this sphere.