Despite numerous promising advantages of investment, many people remain untouched by this sphere. The two most commonly cited reasons for staying out of the stock market are ‘associated risk’ and ‘low capital.’

According to a survey by JPMorgan Chase (2020), 42% of people refrained from investing because they believed they had insufficient investment capital. Moreover, around 63% of participants reported that they need hefty sums to start the investment routine.

However, the above belief is not true as various unique and cost-friendly investment methods allow investing as low as $5. Dollar-cost average is one of the most stable and cost-effective techniques for individuals with limited sums.

Read this article as we have listed the working, characteristics, and limitations of the dollar-cost averaging strategy.

How does dollar-cost averaging work?

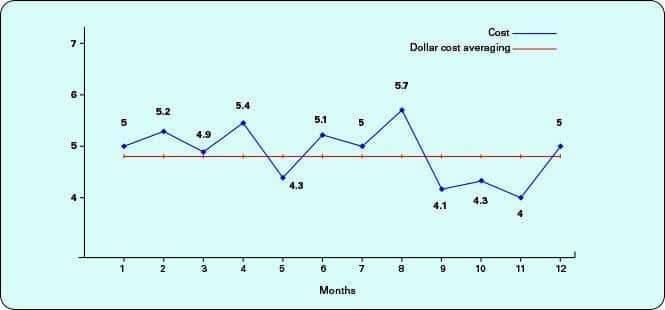

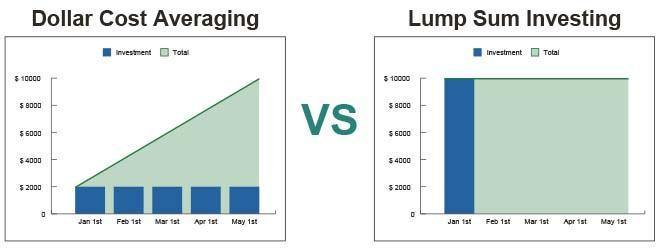

It is the practice of slicing your investment capital into portions and investing that specific amount at regular intervals over a duration. DCA, also known as incremental averaging, minimizes the market volatility risk and increases the chances of maintaining a reasonable-paying average.

This strategy guards the investors against purchasing all the financial securities at higher prices at one time. DCA technique allows the shareholders to invest consistently without any burden despite the market conditions such as 401(k) retirement plan.

Dollar-cost averaging works in contrast to the market timing, in which investors strive to buy assets at the lowest possible prices or market dips. Timing with the market may sound easy, but it is nearly impossible to correctly specify the ‘lowest” or ‘highest’ points in real-time, as the market is constantly changing.

According to a study by Kim Johnson, DCA is a better strategy for low volatile markets. However, selecting a strategy varies with personal circumstances and investing approach.

Reasons to use for investors

It is necessary to understand various factors to effectively utilize the dollar-cost averaging strategy. Firstly, select a brokerage platform with minimal transactional fees and reasonable commissions relative to the contribution.

Moreover, DCA cancels the risks of market variations or ups and downs and price overvaluation. This technique is independent of the occasional public sentiment affecting the market trajectory.

This investing method also wards off any emotional biases and helps investors keep their emotions out of investing. Using this strategy, investors refrain from panic buying and selling, or swaying with the ongoing craze. Incremental averaging is also helpful for fearful and risk-averse investors who can not tolerate market stress.

In addition, DCA is a disciplined approach that helps the investors to remain stable and consistent in their investment journey. In contrast to the aggressive techniques that rely on each market move, it aids the individuals to build up their portfolio smoothly and gradually.

How to use dollar-cost averaging?

It is necessary to understand various factors to effectively utilize the dollar-cost averaging strategy. Firstly, select a brokerage platform with minimal transactional fees and reasonable commissions relative to the contribution.

DCA technique can turn highly unprofitable with high, flat-fee structures as investors periodically contribute the investment portions. Moreover, a basket of securities like no-load mutual funds or ETFs is a good choice for this investing method because they cancel the over-reliance on one stock or sector.

In addition, it is prudent to chalk out your investing plan and maintain some rules beforehand. For instance, determine the duration of your investment intervals, each deposit’s amount, and the total money to be invested.

One of the most important aspects of unit cost averaging is understanding its long-term methodology. To gain considerable profits from this technique, you need to hold your investments over an extended period during both the good and bad market alterations. Resultantly, you would see this approach’s benefits and stability of your paying average at some point.

Using the strategy

Let us look at the example where you can buy more shares at low prices and less at high prices.

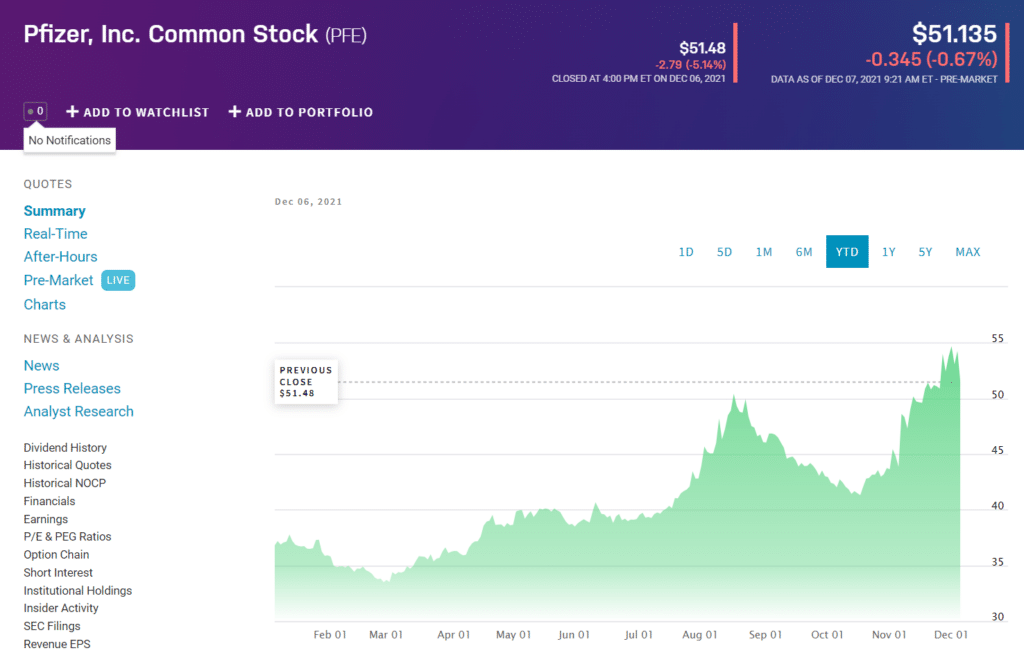

The above Pfizer Inc. chart shows the price oscillation of PFE stock over the recent 12 months. Pfizer is a New York-based biopharmaceutical company that manufactures and distributes medicines, and vaccines, in diverse medical areas.

Let’s suppose you decided to invest $1000 in this stock at the start of the year; however, you opted for dollar-cost averaging instead of a one-time investment. According to this strategy, you allocated $100 to be invested once a month over ten months.

Concerning the above chart, you would attain more shares from February to July, i.e., three or four shares, as the price ranged below $40 in this period. However, you would be able to purchase fewer shares during the price spike in August-September (above $50). The cycle would continue with the end aim of achieving long-run profitability.

The entries are in fixed intervals, specified by the investor. You can also set up automatic investing offered by some brokers.

You might want to hold your investment’s long-term even in adverse market conditions; however, it is necessary to remain aware of some warning signs. Keep checking the company’s fundamentals and changes for exiting an investment timely if it does not perform as expected.

The profit targets can vary from person to person according to their goals and satisfaction. Generally, you can collect your profits after 5-10 years of the initial investments for attaining considerable returns.

Pros & cons

Following are some of the pros and cons of the dollar-cost averaging strategy.

| Pros | Cons |

| Consistent schedule DCA does not require constant monitoring or managing due to its fixed deposit schedule. | Uninvested cash You may miss the upward price moves if your cash is out of the market due to a prolonged investment routine. |

| Suitable for low capital investors If you do not have a hefty lump-sum amount to start investing, this strategy is right for you. | Does not cancel the need for substantial research Though DCA is a passive strategy, you need to evaluate and analyze the relevant investment products to remain profitable. |

| Evade market downturns DCA diminishes the risk of investing all capital before a market crash, which could result in heavy losses. | Not reducing market risk According to various analysts, this approach does not cancel the market risk but merely delays it. |

Final thoughts

This strategy is an excellent approach for investors who desire to separate emotions from investing and do not have large deposit amounts. It allows the shareholders to build wealth over time and stabilize their portfolios consistently.

However, it is essential to set some pre-defined rules and avoid rapidly changing strategies for gaining long-term gains. Moreover, conduct thorough research to select worthy stocks or funds, manage your risks, and choose low fees brokerage platforms to obtain prolonged returns.