ETF investment is a process to accumulate funds and track a commodity, indices, sector, or other assets. Investing in ETF would bring more profits than usual as this fund is managed by a professional with higher profitability.

In a traditional investment system, traders need deep knowledge about the market to accumulate profits from a reliable trading strategy. In that case, it is often hard for traders to spend a lot of time building a trading strategy.

Therefore, making profits from own trading method needs attention to risk management, which is often hard for ordinary people. If you are intended to make money from financial trading without getting involved in trading, ETFs would be the best option for you.

In the following section, we will see the complete trading guide in ETFs that big boost your portfolio in 2022.

What is ETF investment strategy?

Exchange-traded funds (ETFs) are an accumulation of funds that track different investment products to provide profits from a pool of securities. It follows a specific funds type like a commodity, currency, or other assets as an alternative investment method.

Any return from ETFs comes from particular indexes before expenses and fees, led by a fund management system known as a passive income. Investment in ETFs does not involve selling shares to investors. Instead, purchasers of creation units come from large financial institutions.

Nowadays, ETFs investment of ETFs has become common among people. The ETFs sector has valued at nearly $3 trillion in the US due to its low fees and tax-efficient investment environment. ETFs have become a reliable and passive way to make money online without buying and selling any particular asset.

How to determine the ETF investment strategy?

There is no way to rely on ETFs without any calculation like other investment methods. ETFs investment does not involve a deep trading knowledge, but investors should find a reliable investment strategy related to ETFs only.

There are many trading methods in ETFs from where investors should find the perfect one. In the following section, we will see a list of trading strategies in ETFs that might help you to find the reliable one.

- Passive strategy

ETFs investment includes a basket of stocks that makes it easy to diversify the trading portfolio. Therefore, the best approach is to invest in multiple ETFs so that investors can get average profits at any time. In that case, including small, medium, and large caps, emerging markets, and bonds in the portfolio.

- Dollar-cost averaging

Dollar-cost averaging is a HODLing approach that includes all investment approaches, including ETFs. The primary aim of this method is to achieve consistency where people need to invest some amount in the accumulated funds at the same date each month or week.

- Low-volatility investing

Although the market remains upward in the long-term, investors should boost the profit by looking at intraday price fluctuation. Low volatility investment has similar price swings to the average market like iShares Edge MSCI Min Vol USA (USMV).

ETFs investment strategy example

ETFs trading involves a good knowledge of technical analysis where the technical chart and other trading information are available for free.

Bullish trade setup

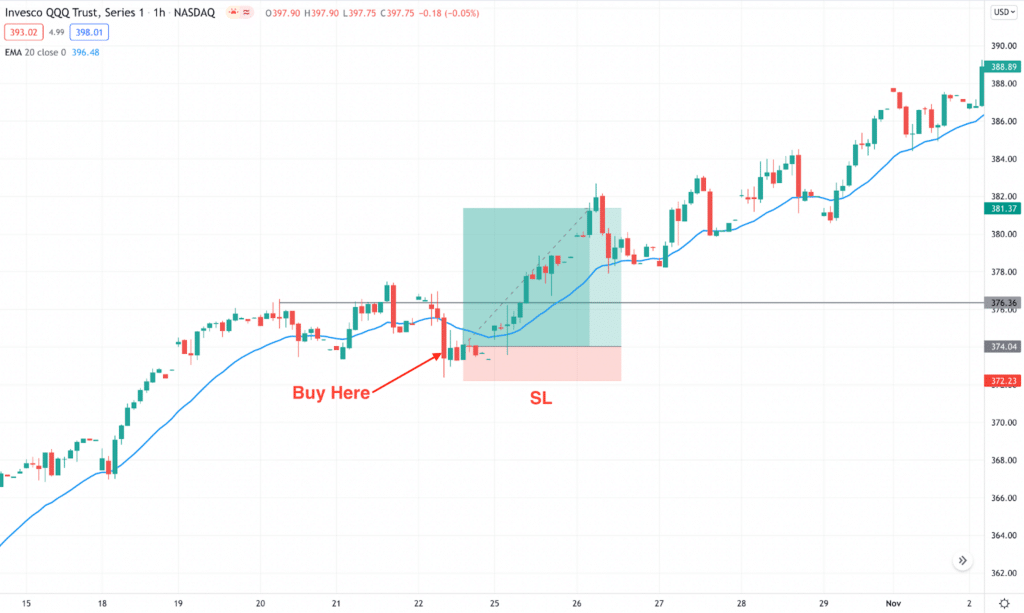

We will focus on buying ETFs that need attention in the bullish trade setup’s short-term and long-term market structures. Although it is a naked charting system, it has higher accuracy due to focusing on longer-term market directions.

First, investors should focus on where the broader market trend is heading. The bullish trade is applicable once the longer-term trend is bullish. After that, move to the lower time frame and find a break of structure.

What is the break of structure?

We know that the price moves like a ZigZag while creating a swing. Once these swing levels are violated, we anticipate that the movement came from significant institutional funds. Therefore, we will see from where the price initiated the break of structure. The price will likely come back to that level and resume the direction.

Enter

Suitable trading comes once the price shows a bullish rejection from the buying order block with a larger volume. The trading entry is valid as long as the price trades above the bullish swing low. Therefore, set the stop loss below the order with some buffer.

Take profit

Ensure that the near-term swing level has at least a 1:2 risk vs. reward ratio where you should set the primary take profit level. On the other hand, you can extend the profit to the next resistance level if the price allows.

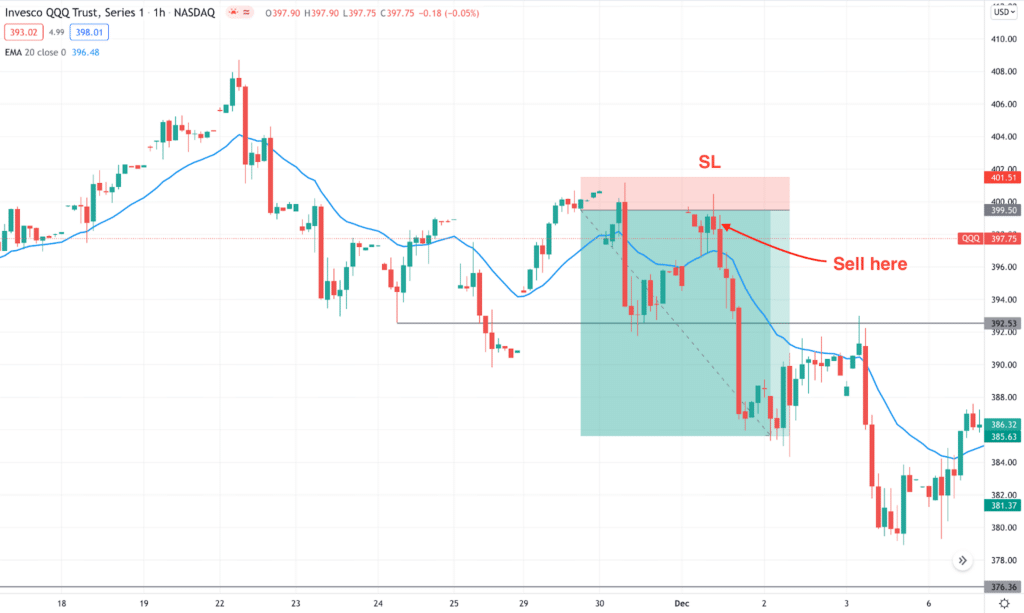

Bearish trade setup

You can open a sell position where the broader market context is bearish. Then, wait for the price to reach the order block from the break of structure initiated.

Enter

Suitable trading comes once the price shows a bearish rejection from the selling order block with a larger volume. The trading entry is valid as long as the price trades below the bearish swing high. Therefore, set the stop loss above the order with some buffer.

Take profit

Ensure that the near-term swing level has at least a 1:2 risk vs. reward ratio where you should set the primary take profit level.

Is the ETF investment strategy profitable?

ETFs investment needs close attention to the trade management as the sharp movement might hit the SL area before moving to the profitable zone. If you are interested in joining the ETF through direct investment, extend the portfolio in multiple sectors.

In 2022, the expansion in portfolios like ETFs should provide higher profit than the traditional stock market. Therefore, if you can implement the best strategy with increased profitability, ETF investing would be fruitful.

Pros & cons

ETFs trading is profitable, but the ultimate success depends on how you consider the pros and cons of this investment method in your consideration.

| Pros | Cons |

| •Profitability ETFs investment has a higher profitability rate than the traditional stock market. | •Risk tolerance Funds trading needs close attention to risk management. |

| •Portfolio diversification It is an excellent way to diversify the trading portfolio. | •Return on investment Sometimes mutual funds provide higher returns than funds. |

| •Trading news All ETFs trading information is available for free. | •Market uncertainty There is no guarantee that you will make consistent profits for a longer time. |

Final thought

In the above section, we have seen the extended outlook of ETFs investment strategy in 2022. If you can handle your asset in these funds, you can build a trading portfolio with higher accuracy rates. However, trading in the financial market involves risks that you cannot ignore. Therefore, implement a risk management system where the uncertain market condition appears.