You would have often seen gaps on your trading charts, an area where traders cannot execute their trades due to high volatility and sharp price movement either up or down.

Yes, you cannot trade at that particular movement, but this gap later gives an excellent trading opportunity with a high-profit probability. In volatile markets, traders can benefit from large jumps in asset prices.

Among small-capped stock traders Gap and Go strategy is quite appealing and famous. Here the main goal is to identify a gap and then take a long or short position.

How do Gap and Go Strategy work?

A gap shows a condition where the price of an asset opens sharply higher or lower, leaving an empty area on the trading chart with no candlestick formation.

A gap in the trading charts appears because of fundamental or technical factors. A gap occurs when a company’s earnings report stands much higher than expected in fundamentals. In technical terms, the market price opened higher than the previous day’s closing price, thus leaving a gap and pushing up the stock prices.

While in technical trading, the price breaking a new high in the current session may push the prices higher in the next session, thus leaving a gap.

The strategy works by identifying the gap in the market. Traders may also use a premarket-scanner to filter out the asset and then take the trade in the direction or against the gap.

Reasons for Gap formation

There are a few crucial reasons for gap formation, among others, and we have listed the important ones below.

- Economic data

Usually, the release of economic data is the cause of gaps in the currency market — a few of these economic data are interest rate decisions, employment numbers, manufacturing, and services PMIs.

- Company’s earnings

The major reason for a stock market to have a gap is the company’s earnings report. If a company’s report shows strong earnings it value goes up sharply and is told to be gap up, while if the earning is low, there is a gap down.

- Mergers and acquisitions

Mergers and acquisitions do not happen much often but are one of the reasons for the gap in the stock charts. When another company acquires a company, there is a price hike in the acquired company’s stock.

- Big sharks

The market also shows the gap when there is a major investment done by some big financial firms or big investors like Warren Buffett, Carl Icahn, etc. These big investors bring a big chunk of money into the market, thus raising the market price.

Reason to use for traders

One of the main reasons to use the Gap and Go strategy is the simplicity that even beginners can understand and use. You can use the strategy while trading any financial asset like currency, commodity, stocks, and ETFs.

Moreover, you can use it in any trading style you may wish, like day trading, swing trading, scalping, or even investing.

How to use Gap and Go strategy?

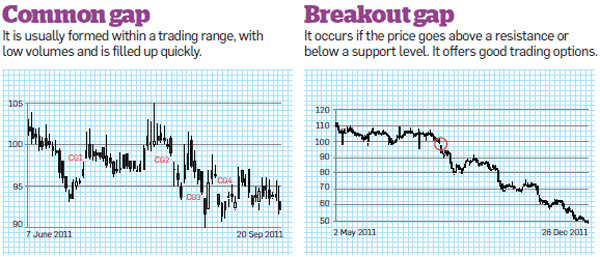

We will usually see two major happening after there is a gap in the market.

- Either the price continues to move in the direction of the gap.

- Price starts moving in the opposite direction and filling up the gap.

Example of the strategy

NYSE and NASDAQ are being traded by the time the stock market opes. During the premarket hours, the Indicies usually witness low trading volume. But there are some times when the volume is on the higher side, like the first premarket period after earnings announcements.

Gap and Go strategy does not work before the market opens but is acting right at the market open or after. However, this does not mean the premarket hours are worthless. Premarket hours are helpful to make out what the prices are doing.

Let’s take a look at a Gap and Go continuation strategy:

- The first thing that we need to see for this strategy is an uptrend.

- The gap occurs in the uptrend.

- After the gap, the first candle is a strong bullish candle showing momentum upwards.

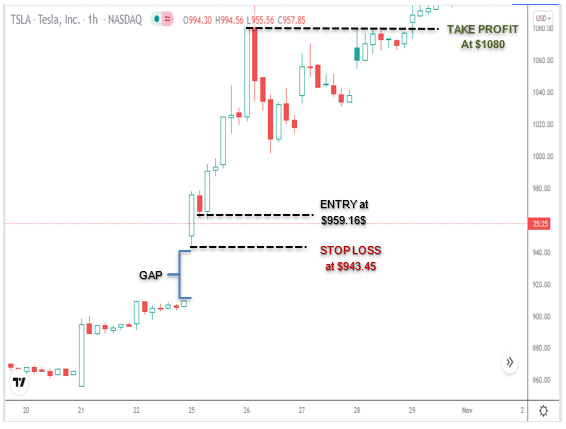

Below is the Gap and Go strategy example, and we have used Tesla as an example.

The gap in the Tesla chart is formed when it was moving in a strong uptrend.

Now, if we take a closer look at the price around the gap.

- You can enter at the open of the next candle, which might restest slightly.

- Stop-loss can be placed below the first candle’s low (above the gap) at $943.45.

- Take the profit you can target $1080 or once the position is in good profit, place a 5% trailing stop should the market reverse.

Pros & cons

Below are the major pros and cons worth looking into before using the strategy.

| Pros | Cons |

| Gaps are pretty easy to identify, even for a beginner, as there is an empty area on the chart. | It would help if you hunted for Catalyst for the gap because it directly impacts the following price action. |

| You can use premarket scanners available on various free sites like investing.com and MarketWatch to find the most active stocks with good trading opportunities. | Massive gaps usually lead to high volatility with high spreads. |

| Gap and Go strategy is very easy to play out, especially when day trading the market open. | Market buy and sell orders might get awful fills. |

Final thoughts

To acquire a high success rate with the Gap and Go strategy, a trader must study the underlying reason for the gap, as just following the gap direction will lead to increased risk.

To acquire better and accurate trading opportunities, you need to get ready early and do your research before the market opens. Continue to monitor the price movement until you can relate the reason to market sentiment.

Nevertheless, we all know there is a probability of making the wrong decision or the trade not going in your desired direction. In this case, try watching the real-time electronic communication network and volume to give you an idea of where different open trades stand.