We live in an era of technology where individual accessibility to the financial market increases rapidly. The increasing demand of participating in the financial market effortlessly introduces us to many services, including semi-automatic trading, automatic trading, signal providing, etc. High-frequency trading (HFT) is an extended practice in traditional markets, becoming a part of the crypto market.

However, some consider HFT a controversial practice, as it requires a particular level of learning and understanding to use this method in crypto trading. This article will introduce the high-frequency trading strategies that you can apply quickly and make effortless trading positions.

What is high-frequency trading?

HFT is a systematic approach to the marketplace depending on algorithms and computer programs. This type of approach involves a high speed of trade executions in a fraction of seconds. HFT suits appropriately on institutional investors as algorithms are capable of executing large orders with high volume to make profits through the market context. It uses many algorithms to determine discrepancies and tiny price changes on different exchange platforms. HFT can evaluate, execute and close multiple trades within a second that may not be possible to manage or notice manually with the naked eye.

Nasdaq declares that approximately 50% of stock trading volume in the United States relates to HFT. Many cryptocurrency exchanges enable options to practice HFT with colocation offers on their platforms. For instance, Gemini, Huobi, and ErisX are on the top of the list.

Primary aspects of HFT

Still, there is no perfect definition of high-frequency trading by the United States securities and exchange commission; it only lists some primary aspects of HFT. The primary aspects are:

- It includes complex and high-speed programs for executing and generating trading positions.

- It will use the exchange platform’s colocation service offerings alongside other services to eliminate latencies and potential delays for the data flow.

- The trade duration will be short as it will submit multiple orders and cancel them within a short period after activation.

- These methods will utilize short time frames for determining trades and trade executions.

- It won’t involve any overnight risk.

- Usually, HFT involves high volume trading, requiring significant investment to cover the volume desire.

- The profit target will be smaller than any manual trading method.

Traders or investors who use HFT are interested in making enormous profits with less effort. The success of any HFT method depends on the equipment and algorithms that participants use. The sad truth about HFT is only the institutional traders have access to those best algorithms and gears to execute HFT methods.

Is HFT available for trading crypto?

High-аrequency еrading is relevant and applicable to cryptocurrency trading, but not every individual can use these methods. The crypto assets are extremely risky and volatile. Additionally, HFT only suits traders who have sufficient experience and skills. The most common practice of HFT in crypto trading is colocation.

Crypto exchange platforms ensure minimum latency in data transmission through colocation. Every millisecond is essential for institutional traders who use HFT. Investors commonly use HFT algorithms for short-term and arbitrage trading in the crypto markets alongside colocation.

An HFT crypto trading strategy

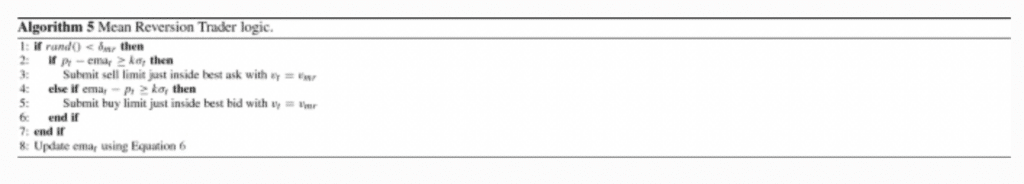

We use a trading algorithm in this HFT method to execute trades automatically. When the price reaches above a certain level, this algorithm will execute a sell position, and conversely, when the price comes below a particular level, it will execute buy orders. Trade durations through this method can be minutes or even seconds. It is a suitable trading method for any institution with considerable investment.

It uses the formula: ema𝑡=ema(𝑡−1)+𝛼(𝑝𝑡−ema(𝑡−1))

Bullish trade setup

Apply this algorithm; it will execute trades automatically.

Entry

The algorithm will execute buy orders when the price comes below the standard deviation point.

Stop loss

This algorithm will generate stop-loss levels automatically according to the market context.

Take profit

This algorithm aims to trade the average price of the asset.

Bearish trade setup

Apply this algorithm and observe.

Entry

The algorithm will execute a sell-limit order when the price reaches above the email.

Stop loss

According to the market context, it will automatically determine the stop loss level for your sell order.

Take profit

This method allows trading of the average price for the asset.

Remarkable HFT trading strategies on the crypto market

Many trading methods rely on HFT trading, which helps investors take advantage of emerging market trends. The most common use of HFT methods includes:

- Market making

Market makers use HFT trading methods to ensure liquidity and benefits from particular assets’ spread (bid-ask). In other words, you can consider market makers as a counterparty of individual traders.

- Volume trading

HFT methods apply to volume trading with considerable investments and algorithms and make profits from small price fluctuations.

- Short-term trading

HFT is not suitable for long-term investors or swing traders. The supply and demand create many opportunities for a short period that manual trades cannot determine, and HFT enables profits from those opportunities.

- Statistical arbitrage

HFT enables determining trading opportunities from price differences of the same asset on different exchange platforms.

How to manage risks?

Risk management is an essential part of any trading method, so for HFT, it is also a crucial factor. We suggest using any HFT methods only after being sure about the efficiency and confirming that it is not a scam. Note that a reliable algorithm only depends on the person who creates it. So it is mandatory to check the potentiality of the algorithm before using it and confirm that it will meet your desire. Moreover, ensure that you have enough resources and gears to execute that algorithm.

Pros & cons

| Pros | Cons |

| HFT allows you to manage significant investments. | HFT is not suitable for individual traders with small capital. |

| It provides liquidity to sustain the market. | It involves the risk of massive loss if an enormous market crash occurs. |

| It reduces price inefficiency or arbitrage. | It has plenty of room for illegal exploitation. |

Final thought

HFT is a typical method for institutional traders in the traditional market while it is available for anyone in crypto trading. Traders may focus on potential opportunities or positive facts of HFT trading rather than the negative impacts. Before using any HFT method, the algorithm must be efficient and legit.