Swing trading is compelling, especially for those who do not spend too much time in front of the trading system. Giving less time but still making money from the market is the main feature of any swing trading strategy.

There are many numbers of professional market participants earning huge profits using swing trading techniques. Traders with experience can take on an average of 15-20% or even more using this style. It is a universal form of trading, meaning it’s available for traders to trade forex and stocks, crypto, or any financial market trading. While trading, you have the full authority to use any indicator, plan, time frame, or strategy.

Now, if you are wondering which are some high probability swing trading strategies? We have mentioned a few of them in this article.

How does the swing trading strategy work?

It is a common technique that FX traders use for trading any financial market to achieve short or medium-term profits.

A swing trader first analyses the market using a particular strategy and then executes the desired trade, either buy or sell. This position is then kept open until the trader makes desired profit from it in the long term, which means the market participant will keep the deal running for days, weeks, or even months. If the trader is not happy with a particular trade setup, he may switch to a different currency pair or asset.

How to use a swing trading strategy?

Unlike any other trading style, it is quite an old form, giving rise to numerous swing trading strategies in the market. The challenge here is to choose the right one. A trading strategy is a plan executed to make a profit from the market.

Technical analysis is a trading method to trade the market by using indicators, price action or Elliott wave, etc. Traders widely use these technical analyses for their swing trading methods. The decision to choose which one to use depends on the trader’s style.

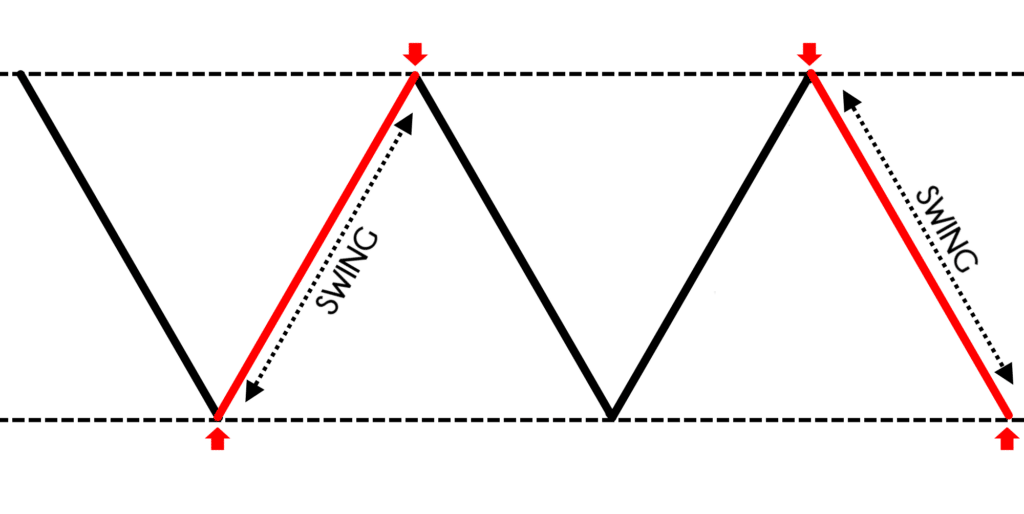

In this trading strategy, we will open the buying position when the price is low and sell when it is high in an uptrend. And vice versa we will open the position for buying on high and sell at low when the market shows a downtrend. Traders can use it while trading any asset as it is effortless and straightforward but at the same time reliable and profitable.

1. Moving with the trend

As the name suggests, you will take the trades with the trend, meaning; you will execute a buy trade when the market is moving in an uptrend and sell if the market is moving in a downtrend.

The strategy is to take the trade at every higher low when it’s an uptrend and at a higher low when it’s a downtrend.

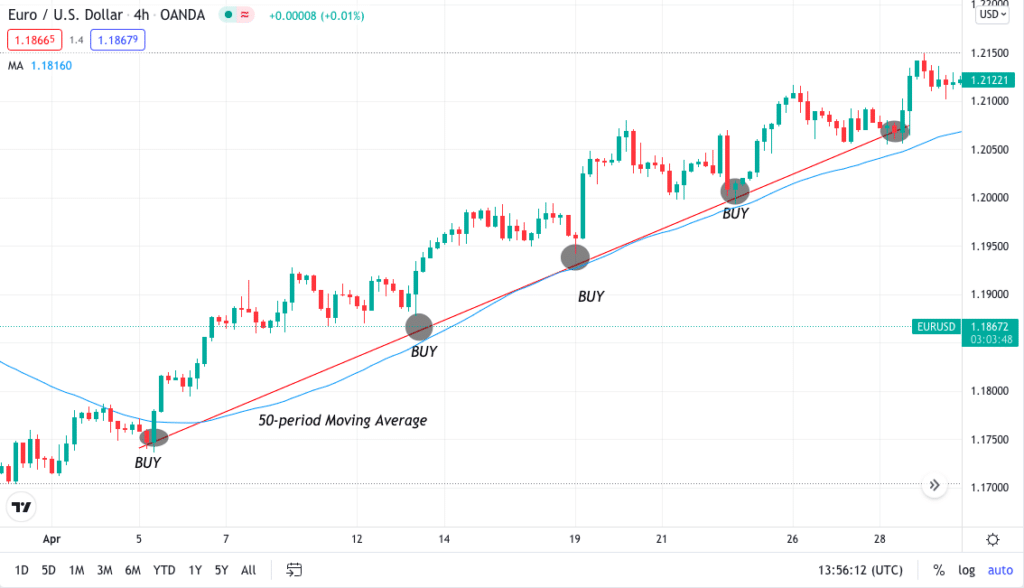

Now, once you know which direction to trade-in, you will add a 50-period moving average (MA) to your chart. This will help you determine the trend of the market.

Now you will wait for the price to pull back and touch the moving average showing the rejection. Once this condition is satisfied, you can take the trade by keeping your SL 4-5 pips below the entry and TP at the break of the previous high.

Here we get multiple buying trade opportunities. In the below EUR/USD chart of the 4H time frame, you can see a price respecting the trendline and the 50-period MA moving up. You can buy at the pullback, where the price touches both the trendline and the MA.

In the below EUR/USD chart of the 4H time frame, you can see a price respecting the trendline and the 50-period MA moving down. Here we get multiple selling trade opportunities. You can sell at the pullback, where the price touches both the trendline and the MA.

2. Forex swing trading against the trend

The following strategy is trading at reversal. The price moves in a particular direction for a time, say in an uptrend, and then it reverses and starts moving down.

Trading reversal is not easy and needs more experience as there are times when the price makes a fake breakout looking that the price will still move in that particular direction.

Trading reversal needs you to find price patterns on the trading chart. Some of the patterns or candlesticks that show reversal are Double top, Double bottom, Pinbar, Doji, etc. Once you see such patterns and candles occurring at support or resistance, you will be sure of the reversal.

You will enter the trade by keeping your SL 4-5 pips away from the previous candle and take profit at 1: 2 risk: reward.

In the below EUR/USD chart of the 4H time frame, you can see a price was moving down and then rested on support. Here you will keep looking for a good reversal candle and rejections from the buyer. Once the price breaks the swing high, you can enter the trade. You can see the price making a significant move up.

In the below EUR/USD chart of the 4H time frame, the price was moving up and could not break the resistance zone. Here you can see a pin bar formation along with multiple candle rejections from the seller. This rejection tells the market not to want to go up more.

3. Consolation trading

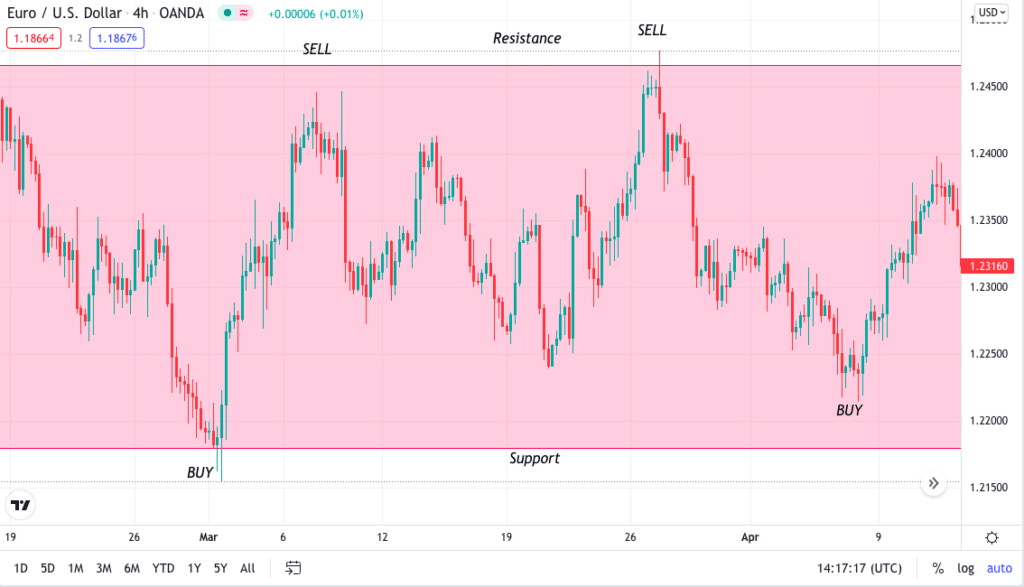

It is the state where the price does not break the high or the low and keeps ranging between them. This trading strategy is tricky as it allows you to take multiple trades until the price breaks the range zone.

Consolation trading is also called sideways or range trading. The price moves in just three directions:

- Upward

- Downwards

- Sideways

Taking trades in both uptrend and downtrend is somewhat easy as compared to sideways, when the price oscillates between the supply and demand zone. The strategy here is to sell an asset when the price reaches a resistance zone and to buy an asset when the price reaches a support zone.

Here, you will wait for rejection when the price reaches either the support or the resistance. In the below EUR/USD chart of the 4H time frame, the price was seen trading between the support and the resistance zone giving various buying and selling opportunities.

Pros & cons

Like every other trading style, swing trading techniques also have some pros and cons that are highly recommended to look into before using them.

| Pros | Cons |

| • Moderate time on screen This trading style does not need you to sit on the screen for too long. Instead, you will maintain a strategy and try to find that perfect trade setup before entering. • Less stressful The style is less stressful than any other form of trading like scalping and day-trading. Swing traders usually take two to three trades in a month and let it run until you get your profit. • A better knowledge of the trades Finding a swing trade setup takes a while; this in terms gives a trader a better understanding of the executed trade. | • Holding trades overnight The trader needs to hold his position until getting a good profit. The market sometimes suddenly sees an increase in volatility. • Trading cost This trading style can increase the trading cost as holding any asset for long will add swap charges. • Inconstant behavior This is risky as any news events or happenings can change the overall movement, leading to a market reversal in the future. |

Final thoughts

Every professional trader must have a used swing trading approach in their trading career. After day trading, swings are the most used trading style globally.

While trading the market using the above strategy, you must keep in mind not to trade when the market does not have sufficient volume. Trade the market with medium volatility while keeping your risk in check.

Everything takes time, and this is true even for trading. It would help if you kept trying and testing your strategy in the market.