George Soros is a billionaire investor and philanthropist, born in Hungary in 1930. He is popular in the financial world, mainly for his investment strategies, which some have labeled controversial.

His net worth is around $8 billion, and most of this he made off his highly publicized investments over the years. He worked in different merchant banks in the United States, and in 1969 he started his hedge fund, Double Eagle, later renamed Quantum Fund.

Soros’s unique investment style has made him extraordinarily wealthy but attracted controversy at the same time. As you will read further in this article, he spotted shifts in the market, and with his significant investments, he could place large bets on currency price directions. This resulted in him making millions of dollars in profits.

Do you want to learn more about the George Soros investment strategy? Let’s see which are the most notable trades that made Soros a fortune.

What is George Soros’ philosophy?

George Soros’ philosophy is on taking positions in a single direction of an asset in the financial markets. When he executes trade positions, it is usually largely leveraged. The strategy is to bet the price of a stock, currency, commodity, or bond will move in one direction. He uses macroeconomics to analyze and put together his strategy.

He refers to the philosophy behind his strategy as reflexivity. The theory behind reflexivity is that decisions are based on reality and not on investors’ perception of reality. When investors act based on facts, they influence fundamentals, and the market participants’ illogical reactions to the fundamentals influence the market.

What are the three significant trades of George Soros?

George Soros’ trades have been somewhat controversial because they go against mainstream investors’ traditional strategies and theories. Let’s take a closer look at his three significant trades, which attracted attention globally.

1. The man who broke the Bank of England

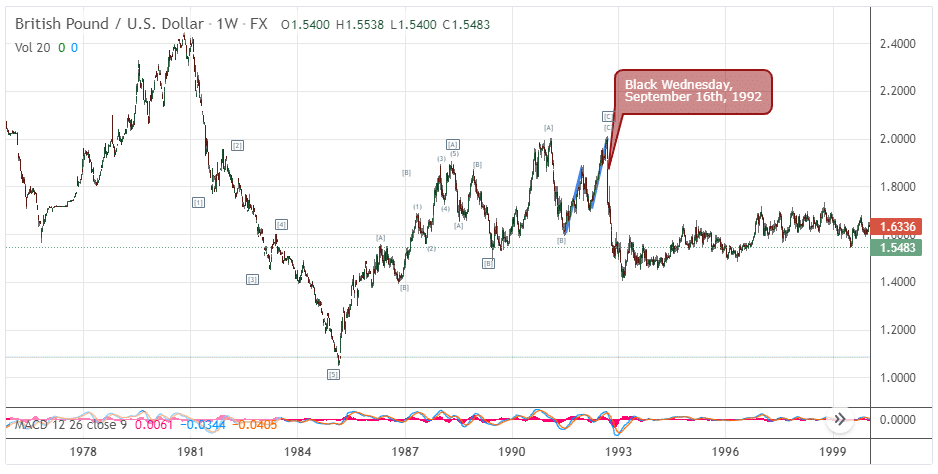

This trade stands out because of the clever way he managed to make billions of dollars in British pounds. The British pound crashed in 1992, and Soros anticipated this move since he was aware of the fundamentals happening globally in the currency markets. At the time, the British pound was trading stronger against the German marks.

George Soros borrowed large sums of money in British pounds and exchanged it for German marks. At the time, the Bank of England raised interest rates to push the pound’s value further.

Soros’s fund, under his instructions, took short positions and sold the British pound. Other global hedge funds and investors joined, including Paul Tudor Jones and Bruce Kovner.

In a desperate attempt to save the pound, the bank tried to push the interest rates up. Furthermore, speculators kept putting more money in the market and followed Soros’ lead by shorting the pound.

On September 16, or Black Wednesday as it’s known, George Soros made $1 billion in one day. This also resulted in his hedge fund Quantum Fund’s assets increasing from $3.3 billion to $7 billion in 1992.

Paul Tudor Jones and Bruce Kovner made profits of $250 million and $300 million, respectively. A long history contributed to the crash of the pound, but ultimately fundamentals were the primary player.

2. The Asian financial crisis of 1997

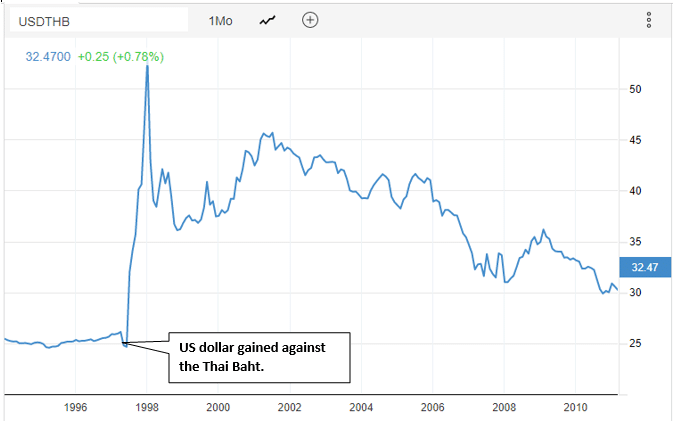

The next notable trade which brought in more than half a billion in profits for George Soros was during the Asian financial crisis in 1997.

Soros speculated that the Thai Baht would decline, and he placed buy trades on the USD/THB pair, meaning he was shorting the Thai baht.

By now, many other speculative investors and traders were following his strategy. This large volume caused the crisis in Asian markets.

The Thai government used $7 billion as a stimulus to safeguard the currency against these trades to save their currency.

Soros made it public knowledge that the Thai baht would fall, and a crisis would follow. Thailand went to extremes and even requested aid from the International Monetary Fund. However, the International Monetary Fund loan was not sufficient, and the Baht crashed against the US dollar.

George Soros made $790 million off this crash of the Baht.

3. Yen crash of 2012

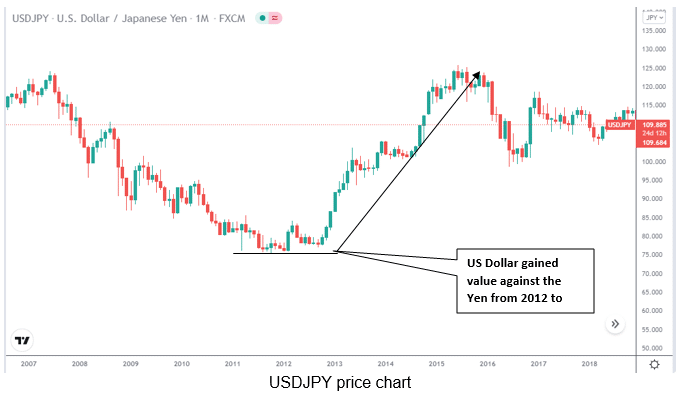

In 2011, Japan’s economy was recovering from a destructive tsunami. However, the growth rate was too slow. The yen was under pressure, and investors and traders were anticipating the currency would weaken.

By the end of 2012, The Prime Minister announced that he plans to weaken the yen to increase the economy’s growth rate.

Soros’ fund took short bets on the yen by placing long positions on the USD/JPY pair. The easing of the country’s monetary policy devalued the yen, and it lost 17% of its value during this time. At the same time, the stock market was rallying, and the Nikkei stock index increased by 28%.

Soros’s bets from the falling yen made him around $1.2 billion in profits. Furthermore, his investment fund made a turnover of about 24% for 2013.

Final thoughts

George Soros’s big wins over the decades are enough to inspire any new trader or investor. However, you should note that speculators like George Soros have large amounts of capital to invest, high-risk trades. Although he has made billions from trading, not all his bets have paid off, and he has also made significant losses.

The key takeaway is that there are many strategies and philosophies when it comes to the financial markets. Successful investors like George Soros have a discipline, and it has made them consistent profits over the many decades.

If we learn anything from trading or investing, it is to stay consistent in our strategy. As a trader, you have to find what you are comfortable risking and stick to your plan. Losses are part of the trading journey; however, the wins should always outweigh the losses.