A small company owner might be an exceptional copywriter or designer. Yet they may not be so comfortable with how to monitor their enterprise’s overall financial health. You have to run many reports and check many numbers; knowing which ones to track can be confusing. This article discusses how to measure EBITDA to monitor your company’s profitability and stay on top of the big picture.

The ability to determine, compute, and apply it plays a vital role in maximizing your exit strategy and uncovering your firm’s value. Several factors can be considered when evaluating your corporation’s high returns.

The article below shares insight into the earning potential of the industry and how you can use these ratios. The comprehensive guide explains what it is and what it means for your firm, beginning with how you can find out or define it.

How does it work?

It measures the financial performance of a company. Many firms use it in place of other metrics, including earnings, revenue, and income. As a prelude to defining what it is and how it works, let us explain what the acronym stands for:

- Interest

This category includes expenses incurred due to interest rates, including loans provided by banks or third parties.

- Taxations

They are imposed by the state and local governments and regulatory agencies in the region and federal income taxes.

- Depreciation

A charge indicating the decline in value of fixed assets. It is an expense that represents a decline in share value.

- Amortization

Another expense that is associated with intangible purchases. You can think of it as a way of gradually reclaiming the cost of a capital buy.

As a result, it emphasizes the financial consequence of operations, eliminating non-operating factors such as tax rates, stake expenses, and significant intangible acquisitions.

Hence, the measure provides owners, traders, and stakeholders with a clear picture of how profitable a corporation is. Because of this, deciding which establishment has more potential when considering mergers and acquisitions is often dependent on EBITDA instead of other metrics.

You can figure it out as part of the accounting period for a firm. This metric represents earnings before adjustments associated with ITDA from the past 12 months. Its LTM is also referred to as trailing 12 months.

How to use it?

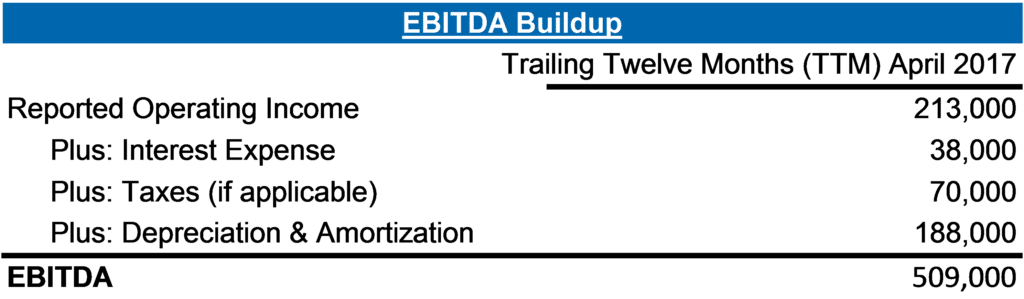

You can find it out by using the given formula:

EBITDA = operating income + interest + taxes + depreciation + amortization

Let’s look at an example:

Choosing a stock by company analysis

Here is the way you can calculate it for an XYZ company.

| Specifics | Amount ($) |

| Amount of revenue | 19,16,36,800 |

| Revenue cost | 11,49,88,200 |

| Operating costs | 4,55,86,000 |

| Charges for selling, general, and administrative services | 1,07,99,400 |

| Expenses for interest | 5,10,000 |

| Taxes on income | 1,09,88,200 |

| Operating income | 2,21,19,100 |

| Earnings | 2,15,94,900 |

You cannot consider earnings before EBITDA calculation. Accordingly, XYZ’s EBITDA for 2022 is as follows:

EBITDA = net income + interest + taxes + depreciation + amortization

= $(21594900+510000+10988200+4306700) = $37399800

A firm’s effectiveness can be significantly impacted even by the slightest miscalculation in these components. Therefore, it is vital to use a reliable accounting system and keep finances up-to-date to prevent the same.

By calculating the margin, one can determine whether an organization’s earning potential is favorable or not.

Reasons to use for investors

Calculating EBITDA can be instrumental when valuing a revenue based on its performance compared to its industry competitors.

Let’s look at an example of hypothetical companies and separate depreciation from expenses. In both companies, returns before depreciation were $100 million, but the factory opened 15 years ago in the first company, which was $3 million. Another enterprise factory has only been operating for one year, and it has depreciated $15 million.

Even though both companies made the same amount of money, the second group appears to have a less promising profit margin even after removing depreciation from the equation.

“These ‘ITDA’ numbers confuse the issue for purposes of comparison, even though they are perfectly valid and legal. A measure of operating cash flow helps you to make informed decisions.

“This method eliminates expenses that are largely beyond the company’s control, resulting in a valuation that is more realistic.”

How can you use it?

A comparison of profitability can be helpful when calculating a cash flow for one business and another. A negative value indicates poor cash flow. Positive EBITDA doesn’t necessarily mean high income. Take note of which factors are excluded from the balance sheet when you compare your business to a company with adjusted earning potential. To make an accurate analysis, you need to compare apples with apples. Before drawing any conclusions regarding the data, make sure you have all the necessary information.

What does it mean to business?

It’s a widely used measure of effectiveness that allows for more apples-to-apples comparisons between companies. It analyses its efficacy based on its generating potential before accounting for capital structures, taxes, and non-cash devaluation.

| Pros | Cons |

| It is a reliable indicator of an organization’s operations and growth effectiveness. | Excluding debt expenses from its results in a misleading figure. This report does not provide information about a company’s actual earnings or liquid assets. |

| The risk associated with variables that affect financial variables, such as capital investments, is reduced sustainability. | Owners often use it to disguise poor financial judgment and other shortcomings. |

| It measures how much cash a corporation generates due to its active operations. | Financial debt with maximum rates is unaffected. |

Final thoughts

EBITDA helps analyze and compare profitability among companies and industries since it does not affect financing, taxation, or accounting factors. This represents earnings in a more raw form.

When it comes to discussing financial value, it is now the most widely used formula and language among professional buyers, private equity investors, and so forth. By using it multiply, you can estimate the valuation range for your firm overall by comparing it to cash flow.