A pair of currencies typically involves any of two currencies traded at odds with each other. Traders often use pairs to buy, sell, or convert currencies for investing and trading internationally.

One of his most famous sayings of Warren Buffett is “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.”

To succeed when investing a significant amount of money in a long-term investment, you should carefully choose a good currency pair. If you want to day trade or scalp your money, choose the best pair to make the most profit. An amateur informal trader might inquire which pair is most suitable for active trading. Therefore, traders need to determine their strategy before selecting the pair.

Let’s discuss common FX pairs and examine the best one used by day traders to maximize their profits.

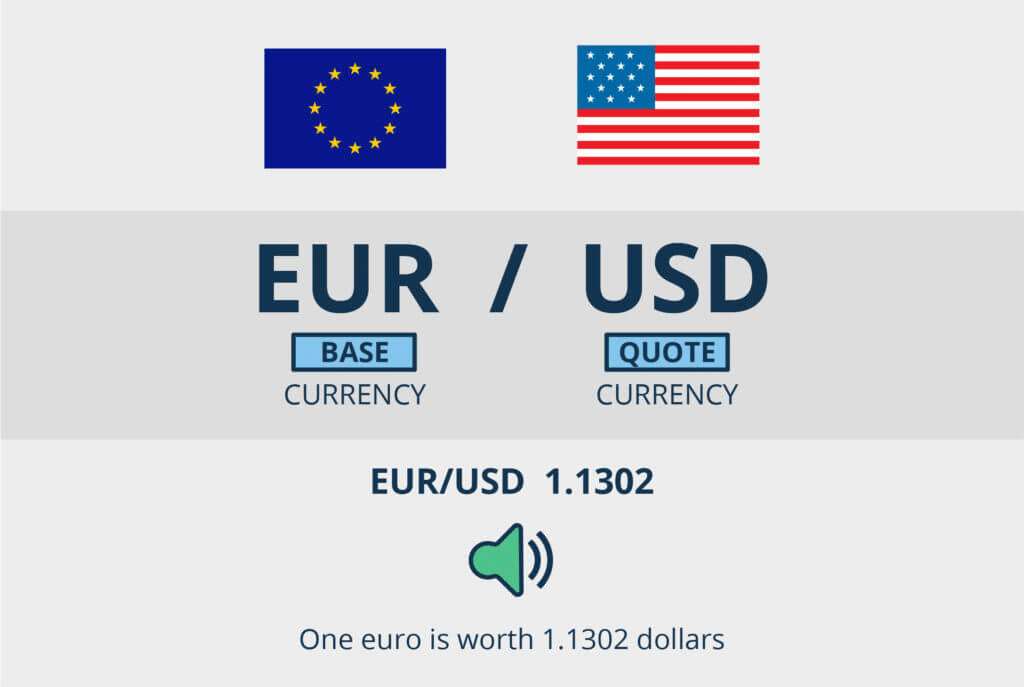

What does a currency pair mean?

It is the ratio of the currencies of two countries, expressed in a quote.

For example, the euro and dollar — EUR/USD currency pair stand for the European Union currency, EUR, to the US currency, USD. This pair determines the value of the euro-denominated in dollars.

EUR/USD = 1.13 means that 1 euro is 1.13 times more expensive than the dollar. In other words, for 1 euro, they give 1 dollar and 13 cents.

What are volatile and non-volatile pairs?

Many of you have heard the word volatility among the generally utilized words in the FX trade market. However, before perusing the article to discover the unpredictable and unstable pairs, you should have a more profound comprehension of volatility.

Thus, fundamentally, volatility is the extent of change in the movement. The financial backers utilize the degree of unpredictability to foresee breakouts. The strong volatility in an FX pair has various value developments in a specific period.

For instance: exotic currencies are considered the most unstable pairs because they have a lower range of liquidity than other major currencies. Exotic pairs are therefore less likely to be traded by day traders due to their unstable market value. So, day traders usually choose major currency pairs that are more stable.

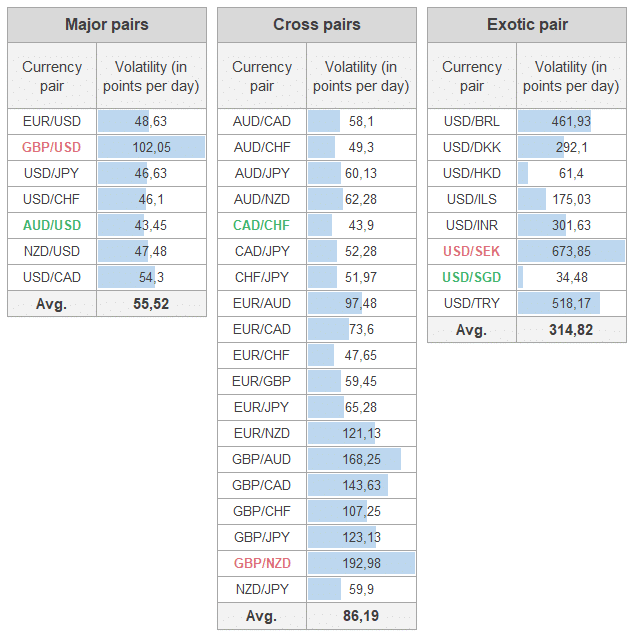

As you can see in the table, the exotic pairs are the most unpredictable ones. They include USD/SEK, USD/TRY, and USD/BRL. These are highly unstable as their average points per day are above 400.

Now, come to the point that dynamic FX pairs are suitable for day trading. The volatility of mostly traded or major pairs is lower. The only GBP/USD shows move per day above 100, and the least unstable among them is AUD/USD. So, now you have the information about volatile and non-volatile FX pairs.

What currency pairs are best for trading?

Understanding which financial instrument can bring a stable profit to a trader is essential to answer this question.

What car can one drive quickly and safely? He knows a car well — all the control devices, dimensions, optimal speed mode, etc.

We have the same story with a currency pair. Only that one will be able to bring you the profit that you know well.

- What is the economic state of the countries whose currencies are included in the pair?

- What hours of the trading session is this pair active?

- What is the average trading volume and volatility of a pair?

- What is the nature of daily movement?

- What important upcoming news will affect the direction of this pair?

- What basic price levels, for example, historically exist for this pair?

If you, as a trader, have this information on a currency pair, this pair will be the best for you. Each financial instrument has its own “character.” Observing the chart of one specific pair for a long time, you can kind of “feel” it and remember the patterns formed most often.

Are volatile pairs better for day trading?

Day trading is the strategy in which a market participant buys and sells the trading pairs in a single day. So, when you trade the most volatile pairs, there are higher chances of bigger rewards. But, at the same time, unstable trading pairs are risky.

The novice traders are suggested to deal with the major pairs having low instability. In contrast, experienced traders can diversify their portfolios by dealing with exotic pairs that are highly fluctuating.

For example, JPY is considered a safe haven as its volatility is extremely low. So, if you are going to be a day trader or active trader, you should trade with currency pairs having a minimum spread.

The EUR/USD and GBP/USD are the best FX pairs with low instability and similarly lower risk. Therefore, day traders should choose the pairs with limited movement. But in case the trader has a high-risk appetite, he can deal with the fast-moving currencies too to achieve maximum profits in a single day.

Next, we will talk about the average daily range of currency pairs and their impact on choosing one.

Why is the average daily range significant?

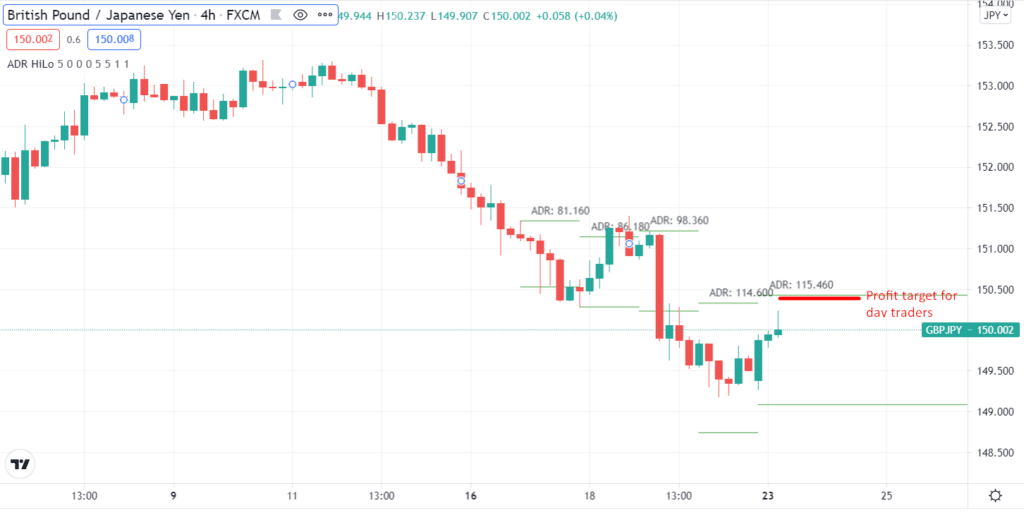

Based on a specific number of trading periods, the average daily range (ADR) predicts the approximate pip range of a forex pair per day. The investors and traders utilize the average daily range to get an estimated price of a pair outside the middle daily currency movement. Greater ADR means higher daily instability of a forex pair than the average estimate. It represents that the forex pair has the potential to extend much more than its expected value.

The ADR usually assists traders in setting targets in day trading. For example, if a report of ADR shows that an fx pair has a daily range of 85 pips, the traders will take a wise step by holding up the target tightened if the price move is achieved or close to the predicted value.

The ADR value is also essential in the trading intraday reversals. As you can say, if an FX pair has the highest daily range, there is a possibility of reversal due. So, if you want potential retracement, you should consider a reversion strategy.

Hence, if the ADR value or the currency is exceptionally high, day traders should not choose them to trade.

Also, there are several other factors that you must consider while choosing an fx pair while day trading. It includes

Price stability

It is also a factor to consider while choosing one for you. The price stability is highly linked with the nation’s economic health or other countries indirectly linked to the nation’s money.

For instance, the US is linked to the USD while the UK is linked to the GBP. So, whenever you have to decide among the FX pairs, you should watch out for the economic conditions of those linked countries.

Final thoughts

When choosing a currency pair for day trading, volatility should be your primary consideration. Profits can be enormous when trading pairs with high volatility, but the risks are also significant. Liquid markets have an inverse relationship with unstable markets.

The pips used to measure price variation make us discover that active trading is not possible except for the major currencies. Trading pairs like the AUD, EUR, and GBP have less volatility and movement and are appropriate for novice day traders with a minimum risk appetite.