Let’s explain how you can use the vertical spread trading strategy for options trading. For those who don’t know anything about vertical spreads, here’s a snippet.

Vertical spreads snippet

Vertical spreads are a complex yet straightforward options trading strategy. They combine the buying and selling of similar types of options.

The combination of buying and selling can be puts or calls with an expiry but with different strike prices. As you probably have read in your Mathematics class, the Y-axis represents the vertical lines in a graph. Similarly, here the word vertical comes from the positioning of the strike price.

A strike price tells you contracts you can buy or sell:

- If you choose a put option, the strike price is one to sell the options contract.

- If you are picking a call option, the strike price is the price to buy the options contract.

We are coming back to our vertical spreads, which help you decide the fluctuations of the asset. Like regular trading, the movements can be bearish or bullish.

Like humans, vertical spreads have two legs:

- One for buying an options contract.

- Other for writing an options contract.

These legs give you credit or debit. Think of these two as debit or credit cards. With a debit, a trade costs you while you get the money for trading with the credit.

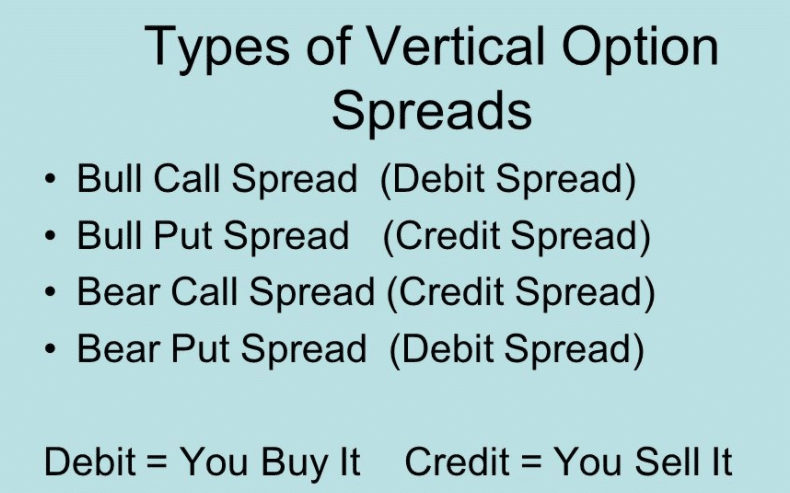

Let’s move to their various types:

We’ll discuss them in detail later, and for now, keep them in mind. They are the suit that makes vertical spreads like an iron man.

How do you calculate vertical spreads, profits, or losses?

We get this a lot that how as a trader, you can determine the profits and losses when trading with these instruments. To answer this question, let’s see their types.

Bull call spread

Your profit is the difference between the strike prices. Conversely, your loss is the premium you pay for opening the position. The premium is the overall cost that you pay to buy an options contract.

- Profit = difference between strike prices.

- Loss = premium you pay.

Bear call spread

Your profits are the premium you receive while writing a contract. On the flip side, your loss is the difference between the strike prices minus the premium you pay.

- Profit = premium you receive.

- Loss = difference between the strike price – the premium you pay.

Bull put spread

You can calculate bull put spread profits through the premium you receive. Your losses are the difference between the strike prices minus the premium you receive.

- Profit = premium you receive.

- Loss = difference between the strike price – the premium you receive.

Bear put spread

Your profits are the spread between the strike price minus the premium you pay. Your losses are the premium you pay.

- Profit = difference between the strike price – the premium you pay.

- Loss = premium you pay.

As you can see from the above equations, all these types of vertical spreads have a connection. For instance, the bull call spread loss is the premium you pay, while bear put spread loss is also the premium you pay. Understanding these calculations will make your life a lot easier. But, before going further, go through these equations again.

Now it’s time to illustrate what they are and how you can use them in your trading strategy. To cut the noise, let’s define them into two groups: bear spreads and bull spreads.

Bear vertical spreads

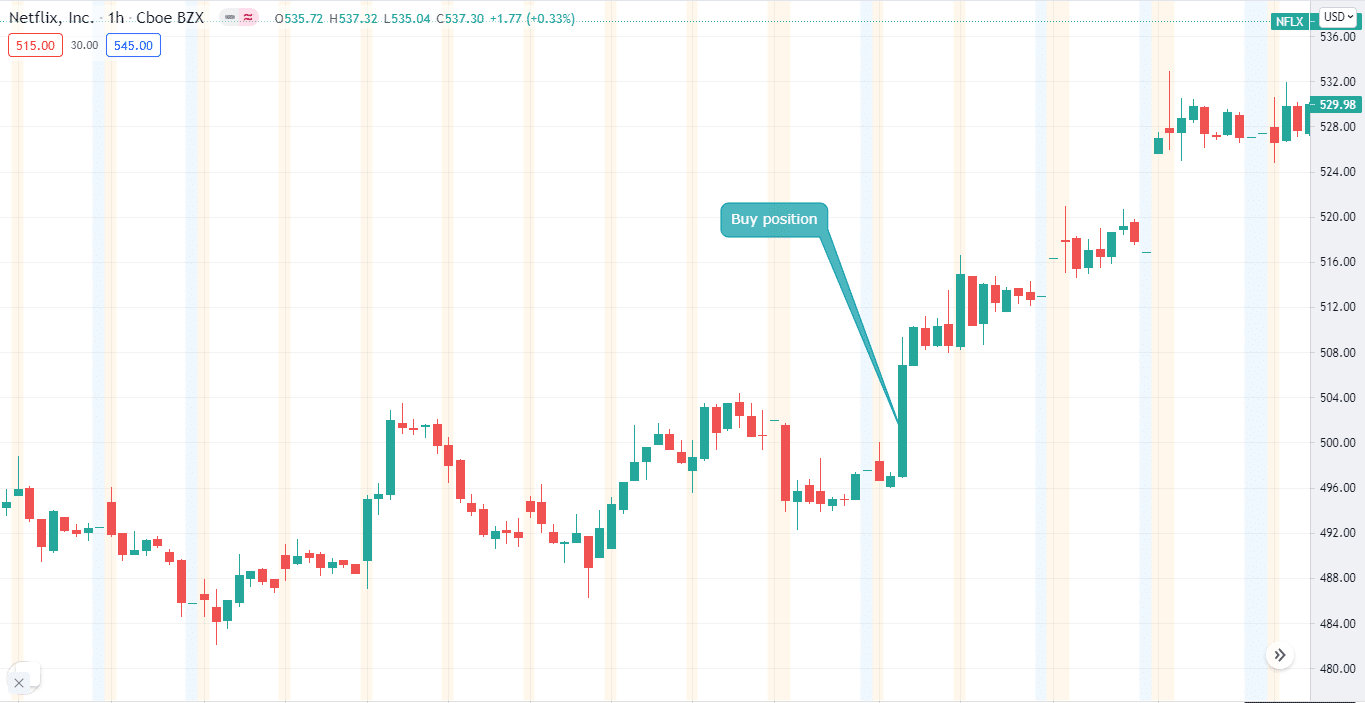

As you know by now, we have two bear spreads: call and put. Let’s take a look at Netflix, Inc. stock as an example.

On June 22, you purchase Netflix shares with a call at the $450 strike price for $3 per contract while the stock is trading at $500 per share. You utilize a $1 premium on a bear call. You may make $100 by placing a single call option with a strike price of 450 for $1. Because your contract size is 100, $1 multiplied by 100 is $100. You will earn if Netflix shares close below 450.

Bear call

It is like the typical bearish approach, which allows you to sell a call option while also buying one more call option at the same time. The option you buy will have the exact expiration date but the more excellent strike price. A key point for you to note is that the bear call is a credit spread.

Test your memory to see if you can remember what credit is. As the bear call is a credit spread, your profits are only the premium you receive for opening the call option.

Bear put

This approach lets you sell one put option and buy another put option with the same expiry date but with a lesser strike price. Bear put is a debit spread, and you know what debit spreads are. If you don’t, then you can check the above. As a debit, the bear put profit is the difference in the strike price minus the premium you pay for opening the put option.

Bull vertical spreads

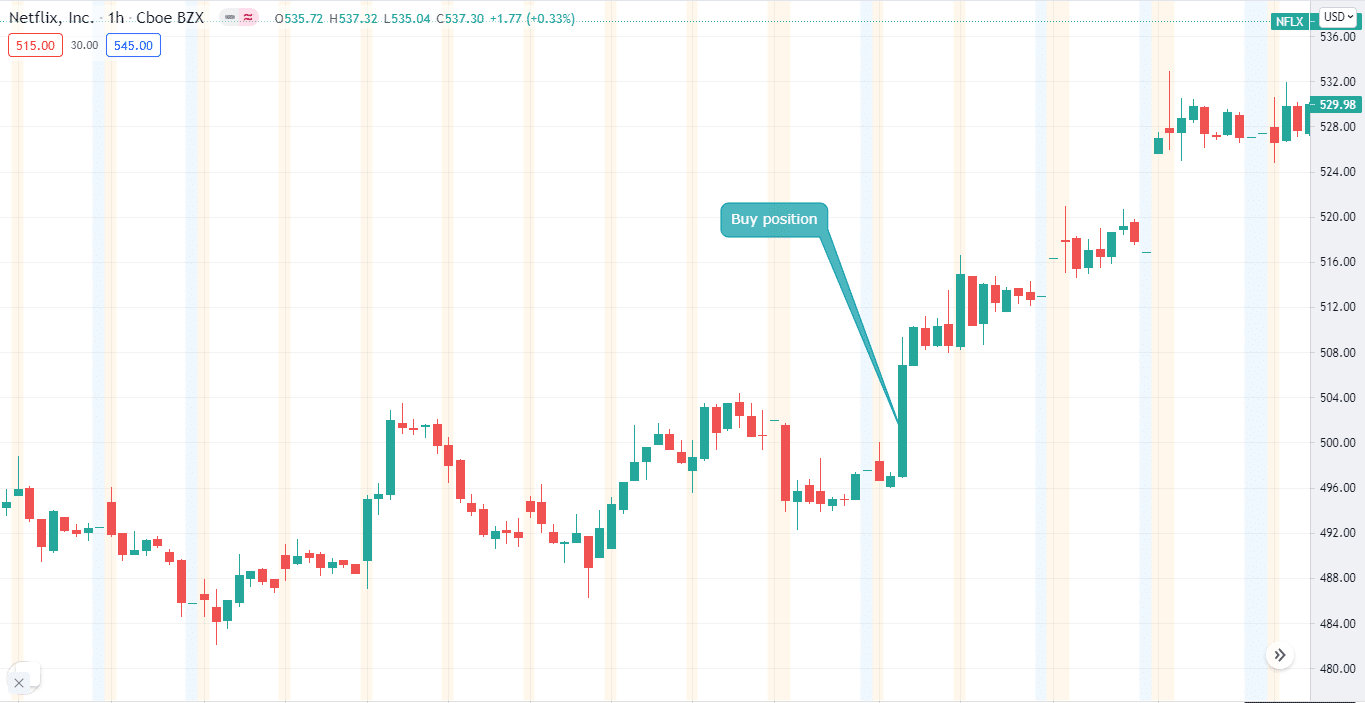

These spreads also have two forms: bull call and bull put. Let’s use the Netflix stock example again.

You purchase Netflix shares with a call at the $40 strike price for $3 per contract while the stock is trading at $500 per share. You sell a call at the $300 strike price and get $1 per contract at the same time. Your net cost to spread is $2 per contract, or $200 because you spent $3 and got $1.

This is a straightforward calculation:

2*100 = $200 is the result of multiplying your contract size by 100. Thus you lose $2 for each contract. The price of $300 will increase to $10 unless the stock rises above $400. These options expire useless if the stock goes below $300.

Bull call

A bull call lets you buy a call option. At the same time, you sell the call option with the same expiry but with a higher strike price. As it is a debit, your profit with the bull call is the change in the strike price minus the premium you pay for opening a bull call.

Bull put

A bull put has one bull option and sells another one with similar expiration but less strike price. A bull put is a credit, and your profit is the premium you receive while opening the put option. You may be wondering which approach you take from the classes mentioned above of vertical spreads.

Well, it depends.

- A bull call spread is a good choice when the volatility is high.

- A bear call is your go-to source when you are expecting a market downside.

- A bull put lets you earn more premiums.

- A bear put is a worthwhile selection when you are anticipating high volatility.

Final thoughts

Don’t dwell on high volatility stocks in your analysis. Look at securities with medium volatility too. Create a separate sheet for stocks and ETFs with the most liquid options.

Even if you have little money, then you can not limit yourself to low-cost promotions. Using a vertical spread, it is quite possible to open positions in AAPL, TSLA, and most liquid ETFs such as SPY, QQQ.