To purchase or sell a derivative, you must have a price and an expiry time in mind. Calls and puts are two types of options. Any time before they expire is allowed for holders of American options to exercise them. Options contracts in the European form are only exercisable after the contract period.

This article will lead you through an in-depth examination of call and put options. After reading this article, you’ll understand this options trading strategy’s fundamental concepts.

How does the strategy work?

The buyer must pay an option premium to engage in a contract. Calls and puts are the most frequent option types.

Call

There is no obligation for the buyer of a call to purchase an asset at the option contract’s strike price. Two types of trades occur on the stock market: long-term and short-term.

Put

Investors will purchase put options when the underlying asset price falls; they will sell them when the price increases. When a put is purchased, the buyer is given the right, but not the obligation, to sell the underlying asset at a stated price. If the put buyer exercises their option, the put seller must acquire the asset.

Reason to use the strategy?

Options are used to protect current assets. Investors can safeguard their direct stock holdings by purchasing or selling options on their existing shares. Investments in options are meant to offset any underlying asset losses partly. The use of options as speculative investments is possible, though.

How to use the strategy?

Using call options

Up to the expiry date, a call option may be used to purchase an asset for a predetermined price. The only way to execute a European-style option is to buy the underlying asset at expiry. An option’s expiry date might vary, depending on whether it’s short-term or long-term.

In call options, the “striking price” refers to the price at which an option buyer may acquire the underlying asset. In the example of a $20 stock call option, the option buyer may utilize the option to purchase the shares before the option expires.

Using put options

In US-style options, a “put” option allows you to sell a security at a fixed price up to the expiry date. However, the underlying asset may only be sold at the expiry date of a European-style option.

The price they may sell the underlying asset is called the striking price for a put buyer. So, for example, the buyer of a $20 stock put option may sell the shares at that price before expiry.

Bullish trends

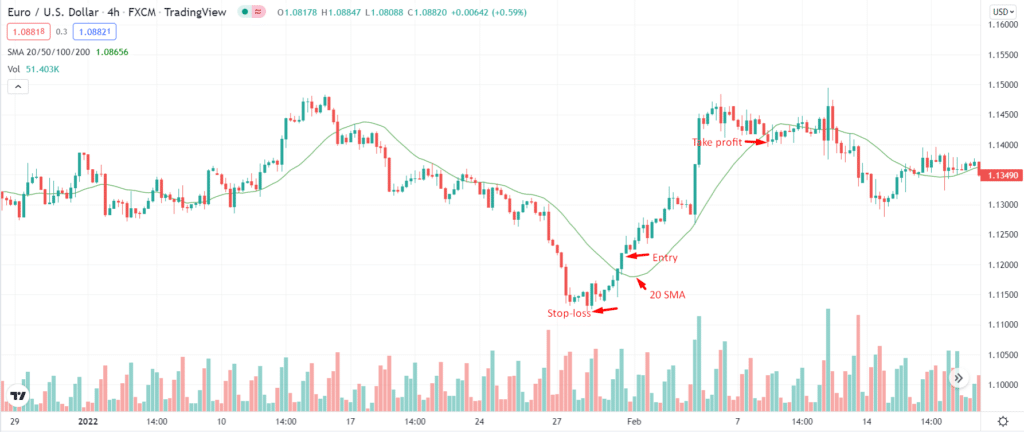

You can use 20-period SMA to create a simple setup for a bullish trend.

Where to enter?

You can enter the long trade when the 20-period SMA confirms the uptrend. The price candle must close above the 20-SMA.

Where to put an SL

You can place an SL just below the local low. If you are an aggressive trader, you can also place an SL below the trigger candle’s low.

Where to TP?

You can place the level twice the size of the SL, or you can exit when the price moves below the 20-period SMA.

Bearish trends

You can also use the same 20-period SMA for the bearish trend setup. For example, look at the following chart.

Where to enter?

You can enter the short trade when the 20-period SMA confirms the downtrend. The price candle must close below the 20-SMA.

Where to put an SL?

You can place an SL just above the local high. If you are an aggressive trader, you can also place the stop-loss above the high of the trigger candle.

Where to TP?

To take profit, either you can place the level twice the size of the stop-loss, or you can exit when the price moves above the 20-period SMA.

Pros and cons

Let us look at the pros and cons of such strategies.

| Pros | Cons |

| To begin with, investing in options allows traders to make small wagers. | The major disadvantage of options is their high degree of uncertainty and the potential that they would expire with no value. |

| Option trading provides investors with a broad selection of trading tools to profit from stock market volatility. | Consequently, since fewer traders are in the options market, options are less liquid. |

| If an investor has a $50000 stock portfolio and wants to reduce risk due to market volatility, they may use index put options to balance the loss in stock price with gains in index put options. | Another issue with options is their complexity since most option strategies are sophisticated and need a good understanding of finance. |

Final thoughts

Your max. loss is the premium already paid for buying the put option as a put buyer. To reach the breakeven point, the option’s price should decrease to cover the strike price minus the paid premium.

Hopefully, you now have a better understanding of how to trade calls and put options.