Range trading is a simple approach of buying from low and selling from high that is easily applicable in the crypto market. On the other hand, the broader crypto market is volatile, where widespread a decent price surge. In that case, making money from range trading would be an excellent choice for you to provide more profits than the traditional financial market.

There is no alternative to having a specific trading method in any financial market, and the crypto market is not different. You cannot deny this market as unusual or bizarre rather; it works logically. Despite some differences, a simple range trading method can be your weapon to make money online, especially from crypto trading.

The following section will uncover everything about range trading in the crypto market. After completing the whole section, you will know the basic range structure, identification process, and buying and selling idea.

What is the range trading method?

Range trading is a process of buying from a lower value and selling at a specific price, selling from a higher value, and taking the benefit from price fluctuation from a zone.

In any financial market, the price remains within a range most of the time due to the lack of excessive buyers and sellers pressure. Therefore, finding the top and bottom of the price zone is very easy with the naked eye.

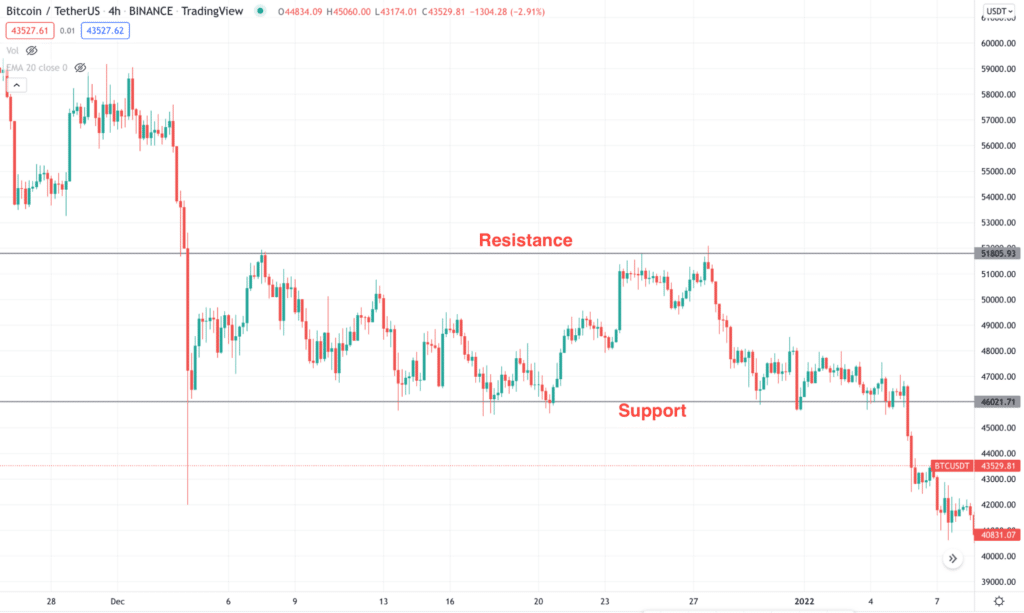

The above image shows the perfect example of a rangebound market. In the BTC/USDT daily chart, the top range is at 51,805.93 and the bottom at 46,021.71. Although the price remained bearish in the chart, it tested the support and resistances within the zone before heading lower. Rangebound trading aims to benefit from the multiple tests of these levels with a reasonable risk: reward ratio.

How to trade using the range trading method?

Although we focus on buying from low and selling from high, there is no way to ignore what is happening in the broader market context. In any trading method, we work on probabilities where the range towards the trend has a higher profitability ratio.

Let’s see some simple steps of using ranges in crypto trading.

Identify the trend

Trend forms when one party takes control over another party by making multiple swings in the price. In an uptrend, the price makes higher highs, and in the downtrend, it makes lower lows.

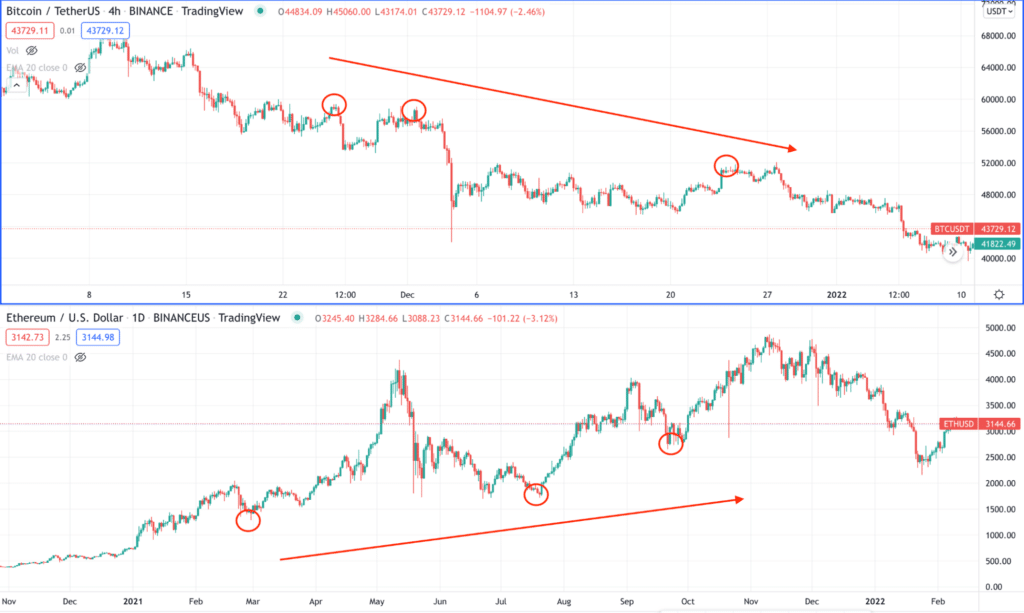

The above image shows how the bearish and bullish trend forms in the market with the arrow.

Don’t get confused to see trends in the range trading method. Because we cannot blindly believe the range except understanding the broader market context.

Identify the range

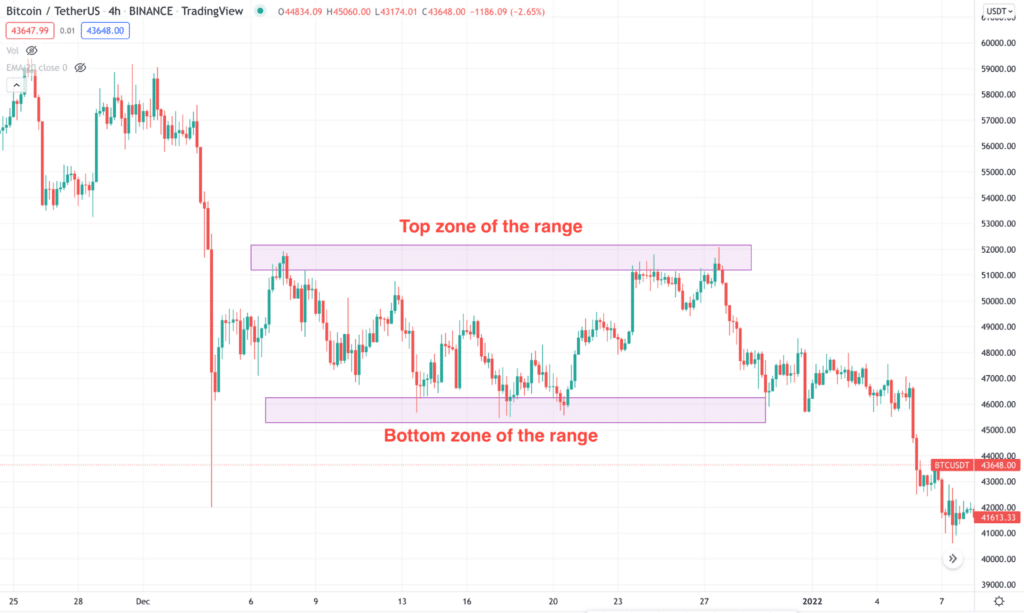

Finding the range is straightforward. You have to draw horizontal lines in the price chart, and it will test more than once to confirm the range. Remember that there is no exact range price level, so that it could be a price zone instead of a level.

Combine the price direction

This part is where most of the traders struggle. In this trading method, you have to identify where the price is heading, which means the current trend. Is it bullish or bearish?

If the trend is bullish, we will identify the price range and consider buying from the bottom of the range only. We will eliminate any sell setups from the range unless the market trend is bearish.

Bullish trade setup

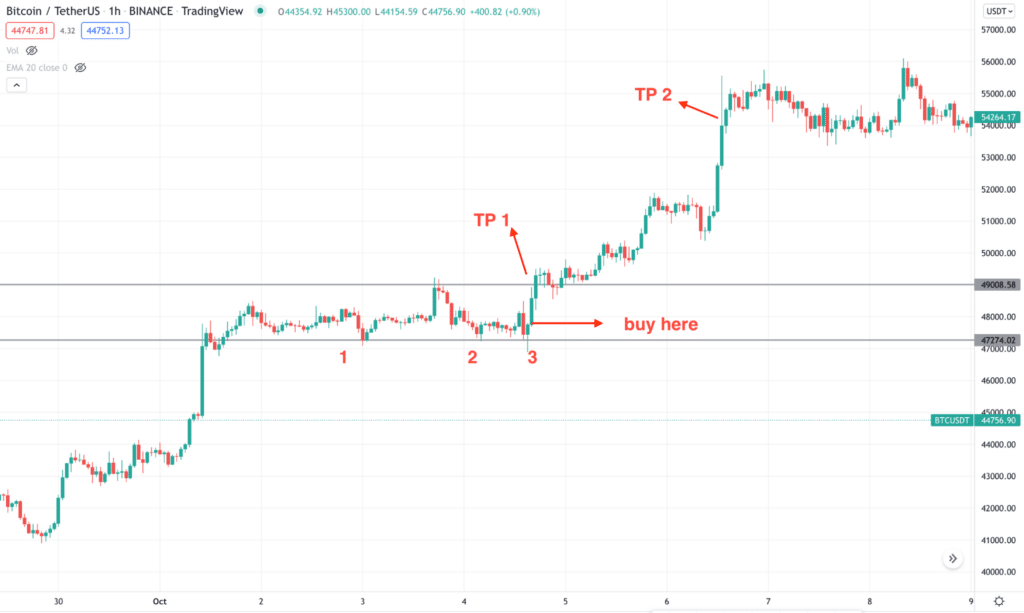

Now it is time to see the practical trading example, including the exact way to open the buying or selling position. Before opening the trade, make sure to find these conditions in the price chart:

- The market is above any significant support level in the higher time frame and aiming up.

- The existing market trend is bullish — there are higher highs and lower highs in the chart.

- After going sideways, the price tested the bottom of the range two times to confirm it.

- In the third touch, the buying possibility is valid.

Entry

Once the above conditions are present in the chart, you are ready to open a buy trade. In that case, make sure to find a bullish candlestick pattern, like the bullish pin bar or engulfing bar.

Stop loss

The aggressive way to set the stop loss is to set it below the rejection candle with some buffer. However, as the crypto market is volatile it is wise to follow the conservative approach by setting the stop loss below the recent swing low.

Take profit

The first take profit is at the top of the range but if the price is supported by a strong change in volume, you can extend the take profit level for further gains.

Bearish trade setup

Before opening a sell trade make sure to find these conditions in the price chart:

- The market is below any significant resistance level in the higher time frame and aiming lower.

- The existing market trend is bearish — there are lower lows and lower highs in the chart.

- After going sideways the price tested the top of the range two times to confirm it.

- In the third touch, the selling possibility is valid.

Entry

Once the above conditions are present in the chart, you are ready to open a sell trade by finding a bearish candlestick pattern, like the bearish pinbar, or engulfing bar.

Stop loss

The aggressive way to set the stop loss is to set it above the rejection candle with some buffer while the conservative approach is to set it above the recent swing high.

Take profit

The first take profit is at the bottom of the range, but if a strong change in volume supports the price, you can hold it.

How to manage risks?

The crypto market is very volatile, with a strong risk management system applicable. Some risk management systems are mentioned below:

- Do not risk more than 10% risk of your overall investment in a single instrument.

- Make sure to follow the support and resistances as bases to the strategy.

- Make sure to use candlesticks before opening the buy/sell trades.

- If you are not expert enough, avoid lower time frame trading.

How to make $500 per day with this strategy?

The profitability in crypto trading is easy as crypto coins move more aggressively than stocks or the forex markets. Therefore, it is straightforward to make a $500 profit a day with only a $5000 investment.

To make a $500 profit, you are targeting 10% profit from your investment that is easily achievable by taking ten trades and risking $500 per trade. However, there is no guarantee that you will make profits each day. The overall profitability comes after a set of 10 to 20 trades.

Final thought

We have seen how the range trading method works in the crypto market, where you can make money without HODLing the trade for a long time with floating loss. Therefore, special attention to trade management applies to this trading method besides following all conditions strictly.