Investors use trading strategies like day trading, swing trading, and many others as a fixed plan for executing a trade in the FX market to achieve profitable returns. Swing or scalp trading are both included in short-term trading methods.

The short-term trading helps Tudor Jones, who achieves $7.8 billion with just a tiny startup, i.e., $30,000. Choosing a plan that suits your trading skills and temperament is essential if you want consistent success in the trading market.

Successful traders can be defined as those who know their comfort zones, whether in technical or fundamental analysis or in short- or long-term trading, and have a firm grasp on the trading plans they choose for themselves.

These two strategies are the most popular. However, before we decide on scalp vs. swing trades, let’s discuss the pros and cons of both.

Swing and scalping trading: opportunities & differences

Scalping

Traders of this style use the shortest time frame when trading. By reducing their time spent on the platform, they expose themselves to the smallest amount of risk.

For instance, if an FX trader enters a position in EUR/USD at 1.1700, a stop at 1.1690, and the profit target at 1.1710, the risk is ten pips or $10 (for a mini lot).

The risk/reward ratio is 1:1. That’s how a scalper makes a small profit in one trade, but as a whole, he meets his financial goal for the day. The risk factor in scalping is extremely low with the minor profit deals.

| Pros | Cons |

| The benefit of using this strategy is that investors have to hold on for short intervals. Scalpers need not wait for trade exits. Thus, they are less likely to be knocked out by reversals from their trading positions. The risk to reward ratio is almost equal, so a more strike rate is possible than a high reward rate. The beginners who have the slightest knowledge about trading strategies of the FX market can also adopt this style as they have to spend less time at the trading platform actively. Scalpers can even ignore trends, pivot points, Fibonacci sometimes. | Trading platforms do not allow scalping strategies for investors. Because of the 1:1 risk and reward ratio, a single loss can deplete the profit of one profitable trade. The pip yields are usually less than ten pips, so a scalp trader must make many trades to accomplish trading objectives. As one should know, scalpers don’t even need to understand long-term analysis of fundamental resources and technical indicators, which is good for short-term trade but can be a curse in the long run. |

Swing trading

On the other hand, this trading style involves identifying the trend and then playing within it. For example, swing traders find out the most trending currency pairs to pick after correction or consolidation. The market participants exit the trade before the pair is ready to rise again. Let’s look deeper with an example.

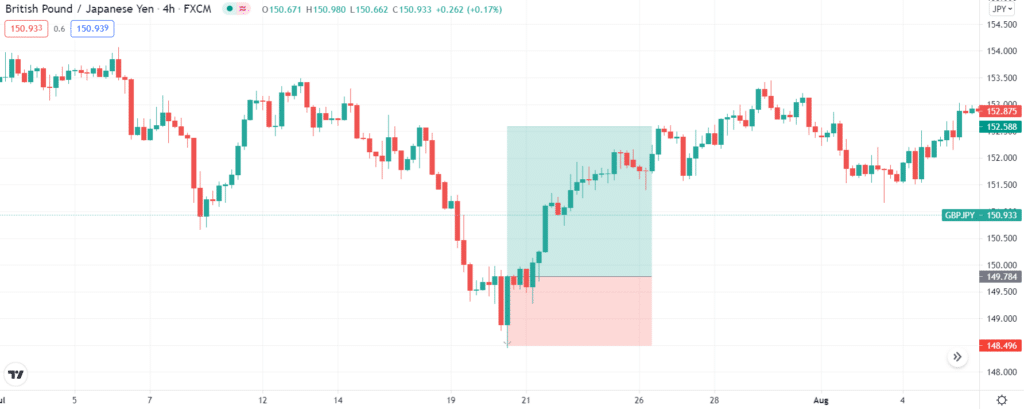

A trader wishes to make gains trading in GBP/JPY. He would like to buy the pair at the top of the bullish engulfing pattern with a maximum recent high of 149.78. He places the stop-loss order at the recent low point at 148.49 and the profit target at 152.87. Using this strategy, the risk extent will be just 129 pips, but the profit is 309.

So in this type of trading, the position is held longer than scalping, but profits are also much more extensive.

| Pros | Cons |

| The profits in pips could reach more than 100-250 while using this style. Signals represented on daily charts are more meaningful. So, investors achieve bigger stop losses along with trades on daily charts. That’s how there is more movement in the trade, and the positions are less sensitive to whipsaws. Traders do not have to sit on the trading screens all day long. Instead, they enter the market once a day when the new candle or bar begins. | The swing traders visit the market once a day, but with unexpected news, the market proves to be much unpredictable. This instability can take away your money in a while. So there is a risk factor present while trending stingingly. Also, swing traders usually found a single candle or bar in a day, which means that there may be fewer trading opportunities than short-term traders. |

Scalping or swing trading: which is better?

Both are common and well-known styles of trading. The scalpers are allowed to make smaller but faster trades, and with swing trading, traders make longer while many profitable trades.

- Comparison of risk factor

Both need the investor’s attention, but swing trading comes up with more risk than scalps. The beginners will get more profit while trading swings, while this type of trading is not for advanced traders.

- Comparison of stress factor

Similarly, scalps trading has more stress factors than the other because the scalp traders have to make dozens of trades every day with the same temperament.

- Chart analysis difference

If you are a scalper, you will be looking for 1-5 minutes charts, while if you trade in swings, you have to keep your eyes on a variety of charts, including daily, weekly, or monthly.

So, as a result, we choose scalping as a better trading style than swing trades because of its predictability and less risk. Also, scalp trading is less volatile due to single-day trading. On the other hand, swing trading is the opposite of having more prolonged time exposure and more risk extent. So, as a whole, you can get more winning rate in scalping than in swinging.

Final thoughts

Both swing and scalp trading have their place in the trade market. The scalping is extremely short-term trading with less profit along with the least amount of risk, but the scalper can trade several times in a single day.

In contrast, swing trading is more risky and time-consuming but can maximize gains in a single jerk. So, the scalping is much better than the other because of having more predictability and less risk.