You probably have heard the term “trend” if you are a trader. It is a price behavior where bulls or bears control the market by making consecutive higher highs or lower lows.

In cryptocurrency trading, any trend trading method has a higher success rate because 50% to 100% movement from the existing trend is widespread. However, following a technique with a strong track record is essential.

If you plan to build a crypto trading portfolio, the following section is for you. Here we will see one of the most profitable strategies applicable to any token and time frame.

Trend trading explained

It is a method where investors follow a price direction already established in the chart. Therefore, the aim is to continue trading towards the existing price direction.

- When the price makes consecutive higher highs, it is an uptrend.

- When the price makes consecutive lower lows, it is a downtrend.

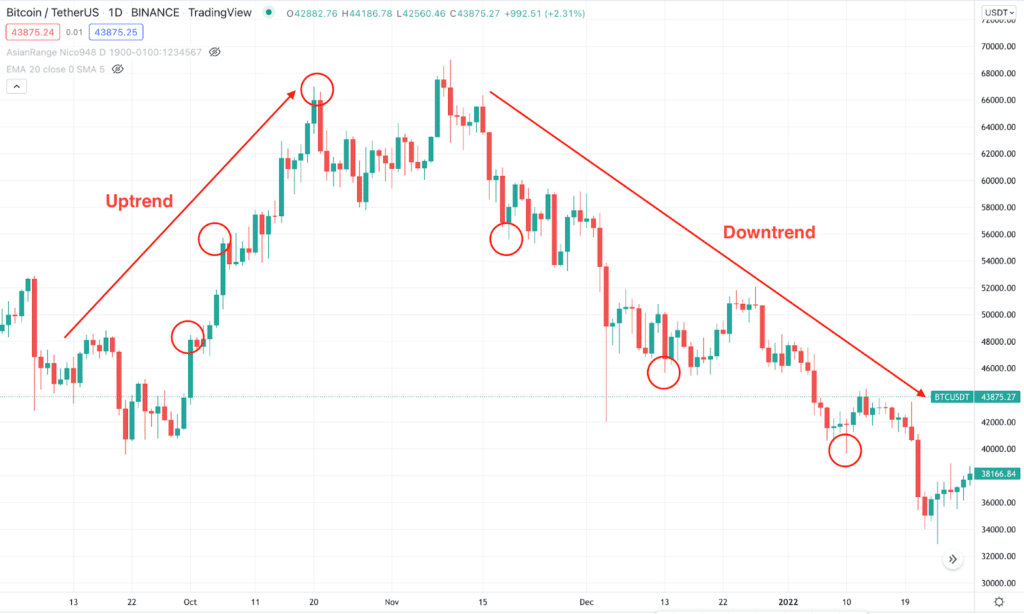

As you can see, the first part of the chart shows how new higher highs came that created a bullish trend. The essential characteristic of the bullish trend is that a corrective bearish pressure should follow an impulsive bullish pressure. Other conditions are shown below:

- Buy pressure is impulsive, and sell pressure is corrective.

- Impulsive buying pressure will make new higher highs.

- Corrective sell pressure will not break the existing low.

On the other hand, the bearish trend is the opposite version of the buying pressure where the following conditions are present:

- Sell pressure is impulsive and buy pressure is corrective.

- Impulsive selling pressure will make new lower lows.

- On the other hand, corrective buying pressure will not break the existing high.

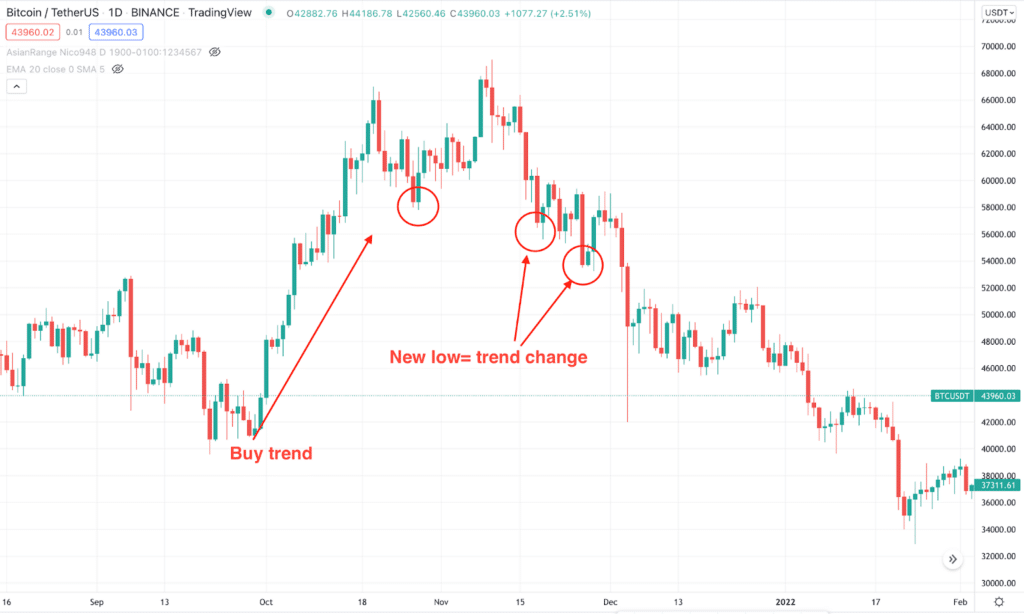

However, there are some conditions where the price trend may change from bullish to bearish or bearish to bullish. In that case, the price should get volatile and volatile near-term highs/lows.

Here we can see the Bitcoin daily chart where the price kept moving up within a bullish trend. However, the situation has changed after the price violates the near-term low, resulting in a trend change.

Why use trend trading in cryptocurrencies?

You probably know how to identify the trend from the above paragraph from the above section. We expect the price to move higher from our buying point in cryptocurrency trading in cryptocurrency trading. No one likes the price to move in the desired direction, right?

Therefore, trend trading ensures a higher success rate than any random strategy. This is because it needs less time on HODLing and opens opportunities to take other trades at a time. On the other hand, the extreme volatility of cryptocurrencies ensures to grab enough profit from the price swing. It is often profitable to buy any crypto asset from the existing trend instead of HODLing the loss.

How to use trend trading in cryptocurrencies?

Traders should have a clear idea about the impulsive and corrective pressure of the trend. In a sudden pressure, the price makes new highs or lows with aggressive pressure. On the other hand, the corrective pressure of the price barely makes new highs or lows.

- In a buy trend, we aim to buy a crypto coin where the bearish corrective momentum is over, and bullish impulsiveness may come.

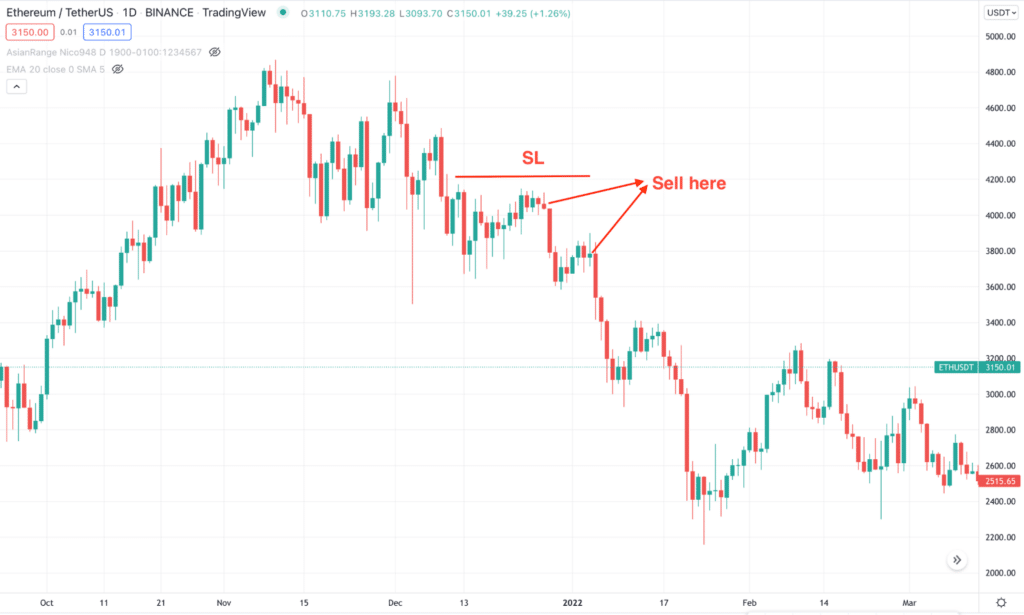

- We aim to sell when the bullish corrective momentum is over, and bearish impulsiveness is coming in the sell trend.

Trend trading crypto strategy

Trend trading is profitable if you are interested in higher time frame trends. Therefore, the trading condition on the daily or weekly time frame would provide more profits than intraday trading. In the following section, we will see trading methods where a higher time frame is used to find the perfect buying or selling points.

Trend trading buy strategy

- Identify the price trend by looking at higher highs and lower lows in the chart.

- In the buy trade, wait for a bearish correction followed by bullish impulsive momentum.

- Closely monitor the swing low of the buying trend and find bullish reversal patterns.

- Make sure to wait for the candle to close before opening the buy trade.

- The conservative SL will be below the candle low.

- The take profit is based on price structure and behavior.

Trend trading sell strategy

- Identify the price trend by looking at higher highs and lower lows in the chart.

- In the sell trade, wait for a bullish correction followed by bearish impulsive momentum.

- Closely monitor the swing high of the bearish trend and find bearish reversal patterns.

- Make sure to wait for the candle to close before opening the sell trade.

- The conservative SL will be above candle high.

- The take profit is based on price structure and behavior.

Key takeaways

- In trend trading, it is important to find the corrective and impulsive pressure of price trends to define the most profitable trade. In any trade, try to find trading opportunities towards the impulse only.

- In any trading entry, make sure to take trades once good price action patterns are present in the price.

- There is no alternative to waiting for the closing candle. In the running candle, the situation might change in the last minutes. Therefore, wait for the candle to close and for a correction before opening the trade.

- Swing trading is not your ultimate financial trading solution. Besides opening buying or selling entries using price actions, make sure to follow a strict money management system. The usual approach uses not more than 2% risk per trade.

Final thoughts

The success rate is high in trend trading if traders manage it with a strict trade management system. In any financial market, trend trading would be an exciting journey for traders, but attention to the trend change is needed.