If you want to see the financial market differently, you should try triangular arbitrage now. This method is more than a traditional technical or fundamental analysis, and it can provide profits from any uncertain price discrepancies between brokers.

Trading with this method needs close attention to the price. You can quickly eliminate additional costs related to cross pair just by using the scheme.

The following section includes everything a trader should know about the triangular arbitrage trading method, including buying and selling.

What is triangular arbitrage?

It is a popular trading system involved in making a profit from buying one currency pair and selling another to reduce the trading costs.

Many traders acquire the triangular method to make profits from the price discrepancies from different markets. There are several kinds of arbitrages where the triangular arbitrage is famous for its effectiveness and profitability.

You don’t need to analyze the market based on technical or fundamental analysis; rather, open the trade based on the over and undervalue of a trading asset.

The two currency arbitrage is very profitable in the forex market, where traders should buy one currency against another. When the seller asks to sell at the lower rate of buyers’ expectations, it negatively spreads. It is possible due to having a market condition where the liquidity is low, and volatility is high.

How to use triangular arbitrage in trading strategy?

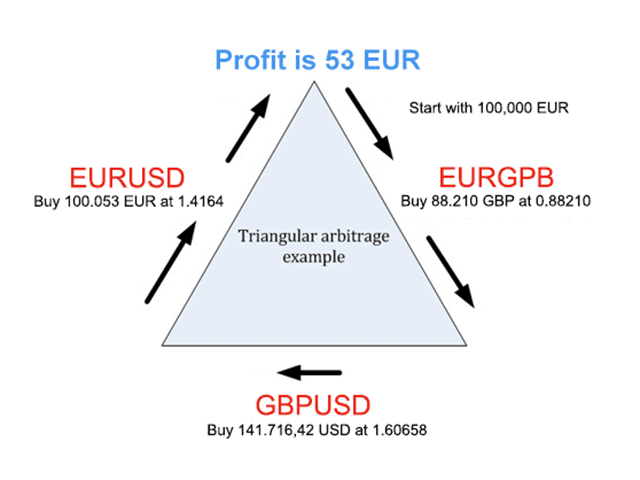

In this trading method, investors take three trades, buying a currency pair and selling another where the third currency is the base of this system. It is only possible if there are any price discrepancies between the exchange rates of multiple brokers or financial markets. The value of a currency becomes lower and higher, indicating discrepancies. Let’s see an example.

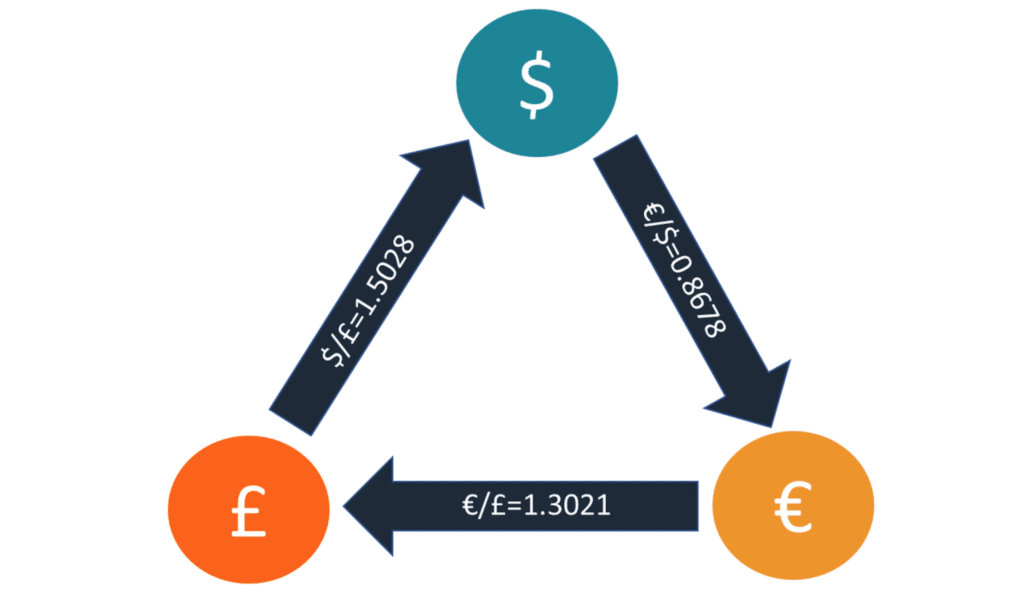

The current price of EURUSD, GBPUSD, and EURGBP is as follows:

- EURUSD: 0.8676

- USDGBP: 1.5028

- EURGBP: 1.3021

Based on the price, can we say which currency is undervalued?

It is the euro, and it opens the arbitrage opportunity. We can find the cross rate as 1.3024 (0.8676 X 1.5028).

Now move to the process of arbitraging. You need to follow these commands simultaneously:

- Sell USD and buy EUR, $100,000 X 0.8676= € 86760

- Sell EUR and buy GBP, € 86760 X 1.3024= £112996

- Sell GBP and buy USD, £112996 X 1.5028= $169810

The above image explains how the triangular arbitrage works in three different currency pairs.

A short-term strategy

The triangular arbitrage includes the following rules while opening a trade.

- Find the arbitraging situation where one quote exchange rate is inappropriate with the cross rate.

- Find the difference between these cross rates.

- If you find any difference, the triangle is possible.

- Now exchange the second currency with the third currency.

- It is the final step where you should exchange the third currency for the initial one and identify the overall profit in this system.

The short-term and long-term strategy looks the same in any system

Best time frames to use

This method is not mandatory to follow a time frame. You can open the trade at any time frame from one minute to 15 minutes.

Entry

The ultimate approach is to eliminate the common currency from both pairs and benefit without paying additional charges.

In the triangular system between the EUR/USD and GBP/USD, you should buy the one standard lot of the EUR/USD and sell EUR/GBP. In this process, you have eliminated the EUR from both pairs, and you can sell the GBP/USD to find the profit in US dollars.

Stop loss

This method is applicable once one currency value is down and another currency’s value is up. The profitability will decrease in case of discrepancies.

Take profit

The profit comes once the third step of this method is complete. Based on the above example, the profit is the difference between the first and third trade.

A long-term strategy

In the long-term strategy, you should follow the same system as the short-term but make sure that you might have to wait a bit to get the maximum benefit.

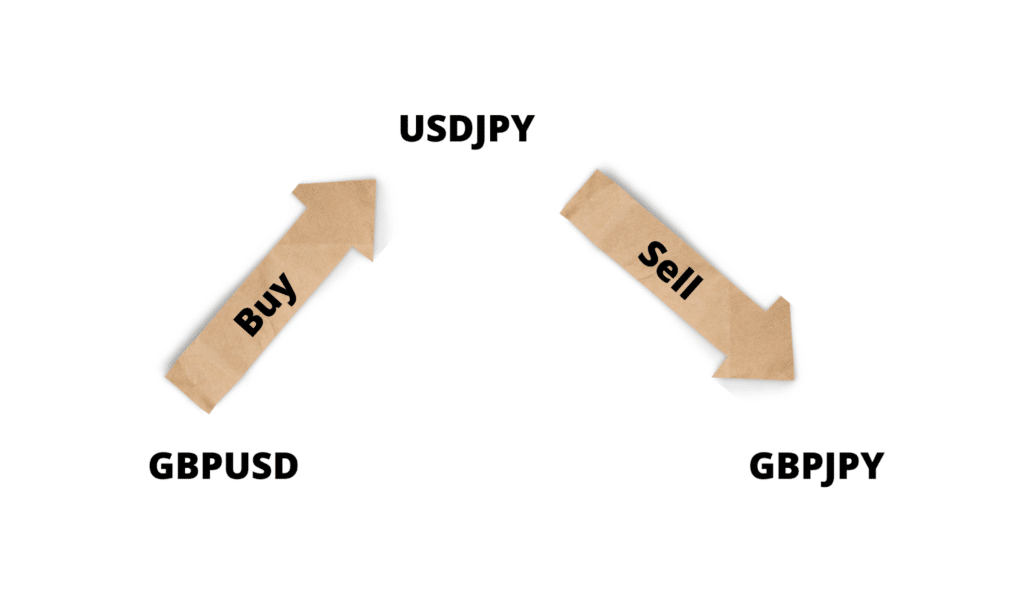

The long-term system is time-consuming and has a higher profitability rate, and you can apply this method to any cross-pairs like GBP/USD, GBP/JPY, or AUD/USD.

Before taking a trade, you should follow these steps:

- Find the arbitraging situation where one quote exchange rate is inappropriate with the cross rate.

- Find the difference between these cross rates.

- If you find any difference, the triangle is possible.

- Now exchange the second currency with the third currency.

- It is the final step where you should exchange the third currency for the initial one and identify the overall profit in this system.

Best time frames to use

It might take days and even weeks to find the ultimate result.

Entry

The ultimate approach is to eliminate the common currency from both pairs and benefit without paying additional charges.

Stop loss

This method is applicable once one currency value is down and another currency’s value is up. The profitability will decrease in case of discrepancies.

Take profit

The profit comes once the third step of this method is complete. Based on the above example, the profit is the difference between the first and third trade.

The above image explains how the arbitrage works in forex trading, where the buy of GBPUSD and sell of USDJPY indicates a sell in GBPJPY.

Pros & cons

| Pros | Cons |

| Every instrument supports triangular arbitrage. | There is no trade management system. |

| You can make an automated system with it. | You cannot trade just by looking at the chart. |

| Does not need complex technical analysis knowledge. | This method may incur a loss if the discrepancies become weaker. |

Final thoughts

It is a profitable trading method if traders can spend a lot of time getting familiar with it. Besides, the financial market has some unavoidable risks that need close attention to the trade management. Make sure to use your funds in a secured way to achieve your trading goal.