Anyone you ask will have their ideas and beliefs on what constitutes financial freedom. The commonality between every single economic freedom definition is “enough cash flow.”

Unfortunately, enough cash flow is subjective depending on individual goals and lifestyles. It ranges from having enough cash flows to pay all monthly expenditures to have a tidy retirement package that ensures a hassle-free retirement life.

No matter the definition, everyone needs to adopt habits that will lead to financial freedom because many people don’t attain this vision. The majority of the populace doesn’t achieve financial freedom due to unforeseen circumstances, natural calamities, thriftless spending, cashflow emergencies, and lack of planning.

So how do the rich and super-rich attain financial independence?

Let’s take a look at:

- The role of having goals in attaining economic freedom

- The role budgeting plays in facilitating financial freedom

- How to save for both financial independence and blissful retirement

- How to minimize debt for enhanced cash flows and financial freedom

- When to start investing to achieve financial freedom

- Lifestyle hacks that ensure economic freedom

Have goals

In all avenues in life, you have to set smart goals to succeed. For financial freedom attainment, it starts with an actual definition. Get into the specifics of what entails financial freedom. The lifestyle shows financial independence, the bank account balances, income from investments, and the time frames to achieve all of these.

The way to ensure these life and financial goals are measurable are by using the time frames set as the milestone markers. These milestones help you assess how well the strategies provide the individual financial independence vision is still achievable.

The goals, milestones, and associated decisions must be written down and revisited regularly to take corrective actions where necessary. It exponentially improves the probability of financial independence actualization.

Know thyself financially

A great general once said, “You cannot beat thy enemy without knowing thyself.” The same is true when it comes to finances. Assessing individual financial position honestly ensures realistic goals and the adoption of optimal strategies to ensure the financial goals set are achievable.

Knowing your financial position involves acknowledging all debts, incomes, gaps in individual financial plans, and an honest assessment of future expenditure. If too complex to handle by yourself, seek the services of a professional financial advisor.

Have budgets

Living within your means starts with identifying all incomes and expenditures that need an accurate budget. Having a written down monthly budget is a great discipline routine that ensures payment of all bills, necessary investments are made, and one has a nest to fall back on. Following it religiously also ensures the elimination of all spendthrift tendencies.

Note debt management

The primary adversary to wealth creation is high-interest loans such as credit cards and other individual loans. Strive to settle these loans balances fully at the end of the month and, where possible, avoid them like the plague. Ensure you also pay off the low-interest loans, such as mortgage and student loans, on time since they have a bearing on your overall credit score.

Why be bothered about credit scores?

Financial institutions use credit score rating as a base for calculating individual interest rates and insurance premiums. A good credit score leads to reduced expenses, while a bad credit score increases individual expenditure through increased cost of insurance and debt financing.

Diversify

Don’t put all your eggs in one basket. There is no single account or investment instrument all strategy that is a one size fits all fix. Having a diversified financial portfolio ensures that the risk is spread to meet individual risk tolerance levels efficiently.

It is always advisable to solicit the services of a financial advisor to ensure a well-balanced portfolio that provides the achievement of financial objectives without risk of overexposure.

One of the best ways for instinct diversification at a meager cost and reduced risk is investing in ETFs.

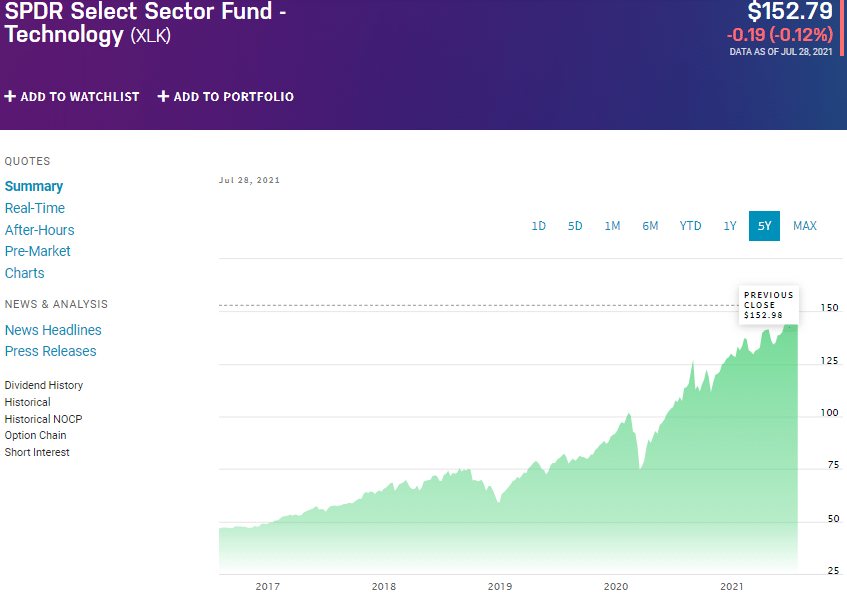

For example, investing in the technology industry in the present world we live in means investing in the future and a sector that is running the globe. However, like all emerging markets, the tech industry has been known to be very volatile. Investing in the overall technology sector via the SPDR Technology Select Sector ETF diversifies your portfolio while ensuring returns in the long run.

Be frugal

Biographies of the world’s most affluent people reveal that before they immersed their wealth, they learned the art of frugal living. This is by no means a call to action to be King Midas. Being frugal is all about being able to distinguish between wants and needs. Always take care of the needs and hold out on the wishes, saving finances for investment and other nest activities.

Live within your means but for accelerated wealth creation, live below your means.

Track your spending

Unless you know where you channel your money and the associated values, you cannot find ways to trim expenses down to free up cash for savings and investments. At present, they are applications that help you track your expenditures to the extent of demystifying hidden costs. They do so by collecting data on your payment and then categorizing it. These applications ensure you lie within your means and precisely identify your money attrition points.

Enhance your income

The goal of financial independence is to have enough money to indulge your passions stress-free. You can only cut your expenses so low before life becomes unbearable. Therefore, while being frugal is limited, how much you can earn is limitless. Work on having multiple passive income streams to facilitate quick achievement of financial independence.

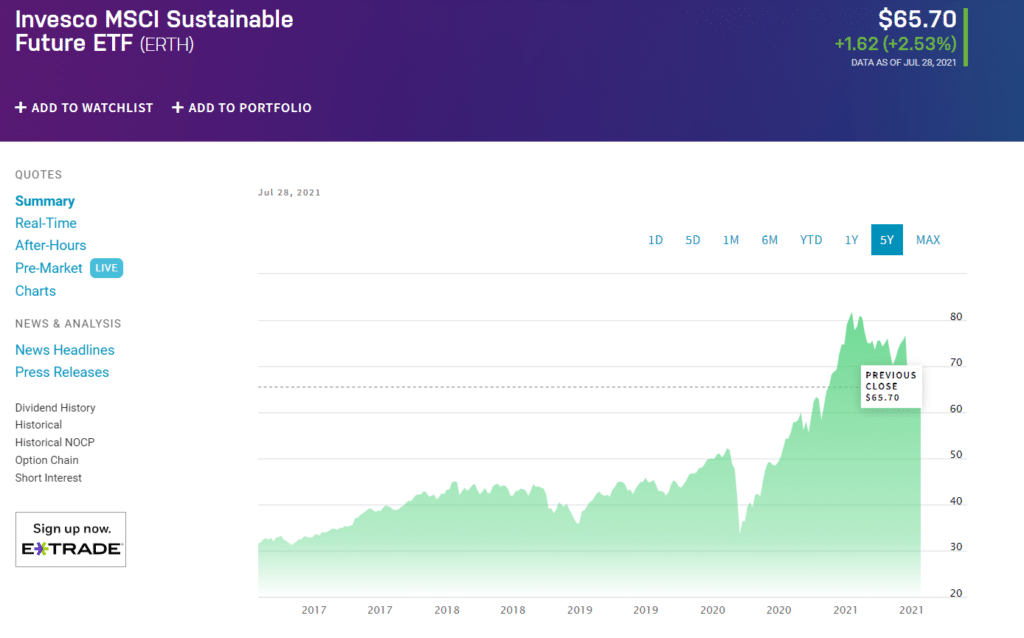

One of the best ways to achieve passive income is investing in high-yield ETFs. Investing in the Invesco MSCI Sustainable Future ETF exposes investors to a dividend yield of 15.67%-quarterly dividends of $0.30.

Remember that health is wealth

It is said that “Good health is above wealth.” If you are ailing, the achievement of financial independence is not enjoyable; wealth might ease the pain and discomfort, but one is not happy.

In a world filled with lifestyle diseases, unhealthy living results in more medical bills and insurance premiums. Most of these health issues are preventable. Make a conscious decision to adopt a healthy lifestyle that ensures you have the energy to work towards financial freedom for longer.

Final thoughts

Financial freedom is a highly personalized goal. The above is not the holy grail of financial independence but the launchpad that ensures no matter your definition, economic freedom is attainable.