Swing is a popular trading style usually used by a market participant who sits for very little time on the screen and takes big chunks from the market movement.

Swing trading is a trending tactic that involves opening deals in the direction of price movement at the bottom of local pullbacks. This trading model is attractive because the number of losing trades concerning profitable ones is relatively tiny with strict adherence to risk management rules. The strategy itself is understandable even for a novice trader.

Which time frame to use in swing trading is a big question in a trader’s mind. Deciding and utilizing the correct time frame is crucial to get a good trading setup.

Let’s find out the best time frame you can use to trade any swing strategy.

How does swing trading work?

Out of all the trading styles, swing trading is in the middle of the trading duration. The least time a trader is in a trade is the scalping followed by day trading. Both of these options here are pretty aggressive and need a lot of your attention.

On the other hand, swing trading requires very little time and keeps you relaxed as you take the trade and hold it for long, say days, weeks, or even months. Once you see your profit target achieved, you come off the market.

The trade setups for swing trading are finalized by looking into the higher time frame because the higher the time, the more powerful trade strength or accuracy.

Reason to use swing trading

Out of many reasons to choose swing trading strategies as your trading approach, one significant reason is the less screen time and trade accuracy.

Another reason is the accessibility to compound your forex gains. You can make a strategy and try taking out some profit percentage and compound it monthly.

For traders who do not have much time, swing trading is supposed to be the best trading option. A trader who swings trade looks for more significant and more considerable gains and does not settle for small days or scalpers.

Best time frames to trade swing

Overtrading is one of the major reasons traders lose money in the market; to gain more, they take more risk and push more trades; swing trading strategies help in this case.

Especially for beginners, swing trading keeps various emotions in check and helps take trades worth taking. The small number of trades per month does not harm their trading account even if they go wrong.

Main forex trading time frames

Swing trading’s main criteria are to find the trades at a higher time frame to gain big profits. Swing traders usually use weekly followed by daily, 4-hour, and 1-hour time frames to trade the market. This shift from a higher to lower time frame is called the top-down trading approach.

The weekly time frame is to check the overall market trend if the market is moving up or down. Now let us look at how other time frames work in swing trading.

Daily time frame

The most important thing to do in trading is figuring out the market trend as you must take the trade in the market direction to have a higher winning probability. The daily time frame shows a promising market trend to get an idea of the proper direction.

The daily time frame is used mainly for swing trading as it gives a better understanding of where the market currently is and where it might go in the future.

Institutions, large firms, and mutual fund organizations usually use daily time frames.

Example

Swing trading also depends on the currency pair you choose; the pair must have sufficient volume and volatility.

We have chosen the GBP/USD pair for trading swing as this pair is volatile and keeps moving majorly in an upwards direction.

Bullish

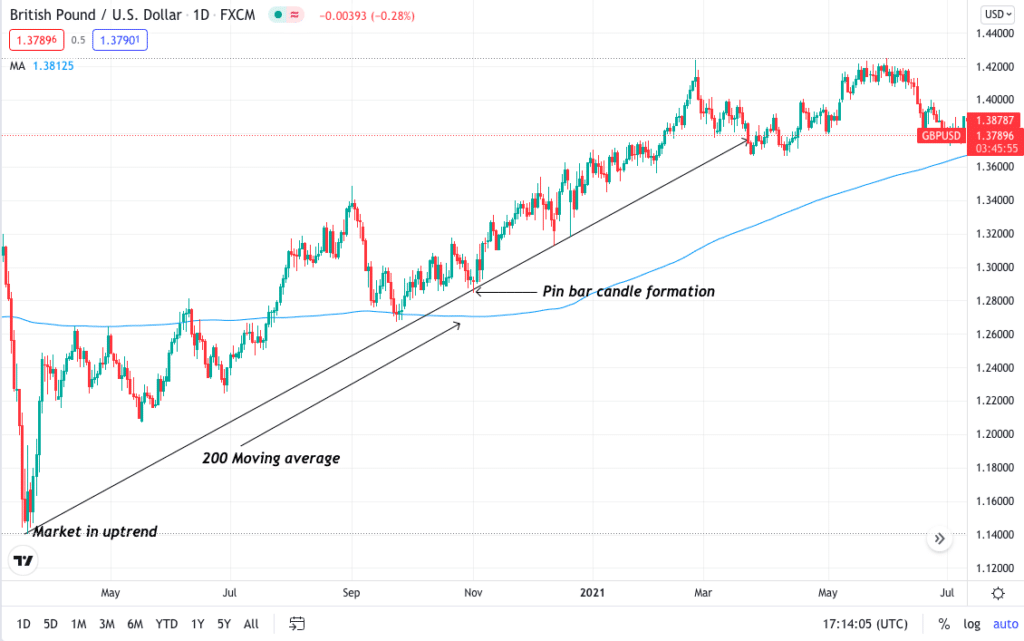

In the below GBP/USD daily time frame, you can see the market moving in an uptrend. Also, you will try to find some good candlesticks that show continuation or reversal, in this case, pin bar.

You can use the 200-moving average for better trade confirmation. The pin bar here is seen touching both the trendline and is near the moving average.

Bearish

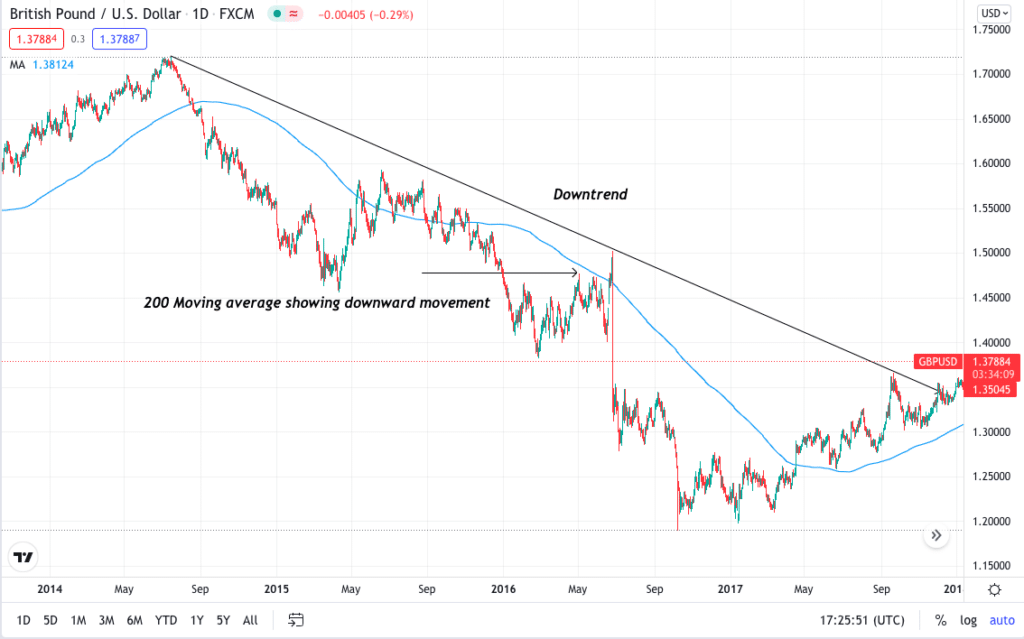

In the below GBP/USD daily time frame, you can see the market moving in a downtrend. Also, near the moving average and trendline, a big bearish candle rejection showed seller strength to be significant.

H4 time frame

The 4H time frame is by far the best for swing trading. Here the trader can keep an eye on the candlesticks and price pattern formation.

The market always makes some structure as it moves in a waveform, making highs and lows. The 4H time frame is the best for looking at and analyzing the system. It is also used to look for breakouts.

Example

No other time frame is better than 4H as the market tends to tell everything you need to know here and mainly the price patterns.

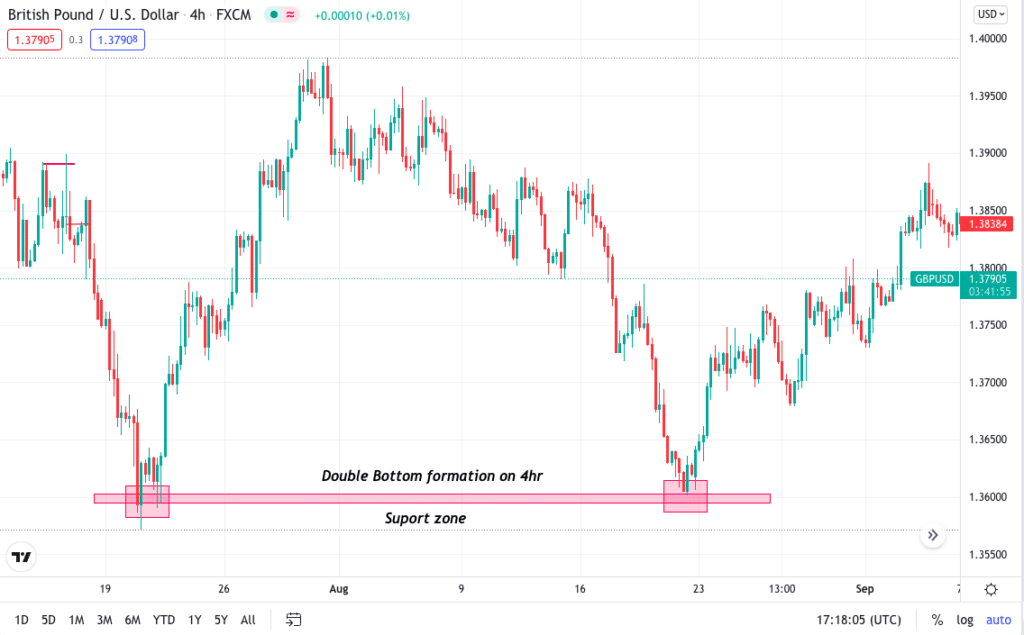

Bullish

Double bottom is a very accurate bullish reversal pattern and, if found in 4H, gives a higher trading opportunity. Here the GBP/USD chart of 4H shows this pattern. You can see how the market touched the support for the first time, went up, and tried to break the zone but was unsuccessful. Moving forward, the price after touching the zone showed a massive movement towards upward.

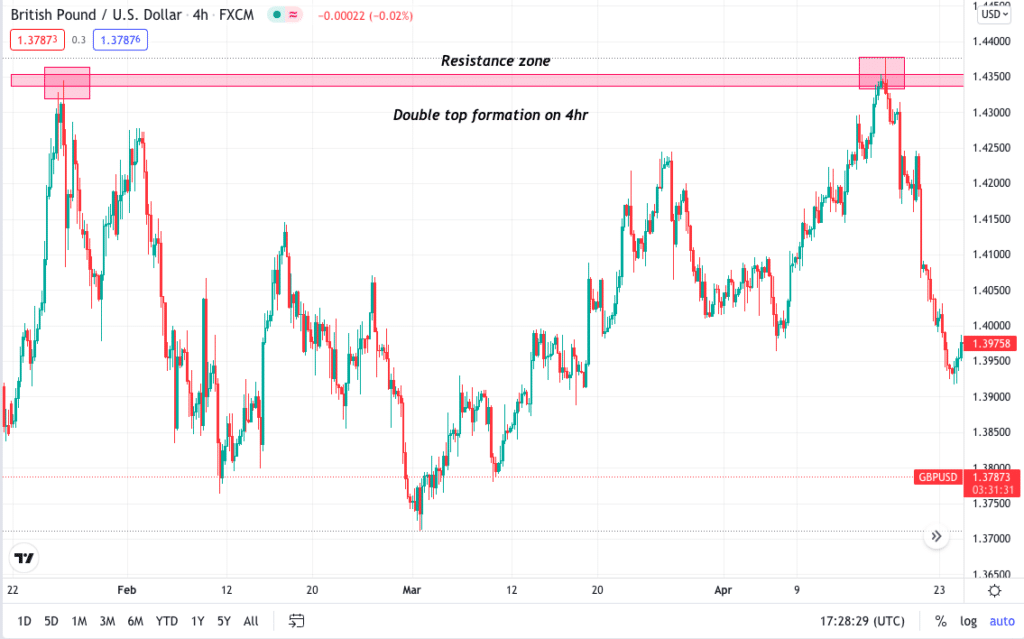

Bearish

A double top is a bearish reversal pattern; in the below example of GBP/USD 4H, you can see the pattern formation. The second touch shows a good rejection with a seller candle formation. There is where lies the selling trade opportunity.

H1 time frame

The 1H time frame is excellent for looking into the price rejections for a specific pattern formed in 4H. The price formed a wedge pattern on 4H, 1H will show the exact fluctuations and rejections and guide us where to take the trade.

Hourly time frame sometimes also gives a good knowledge of market sentiment. Swing traders generally use 1H time frame for deciding the entry price and trade execution.

Example

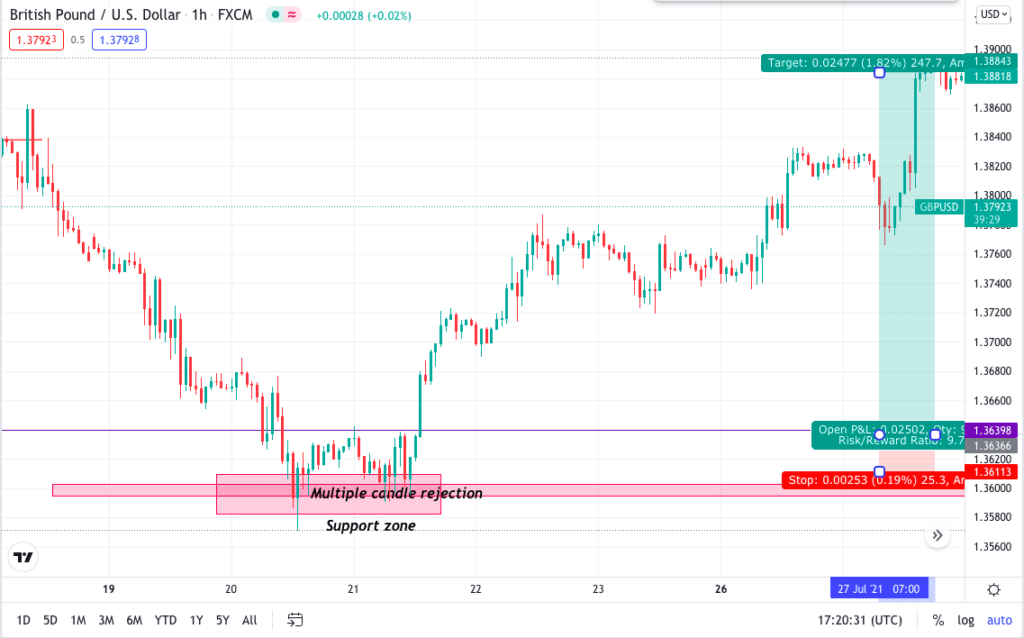

If you call yourself a swing trader, then you must be familiar with the breakout strategies. 1H is a solid time frame to look for multiple candlestick rejections, breakout, and retests.

Bullish

In the below GBP/USD 1H time frame, you can see multiple candlestick rejections at support. This signifies that the market does not want to go further down. Once you take the trade, you need to hold it for longer.

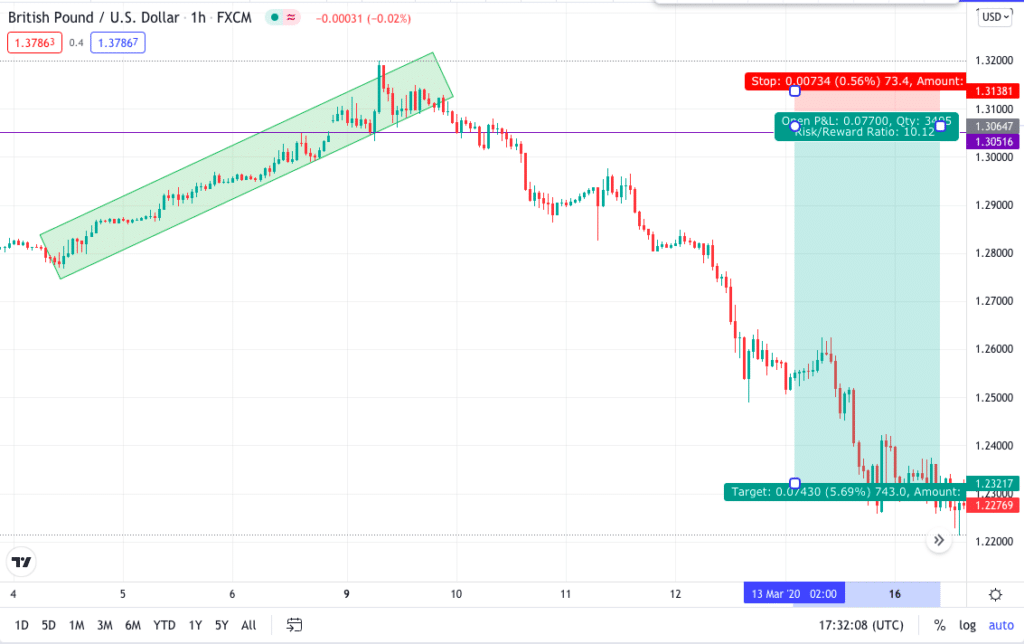

Bearish

In the below GBP/USD 1H time frame, you can see the market was heading up; the green box on the chart represents the bullish channel. Once the market broke the channel and the swing low, there was a significant move towards the downside.

Pros & cons

Although swing trade does not have too many limitations, some are worth looking at before deciding.

| Pros | Cons |

| • One trade making a good profit Swing trade allows you to take one single trade and gain massive profit. • Higher time frame supports the analysis Usage of the higher time frame in swing trading makes the trade accurate by decreasing the noise. • Less screen time More time on analysing a perfect trade setup but less time on screen. | • Overnight trade holding You will end up paying more commission and swap charges. • Unwanted market movement News events can totally change the market direction, stopping you out of the market. • Prone to greater losses If not appropriately analyzed, swing trading can give more loss than day trading. |

Final thoughts

Swing trading along with multi-time frame analysis can significantly increase your winning ratio. The primary reason to say so is that you tend to know all the market movements.

Looking into the correlations can also prove to be a good option in swing trading. Monitoring the trades from time to time is the only task you have once you have your proper stop loss and take profit. Holding the trades overnight and for too long is harmful when you do not use appropriate risk management strategies.