Simple binary options are trades where you gain a fixed amount or lose it all, but by hedging, you can minimize your risk and avoid the total loss of your investment.

There are many different ways of hedging in binary options. Experienced traders often use these techniques to cap their losses and make smarter trades. As a result, you can be a part of the small portion of successful traders that avoid gambling and consistently make profits by applying hedging strategies.

While everyone wants to maximize their profits from every trade and focus solely on rewards, what differentiates successful traders is their ability to limit losses. Find out how to use hedging techniques so you can join the small group of traders who succeed.

How does binary options hedging strategy work?

Like in other trading markets, hedging techniques are used to protect your capital when the market goes against you. Typically, hedging strategies consist of trades in opposite directions.

When the trades do not go your way, especially when it comes to binary options, suddenly, the losses will become more dramatic. The way traders solved this problem was to make trades that made up for the losses of the first trade.

There is no way to avoid risks, and typically hedging has a side effect on the reward side. Even though some traders may work out better without hedging, hedging options are better to trade in the long run.

Reason to use binary options hedging strategy for traders

Binary options trading has a big downside. Once you lose the trade, you lose all the money invested. Only some brokers rebate around 15%. A way of avoiding losing all your money is by setting stop-loss at a given point.

The problem with stop-losses is that sometimes the price of an asset can retrace before getting the trend direction we want. If the retracement is enough to reach our stop-loss, we’ll be out of the trade. So, if the price trends the way we want it, we won’t see the benefits since we already have exited the position.

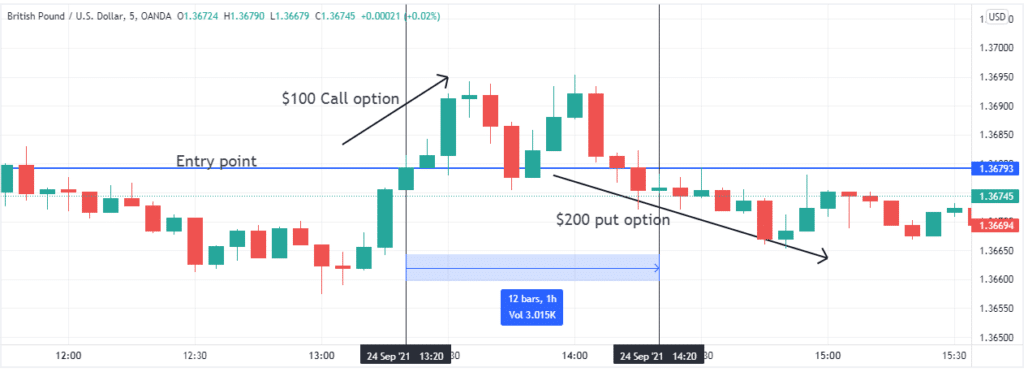

Let’s take a look at the following trade to see how hedging options could outperform stop-loss. Two traders put binary options on the pair GBP/USD at 1:20 PM, the option expires in an hour, and the cost of the call is $200.

The reward offered by the broker is 95% of the investment. Both traders are worried about the trade going against them, so they use different strategies to protect their investment. The first trader sets a stop-loss while the second trader uses a hedging strategy with two opposite options. Let’s see how they went.

For the first trader

- The entry-level was 1.36793, and he set the stop-loss at 1.36913.

- Around 15 minutes later, the stop-loss was triggered, and the trader exited the position.

- Let’s assume that he recovers 50% of his initial investment.

For the second trader

- He buys both a call and a put option.

- Since his sentiment is bearish, the put option doubled the call option, so the cost of the call option was $100.

- Like the first trader, the hedging trader thought that the trade was going against him 15 minutes after the entry.

- But in the end, the trade went his way, and the put option paid off, giving him a $195 profit.

The table below summarizes the balance of each trader.

| Trader | Put option cost | Hedging cost | Total investment | Earnings for winning option | Money saved | Final balance |

| Stop-loss trader | $200.00 | $0.00 | $200.00 | $0.00 | $100.00 | -$100.00 |

| Hedging trader | $200.00 | $100.00 | $300.00 | $390.00 | $0.00 | $290.00 |

How to use it?

The more traditional setup for hedging binary options is to buy one call, and one put option on the same asset with the same expiration date. As a result, this setup limits both losses and profits if the trade doesn’t go as planned.

Of course, these limits are a big problem in other markets like regular options trading, where your profits could be unlimited. But for binary options, the profit is fixed, so what you are doing by hedging is to change the margins the broker offers you to risk a lower amount of money.

Now, some brokers don’t allow traders to make two opposite options on the same asset, so you have to find a way around it to protect your investment.

The two most popular options to sort out these problems are:

- Use different brokers. If your broker doesn’t allow you to put two opposite options for one asset, you should put one call in one broker and a put option on the other broker.

- Use related assets. Some assets like currency pairs are related to each other. For example, EUR/USD and GBP/USD move in the same direction. So by buying a call on one and a put in the other, you get the same hedging effect.

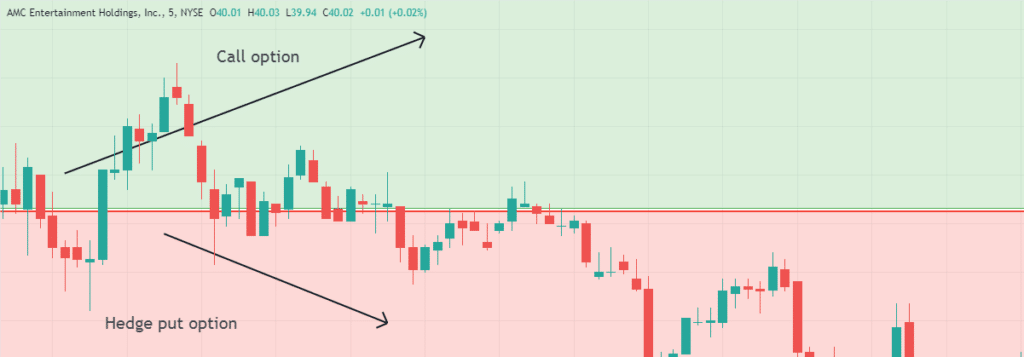

Bullish trends

The setup for hedging binary options during a bullish trend consists of buying a big call and buying a smaller put option.

Where to enter?

The entry point depends on the indicator you use to determine where the price is going. In general, we recommend avoiding short periods since it is much harder to figure out where the price is going in short time frames.

Where to put the stop-loss?

When hedging, one thing you want to avoid is to use stop-losses, so you can have a chance of winning the trade till the last minute. However, sometimes it doesn’t make sense to keep an option that is going wrong. We recommend putting the stop-loss when the price is 75% below the entry price.

Where to put take-profit?

In binary options, you can almost double your investment, but hedging reduces that payout. Since you’re already hedging your investment and as a result, your reward will be lower, for a take-profit to make sense, it should be close to the max profit. Therefore, we recommend setting a take-profit at 80% of the max reward you could make after hedging.

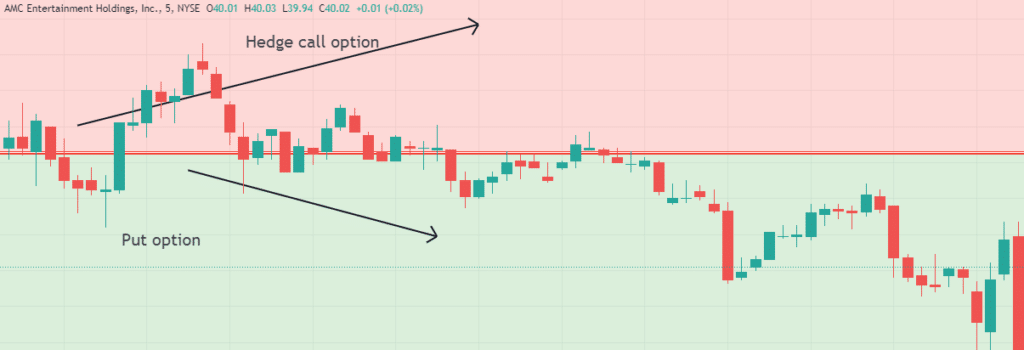

Bearish trends

The setup for hedging binary options during bearish trends is to buy a put option and then buy a smaller call option.

Where to enter?

The entry point depends on the trader’s strategy. Support and resistance levels are always good choices. Once the price breaks out below the support level, it is time to enter the position.

Where to put the stop-loss?

Stop-loss should be far above the entry level. 75% above is a good point to set the stop loss on the put option. You could also set a stop-loss on the call option if you are sure the trade is going your way.

Where to put take-profit?

Take profit should be at least 80% below the entry-level, so the hedging with the call option makes sense.

Pros & cons

| Pros | Cons |

| •Risk management If the trade doesn’t work out, you get some of the money back instead of losing it all. | •Brokers Many brokers don’t allow you to hedge directly, so you have to sort out the limitations. |

| •Reward/risk personalization You can adjust the amount of money you could make or lose according to your preferences. So, with this strategy, you no longer depend on the broker’s rates. | •Maybe it is not necessary For example, some traders don’t like hedging on binary options since they could get the same result in the risked amount of money by just investing less money on the options they buy. |

| •Better than stop-losses Instead of protecting your money by exiting the trade as stop-losses do, hedging allows you to limit your losses without leaving the trade. | •Capped reward Since binary options have capped rewards. By hedging, you get even more limited profits. |

Final thoughts

Hedging is an excellent way to personalize one’s risk/reward ratio in a market with fixed incomes, such as binary options. By hedging, you can limit your losses which sometimes is even more critical than getting more significant profits. Unlike stop-losses, hedging is a strategy that allows you to keep in the trade until the last moment and still avoid losing your entire investment.