One of the reasons many traders like forex trading is the use of leverage. Unlike stock or other markets, forex presents you with much greater leverage.

But what is leverage, and can you invest in the forex market with it? In this guide, we are going to answer all your questions about this FX tool.

Forex leverage explained

The tool gives you the ability to trade with more capital with fewer funds in your account. Sounds too good to be true?

A forex broker allows you to buy more with fewer funds by using leverage. Think of it as a market tool, which presents you with an opportunity to buy more. Brokers are at the center of this discussion, as they are the one that provides you with leverage. They allow forex trading on margin.

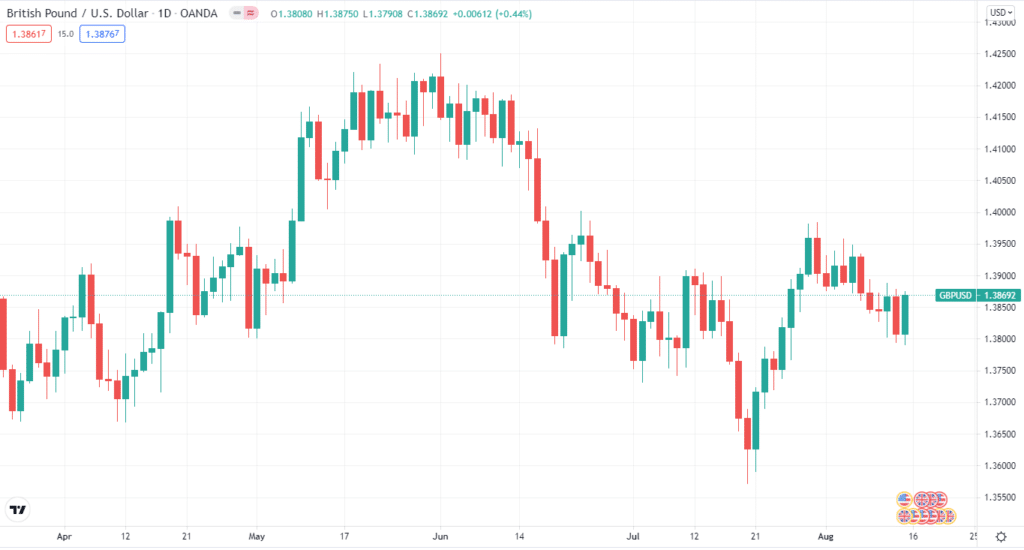

Let’s look at a GBP/USD chart. To buy or sell 5000 units of USD/CAD without leverage would require you to put up $5000 in our account. However, with 1:100 leverage, you only need $50 to go long or short on the GBP/USD pair.

Leverage ratios

You get leverage of fixed ratio from your FX broker. Every broker has a different concept of leverages, so make sure to check it before using it. Generally, brokers offer leverage ranging from 1:5 to 1:3000.

A leverage of 1:100 means that if you have a $10 in your account, you can place a trade of $10,000 value. This is what draws many traders, as you have a chance to make a great amount instead of going with your real account funds.

A key point to add here is that your brokers do not provide you with large leverages from the goodness of heart; they require some security or insurance.

To control a $10,000 position, your broker will set aside $100 from your account in forex. Thus, your leverage will be 1:100. Thus, you have a $10,000 buying power with $100.

The $10 is an amount you need to have in your account to open a position of $10,000 with leverage of 1:100. This amount is known as margin. It is a good faith deposit that your broker requires from you to open leverage-based positions.

Margin signifies a percentage of a particular amount. Many brokers have margin requirements of 1 or 2%, depending on your used leverage. Brokers that offer high leverage like 1:1000 have less margin requirement.

For instance, in our above example of 1:100 leverage, the margin requirement was 1%.

A double-edged sword

There’s an old saying that leverage is a double-edged sword. What they meant was the tool can make or break your trading account. If it can give you a chance to make good sums, it can also take them away from you. The greater leverage you use, the greater your capital risk will be.

Let’s illustrate this point with an example.

Suppose you are long on GBP/USD. Then, if the GBP/USD price moves from the current price of 1.3869 to 1.3969 (100 pips) in the next week, you will make $10 on each trade with the account of $1000.

If the opposite happens and the price moves to 1.3769 (100 pips) in the following week, you would lose $10 on each trade. So, that’s how leverage is a double-edged sword.

Many pro traders are against using too much leverage. They think that by keeping your leverage ratio low, like 1:10 or 1:20, you don’t put too much stress on your trading account.

How to invest in FX with leverage?

A vast amount of leverage doesn’t mean you should use it. Yeah, it gives you more buying power, but it is a double-edged sword. You have to use the leverage in a way that can keep your profits consistent.

When adding to a profitable trade, leverage is a solid option. This is an excellent use of leverage if you have a strategy that has performed well and want to add to it.

When it comes to leverage, don’t go for scalping or intra-day trading. It’s tempting to utilize high leverage to make quick money on single trades, but the dangers aren’t worth it. This is especially true given the uncertainty of the future.

There is no perfect leverage, but we advocate using more considerable leverage on a small trading account and trading small volumes as a beginner. At the same time, you educate yourself and create your trading plan.

Suppose a trader uses careful money management, such as risking the only % of their balance per transaction and only entering one deal. In that case, it makes no difference whether he uses 1:2000 because they are committed to risking only a small percentage of their balance per trade.

Pros and cons of using leverage

| Pros | Cons |

| •You only need to deposit a small fraction of your capital, and leverage can increase your profits. | •The most significant and often feared disadvantage of leverage is its ability to magnify losses when there’s market volatility |

| •It is an effective tool against low market volatility. | • Your risk to leveraged positions is unrestricted by the size of your trade or your trading account balance. |

| •By using leverage in FX, you can take advantage of long and short positions. | • Your broker may demand further deposits to pay the agreed margin requirement if your margin requirements surpass your trading balance, which is known as a margin call. |

| •As the FX runs round the clock, you can harness leverage with more profitability. | |

| •This tool can provide greater returns in a short period. |

Final thoughts

You don’t have to remain a distance from leverage. Yes, it is a two-edged sword and can hurt your account, but leverage won’t do much to your account as long as you follow risk management.