Stock in a company that mines lithium or manufactures lithium-based products is referred to as a lithium stock. Lithium has grown increasingly desirable because of the expanding electric vehicle (EV) market. For example, Tesla, which relies on lithium, was commended by Elon Musk.

Electric cars’ batteries are powered in part by this rare and precious raw element. With the rise of “green” initiatives throughout the globe and the shift to environmentally friendly vehicles, lithium has become a hot commodity.

As a result, having lithium stocks in your portfolio early on may pay off handsomely for investors. This article will go through the top five lithium stocks to pick up in 2022.

Can you make real money with lithium stocks?

Lithium stocks hold solid potential, which can help you generate a good profit if you invest in them for the long term.

How to earn lithium stocks?

You can buy lithium stocks and HODL. Besides, you can also indulge in trading lithium stocks to profit. Lithium stock investments have performed well in recent times. However, before making a purchase, always consider the investment’s risk.

How to start with lithium stocks?

There are several platforms where you can buy and invest in stocks. For instance, you can begin with eToro or Robinhood. For example, lithium stocks are listed on several platforms.

Top 5 best lithium stocks to invest in

Albemarle Corp. (ALB)

One of the world’s leading lithium producers is Albemarle Corporation, which has facilities on six continents. In addition to lithium, the company generates a wide range of other lithium compounds.

As well as possibilities for consumer electronics, these compounds also hold promise for application in electric vehicles. Albemarle has secured long-term contracts with its customers as lithium prices have fallen.

Apart from bromine and catalyst, Albemarle is a producer of several products used in various sectors. These initiatives are expected to be completed in several months, putting the company on track for future development.

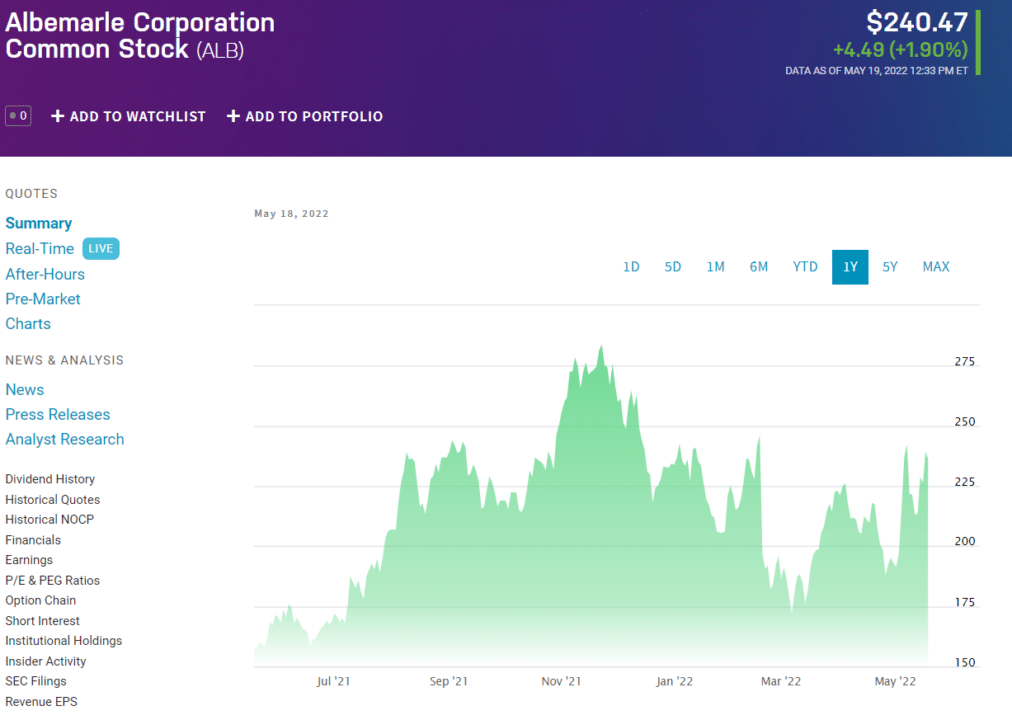

The dividend yield of Albemarle is 0.79%, and the stock price has risen 19% during the last year.

ALB price forecast 2022

The stock price of ALB can reach $198.98 by 2022. This price prediction represents a -5.65% loss over the current price of $240.47.

ALB price forecast 2025

The stock price of ALB can reach $137.35 by 2025. This price prediction represents a -34.87% loss over the current price of $240.47.

Livent Corporation (LTHM)

The US-based chemical manufacturing company is noted for its lithium compound manufacture. In addition to electric vehicles, portable electronics, aerospace alloys, and other industries, lithium products are used in these and other industries.

A lithium hydroxide supply agreement with Tesla’s key supplier, Livent, spans through the end of 2021. Despite the current uncertainties, Livent expects that this cooperation will continue. In addition, the company has agreed to provide lithium batteries to BMW beginning in 2022.

Livent plans to enhance carbonate output in Argentina and hydroxide capacity in other locations to continue growth. In the fourth quarter of 2021, sales and earnings per share surpassed projections, helping to keep stock prices positive.

Investors should keep an eye on a possible long-term partnership between Tesla and Livent, which might significantly impact the stock price in the future.

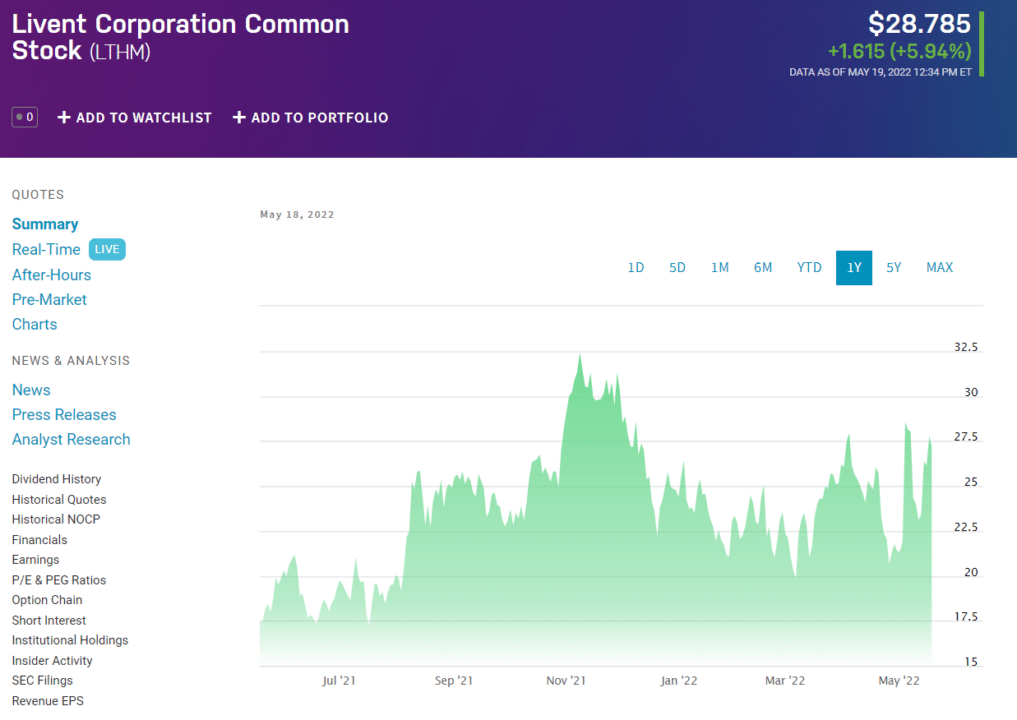

LTHM price forecast 2022

The stock price of LTHM can reach $29.62 by 2022. This price prediction represents a 6.7% gain over the current price of $27.20.

LTHM price forecast 2025

The stock price of LTHM can reach $47.4 by 2025. This price prediction represents a 70.74% gain over the current price of $27.20.

QuantumScape (QS)

The company is developing solid-state batteries. This method offers a far faster charge and a much higher energy density than existing battery technology.

How quickly would you say that? Indeed, according to extensive study, batteries in electric cars should be able to charge up to 80% of their total capacity in about 15 minutes using domestic sources and should last around 12 years under ordinary use conditions.

Even though the firm may not be ready for full-scale production, Microsoft founder Bill Gates has invested in the company as an early investor. As a result, a lot of people are excited about QuantumScape. In the SPAC transaction that made the firm public, the company was valued at $3.3 billion, but it is now worth more than $20 billion. That’s a rise of almost 500% in less than a year.

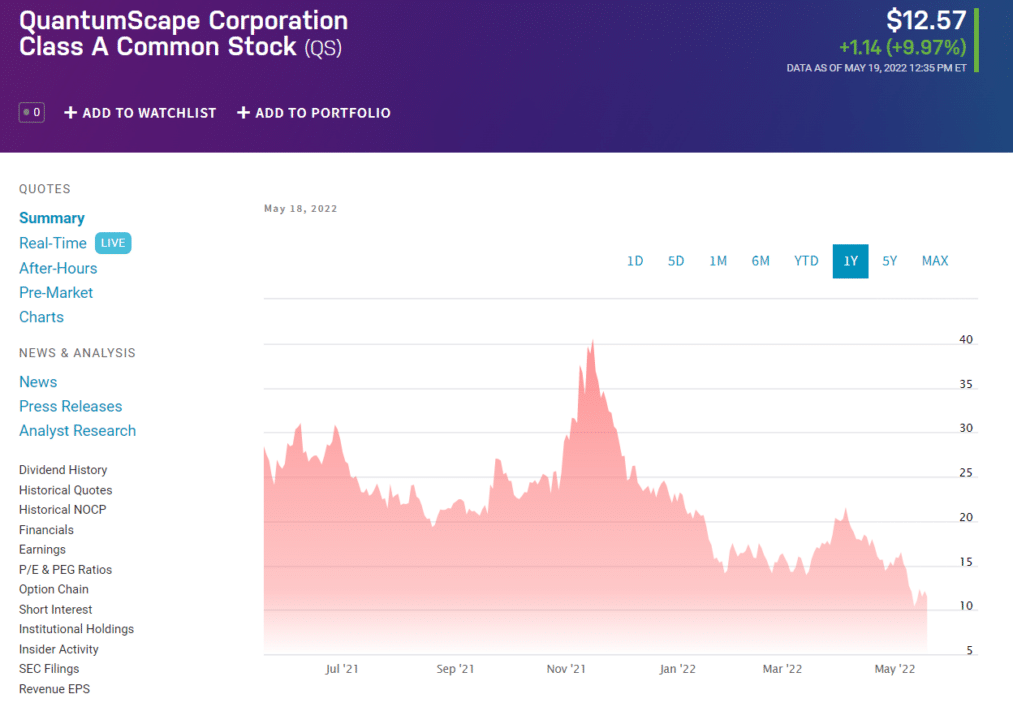

QS price forecast 2022

The stock price of QS can reach $3.06 by 2022. This price prediction represents a -47.96% loss over the current price of $11.44.

QS price forecast 2025

The stock price of QS can reach $6.44 by 2025. This price prediction represents a -46.83% gain over the current price of $11.44.

Piedmont Lithium (PLL)

Located in North Carolina, Piedmont Lithium is a lithium exploration and production firm. An electric vehicle and battery storage industry that is quickly increasing needs a local source of lithium hydroxide. Quartz, mica, and feldspar are also mined in the United States and used in various industries.

Piedmont has provided spodumene from its North Carolina mines to Tesla for several years as part of a deal struck last year. Currently, Tesla is building a facility in Texas to process spodumene, with the first exports anticipated in 2023.

Piedmont Lithium’s maiden public offering (IPO) emphasized its desire to become a leading US provider of battery-grade lithium, generating $57.5 million for future initiatives. In addition, the company aims to be the cleanest lithium hydroxide facility in the world.

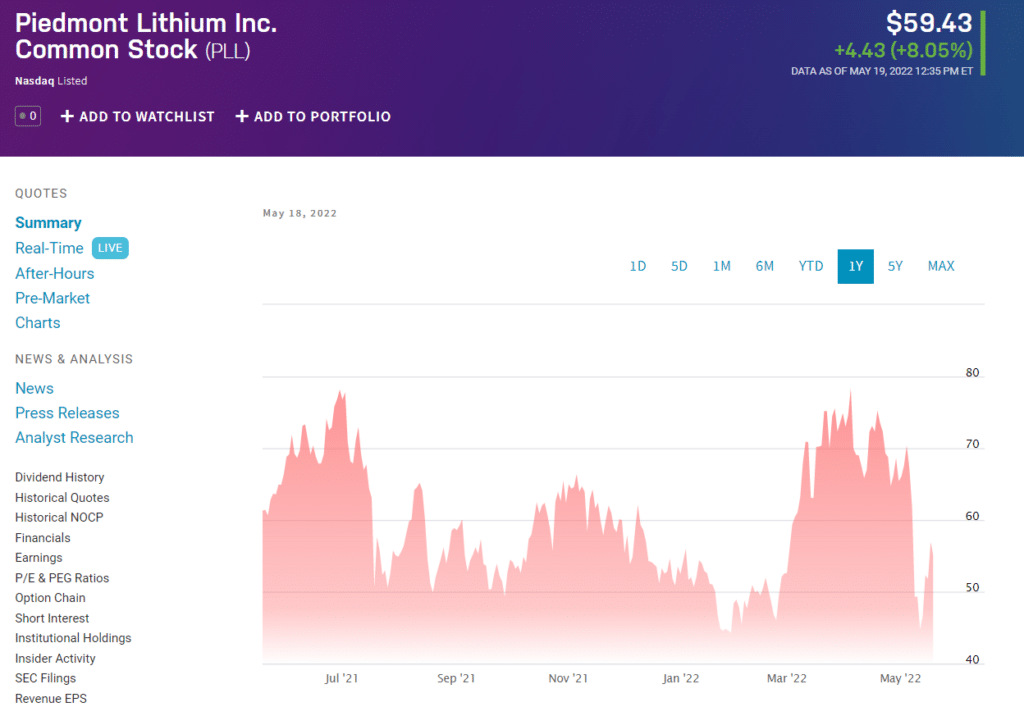

Investors have been on a roller coaster ride over the last year as they await Piedmont’s expansion. However, if you buy shares right, both short-term and long-term investors may gain.

PLL price forecast 2022

The stock price of PLL can reach $71.54 by 2022. This price prediction represents a -2.59% loss over the current price of $55.00.

PLL price forecast 2025

The stock price of PLL can reach $186 by 2025. This price prediction represents a 2.11% gain over the current price of $55.00

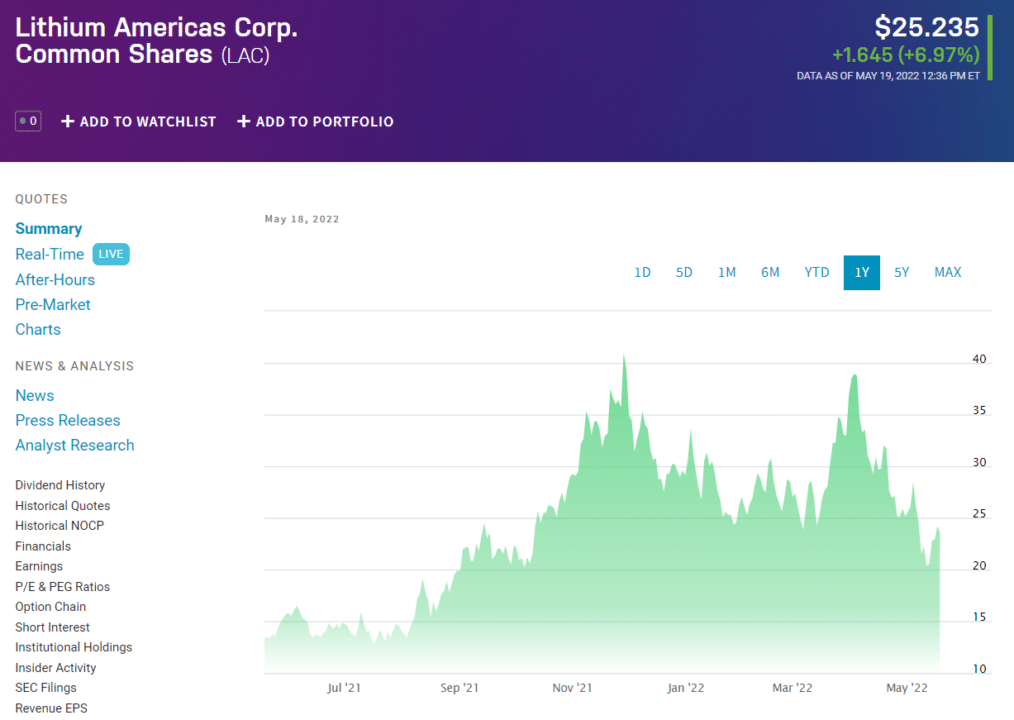

Lithium Americas Corp. (LAC)

In Canada, the lithium mining company Lithium Americas has focused on projects in Argentina and Nevada that are in the early stages of development. An investment of $5 million in Arena Minerals allowed the company to extend its operations in Argentina.

Both Lithium Americas and the Thacker Pass Project in Nevada has boosted their investments in the latter. As a result, the mining industry is rapidly preparing to commence mining despite the absence of revenue.

Because of this, Lithium Americas has offered to purchase Millennial lithium and its Argentine mine. As a result, the price of lithium might rise if the company starts harvesting lithium as anticipated in mid-2022.

LAC price forecast 2022

The stock price of LAC can reach $36.63 by 2022. This price prediction represents a -1.64% loss over the current price of $23.59.

LAC price forecast 2025

The stock price of LAC can reach $79.79 by 2025. This price prediction represents a 0.74% gain over the current price of $23.59.

Final thoughts

The risk management aspect of investing may need some attention. Lithium stocks are a popular commodity right now, drawing short-term speculative speculators. However, the shift to renewable energy has reached a tipping point. Investors with a longer time horizon would be advised to battle their way through the market ‘noise.’ When it comes to investing in lithium, seeing and following patterns is the key to long-term success.