Futures trading is available in several markets, like stocks, crypto, and commodities. Investing in this asset is a unique way to benefit from exposure to cryptocurrencies without owning it. But can the average investor take part in this game, or it’s too complicated?

Let’s look at the details of futures contracts, their cost, and benefits in the crypto market.

What are futures crypto contracts?

Digital currencies are sold and bought at a quoted price at a future date. Other than crypto, assets that could be traded are soybeans, coffee, oil, stocks, ETFs, currencies, and others.

Futures contracts are agreements between traders and the exchange to buy or sell a specific quantity of an asset at a specific price. Upon completion of the contract, it seems that the seller must provide the supply, and the buyer can take possession of the product when it is delivered.

In general, crypto futures contracts protect traders against negative price fluctuations and volatility associated with digital currencies. These assets are a good way to invest in digital currencies without having to own them yourself in actual currency. In general, crypto futures protects traders from adverse price variations and the high volatility of digital currencies.

Assets like these are a less expensive and more inclusive alternative to traditional investments. The traditional method of investing is often much more complicated than cryptocurrency. As it requires little money and doesn’t require accredited investors’ approval, it’s a great solution.

Here is the question, how do crypto futures work? Using some examples, let’s explore it.

How can investors trade crypto futures?

With digital assets, there is a possibility to be negatively affected by bad press and high volatility. Nevertheless, some experienced traders can exploit the volatility of futures to maximize profits.

The market of these assets may not offer traders actual cryptos but rather the ability to trade with price changes.

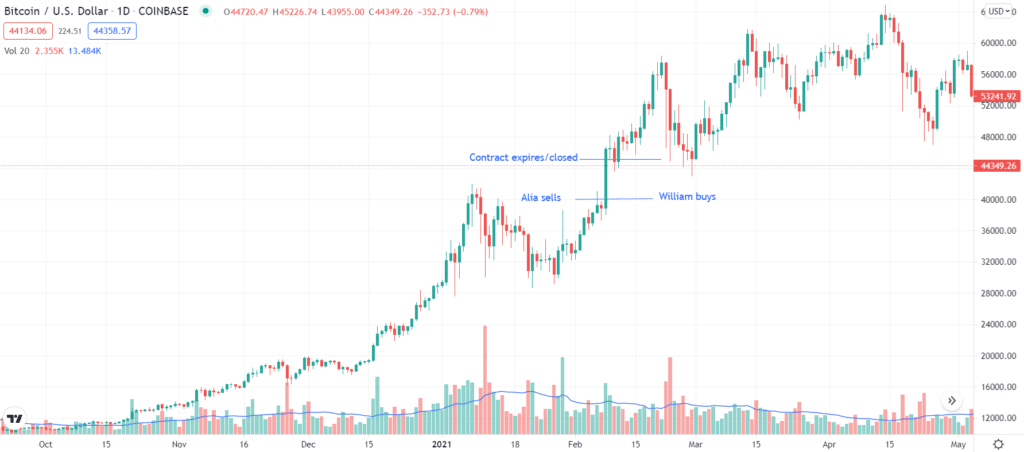

A simplified example will show you what we mean. William and Alia both entered a Bitcoin futures position worth $40.000 each. A long position is held by William, while Alia holds a short position. On expiration, they had settled $45,000 in futures contracts. Alia’s losing position entails a loss of $5,000, which means she has to pay the loss to herself. Subtract $45000 from $40000 to find the loss. In contrast, William stands to profit $5,000.

Investing in equities, indexes, or commodities in this way involves a risk of price appreciation on an asset. Bitcoin and Ethereum are digital currencies that are used as the underlying assets for crypto futures. As we mentioned earlier, the trade of futures does not require the ownership of crypto assets.

The traders who deal in futures contracts must use cash when the contract expires and cannot physically deal in crypto.

Even though platforms that trade currency and crypto exchanges charge fees, part of the appeal is the ability to do transactions for a nominal fee. Thus, you might be interested in learning more about the trading pricing of these assets. Fees are an essential factor in determining the profitability of trading platforms and crypto exchanges.

Cost of trading futures contracts of digital assets

Traders pay transaction fees to operate their business, and such fees are inevitable in crypto trading. Therefore, each time you buy, sell, or convert a crypto futures contract, you must pay a specific fee.

Types of trading fees you should know

Traders of futures may be required to pay maker and taker fees, just as they will with other derivative exchanges, including bitcoin futures.

- Maker fees

Ordering above the market price or placing a limit order increases liquidity, and so fees are paid. Participants on the market and exchanges benefit from more significant order books. Compared with taker fees, maker fees are more favorable. When high-frequency traders make money, they tend to make the trading process easier for other traders.

- Taker fees

If you place market orders, you have to pay for the loss of liquidity from the order book. Because of this, makers charge higher fees than takers.

You have to ask yourself why you would want to trade crypto futures once you know the costs involved? There are several benefits to trading crypto futures, and you need to understand them.

Benefits of trading futures contracts

Trading futures has many benefits. These types of trades offer several advantages. Beginners will undoubtedly find it tricky and risky. With the right strategy, you can earn the most profits from trading futures.

Opens the market to investors

Futures contracts can be beneficial to risk-tolerant investors. A major advantage of investing is that it allows investors to access markets that would otherwise be unavailable to them.

Stable market requirements

Most assets are subject to margin requirements in the futures market. A trader knows what margin is needed in a contract, therefore.

No involvement of time-delay

Traders face dramatic drops in profitability as assets’ value declines over time when trading options. We can describe this as time decay. Futures are not affected by time decay, so you need not worry about it.

High liquidity

Future markets with digital currencies, in particular, are extremely liquid. Traders can thus enter and exit markets whenever they want.

Simple pricing

Are you aware of the complex pricing of Black-Scholes model-based options? Compared to that, futures are much simpler. Cost-of-carry is the basis for the model. By adding the carrying cost to the spot price of an asset, we calculate the futures price.

Therefore, we have seen a glimpse of what crypto futures trading has to offer.

However, to maximize your profit, you have to learn all the ups and downs of the market. There are also some disadvantages to this type of trade, such as:

- No control over futures events

- Leverage issues

- Specific expiration dates

However, if the trader applies effective strategies to maximize profits, they can reduce the risk factors.

Final thoughts

This type of contract predicts the future value of digital assets. The future crypto contracts entail delivering or receiving assets within a specific period. Knowing how futures exchanges work can result in tremendous profits. It can be profitable to trade futures occasionally. Making use of risk management techniques and knowledge will help you avoid enduring massive losses.

On trading platforms, you can find contracts not only for Bitcoin. They showcase many other products based on alternative crypto including Ethereum, Litecoin, Bitcoin Cash, XRP, and other popular coins.

This gives users more flexibility and allows for more complex strategies. Another significant advantage is that you can start trading with much less start-up capital than with institutional services. You don’t need to be a famous and wealthy trader to open an account. In other words, this trading option speaks of the possibility of accessing the market and financial instruments for ordinary people, not just for Wall Street investors.