Forex trading has become popular in the last few years, mainly because of the easy access that online platforms offer. As a result, every day, investing money in the forex market becomes a better option for millions of people who want to make some additional money and hopefully one day retire and become a full trader.

There is no explicit difference between trading and investing. You can maybe define one as the other by saying that trading is nothing but a short-term investment. However, here will try to separate both terms to answer how to adopt forex as an investment.

The main difference between trading and investing is philosophy. While traders seek to speculate and take advantage of the market’s volatility, investors try to generate value through their movements and often have long-term relations with their assets.

For example, a trader in the stock market will buy some shares of the XYZ company because he believes in its philosophy and trust in its products or services. On the other hand, a trader is looking for the shares price of that company to rise and then sell them at the best price.

Making an analogy for the FX market can be challenging because nobody buys a currency to invest in. The FX market is mainly speculative, so the best way of thinking about investing in forex is to put your eyes on the long-term reward. That is probably the most significant difference between traders and investors in FX.

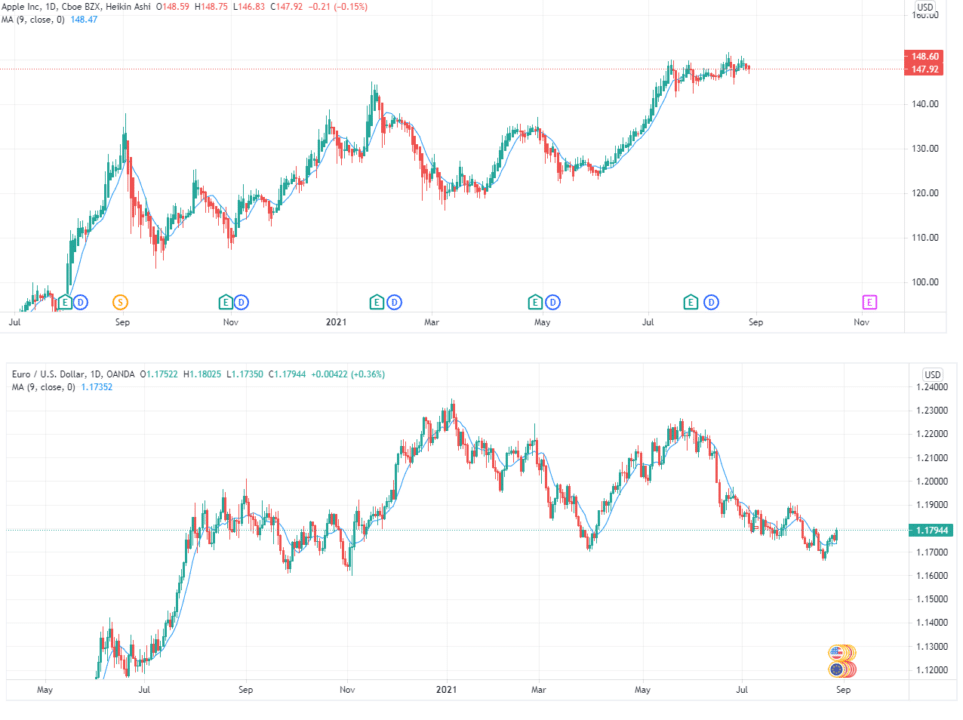

Above, we see the price of Apple’s share (first image) and the EUR/USD pair (down). Again, we used Heikin Ashi candlesticks to reduce the noise of the market. As a result, we can see how the share action moves up more stably while the pair has much more ups and down moves.

Understanding forex

The forex market consists of currency exchange. What you do is to buy a currency when you believe that its price is going to rise and sell it when you expect it to go down.

The FX is made of pairs because buying one currency is trading it for another one. This way, whenever you buy a currency, you are selling the currency you use to pay. So, for example, for the pair EUR/USD, if you want to buy an amount of that pair, you are getting some EUR in exchange for the equivalent amount of USD you paid to the broker.

There are four types of pair you can trade in most platforms:

- Major pairs

These are the most important currencies in the world regarding their intrinsic value and trading volume. Major pairs include EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, and AUD/USD. As you can see, major pairs always include the USD as a part of the pair.

- Minor pairs

These are other combinations of the major pairs, excluding the USD. For example, EUR/GBP, EUR/JPY, GBP/JPY, and EUR/CAD.

- Exotics

These are pairs that trade major currencies to the small or emerging currencies such as Russia, Poland, and Mexico.

- Regional pairs

These are currencies paired by the region. For example, New Zealand and Australia. Some regional pairs are EUR/HUF or JPY/KRW.

Why invest in forex?

There are many reasons to invest in this market instead of other options.

Small initial investment

Compared to some other financial investments, you can start trading with amounts as low as $50. In comparison, any major company shares are much more expensive. For example, Tesla’s shares are around $700 each, and Apple’s shares are over $145.

Liquidity

Forex is the largest market in the world. According to the Bank for International Settlements, in 2019, it traded 6.6 trillion dollars every day. This means that it’s easy to buy or sell whatever pair you want to trade.

Getting started

Entering the trading world is very easy compared to other markets. The times when only well-dressed-up guys get up at 5:00 am and read the news on the paper to go to their jobs on Wall Street are well behind. Now anyone can open a forex trading account and start trading.

But not just that, the options for choosing a broker are a lot, so they compete to give you the best deal. Depending on the broker, you can get free training, low fees, a demo account, and other advantages. It’s just a matter of looking for the best deal for you.

Very profitable

Once you understand the concepts and get your strategy, the possibilities for making money are strong. Of course, you won’t get rich overnight. 95% of traders lose money, but those who understand how this works can make a living from this.

How to trade correctly?

Prepare yourself

Before doing anything else, you need to understand how the market works. Millions of people are traders, and 95% of them fail. The lesson is that you can not be arrogant and believe that you will succeed where millions have failed without hard work. Before you get in, you need to study as hard as possible to be a part of the successful 5%.

Find the right broker

There are tons of broker options. You can find apps and website-based platforms to make deals for you. Include time in your forex study to choose the best broker for you. Your decision will depend on various factors such as fees, initial investment, training options, and others. But overall, the essential requirement is to check if it is a regulated broker. Before choosing your broker, check that a crucial regulatory institution accredits it.

Demo account

Even after reading all the trading books you can, signing up for every online course, and watching every youtube video about trading, nothing is better than practice. Many platforms offer demo accounts so you can practice your trading and develop your strategy.

Look, trading platforms want you to be profitable. They make money with every move you make, but you will only keep trading if you make money, so they want you to keep trading. That is why they offer these options. They want you to make a profit. You should take advantage of this and use all the tools they give you. You can amend your errors and find your trading strategy before trading real money on a demo account.

Keep your eyes on the long-term reward

Once you feel that you are ready, open your real trading account and start trading. Use what you learn and apply it carefully to your trades. Be disciplined, enter the trade once you confirm the trend, get out before it reverses. Of course, you won’t get all the money you could, but being patient will keep you alive until you finally get how this works and start making the profits you want. Hopefully, you’ll make a living from this.

Final thoughts

The forex exchange market is the biggest in the world. However, anyone who desires to invest in FX needs to know that it’s not easy.

95% of traders fail, and to not become one of them, you have to do things differently. Investing is putting your money to you, and that’s what traders do. But to be successful and have the results you expect, you need to be disciplined and understand that you can only make money one pip at a time.