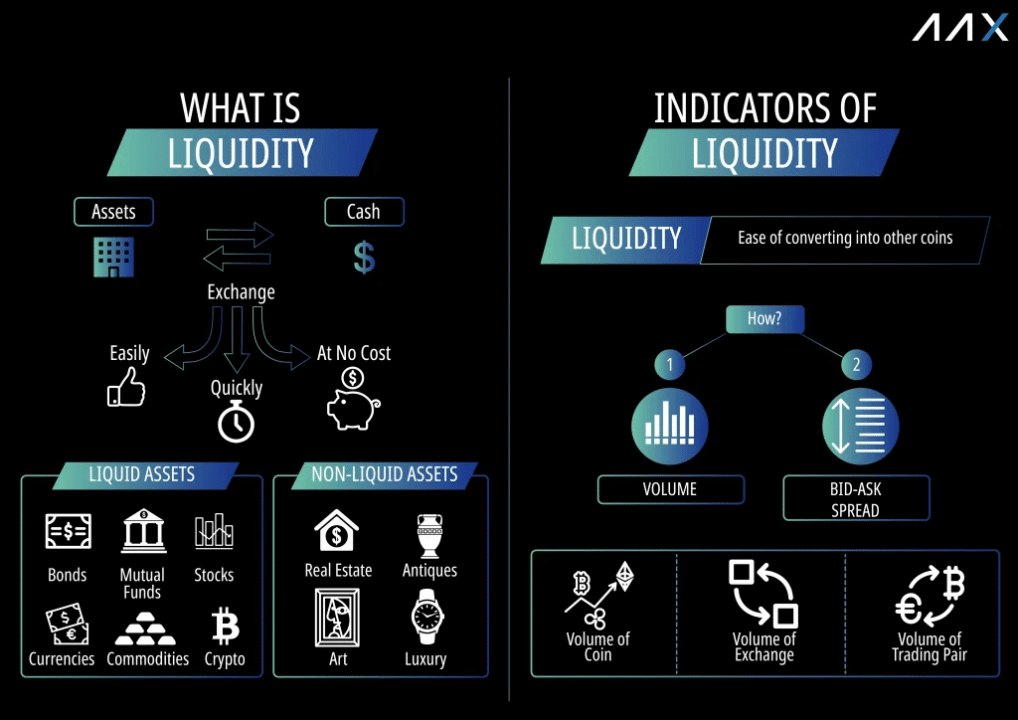

Liquidity is a critical notion in the fast-paced cryptocurrency markets that any trader or investor must thoroughly understand before making any investment choice. The primary goal of crypto liquidity is to make it easy for traders to buy and sell assets. In addition, liquidity in cryptocurrencies refers to the ease with which a coin may be swapped for fiat cash.

Because the crypto market is infamous for its volatility, liquidity is a crucial consideration. This guide will talk about the liquidity-constrained crypto investment strategy and what you need to know before applying the strategy.

What is the liquidity-constrained crypto strategy?

Liquidity is considered a coin’s capacity to be exchanged into cash without jeopardizing its value, critical for any cryptocurrency exchange. In addition, liquidity is crucial to traders because it dictates whether they will be able to join or exit deals at their desired positions or not.

Because the crypto market is one of the most volatile marketplaces accessible today, when liquidity is strong, traders can enter or exit a position at any time.

High liquidity

- High liquidity is essential for fair asset values, market stability, technical analysis accuracy, and faster transactions. In addition, high liquidity indicates that an asset may be acquired or sold quickly without significantly impacting its price.

Low liquidity

- In contrast, low liquidity suggests that an asset cannot be obtained or sold rapidly. As a result, traders must quit positions immediately, or price fluctuations will disrupt their trading tactics. Alternatively, the transaction will affect its price substantially if it can.

The volume of crypto can give you a solid idea of how liquid crypto is. The trade volume indicates how many units of that crypto were traded in a specified time frame, generally 24 hours.

The trading volume of crypto reflects a market interest in that coin. For instance, BTC is the most liquid crypto on the planet, and it offers good buying and selling opportunities. Smaller cryptos with lesser trading volumes experience ongoing liquidity issues, resulting in market manipulation and attracting smaller investors.

So, it would help if you determined the crypto volume first for a liquidity-constrained crypto strategy.

How to trade using the liquidity crypto investment strategy?

When the market is hugely liquid, it means better pricing for brokers and traders since the quantity and size of buyers and sellers establish a balanced price for the instrument that all players can agree on.

Market volatility is severe when a lack of liquidity causes asset values to skyrocket. Conversely, when liquidity is high, it indicates that the market is steady and there are minor price movements. You should evaluate the liquidity of any crypto before opening a buy or a sell position. When the cryptos are less liquid, there are linked to more significant fluctuations, which come with greater risks.

The most critical thing to remember is that market liquidity is not always constant; it fluctuates on an evolving scale from high to low. It can be more difficult to exit your position if the market is volatile yet there are fewer buyers than sellers. In this circumstance, you may find yourself in a losing position. Many variables determine the price of crypto. It includes the volume of traders and the time of day.

Understanding liquidity can help you find spots when deciding whether to buy or sell a particular cryptocurrency, preventing you from incurring more extraordinary trading expenses or inefficiencies that might catch you off guard.

Bullish strategy

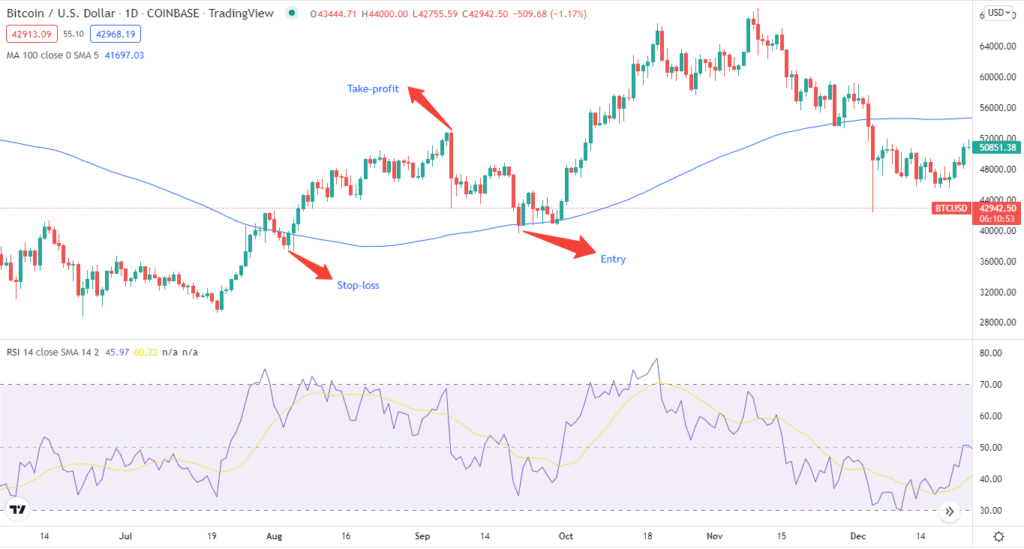

For a bullish strategy, it’s important to select liquid cryptos like BTC or ETH. After finding crypto, you need to look at the charts to find an uptrend. Then, you can apply indicators like the RSI or moving averages to find the trend’s course.

Let’s check a BTC/USD chart. We have applied for the 100-day MA along with the RSI. You can apply any indicator with this strategy.

Entry

To find the entry point, we need the price to go above the MA, and the RSI should be in oversold territory. It means the RSI should be below or at 30.

Stop-loss

You should note that SLs are an important part of a liquidity-constrained crypto strategy. You can place the stop-loss at the recent low.

Take profit

You can select multiple TPs for a take-profit or place it on the recent high.

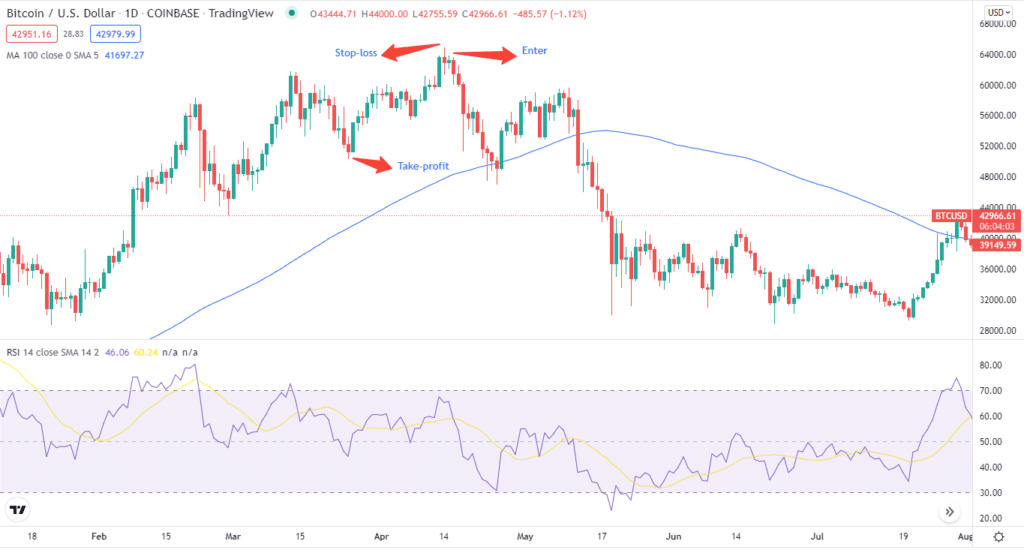

Bearish strategy

Just like the bullish strategy, you need to select liquid crypto for the strategy. For demonstrating the strategy, we have selected BTC/USD. You can select any other liquid crypto like ETH, ADA, XRP, etc. Again we have selected MA and the RSI for our bearish trade setup.

Entry

The price should be below the MA to enter the trade, and the RSI should be in overbought territory. It means that it should be at or above 70.

Stop-loss

You can place a stop-loss near the recent high.

Take profit

Again, you can either select multiple TPs or mark a recent low price level.

How to make $500 from this liquidity strategy?

Buys and sales can take place simply if there is liquidity. For example, consider the following scenario. Suppose you have the token XYZ, and it has the liquidity pair XYZ/BUSD. You can sell XYZ and obtain the BUSD in the liquidity pair if you have adequate liquidity. Furthermore, it is possible to buy or sell because the two tokens were delivered in equal quantities.

You can’t sell if there’s no liquidity. However, you can swap your tokens at the “current fair market price.” However, if there is insufficient liquidity, you may wind yourself purchasing above the market price or selling below the market price because you have cleared the order book.

As previously stated, the amount bought/sold in a liquid market does not affect the market.

Final thoughts

When considering a liquidity-constrained strategy, it’s essential to be aware of the trading volume. As the crypto market is highly volatile, a news ticker can cause market panic. So, it’s vital to consider all the factors before applying the strategy.