Options trading has become a reliable way to make money from the crypto market. Option trading strategies like long straddle are readily applicable to the Bitcoin market to benefit from the price fluctuation. Although this method is very profitable in the traditional financial market, many people wonder whether it will be profitable to the crypto market or not.

If you are intended to extend your trading portfolio on BTC options trading, the following section is for you. Here we will discuss the nuts and bolts of the long straddle crypto strategy that might increase your profitability in the cryptocurrency market.

How does it work?

The recent surge in the crypto market encouraged many traders to get involved. Moreover, the application of options trading in cryptocurrencies opened a new era in the market where people can easily manage their position, hedge risks, and make profits. However, in financial trading, there is no alternative to having a profitable trading method where the risk and rewards are predetermined in a controllable manner.

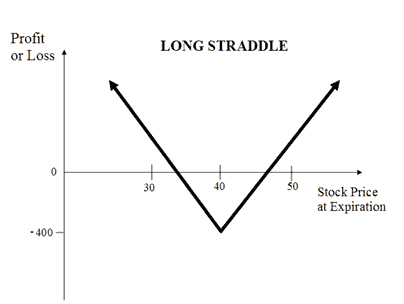

In this way, the straddle crypto has become a popular method in crypto trading where the basic idea of the straddle is to open two orders on the same crypto asset that will offset each other. In this method, we are talking about options trading where buying a call and put option will open the straddle crypto trade where the expiry and strike price will be the same. However, the opposite version of the long straddle is the short straddle, where investors should perform the opposite trade by selling call and put options simultaneously.

Reason to use the strategy for traders

It depends on investors’ speculation about the crypto tokens’ performance. Generally, the long struggle is profitable when the price movement of an asset is very fast, and it might show a sharp price movement. Conversely, the put option is applicable when the price movement remains uncertain due to excessive volatility.

How to use the strategy?

This strategy is suitable for an instrument with impulsive pressure on the buying side. Therefore, it perfectly matches cryptocurrencies behavior where excessive volatility is widespread.

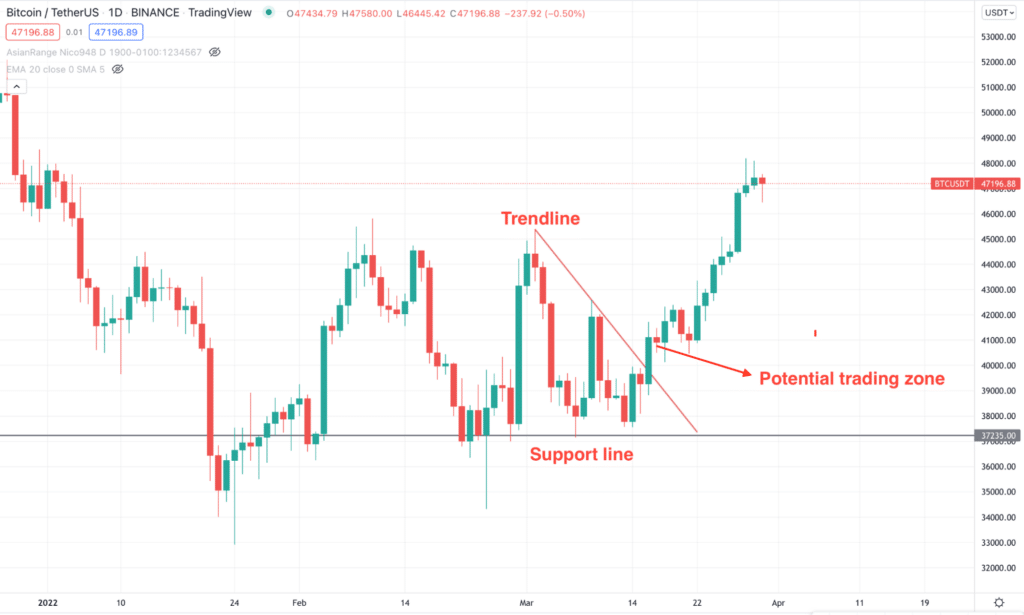

Let’s see an example of how this method works. First, assume that the BTC/USDT showed a solid bullish rejection at the historic $30K level from where decent price pressure may come. As you expect a sharp move but don’t know the direction, you can buy both calls and put them at the same price.

1. Choose a good asset

The first step is to choose the right asset. For this strategy, the trading asset should be volatile. Therefore, you can easily apply this method to large-cap cryptocurrencies like Bitcoin, Ethereum, Litecoin, XRP, etc.

2. Wait for the key point

After choosing the asset, read the price action carefully and identify from where a sharp movement will come. The best idea is to use technical and fundamental analysis, as shown below.

3. Apply the strategy

Once the asset and price action is visible, you can open calls and put them at the same strike price with the same expiry time.

Bullish trends

In the long straddle strategy, you are opening put and call options simultaneously and at the same price. However, if the price moves up from the entry, the call option will profit, and the put option will provide a loss.

The formula of the buying scenario is here.

Where to enter?

The entry should come on a price level from where a sharp move may happen. It is usually a support level for buying with a proper candlestick formation in the spot chart.

Where to put the stop-loss?

If the price fails to show upside or downside breakeven from the entry price, it will incur a loss. For example, the trade takes place at $35k, the upside breakeven is $43K, and the downside breakeven is $27K. If the expiration date fails to reach any of these levels, the trade will incur a loss.

Where to take profit?

If the price moves up and reaches the upside breakeven level of $43K, the profit will come from the following formula. Let’s say the premium is $4K.

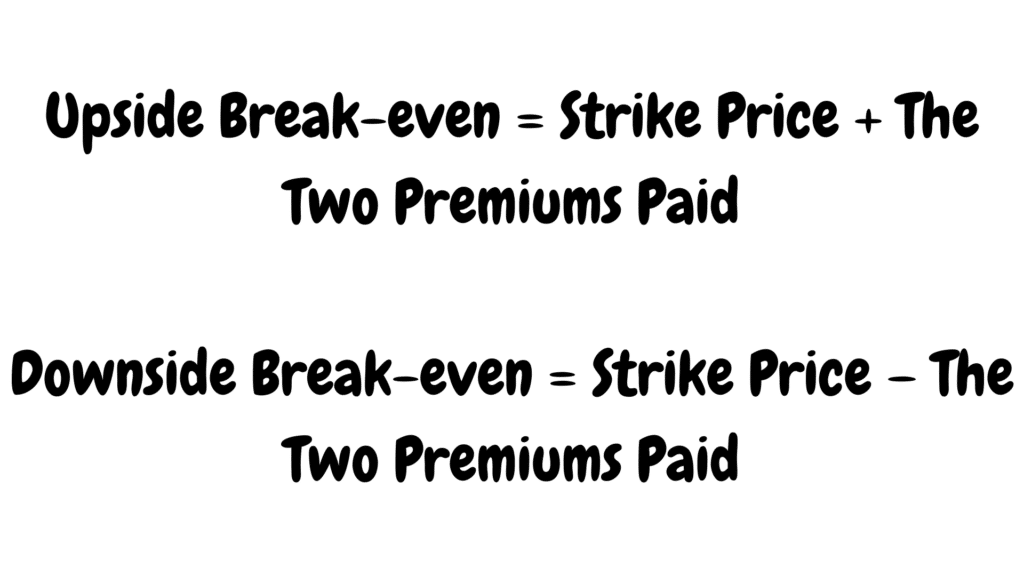

Now apply the upside breakeven equation. Upside break-even = strike price (35K) + the two premiums paid (4k+4k) = $43K

Therefore, if the expiry price comes at $45K, the overall profit will be based on the following formula. Total profit= 45K – (35K +8K), or $2K.

Bearish trends

The bearish trend will be activated if the price moves down from the strike price. It will activate the put option and close the contract with a profit.

Where to enter?

Like the bullish trade, the entry should come on a price level from where a sharp move may happen. It is usually a resistance level for selling with a proper candlestick formation in the spot chart.

Where to put the stop-loss?

If you set the lower breakeven level at $27K, but the price fails to reach the level, the contract will be eliminated with a loss.

Where to take profit?

If the price moves down and reaches the downside breakeven level of $27K, the profit will come from the following formula.

Let’s say the premium is $4K, now apply the upside breakeven equation:

Downside break-even = strike price (35K) – the two premiums paid (4k+4k) = $27K

Therefore, if the expiry price comes at $25K, the overall profit will be based on the following formula:

Total profit= 35K – (25K +8K), or $2K.

Pros & cons

| Profitability The profitability of the strategy applies to the volatile market that matches the cryptocurrency’s behavior. | Spot trading The strategy does not provide enough profit like spot trading. |

| Volatility The volatility in the crypto market with no roof and bottom. Therefore, it is highly possible to reach the breakeven level before expiry. | Risk management If the price does not reach the upper or lower breakeven level, it will incur a loss. |

| Market bias The long straddle provides profit from either bullish or bearish movements. Therefore, you don’t have to set the bias. | Market uncertainty The global financial market is uncertain, and investors should remain cautious about uncertainty. |

Final thought

It is a profitable trading method applicable to the crypto market. As it does not require a bias, beginner traders can easily make profits using this method and make money online.